Coupang (NYSE:CPNG): Revisiting Valuation as Taiwan Expansion Seeks to Replicate South Korea Growth Model

Reviewed by Simply Wall St

Coupang (NYSE:CPNG) is drawing fresh attention after doubling down on its Taiwan expansion, a strategy many see as echoing its early South Korea playbook and potentially reshaping the company’s long term growth mix.

See our latest analysis for Coupang.

The Taiwan push comes after a choppy few months in the market, with a 90 day share price return of negative 15.47 percent but a stronger year to date share price return of 22.61 percent, and a three year total shareholder return of 53.37 percent suggests longer term momentum remains intact.

If Coupang’s cross border expansion has caught your attention, this could be a good moment to explore other tech enabled retailers and platforms using our fast growing stocks with high insider ownership.

With revenue and profits now scaling, Taiwan adding a fresh growth leg, and the stock still trading at a sizeable discount to analyst targets, is Coupang quietly undervalued, or is the market already pricing in the next chapter?

Most Popular Narrative: 24.6% Undervalued

With Coupang last closing at $27.33 versus a narrative fair value near $36, the spread implies investors may be underestimating its long term earnings power.

Ongoing investments in automation, AI, and logistics technology are already driving major improvements in operational efficiency and gross margins, and management sees significant further upside as these technologies are scaled. Over time, this is likely to result in continued margin expansion and growth in earnings.

Want to see how steady revenue growth, rising margins, and a rich future earnings multiple combine into that valuation gap? The full narrative unpacks every assumption.

Result: Fair Value of $36.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, scaling inefficiencies in Taiwan and persistently high operating expenses could delay margin expansion and challenge the view that Coupang is meaningfully undervalued.

Find out about the key risks to this Coupang narrative.

Another View: Rich Multiples Signal Less Obvious Bargain

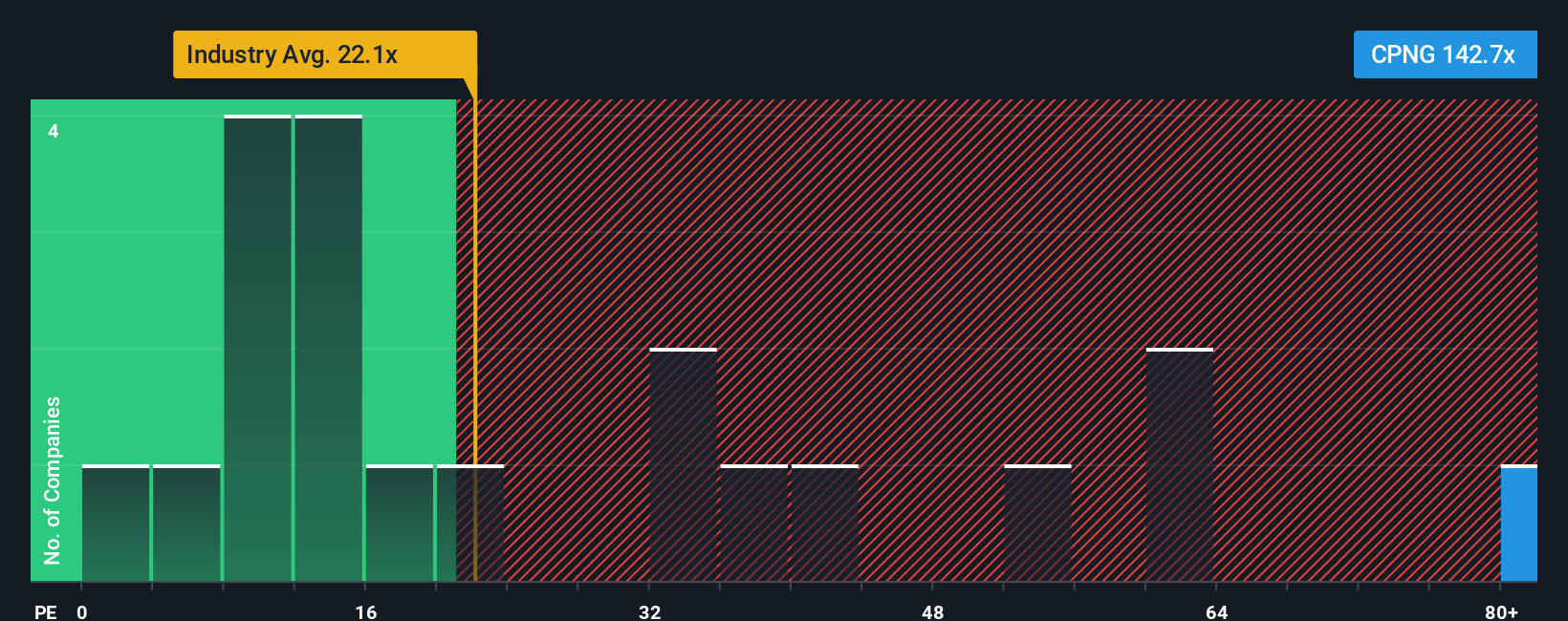

Against that narrative fair value of about $36, Coupang trades on a steep 128 times earnings, versus 19.9 times for the global multiline retail industry, a 32.9 times peer average, and a 43.5 times fair ratio our model suggests the market could drift toward. Is this a rerating in progress or downside risk if growth stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coupang Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Coupang research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next investing edge?

Before you move on, line up fresh ideas with our powerful screeners so you are not relying on just one stock to shape your returns.

- Lock in potential income streams by scanning these 15 dividend stocks with yields > 3% to help anchor your portfolio with dependable payouts.

- Position yourself ahead of the next tech wave by targeting these 27 AI penny stocks focused on automation, data, and intelligent software.

- Strengthen your long term upside by focusing on these 908 undervalued stocks based on cash flows where market prices may not yet reflect underlying cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPNG

Coupang

Owns and operates retail business through its mobile applications and internet websites in South Korea and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026