- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:EH

US Growth Companies With High Insider Ownership In January 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of mixed performance, with investor attention focused on earnings reports and Federal Reserve meetings, the resilience of growth companies becomes particularly noteworthy. In this environment, stocks with high insider ownership can offer unique insights into potential long-term value, as insiders may have confidence in their company's prospects despite broader market fluctuations.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 48% |

| Ryan Specialty Holdings (NYSE:RYAN) | 16.6% | 43.9% |

| Myomo (NYSEAM:MYO) | 12.7% | 56.7% |

| RH (NYSE:RH) | 17.1% | 53.8% |

Let's dive into some prime choices out of the screener.

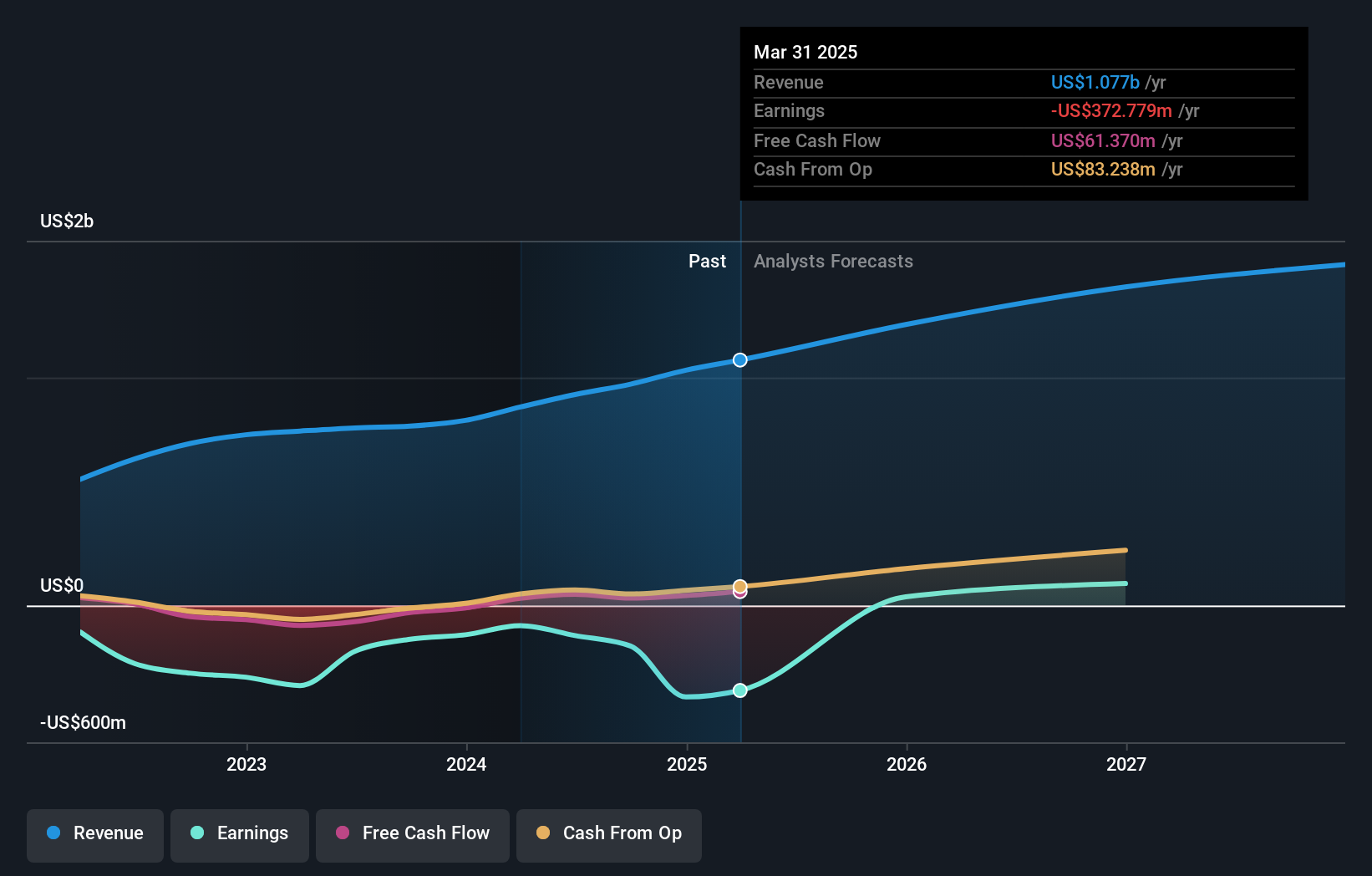

Pagaya Technologies (NasdaqCM:PGY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pagaya Technologies Ltd. is a technology company that utilizes data science and proprietary AI-powered technology to serve financial institutions and investors globally, with a market cap of approximately $711.51 million.

Operations: The company generates revenue primarily through its Software & Programming segment, which accounts for $970.90 million.

Insider Ownership: 19%

Revenue Growth Forecast: 15.2% p.a.

Pagaya Technologies is poised for growth with a forecasted revenue increase of 15.2% annually, outpacing the broader US market. Despite trading at 73.5% below its estimated fair value, insider buying has been modest recently. The company anticipates becoming profitable within three years, supported by strategic board appointments and successful debt financing deals totaling $1 billion in recent months, underscoring investor confidence in its AI-driven credit assets. However, share price volatility remains a concern.

- Take a closer look at Pagaya Technologies' potential here in our earnings growth report.

- According our valuation report, there's an indication that Pagaya Technologies' share price might be on the cheaper side.

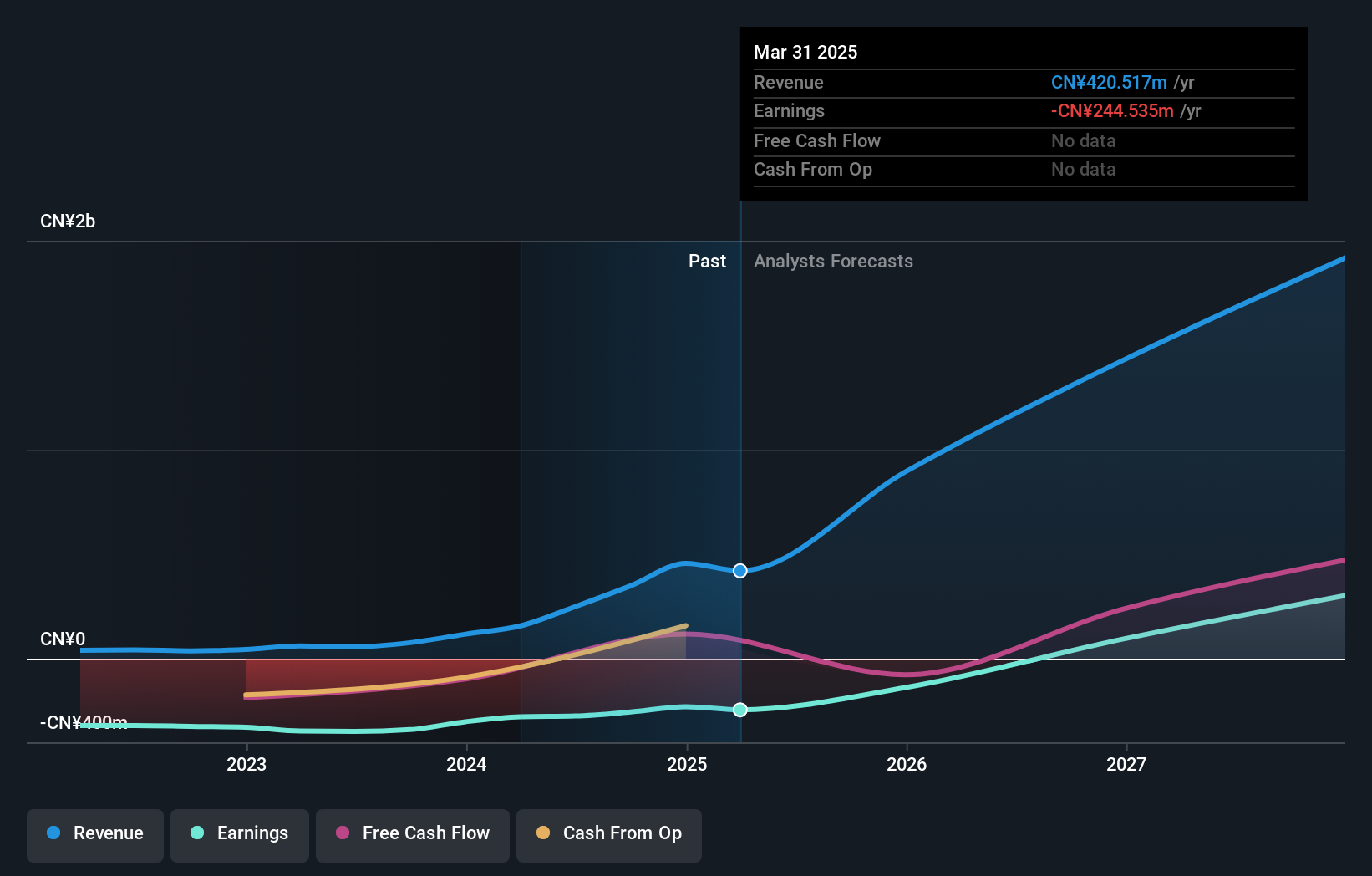

EHang Holdings (NasdaqGM:EH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EHang Holdings Limited is an autonomous aerial vehicle technology platform company operating in China and internationally, with a market cap of approximately $1.05 billion.

Operations: The company's revenue segment is Aerospace & Defense, generating CN¥348.48 million.

Insider Ownership: 31.4%

Revenue Growth Forecast: 37.4% p.a.

EHang Holdings is advancing rapidly in the urban air mobility sector, highlighted by strategic partnerships and significant product milestones like the EH216-S demo flight in Shanghai. Forecasted revenue growth of 37.4% annually surpasses market averages, indicating strong potential despite current losses. The company recently raised its revenue guidance and announced a $30 million share buyback program, reflecting confidence in its long-term strategy. However, profitability remains a future target as insider trading activity shows no substantial changes recently.

- Get an in-depth perspective on EHang Holdings' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, EHang Holdings' share price might be too optimistic.

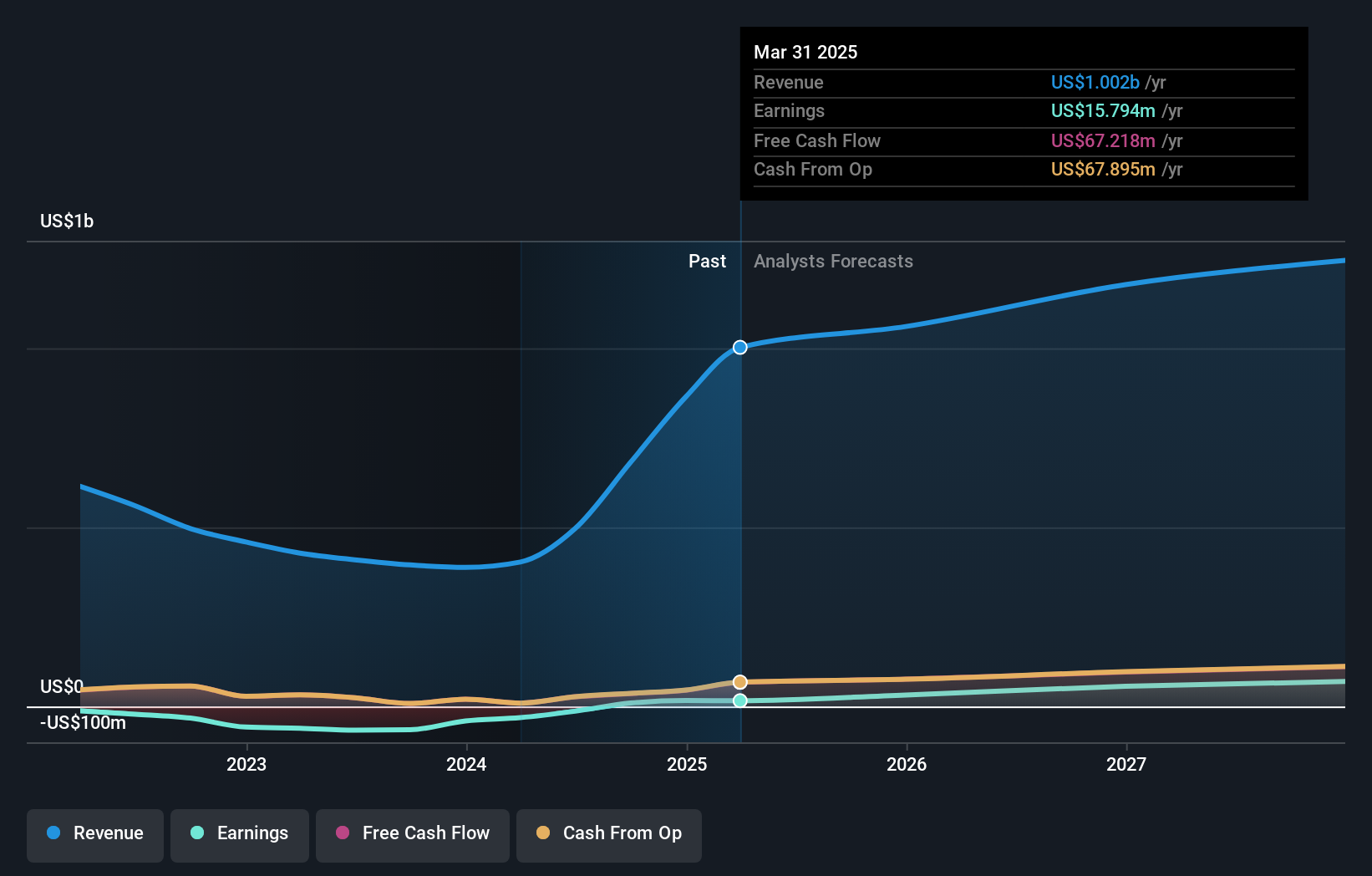

MediaAlpha (NYSE:MAX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MediaAlpha, Inc. operates an insurance customer acquisition platform in the United States and has a market cap of approximately $732 million.

Operations: The company's revenue primarily comes from its Internet Information Providers segment, generating $681.23 million.

Insider Ownership: 12.2%

Revenue Growth Forecast: 18.6% p.a.

MediaAlpha has achieved profitability this year, with earnings forecasted to grow at 35.3% annually, outpacing the US market's average growth rate. Despite trading at 74.3% below its estimated fair value, the company faces challenges with negative shareholders' equity and interest payments not well covered by earnings. Recent financial results show a significant revenue increase to US$259.13 million in Q3 2024 from US$74.57 million a year ago, alongside improved net income figures and positive EPS from continuing operations.

- Dive into the specifics of MediaAlpha here with our thorough growth forecast report.

- Our expertly prepared valuation report MediaAlpha implies its share price may be lower than expected.

Where To Now?

- Explore the 203 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if EHang Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EH

EHang Holdings

Operates as an autonomous aerial vehicle (AAV) technology platform company in the People’s Republic of China, East Asia, West Asia, Europe, and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives