- United States

- /

- Metals and Mining

- /

- NasdaqGS:TMC

Three Stocks That May Be Undervalued In July 2025

Reviewed by Simply Wall St

The United States market has shown positive momentum, rising 1.5% over the last week and 18% over the past year, with earnings projected to grow by 15% annually in the coming years. In this environment, identifying stocks that are potentially undervalued can offer opportunities for investors seeking to capitalize on discrepancies between a company's intrinsic value and its current market price.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TowneBank (TOWN) | $35.70 | $69.58 | 48.7% |

| Sotera Health (SHC) | $12.29 | $24.38 | 49.6% |

| Rapid7 (RPD) | $22.65 | $43.80 | 48.3% |

| Hims & Hers Health (HIMS) | $58.68 | $113.93 | 48.5% |

| Gogo (GOGO) | $16.33 | $32.45 | 49.7% |

| Customers Bancorp (CUBI) | $65.74 | $131.18 | 49.9% |

| Carter Bankshares (CARE) | $17.93 | $35.83 | 50% |

| Camden National (CAC) | $41.46 | $82.80 | 49.9% |

| ATRenew (RERE) | $3.28 | $6.50 | 49.6% |

| Acadia Realty Trust (AKR) | $18.60 | $36.62 | 49.2% |

Let's review some notable picks from our screened stocks.

Atlassian (TEAM)

Overview: Atlassian Corporation, with a market cap of $53.29 billion, designs, develops, licenses, and maintains various software products globally through its subsidiaries.

Operations: The company generates revenue of $4.96 billion from its Software & Programming segment.

Estimated Discount To Fair Value: 22.8%

Atlassian is trading at US$201.84, below its estimated fair value of US$261.41, suggesting it may be undervalued based on cash flows. Despite a recent net loss of US$70.81 million for Q3 2025, revenue grew to US$1.36 billion from the previous year’s US$1.19 billion, with earnings expected to grow significantly over the next three years as profitability improves and return on equity is forecasted to reach 41.2%.

- Insights from our recent growth report point to a promising forecast for Atlassian's business outlook.

- Click to explore a detailed breakdown of our findings in Atlassian's balance sheet health report.

TMC the metals (TMC)

Overview: TMC the metals company Inc. is a deep-sea minerals exploration company that specializes in the collection, processing, and refining of polymetallic nodules from the seafloor in California, with a market cap of $3.09 billion.

Operations: TMC focuses on the exploration and refinement of polymetallic nodules sourced from the ocean floor in California.

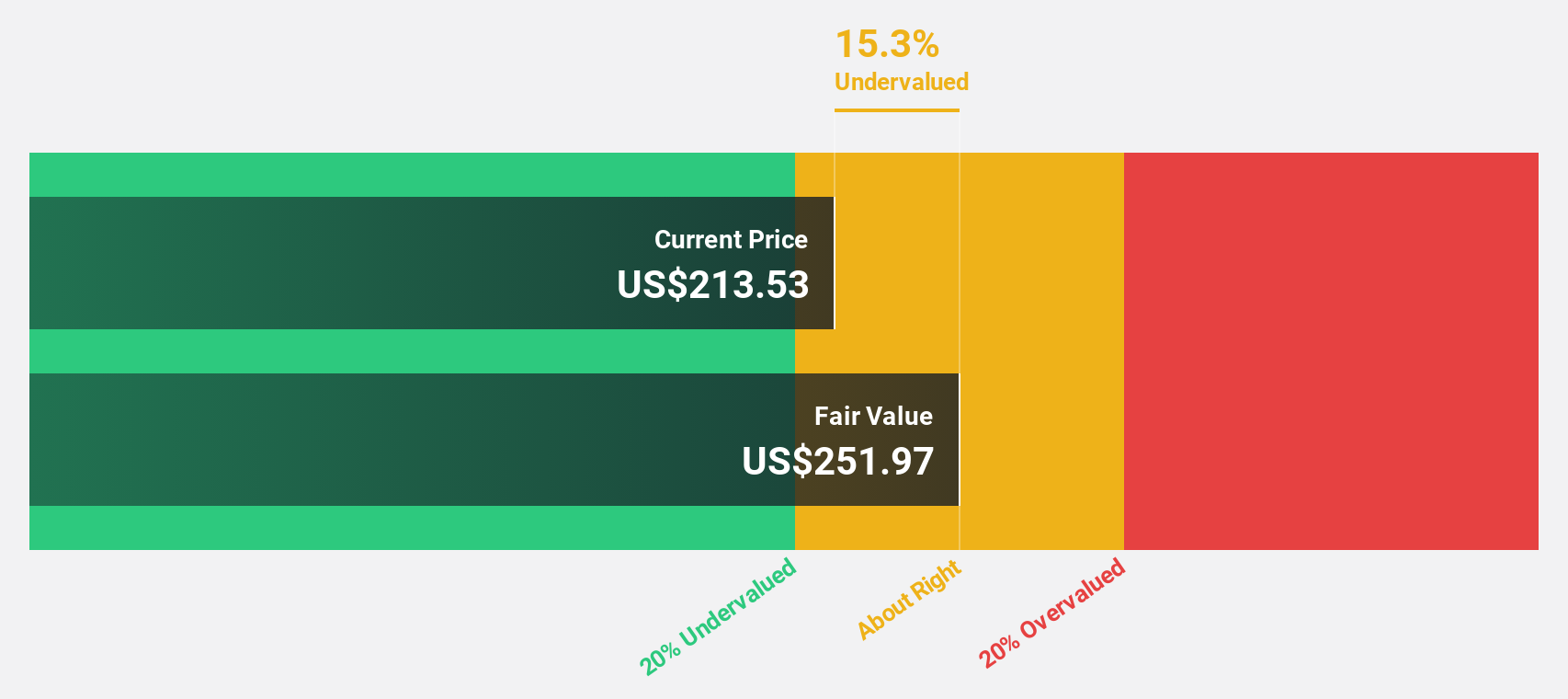

Estimated Discount To Fair Value: 12.2%

TMC the metals company is trading at US$7.45, slightly below its fair value estimate of US$8.48, indicating potential undervaluation based on cash flows. Despite a net loss of US$20.59 million in Q1 2025 and no expected revenue next year, TMC's earnings are forecast to grow significantly, potentially becoming profitable within three years with a high projected return on equity. Recent board appointments and strategic partnerships aim to advance its seabed mining initiatives.

- Our comprehensive growth report raises the possibility that TMC the metals is poised for substantial financial growth.

- Take a closer look at TMC the metals' balance sheet health here in our report.

Comfort Systems USA (FIX)

Overview: Comfort Systems USA, Inc. offers mechanical and electrical installation, renovation, maintenance, repair, and replacement services across the United States with a market cap of approximately $24.25 billion.

Operations: The company's revenue is derived from two main segments: Electrical Services, contributing $1.75 billion, and Mechanical Services, accounting for $5.93 billion.

Estimated Discount To Fair Value: 41.8%

Comfort Systems USA is trading at US$692.97, well below its fair value estimate of US$1,190.33, highlighting potential undervaluation based on cash flows. Recent Q2 2025 earnings showed significant growth with net income rising to US$230.85 million from US$134.01 million a year ago, supporting robust cash flow generation. The company increased its quarterly dividend and expanded its share buyback plan, reflecting strong financial health and shareholder return focus amidst forecasted profit growth outpacing the market average.

- Upon reviewing our latest growth report, Comfort Systems USA's projected financial performance appears quite optimistic.

- Dive into the specifics of Comfort Systems USA here with our thorough financial health report.

Next Steps

- Click this link to deep-dive into the 167 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TMC the metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMC

TMC the metals

A deep-sea minerals exploration company, focuses on the collection, processing, and refining of polymetallic nodules found on the seafloor in California.

Moderate risk with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)