- United States

- /

- Biotech

- /

- NasdaqCM:CELC

Insider-Favored Growth Stocks To Consider In October 2025

Reviewed by Simply Wall St

As of late October 2025, major U.S. stock indexes have reached new record highs, buoyed by solid corporate earnings and optimism surrounding potential trade agreements between the U.S. and China. Amidst these favorable market conditions, growth companies with high insider ownership can present intriguing opportunities for investors seeking alignment between company executives' interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11% | 30.4% |

| Celsius Holdings (CELH) | 10.8% | 31.6% |

| Bitdeer Technologies Group (BTDR) | 37.3% | 96.9% |

| Atour Lifestyle Holdings (ATAT) | 18.3% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

| AppLovin (APP) | 27.5% | 25.7% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

We're going to check out a few of the best picks from our screener tool.

ASP Isotopes (ASPI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ASP Isotopes Inc. is a development stage advanced materials company focused on producing, distributing, marketing, and selling isotopes with a market cap of $1.12 billion.

Operations: The company's revenue primarily comes from its Specialist Isotopes and Related Services segment, which generated $4.38 million.

Insider Ownership: 17.3%

Revenue Growth Forecast: 62.1% p.a.

ASP Isotopes has recently completed a $210.3 million equity offering and announced strategic initiatives, including a supply agreement for enriched silicon-28 and the acquisition of a U.S. radiopharmacy to enhance its operations. Despite significant insider selling over the past three months, ASP Isotopes is trading significantly below its estimated fair value and is forecasted to grow revenue by 62.1% annually, surpassing market averages. The company anticipates profitability within three years amid high volatility in share price.

- Take a closer look at ASP Isotopes' potential here in our earnings growth report.

- Our valuation report here indicates ASP Isotopes may be overvalued.

Celcuity (CELC)

Simply Wall St Growth Rating: ★★★★★☆

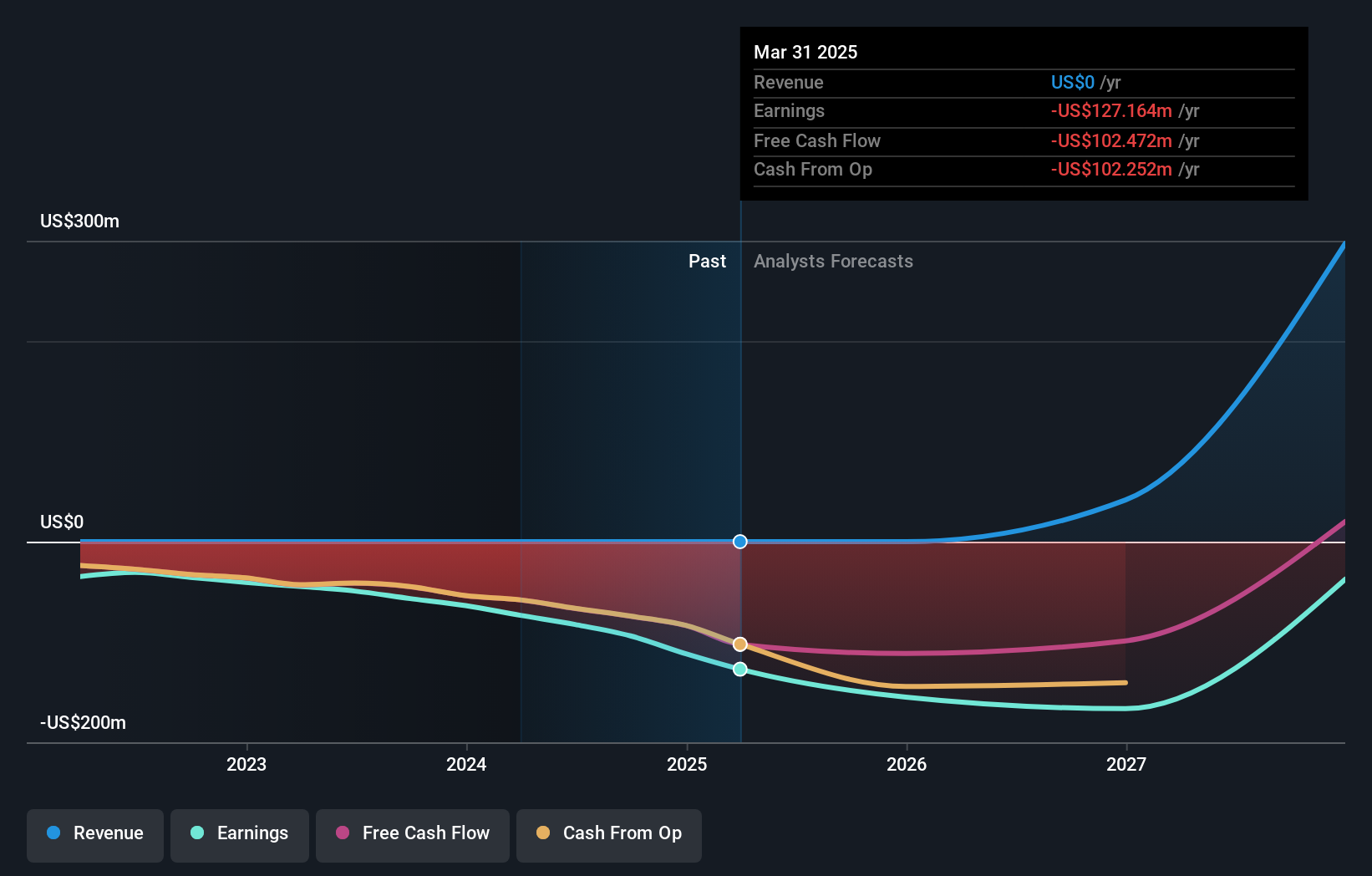

Overview: Celcuity Inc. is a clinical-stage biotechnology company that develops targeted therapies for treating various solid tumors in the United States, with a market cap of approximately $3.29 billion.

Operations: Revenue Segments (in millions of $): null

Insider Ownership: 10.7%

Revenue Growth Forecast: 63.9% p.a.

Celcuity, with significant insider ownership, is advancing its clinical trials for gedatolisib in breast cancer treatment. The company recently announced positive Phase 3 results and an increased credit facility of $500 million to support its strategic initiatives. Despite a volatile share price and current net losses, Celcuity's revenue is forecasted to grow at 63.9% annually, outpacing market averages. It aims for profitability within three years while trading well below estimated fair value.

- Delve into the full analysis future growth report here for a deeper understanding of Celcuity.

- Our comprehensive valuation report raises the possibility that Celcuity is priced higher than what may be justified by its financials.

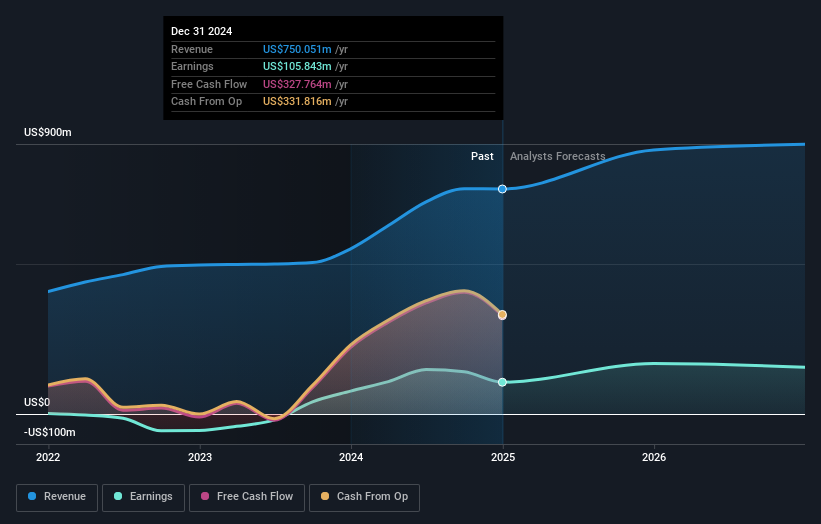

HCI Group (HCI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HCI Group, Inc. operates in the United States through its subsidiaries in property and casualty insurance, insurance management, reinsurance, real estate, and information technology sectors with a market cap of approximately $2.64 billion.

Operations: The company's revenue segments include $726.94 million from insurance operations, $49.26 million from reciprocal exchange operations, and $11.12 million from real estate.

Insider Ownership: 14.3%

Revenue Growth Forecast: 13.8% p.a.

HCI Group's insider ownership aligns with its growth trajectory, as evidenced by a forecasted earnings growth of 25.5% annually, surpassing the US market average. Despite recent shareholder dilution, the company trades at 44.2% below its estimated fair value, suggesting potential undervaluation. Recent financials show revenue and net income improvements over last year, while a regular dividend underscores financial stability. Revenue is expected to grow at 13.8%, faster than the market rate of 10.1%.

- Unlock comprehensive insights into our analysis of HCI Group stock in this growth report.

- Upon reviewing our latest valuation report, HCI Group's share price might be too pessimistic.

Next Steps

- Access the full spectrum of 204 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Searching for a Fresh Perspective? The end of cancer? These 27 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELC

Celcuity

A clinical-stage biotechnology company, focuses on the development of targeted therapies for the treatment of various solid tumors in the United States.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)