- United States

- /

- Insurance

- /

- NasdaqGS:SAFT

Undiscovered Gems In The US Spotlighting 3 Promising Small Caps

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it boasts a remarkable 26% increase over the past year with earnings forecasted to grow by 15% annually. In such a dynamic environment, identifying promising small-cap stocks can offer unique opportunities for investors seeking growth potential beyond the well-trodden paths of larger companies.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Amalgamated Financial (NasdaqGM:AMAL)

Simply Wall St Value Rating: ★★★★★★

Overview: Amalgamated Financial Corp. is a bank holding company for Amalgamated Bank, offering commercial and retail banking, investment management, and trust and custody services in the United States, with a market cap of approximately $1.03 billion.

Operations: Amalgamated Financial generates revenue primarily from its banking segment, which accounts for $303.03 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

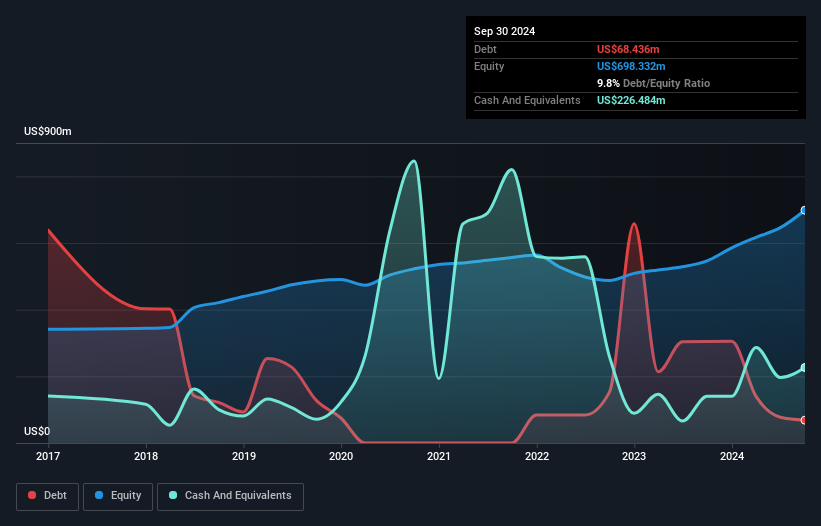

Amalgamated Financial, a bank holding company with total assets of US$8.4 billion and equity of US$698.3 million, is gaining attention for its strategic focus on sustainable financing. With 98% of liabilities funded by low-risk customer deposits, it offers a stable financial foundation. The bank's allowance for bad loans is robust at 215%, covering 0.6% of total loans, ensuring asset quality remains high. Recent earnings growth of 16.2% outpaced the industry average significantly, highlighting its operational strength and potential in clean energy investments aligned with U.S.'s net-zero emissions goals by 2050.

Safety Insurance Group (NasdaqGS:SAFT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Safety Insurance Group, Inc. is a U.S.-based company specializing in private passenger and commercial automobile, as well as homeowner insurance, with a market capitalization of approximately $1.22 billion.

Operations: Safety Insurance Group generates revenue primarily from its property and casualty insurance operations, totaling $1.09 billion.

Safety Insurance Group, a relatively small player in the insurance sector, has shown impressive financial metrics recently. Its earnings surged by 139% over the past year, outpacing the industry average of 36%. Despite this growth, its price-to-earnings ratio stands at 16.4x, which is below the US market average of 18.4x, indicating potential value for investors. The company maintains a healthy balance sheet with more cash than total debt and an increased debt-to-equity ratio from 0% to just 3.5% over five years. Additionally, its interest payments are well covered by EBIT at an impressive rate of nearly 190 times coverage.

- Dive into the specifics of Safety Insurance Group here with our thorough health report.

Explore historical data to track Safety Insurance Group's performance over time in our Past section.

United Fire Group (NasdaqGS:UFCS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: United Fire Group, Inc., along with its subsidiaries, offers property and casualty insurance services to individuals and businesses across the United States, with a market capitalization of $712.87 million.

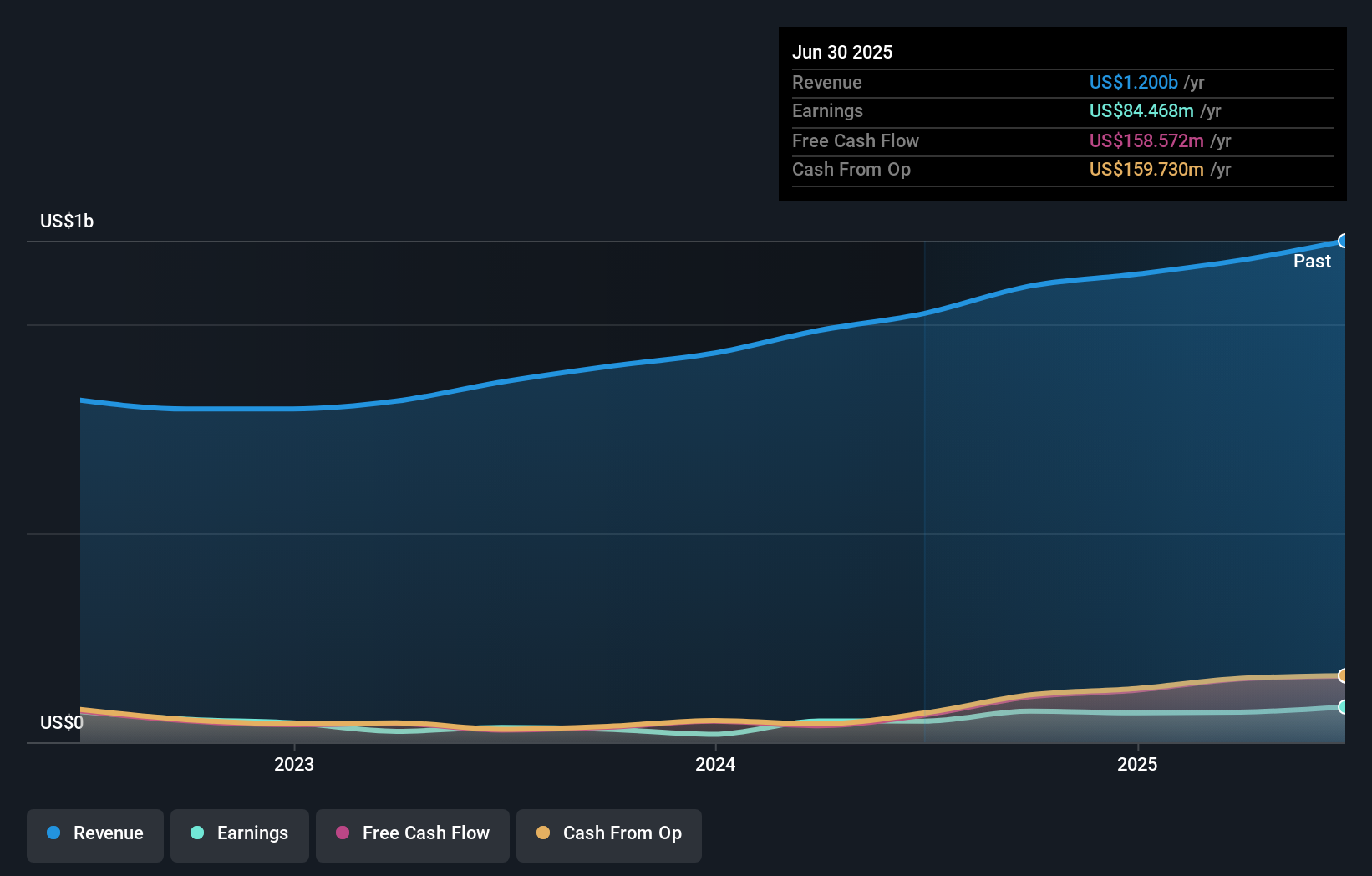

Operations: United Fire Group generates revenue primarily from its property and casualty insurance segment, which reported $1.20 billion in revenue. The company's financial performance can be analyzed through its net profit margin trends over time.

United Fire Group, with its recent profitability, stands out in the insurance sector. The company reported a notable jump in net income for Q3 2024 to US$19.75 million from US$6.38 million the previous year, and revenue rose to US$322.96 million from US$273.96 million. Its debt-to-equity ratio has increased to 14.9% over five years but remains manageable given its cash position exceeding total debt and an EBIT interest coverage of 11.9x, indicating robust financial health. With a price-to-earnings ratio of 14.2x below the market average, it presents an attractive valuation for investors eyeing growth potential in this segment.

- Get an in-depth perspective on United Fire Group's performance by reading our health report here.

Assess United Fire Group's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Dive into all 248 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SAFT

Safety Insurance Group

Provides private passenger and commercial automobile, and homeowner insurance in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives