- United States

- /

- Insurance

- /

- NasdaqGS:CINF

Here's Why I Think Cincinnati Financial (NASDAQ:CINF) Might Deserve Your Attention Today

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Cincinnati Financial (NASDAQ:CINF), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Cincinnati Financial

Cincinnati Financial's Improving Profits

In the last three years Cincinnati Financial's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like the last firework on New Year's Eve accelerating into the sky, Cincinnati Financial's EPS shot from US$7.54 to US$18.28, over the last year. You don't see 142% year-on-year growth like that, very often. The best case scenario? That the business has hit a true inflection point.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Cincinnati Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. The good news is that Cincinnati Financial is growing revenues, and EBIT margins improved by 18.1 percentage points to 39%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

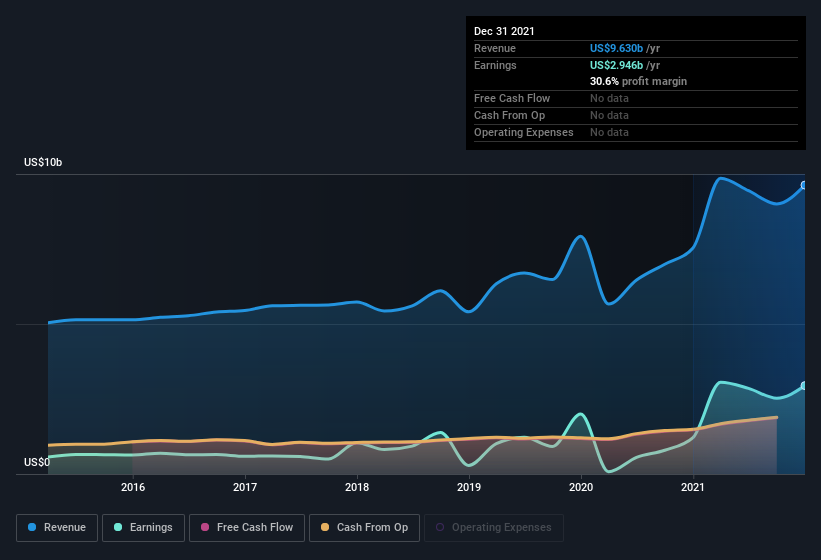

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Cincinnati Financial's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Cincinnati Financial Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Like a sturdy phalanx Cincinnati Financial insiders have stood united by refusing to sell shares over the last year. But the bigger deal is that the Independent Director, Dirk Debbink, paid US$150k to buy shares at an average price of US$117.

On top of the insider buying, it's good to see that Cincinnati Financial insiders have a valuable investment in the business. Notably, they have an enormous stake in the company, worth US$572m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Steve Johnston, is paid less than the median for similar sized companies. For companies with market capitalizations over US$8.0b, like Cincinnati Financial, the median CEO pay is around US$12m.

The Cincinnati Financial CEO received total compensation of just US$3.8m in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Cincinnati Financial Deserve A Spot On Your Watchlist?

Cincinnati Financial's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The cherry on top is that insiders own a bunch of shares, and one has been buying more. Because of the potential that it has reached an inflection point, I'd suggest Cincinnati Financial belongs on the top of your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Cincinnati Financial , and understanding this should be part of your investment process.

As a growth investor I do like to see insider buying. But Cincinnati Financial isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Cincinnati Financial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CINF

Cincinnati Financial

Provides property casualty insurance products in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives