- United States

- /

- Software

- /

- NasdaqGS:MNDY

3 US Growth Companies With Insider Ownership Up To 17%

Reviewed by Simply Wall St

As the U.S. stock market experiences a Santa Claus Rally, with major indices like the Nasdaq Composite and S&P 500 posting gains, investors are keenly observing growth companies that demonstrate resilience and potential in this upbeat environment. In such a climate, stocks with high insider ownership can be particularly appealing as they often indicate confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 34.7% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| Myomo (NYSEAM:MYO) | 13.7% | 69.1% |

Here we highlight a subset of our preferred stocks from the screener.

monday.com (NasdaqGS:MNDY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: monday.com Ltd. develops software applications globally, with a market capitalization of approximately $11.71 billion.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, totaling $906.59 million.

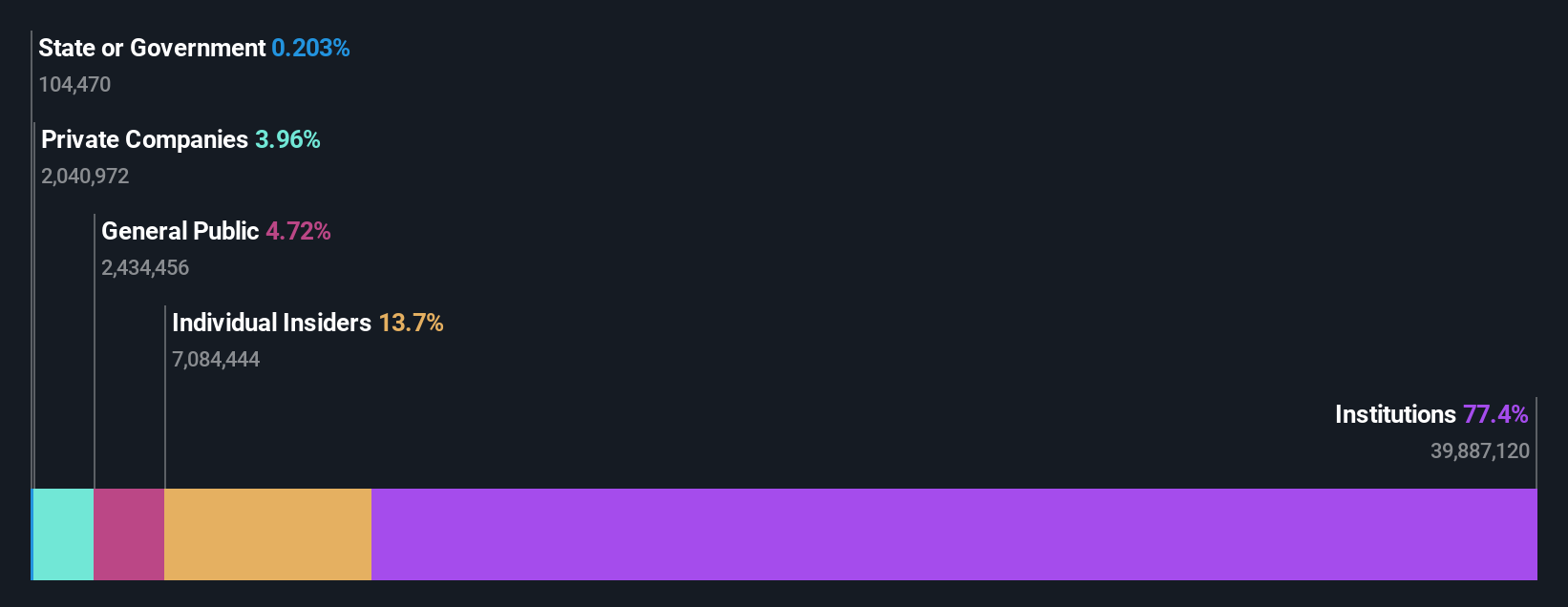

Insider Ownership: 15.4%

monday.com demonstrates strong growth potential with forecasted revenue and earnings growth significantly outpacing the US market. Despite recent shareholder dilution, the company trades slightly below its estimated fair value. Recent expansions, such as a new Denver office, reflect its commitment to growth and innovation. While third-quarter results showed a net loss of US$12.03 million, annual guidance indicates robust revenue growth of around 32%. The company's strategic focus on M&A opportunities further underscores its expansion ambitions.

- Click here to discover the nuances of monday.com with our detailed analytical future growth report.

- Our valuation report here indicates monday.com may be undervalued.

Hims & Hers Health (NYSE:HIMS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hims & Hers Health, Inc. operates a telehealth platform connecting consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally, with a market cap of approximately $6.15 billion.

Operations: The company's revenue segment includes online retailers, generating approximately $1.24 billion.

Insider Ownership: 13.4%

Hims & Hers Health is experiencing rapid revenue growth, with recent quarterly sales reaching US$401.56 million, marking a significant increase from the previous year. The company has achieved profitability and forecasts continued earnings growth above the US market rate. Despite some insider selling, it remains undervalued relative to its estimated fair value. Strategic initiatives include expanding product offerings and exploring M&A opportunities, supported by experienced leadership additions like Deb Autor to enhance quality and safety oversight.

- Unlock comprehensive insights into our analysis of Hims & Hers Health stock in this growth report.

- The valuation report we've compiled suggests that Hims & Hers Health's current price could be quite moderate.

Spotify Technology (NYSE:SPOT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Spotify Technology S.A., along with its subsidiaries, offers audio streaming subscription services globally and has a market capitalization of approximately $93.29 billion.

Operations: Spotify generates revenue from two main segments: Premium, which accounts for €13.28 billion, and Ad-Supported, contributing €1.82 billion.

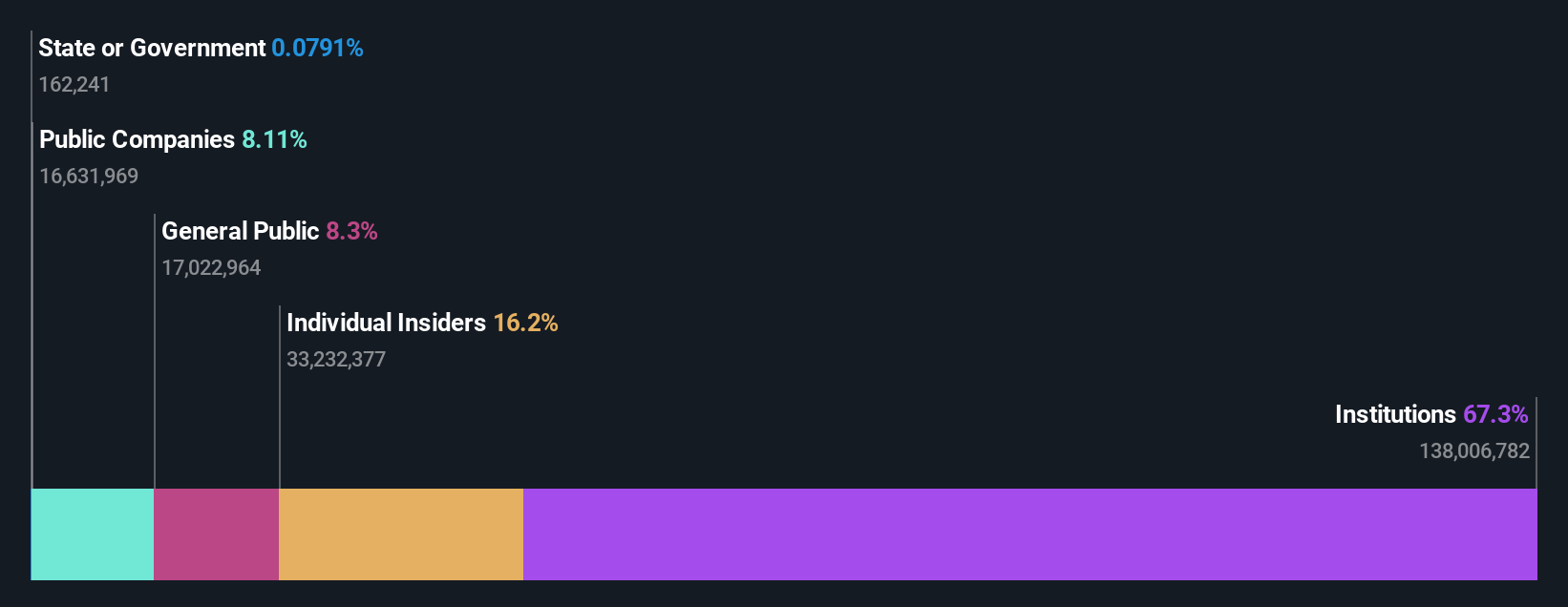

Insider Ownership: 17.6%

Spotify Technology is experiencing robust revenue growth, with recent quarterly sales of €3.99 billion and net income of €300 million, a substantial increase from the previous year. The company forecasts earnings growth at 29.6% annually, outpacing the US market average. Despite past shareholder dilution, Spotify remains slightly undervalued relative to its fair value estimate. A strategic partnership with Opera enhances user engagement by integrating Spotify as the default music player in Opera's browser, potentially driving future user acquisition and retention.

- Navigate through the intricacies of Spotify Technology with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Spotify Technology shares in the market.

Turning Ideas Into Actions

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 196 more companies for you to explore.Click here to unveil our expertly curated list of 199 Fast Growing US Companies With High Insider Ownership.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNDY

monday.com

Develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally.

Flawless balance sheet and undervalued.