- United States

- /

- Consumer Finance

- /

- NYSE:LC

Exploring 3 Undervalued Small Caps With Insider Action Across Regions

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet it has shown a robust 9.0% increase over the past year with earnings forecasted to grow by 14% annually. In this environment, identifying stocks that are potentially undervalued and have insider activity can offer intriguing opportunities for investors seeking growth potential in small-cap companies across various regions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| First Mid Bancshares | 10.8x | 2.7x | 40.51% | ★★★★★★ |

| Shore Bancshares | 10.3x | 2.3x | 8.94% | ★★★★★☆ |

| MVB Financial | 11.0x | 1.5x | 30.30% | ★★★★★☆ |

| S&T Bancorp | 11.2x | 3.8x | 40.55% | ★★★★☆☆ |

| West Bancorporation | 14.3x | 4.4x | 42.31% | ★★★☆☆☆ |

| Quanex Building Products | 77.7x | 0.6x | 40.27% | ★★★☆☆☆ |

| Columbus McKinnon | 56.1x | 0.5x | 41.87% | ★★★☆☆☆ |

| PDF Solutions | 208.9x | 4.7x | 12.25% | ★★★☆☆☆ |

| Thryv Holdings | NA | 0.8x | 13.02% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -191.83% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Delek US Holdings (NYSE:DK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Delek US Holdings operates in the energy sector, focusing primarily on refining and logistics, with a market cap of approximately $1.6 billion.

Operations: The primary revenue stream comes from the refining segment, generating $11.78 billion, while logistics contributes $940.6 million. The company's gross profit margin has shown fluctuations, with a notable peak at 13.48% in mid-2019 and recent figures around 2.59% by early 2025. Operating expenses have varied over time but remain a significant component of the cost structure, impacting overall profitability alongside non-operating expenses and depreciation & amortization costs.

PE: -1.5x

Delek US Holdings, a company with a market cap under $1 billion, recently reported significant goodwill impairments and a net loss of $413.8 million for Q4 2024, reflecting operational challenges. Despite these setbacks, insider confidence is evident through substantial share repurchases totaling 1.23 million shares in the last quarter of 2024. The company also maintains its quarterly dividend at $0.255 per share, indicating commitment to shareholder returns amidst financial restructuring efforts and anticipated earnings growth of 81% annually.

- Click here to discover the nuances of Delek US Holdings with our detailed analytical valuation report.

Gain insights into Delek US Holdings' past trends and performance with our Past report.

LendingClub (NYSE:LC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: LendingClub operates as a financial services company focusing on personal loans and banking services, with a market cap of approximately $0.79 billion.

Operations: Lending Club generates revenue primarily through its bank operations, which account for $1.13 billion. The company has experienced fluctuations in its gross profit margin, reaching a high of 1.07% and declining to 0.24% more recently. Operating expenses have consistently been a significant portion of costs, with sales and marketing being notable components over time.

PE: 24.0x

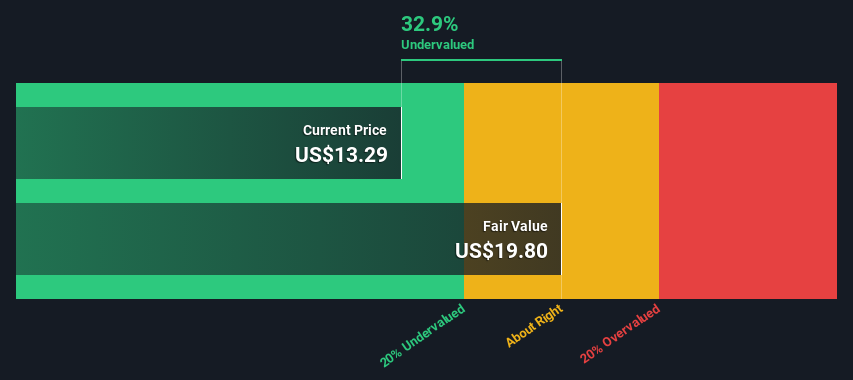

LendingClub stands out in the U.S. small-cap sector with a unique blend of high-quality earnings and projected profit growth of 42% annually. Despite relying solely on external borrowing for funding, which carries higher risk than customer deposits, the company reported a full-year net income increase to US$51.33 million from US$38.94 million previously. Insider confidence is evident as Michael Zeisser purchased 20,000 shares worth US$257,600 in early 2025, reflecting potential optimism about future prospects despite recent challenges like net charge-offs decreasing to US$45.98 million from US$82.51 million year-over-year.

- Dive into the specifics of LendingClub here with our thorough valuation report.

Gain insights into LendingClub's historical performance by reviewing our past performance report.

Victoria's Secret (NYSE:VSCO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Victoria's Secret is a specialty retailer primarily focused on women's lingerie, apparel, and beauty products, with a market capitalization of approximately $1.63 billion.

Operations: Victoria's Secret generates revenue primarily from its Retail - Specialty segment, with recent figures reaching $6.23 billion. The company's gross profit margin has shown variability, with a notable decrease to 36.67% in early 2025 from previous higher levels. Operating expenses have been substantial, consistently impacting net income margins which recently stood at 2.65%.

PE: 8.8x

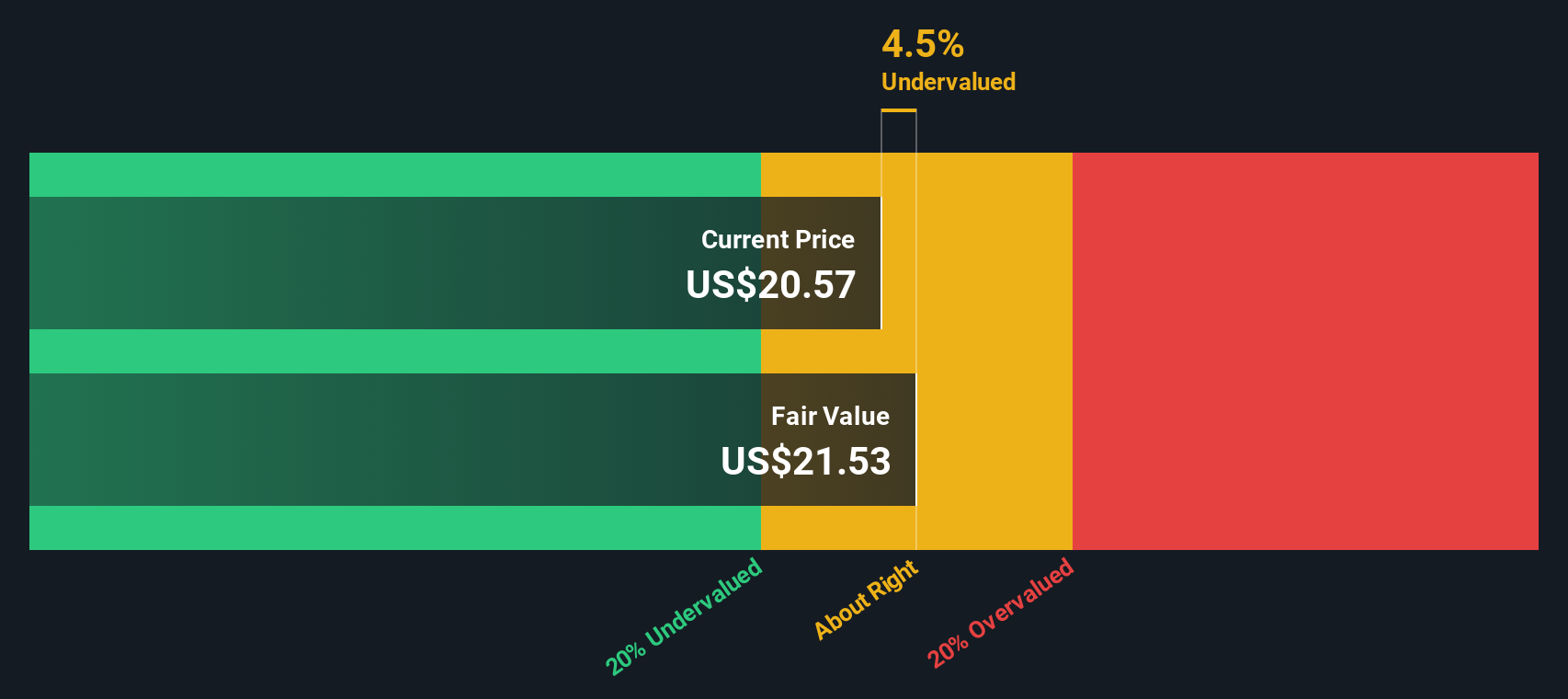

Victoria's Secret, a smaller player in the market, has shown signs of potential growth with earnings projected to rise by 4.94% annually. Recent insider confidence is evident as they purchased shares between January and March 2025, signaling belief in future prospects. Despite relying on higher-risk external borrowing for funding, the company reported increased net income for FY 2024 at US$165 million from US$109 million previously. Their new collaboration with designer Joseph Altuzarra marks an expansion into ready-to-wear fashion, potentially broadening revenue streams beyond traditional offerings.

Make It Happen

- Gain an insight into the universe of 71 Undervalued US Small Caps With Insider Buying by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade LendingClub, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LC

LendingClub

Operates as a bank holding company, that provides range of financial products and services in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives