- United States

- /

- Oil and Gas

- /

- NYSE:COP

3 Reliable Dividend Stocks To Consider With Up To 9.9% Yield

Reviewed by Simply Wall St

As the U.S. stock market faces a downturn with major indices like the Dow Jones and S&P 500 closing lower amid risk-off sentiment, investors are increasingly seeking stability through dividend stocks. In this environment, reliable dividend-paying companies can offer a steady income stream, making them an attractive option for those looking to balance their portfolios against market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.94% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.49% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.71% | ★★★★★★ |

| Heritage Commerce (HTBK) | 4.67% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.69% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.99% | ★★★★★★ |

| Ennis (EBF) | 5.68% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.13% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.56% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.56% | ★★★★★☆ |

Click here to see the full list of 121 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

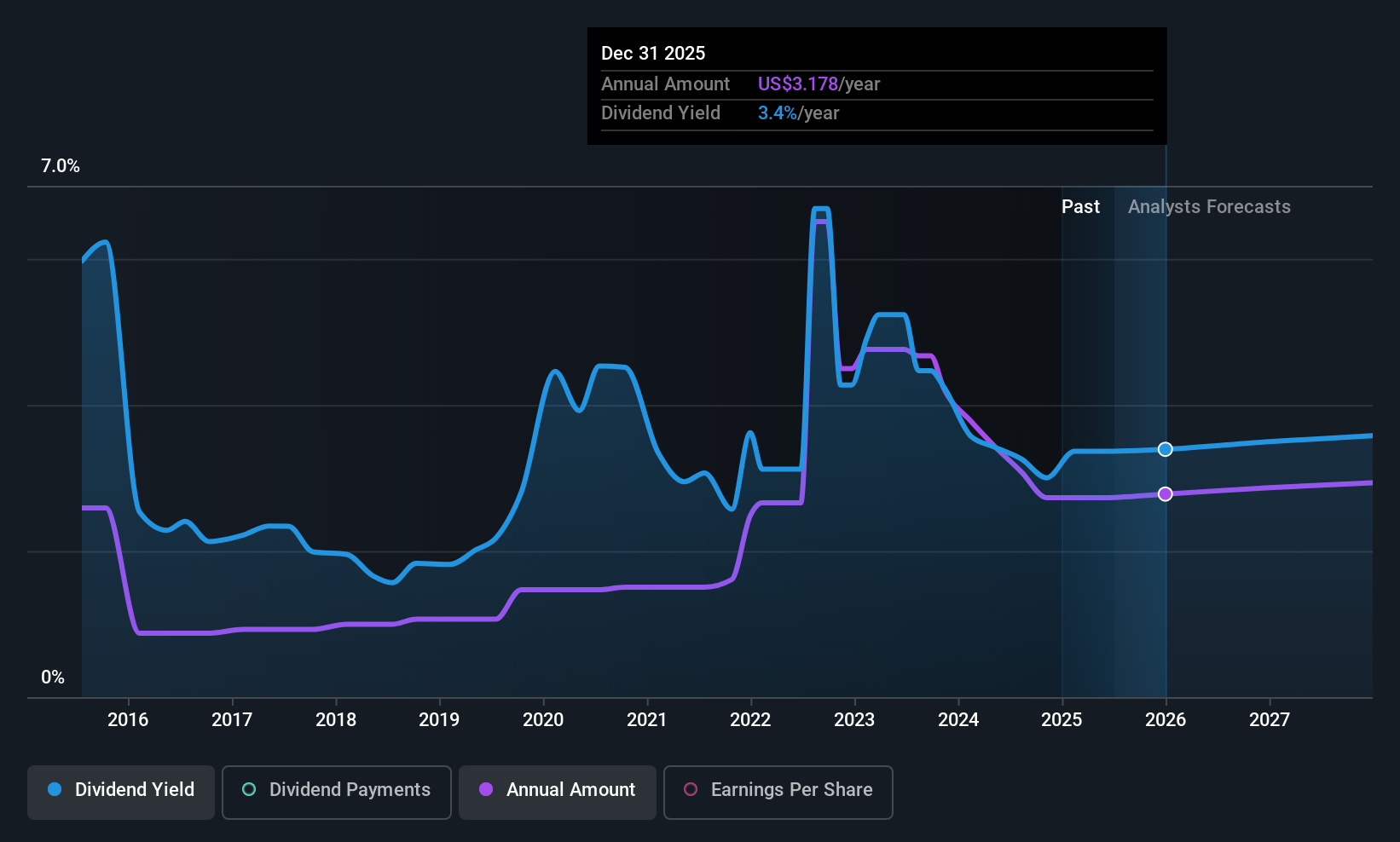

ConocoPhillips (COP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ConocoPhillips is engaged in the exploration, production, transportation, and marketing of crude oil, bitumen, natural gas, LNG, and natural gas liquids with a market cap of $109.60 billion.

Operations: ConocoPhillips generates revenue from several geographic segments, including Alaska ($5.99 billion), Canada ($5.78 billion), Lower 48 ($41.66 billion), Asia Pacific ($2.60 billion), and Europe, Middle East and North Africa ($7.22 billion).

Dividend Yield: 3.7%

ConocoPhillips trades at a significant discount to its estimated fair value, offering potential capital appreciation. Despite a volatile dividend history, recent increases reflect improved financial health. The current yield of 3.72% is below the top tier in the US market but remains covered by both earnings (44.1% payout ratio) and cash flows (58.6% cash payout ratio). Recent earnings showed increased production but lower net income year-over-year, with strategic buybacks continuing to enhance shareholder value.

- Take a closer look at ConocoPhillips' potential here in our dividend report.

- In light of our recent valuation report, it seems possible that ConocoPhillips is trading behind its estimated value.

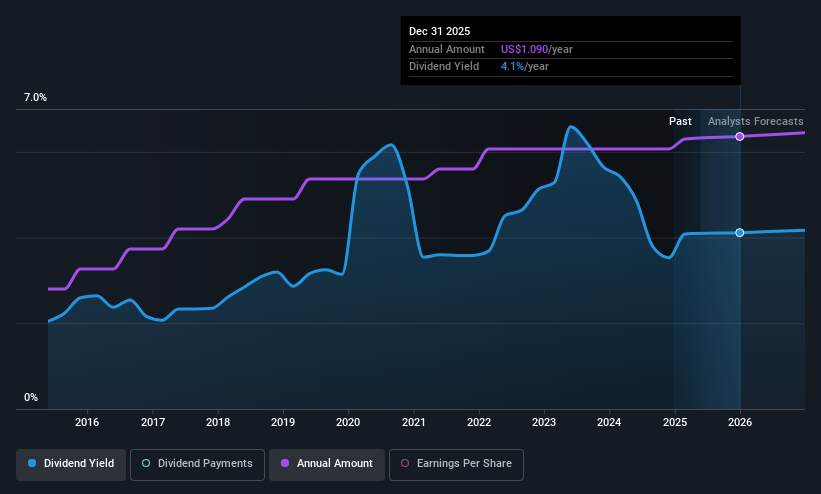

Central Pacific Financial (CPF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Central Pacific Financial Corp. is the bank holding company for Central Pacific Bank, offering a variety of commercial banking products and services to businesses, professionals, and individuals in the United States, with a market cap of $797.85 million.

Operations: Central Pacific Financial Corp. generates revenue primarily through its banking operations, which amounted to $260.67 million.

Dividend Yield: 3.7%

Central Pacific Financial offers a stable dividend history with consistent increases, recently raising its quarterly payout to $0.28 per share. The dividend yield of 3.67% is reliable but below the top US market tier. Earnings growth supports sustainable dividends, evidenced by a low payout ratio of 43.8%. Recent executive resignations and share buybacks have not disrupted financial performance, as demonstrated by increased net income and interest income in the latest quarter's results.

- Click here to discover the nuances of Central Pacific Financial with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Central Pacific Financial's current price could be quite moderate.

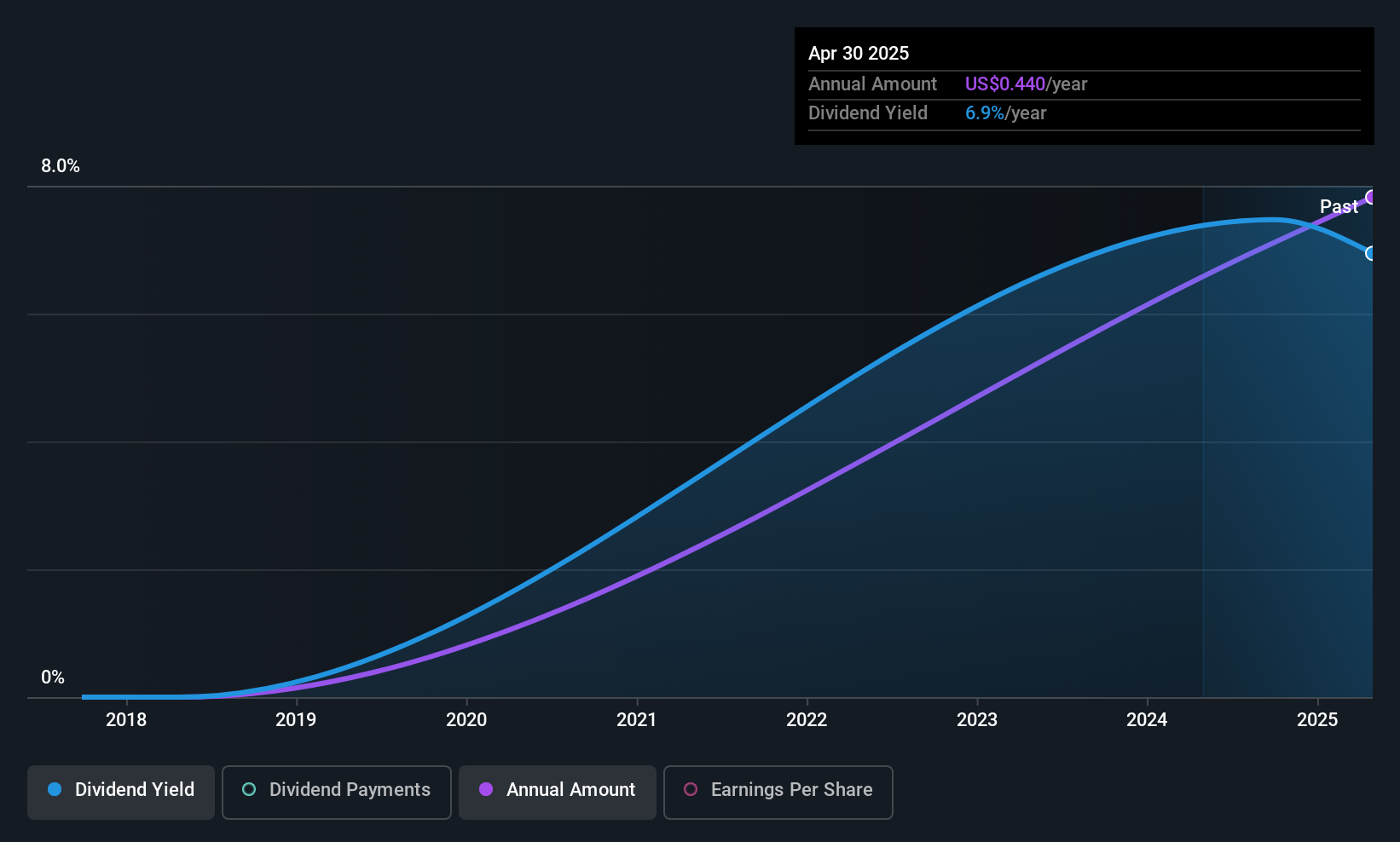

Yiren Digital (YRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yiren Digital Ltd. operates an AI-powered financial services platform in China with a market cap of $381.92 million.

Operations: Yiren Digital Ltd. generates revenue primarily from its Financial Services Business, which accounts for CN¥5.26 billion, and its Insurance Brokerage Business, contributing CN¥320.21 million.

Dividend Yield: 10%

Yiren Digital's dividends are newly initiated, with a low payout ratio of 22.3%, indicating coverage by earnings and cash flows. Although the dividend yield of 9.95% ranks in the top 25% in the US market, its stability and growth remain uncertain due to their recent inception. The company reported Q3 revenue growth to CNY 1.55 billion but saw a decline in net income compared to last year, reflecting challenges despite strategic advances in blockchain and AI technologies.

- Click to explore a detailed breakdown of our findings in Yiren Digital's dividend report.

- According our valuation report, there's an indication that Yiren Digital's share price might be on the cheaper side.

Summing It All Up

- Click this link to deep-dive into the 121 companies within our Top US Dividend Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COP

ConocoPhillips

Explores for, produces, transports, and markets crude oil, bitumen, natural gas, liquefied natural gas (LNG), and natural gas liquids.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Google Maps" of Cancer Biology – Data is the Moat

The "Rare Disease Monopoly" – Commercial Execution Play

The "Landlord of Orbit" – A Deep Value Play Ahead of the Starlab Era

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026