- United States

- /

- Hospitality

- /

- NYSE:FLUT

US Stocks With Estimated Discounts Of Up To 49.5% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market navigates mixed signals with tech stocks under pressure and bond yields on the rise, investors are keenly watching for opportunities amid economic resilience and inflation concerns. In this environment, identifying undervalued stocks can be a strategic move, as these equities may offer potential value when trading below their intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| CareTrust REIT (NYSE:CTRE) | $26.41 | $51.10 | 48.3% |

| Cadence Bank (NYSE:CADE) | $33.81 | $65.12 | 48.1% |

| Camden National (NasdaqGS:CAC) | $42.13 | $83.83 | 49.7% |

| Afya (NasdaqGS:AFYA) | $15.20 | $29.48 | 48.4% |

| Ally Financial (NYSE:ALLY) | $34.96 | $69.53 | 49.7% |

| Expand Energy (NasdaqGS:EXE) | $102.21 | $202.41 | 49.5% |

| Constellium (NYSE:CSTM) | $10.32 | $20.58 | 49.9% |

| Sociedad Química y Minera de Chile (NYSE:SQM) | $38.90 | $75.19 | 48.3% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.45 | $30.73 | 49.7% |

| Annaly Capital Management (NYSE:NLY) | $18.12 | $35.15 | 48.4% |

Let's review some notable picks from our screened stocks.

Expand Energy (NasdaqGS:EXE)

Overview: Expand Energy Corporation is an independent exploration and production company operating in the United States with a market cap of $23.61 billion.

Operations: The company generates revenue of $3.29 billion from its exploration and production activities in the United States.

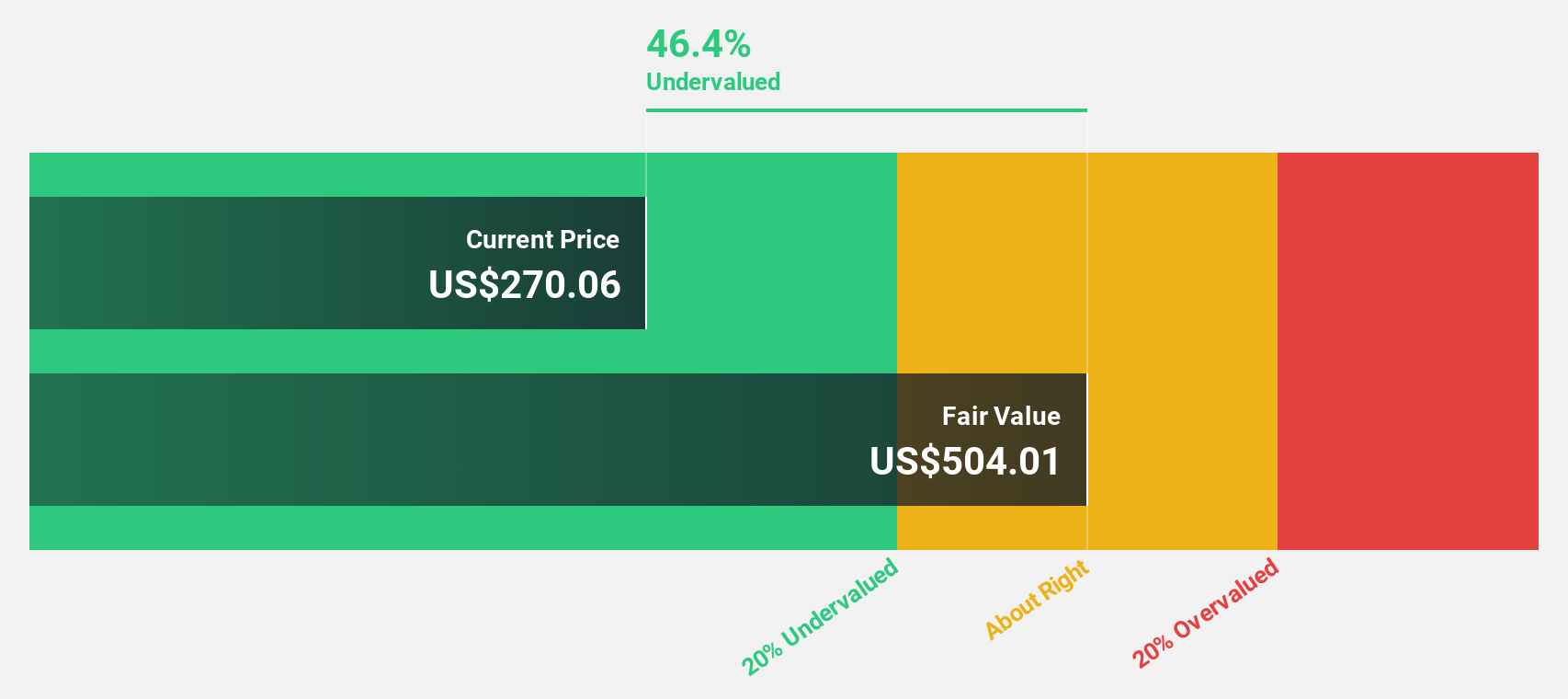

Estimated Discount To Fair Value: 49.5%

Expand Energy appears undervalued, trading at US$102.21, significantly below its estimated fair value of US$202.41. Despite recent financial setbacks, including a net loss of US$315 million for the first nine months of 2024 and substantial shareholder dilution, the company is forecasted to achieve high revenue growth at 47.2% annually. Recent debt restructuring through a tender offer and new note issuance may improve cash flows by reducing interest burdens on older notes due in 2026 and 2028.

- Our expertly prepared growth report on Expand Energy implies its future financial outlook may be stronger than recent results.

- Take a closer look at Expand Energy's balance sheet health here in our report.

Flutter Entertainment (NYSE:FLUT)

Overview: Flutter Entertainment plc is a sports betting and gaming company with operations in the United Kingdom, Ireland, Australia, the United States, Italy, and internationally, boasting a market cap of approximately $45.17 billion.

Operations: The company's revenue is derived from several key regions: $5.68 billion from the US, $3.44 billion from the UK and Ireland, $1.42 billion from Australia, and $3.03 billion internationally.

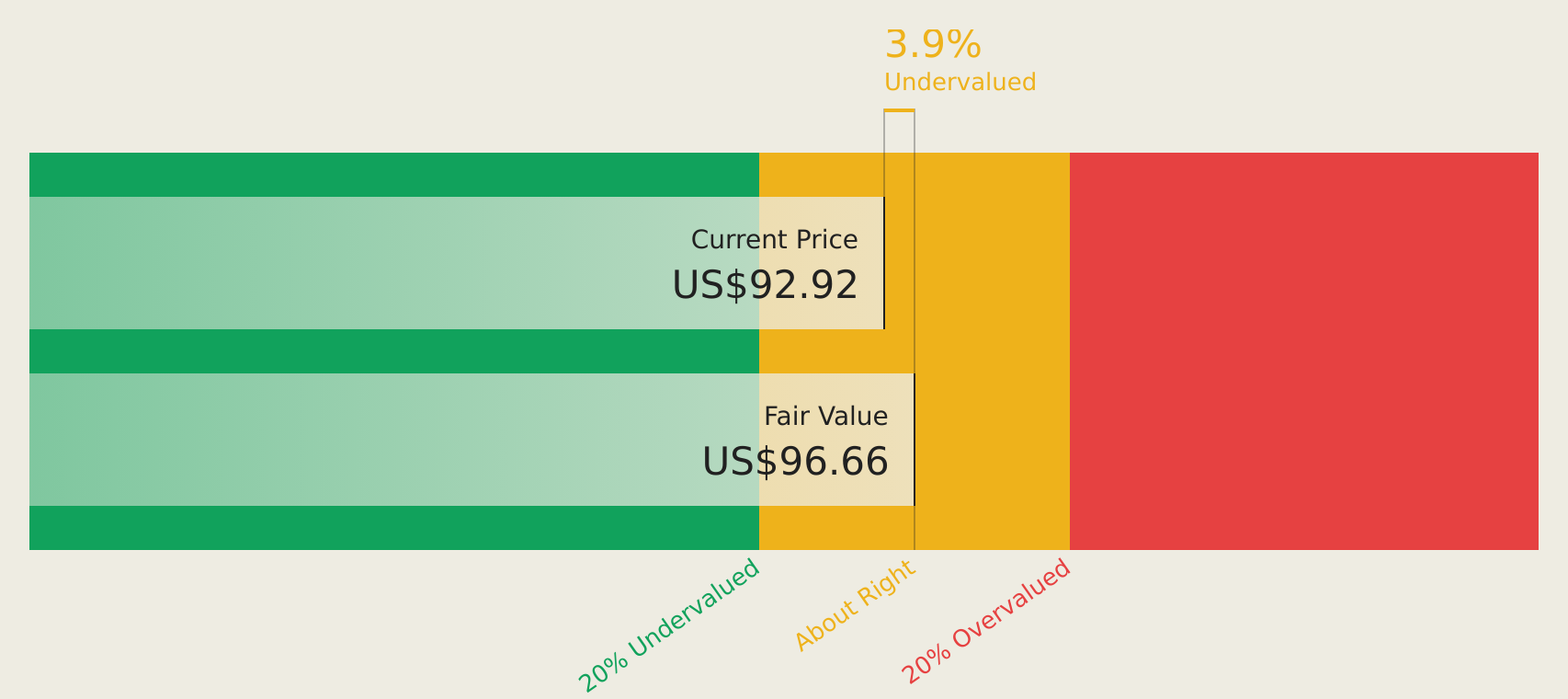

Estimated Discount To Fair Value: 20.6%

Flutter Entertainment is trading at US$256.60, over 20% below its fair value estimate of US$323.05, highlighting potential undervaluation based on cash flows. Recent earnings show a narrowed net loss and increased sales, with revenue guidance for 2024 adjusted to reflect both positive performance and unfavorable sports results. Revenue growth is projected at 11.2% annually, outpacing the broader U.S. market's expected growth rate of 9%, while profitability is anticipated within three years.

- In light of our recent growth report, it seems possible that Flutter Entertainment's financial performance will exceed current levels.

- Click here to discover the nuances of Flutter Entertainment with our detailed financial health report.

National Fuel Gas (NYSE:NFG)

Overview: National Fuel Gas Company operates as a diversified energy company with a market cap of approximately $5.68 billion.

Operations: The company's revenue segments include Utility ($697.36 million), Gathering ($244.23 million), Pipeline and Storage ($412.39 million), and Exploration and Production ($961.08 million).

Estimated Discount To Fair Value: 24.7%

National Fuel Gas, priced at US$63.67, is trading over 20% below its fair value of US$84.53, indicating potential undervaluation based on cash flows. Despite high debt levels and recent asset impairments impacting earnings, the company forecasts significant annual profit growth of 44.2%, outpacing the U.S. market's 14.9%. However, insider selling raises caution and dividend sustainability remains a concern with coverage issues by earnings or free cash flow.

- According our earnings growth report, there's an indication that National Fuel Gas might be ready to expand.

- Navigate through the intricacies of National Fuel Gas with our comprehensive financial health report here.

Next Steps

- Explore the 169 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLUT

Flutter Entertainment

Operates as a sports betting and gaming company in the United Kingdom, Ireland, Australia, the United States, Italy, and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives