- United States

- /

- Capital Markets

- /

- NasdaqGM:LPRO

There's Reason For Concern Over Open Lending Corporation's (NASDAQ:LPRO) Price

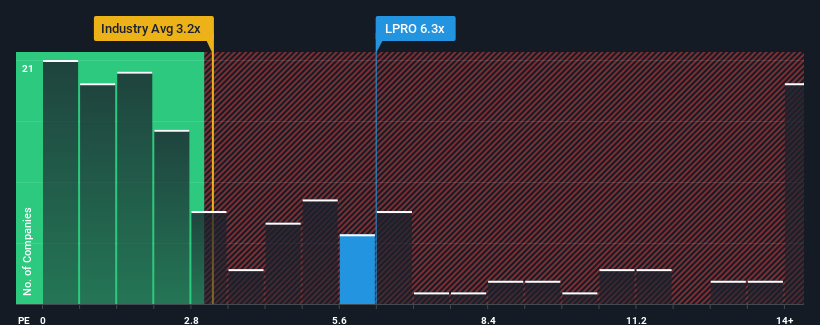

Open Lending Corporation's (NASDAQ:LPRO) price-to-sales (or "P/S") ratio of 6.3x may look like a poor investment opportunity when you consider close to half the companies in the Capital Markets industry in the United States have P/S ratios below 3.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Open Lending

What Does Open Lending's P/S Mean For Shareholders?

Open Lending could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Open Lending.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Open Lending would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 37%. Even so, admirably revenue has lifted 36% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue growth is heading into negative territory, declining 0.1% over the next year. Meanwhile, the broader industry is forecast to expand by 10%, which paints a poor picture.

In light of this, it's alarming that Open Lending's P/S sits above the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Bottom Line On Open Lending's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

For a company with revenues that are set to decline in the context of a growing industry, Open Lending's P/S is much higher than we would've anticipated. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 1 warning sign for Open Lending that you should be aware of.

If you're unsure about the strength of Open Lending's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:LPRO

Open Lending

Provides lending enablement and risk analytics solutions to credit unions, regional banks, finance companies, and captive finance companies of automakers in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives