- United States

- /

- Real Estate

- /

- NYSE:MMI

US Growth Stocks With High Insider Ownership And 10% Revenue Growth

Reviewed by Simply Wall St

As the S&P 500 flirts with record highs and major indexes post weekly gains, investors are keenly observing growth companies that demonstrate resilience amid market fluctuations. In this environment, stocks with substantial insider ownership and consistent revenue growth of at least 10% can be particularly appealing, as they often signal confidence from those closest to the company’s operations.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 27.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Astera Labs (NasdaqGS:ALAB) | 15.7% | 61.3% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 103.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.3% | 33.8% |

| Capital Bancorp (NasdaqGS:CBNK) | 31% | 30.2% |

Let's review some notable picks from our screened stocks.

Bilibili (NasdaqGS:BILI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bilibili Inc. offers online entertainment services targeting young audiences in China, with a market cap of $9.14 billion.

Operations: The company's revenue from Internet Information Providers amounts to CN¥25.45 billion.

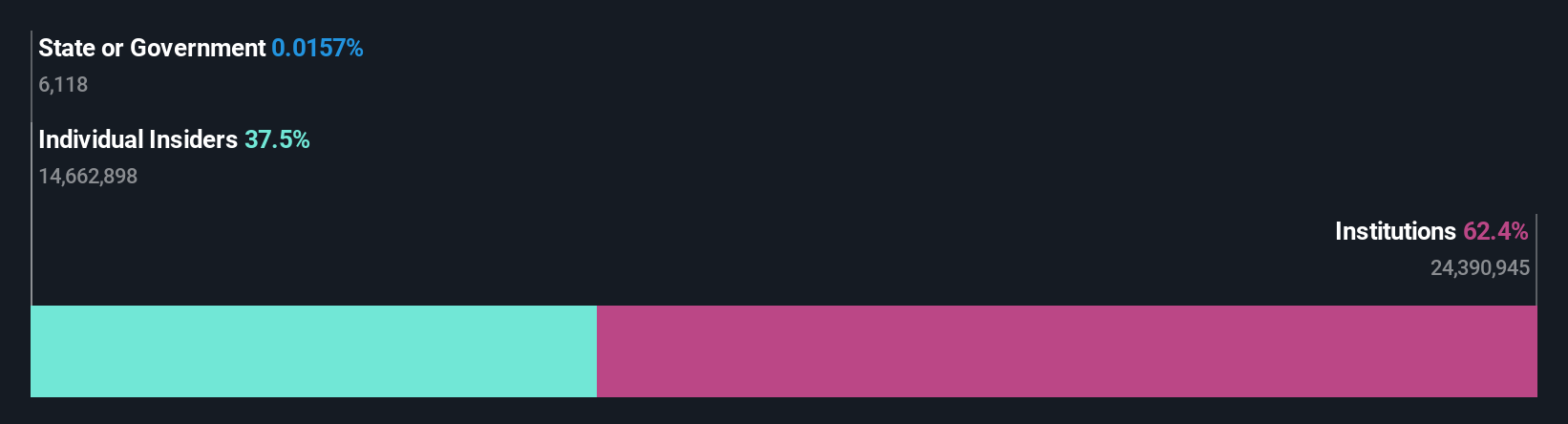

Insider Ownership: 20.3%

Revenue Growth Forecast: 10.2% p.a.

Bilibili is expected to achieve profitability within three years, with earnings forecasted to grow significantly at 65.01% annually. While revenue growth is projected at 10.2% per year, outpacing the US market average of 8.9%, insider activity shows substantial selling recently with no significant buying over the past three months. The stock trades at a notable discount of 23.9% below its estimated fair value, indicating potential undervaluation amidst these dynamics.

- Dive into the specifics of Bilibili here with our thorough growth forecast report.

- Our valuation report unveils the possibility Bilibili's shares may be trading at a discount.

Credit Acceptance (NasdaqGS:CACC)

Simply Wall St Growth Rating: ★★★★★★

Overview: Credit Acceptance Corporation provides financing programs and related services in the United States, with a market cap of $6.26 billion.

Operations: The company's revenue is primarily derived from offering dealers financing programs and related products and services, amounting to $928.20 million.

Insider Ownership: 14.3%

Revenue Growth Forecast: 37.6% p.a.

Credit Acceptance Corporation's earnings are forecast to grow significantly at 33.8% annually, surpassing the US market average. Despite no substantial insider buying recently, more shares were bought than sold in the past three months. Revenue is expected to rise by 37.6% annually, while recent financial maneuvers include a US$500 million fixed-income offering aimed at refinancing existing debt and supporting corporate activities. However, their debt remains inadequately covered by operating cash flow.

- Navigate through the intricacies of Credit Acceptance with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Credit Acceptance's shares may be trading at a premium.

Marcus & Millichap (NYSE:MMI)

Simply Wall St Growth Rating: ★★★★☆☆

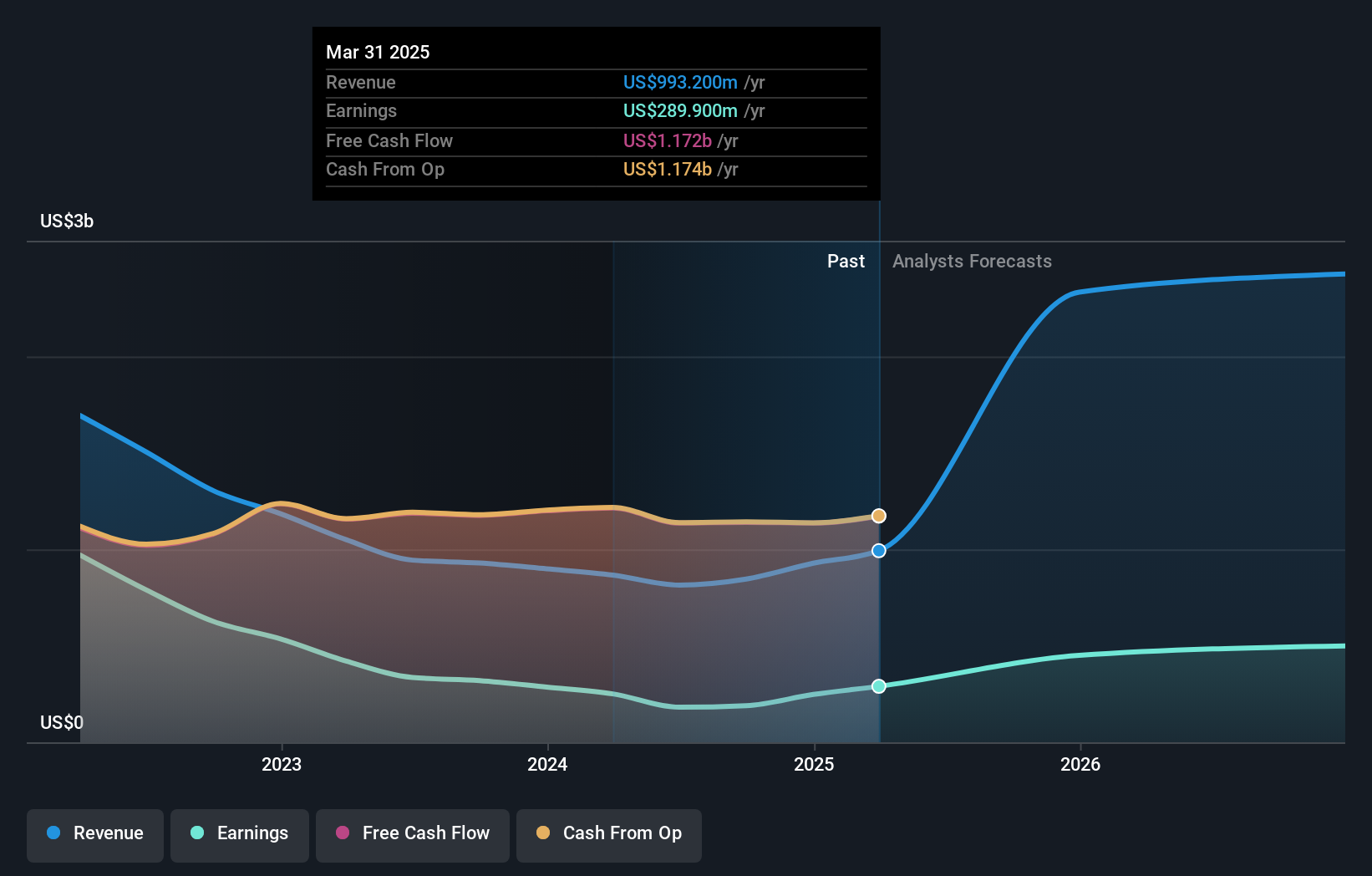

Overview: Marcus & Millichap, Inc. is an investment brokerage company offering real estate investment brokerage and financing services for commercial properties in the United States and Canada, with a market cap of approximately $1.53 billion.

Operations: The company's revenue primarily comes from delivering commercial real estate services, amounting to $696.06 million.

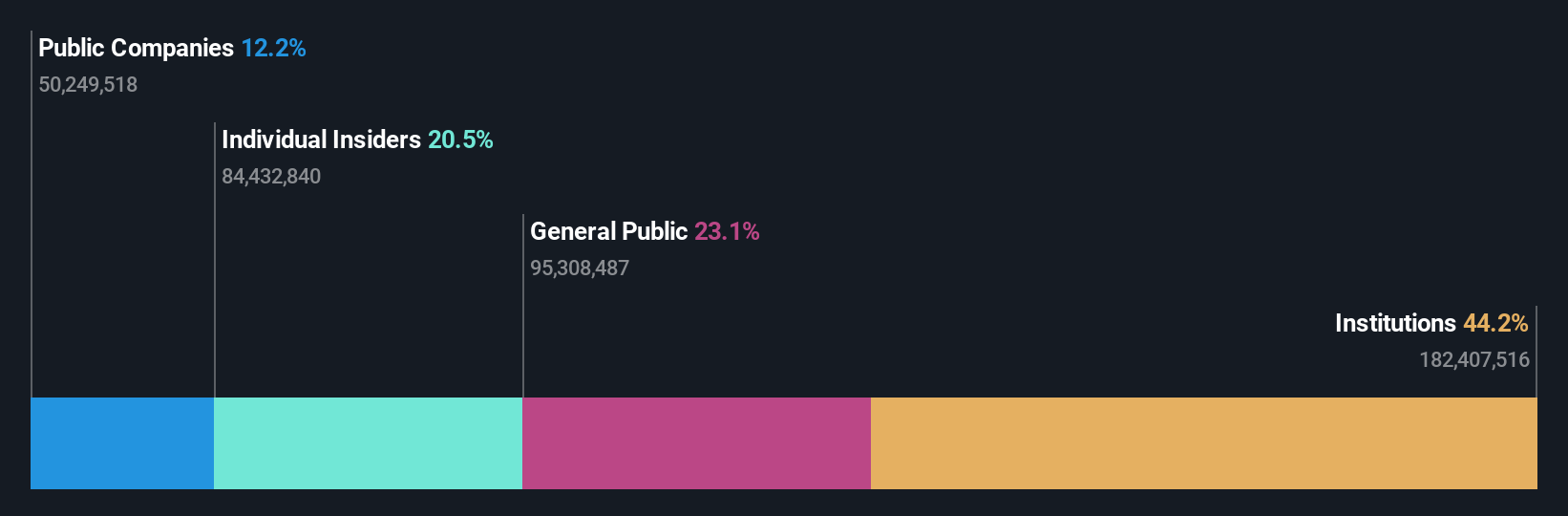

Insider Ownership: 37.4%

Revenue Growth Forecast: 18.5% p.a.

Marcus & Millichap's recent earnings report showed a strong turnaround, with Q4 revenue at US$240.08 million and net income of US$8.55 million, reversing last year's loss. The company forecasts annual profit growth above market averages and expects revenue to grow by 18.5% annually, outpacing the broader US market's 8.9%. Despite no substantial insider buying or selling recently, high insider ownership may align management interests with shareholders as they navigate future growth prospects.

- Click here and access our complete growth analysis report to understand the dynamics of Marcus & Millichap.

- Our comprehensive valuation report raises the possibility that Marcus & Millichap is priced higher than what may be justified by its financials.

Summing It All Up

- Click this link to deep-dive into the 197 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMI

Marcus & Millichap

An investment brokerage company, provides real estate investment brokerage and financing services to sellers and buyers of commercial real estate in the United States and Canada.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives