- United States

- /

- Personal Products

- /

- NasdaqGM:ODD

US Stocks That Might Be Trading At A Discount In February 2025

Reviewed by Simply Wall St

As the U.S. stock market approaches record highs, with major indices like the S&P 500 and Nasdaq Composite showing strong gains, investors are keenly observing opportunities that may still be trading at a discount. In this environment of optimism and speculation, identifying undervalued stocks requires a careful analysis of fundamentals and potential growth prospects amidst prevailing market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $18.65 | $36.99 | 49.6% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | $30.80 | $58.66 | 47.5% |

| Old National Bancorp (NasdaqGS:ONB) | $23.89 | $45.71 | 47.7% |

| Sandy Spring Bancorp (NasdaqGS:SASR) | $33.65 | $64.49 | 47.8% |

| Incyte (NasdaqGS:INCY) | $70.42 | $134.86 | 47.8% |

| Array Technologies (NasdaqGM:ARRY) | $6.79 | $13.53 | 49.8% |

| Constellium (NYSE:CSTM) | $9.34 | $18.30 | 49% |

| First Advantage (NasdaqGS:FA) | $19.93 | $38.12 | 47.7% |

| Fluence Energy (NasdaqGS:FLNC) | $6.43 | $12.61 | 49% |

| Kyndryl Holdings (NYSE:KD) | $41.79 | $82.10 | 49.1% |

Let's review some notable picks from our screened stocks.

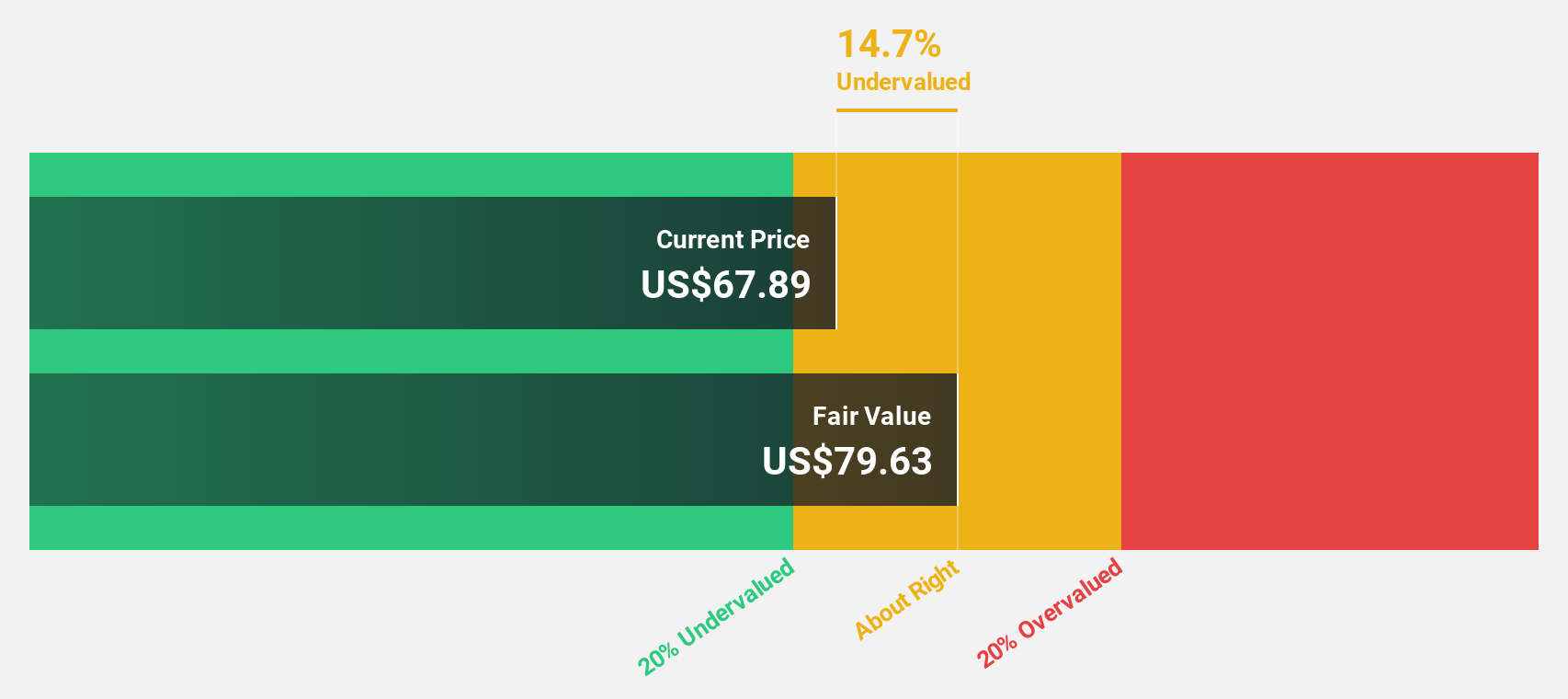

Oddity Tech (NasdaqGM:ODD)

Overview: Oddity Tech Ltd. is a consumer tech company that creates digital-first brands for the beauty and wellness industries globally, with a market cap of approximately $2.46 billion.

Operations: The company generates revenue primarily from its Personal Products segment, which amounted to $620.65 million.

Estimated Discount To Fair Value: 44%

Oddity Tech, currently trading at US$43, is significantly undervalued compared to its estimated fair value of US$76.74. Its earnings are projected to grow 19.6% annually, outpacing the broader US market's growth rate of 14.5%. Recent agreements for a new US$200 million credit facility enhance financial flexibility without current utilization, supporting growth and acquisitions while maintaining a robust cash position of over US$165 million as of December 2024.

- Our expertly prepared growth report on Oddity Tech implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Oddity Tech.

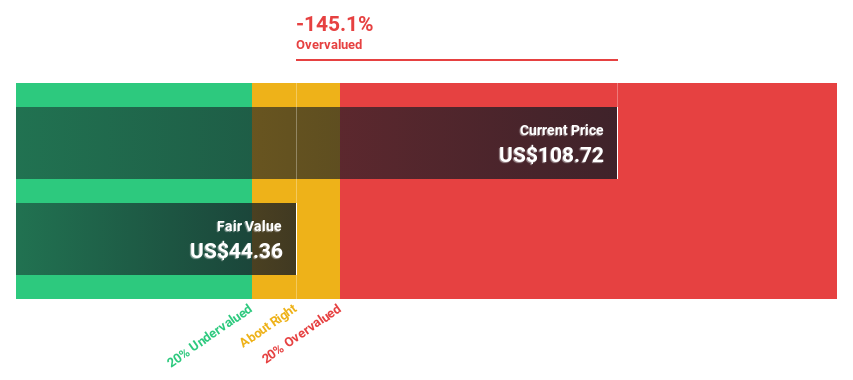

Shake Shack (NYSE:SHAK)

Overview: Shake Shack Inc. owns, operates, and licenses Shake Shack restaurants in the United States and internationally, with a market cap of approximately $4.61 billion.

Operations: The company's revenue primarily comes from its owned and operated restaurants, generating approximately $1.21 billion.

Estimated Discount To Fair Value: 18.7%

Shake Shack's stock is trading at US$108.40, below its estimated fair value of US$133.26, suggesting potential undervaluation based on cash flows. Earnings are expected to grow significantly over the next three years, outpacing the broader US market growth rate of 14.5%. Recent leadership changes aim to drive digital and culinary innovation, with revenue guidance for early 2025 between US$1.45 billion and US$1.48 billion supporting strategic growth initiatives.

- The growth report we've compiled suggests that Shake Shack's future prospects could be on the up.

- Navigate through the intricacies of Shake Shack with our comprehensive financial health report here.

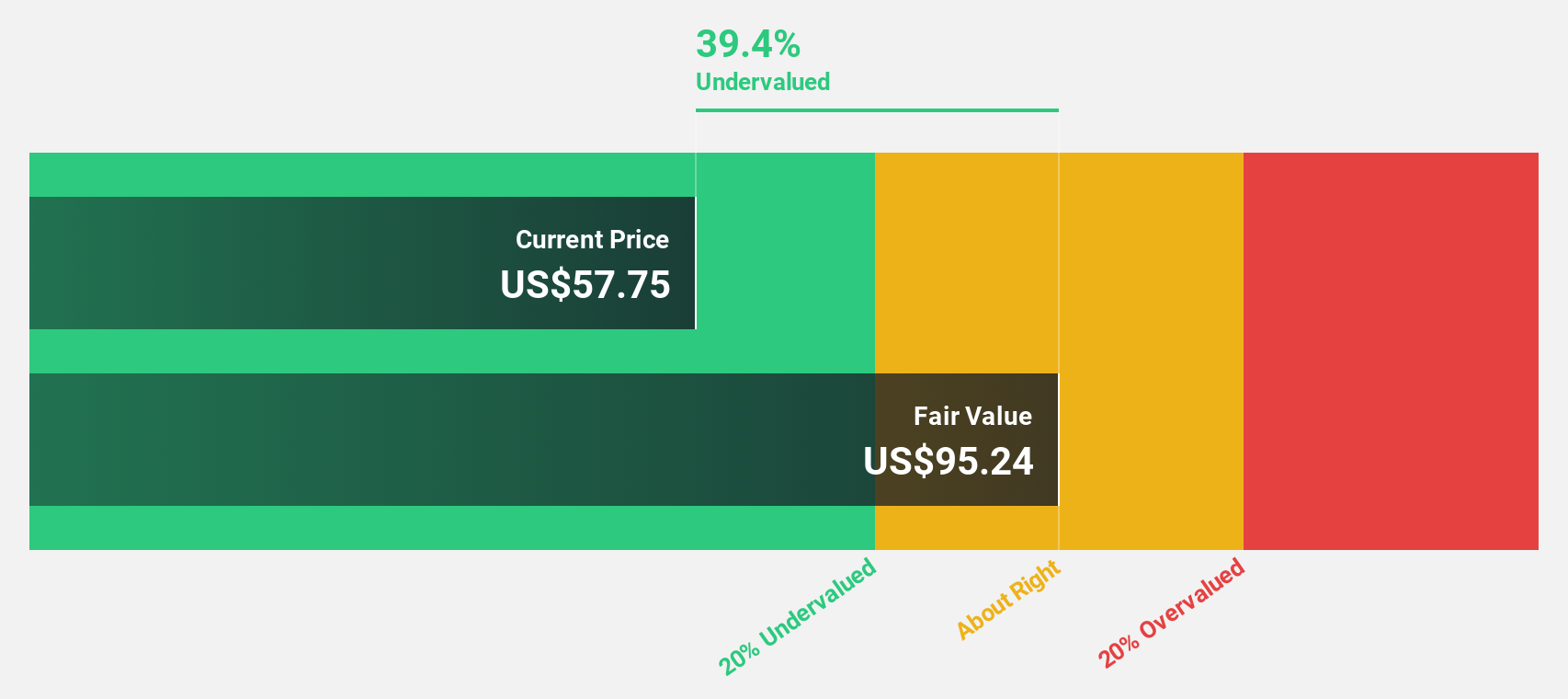

Viking Holdings (NYSE:VIK)

Overview: Viking Holdings Ltd operates in the passenger shipping and transport sector across North America, the United Kingdom, and internationally, with a market cap of $22.21 billion.

Operations: The company's revenue is primarily derived from its Viking Ocean segment, generating $2.12 billion, and its Viking River segment, contributing $2.51 billion.

Estimated Discount To Fair Value: 27.7%

Viking Holdings is trading at US$51.47, significantly below its estimated fair value of US$71.23, indicating potential undervaluation based on cash flows. The company forecasts a strong annual earnings growth rate of 50.71%, surpassing the broader market's expectations and is set to become profitable within three years. Recent executive changes with Leah Talactac as President aim to bolster leadership, while new itineraries expand revenue opportunities in the cruise sector.

- Insights from our recent growth report point to a promising forecast for Viking Holdings' business outlook.

- Take a closer look at Viking Holdings' balance sheet health here in our report.

Make It Happen

- Explore the 160 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ODD

Oddity Tech

Operates as a consumer tech company that builds digital-first brands for the beauty and wellness industries in the United States and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives