- United States

- /

- Hospitality

- /

- NYSE:RSI

3 Stocks That May Be Undervalued By Up To 34.5%

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape marked by strong bank earnings and renewed trade tensions with China, investors are keeping a close eye on potential opportunities amidst the volatility. In this environment, identifying undervalued stocks can be crucial for those seeking to capitalize on discrepancies between market prices and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wix.com (WIX) | $136.16 | $260.98 | 47.8% |

| NeuroPace (NPCE) | $10.48 | $20.14 | 48% |

| MoneyHero (MNY) | $1.27 | $2.54 | 49.9% |

| Midland States Bancorp (MSBI) | $16.02 | $30.68 | 47.8% |

| Glaukos (GKOS) | $83.09 | $162.17 | 48.8% |

| Equity Bancshares (EQBK) | $40.46 | $78.29 | 48.3% |

| e.l.f. Beauty (ELF) | $132.69 | $254.55 | 47.9% |

| Dime Community Bancshares (DCOM) | $29.27 | $57.31 | 48.9% |

| Corpay (CPAY) | $282.51 | $548.56 | 48.5% |

| AGNC Investment (AGNC) | $9.99 | $19.72 | 49.3% |

Let's explore several standout options from the results in the screener.

Live Oak Bancshares (LOB)

Overview: Live Oak Bancshares, Inc. is a bank holding company for Live Oak Banking Company, offering various banking products and services in the United States, with a market cap of approximately $1.59 billion.

Operations: The company's revenue primarily comes from its banking platform for small businesses, generating $406.00 million.

Estimated Discount To Fair Value: 18.2%

Live Oak Bancshares is trading at US$35.62, below its estimated fair value of US$43.56, suggesting it might be undervalued based on cash flows. Despite a high level of bad loans at 4.2%, earnings are forecast to grow significantly by 43.8% per year, outpacing the broader U.S. market's growth expectations. Recent net interest income improvements and strategic board appointments highlight potential for future performance gains despite current profit margin declines from last year’s figures.

- Our comprehensive growth report raises the possibility that Live Oak Bancshares is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Live Oak Bancshares stock in this financial health report.

Rush Street Interactive (RSI)

Overview: Rush Street Interactive, Inc. is an online casino and sports betting company operating in the United States, Canada, and Latin America with a market cap of approximately $4.20 billion.

Operations: The company generates revenue from its online casino and sports betting operations, with the Casinos & Resorts segment contributing $1.02 billion.

Estimated Discount To Fair Value: 13.3%

Rush Street Interactive is trading at US$18.9, below its estimated fair value of US$21.8, reflecting potential undervaluation based on cash flows. The company recently became profitable and forecasts indicate significant earnings growth of 21.1% annually over the next three years, surpassing the U.S. market average. Recent strategic initiatives include launching a new debit payment solution with Sightline Payments and appointing a seasoned CTO to drive technological advancements in online gaming platforms.

- Our expertly prepared growth report on Rush Street Interactive implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Rush Street Interactive.

Wolverine World Wide (WWW)

Overview: Wolverine World Wide, Inc. designs, manufactures, sources, markets, licenses, and distributes footwear, apparel, and accessories across various regions including the United States and international markets with a market cap of approximately $2 billion.

Operations: The company's revenue segments include the Work Group, which generated $442.50 million, and the Active Group, contributing $1.33 billion.

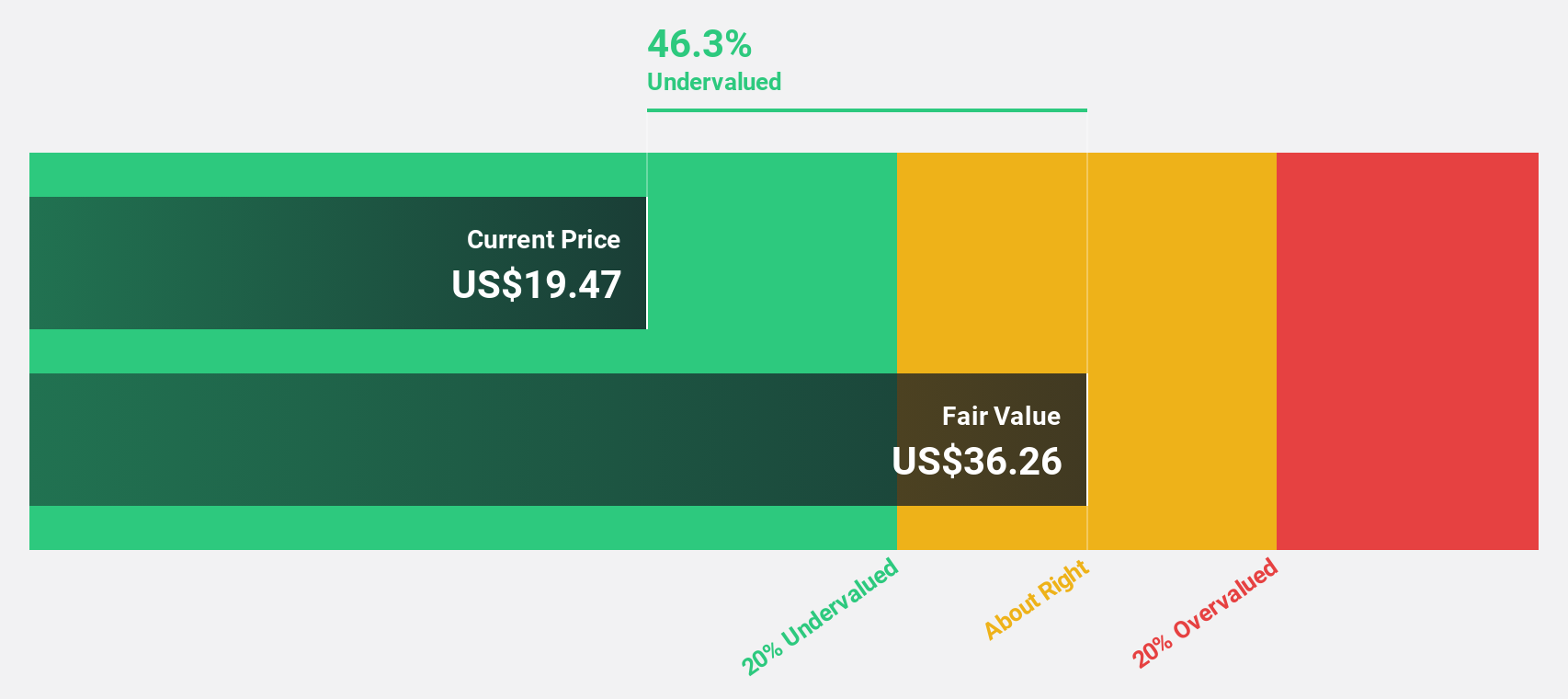

Estimated Discount To Fair Value: 34.5%

Wolverine World Wide, trading at US$25.36, is undervalued compared to its fair value estimate of US$38.74, suggesting it might be a good candidate for those focusing on cash flow-based valuations. The company has become profitable this year and anticipates robust annual earnings growth of 28%, outpacing the U.S. market average. Despite high debt levels, Wolverine's strategic moves include refinancing its credit facility to $600 million and launching innovative product collaborations that could bolster revenue streams.

- Upon reviewing our latest growth report, Wolverine World Wide's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Wolverine World Wide's balance sheet health report.

Taking Advantage

- Embark on your investment journey to our 182 Undervalued US Stocks Based On Cash Flows selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RSI

Rush Street Interactive

Operates as an online casino and sports betting company in the United States, Canada, and Latin America.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

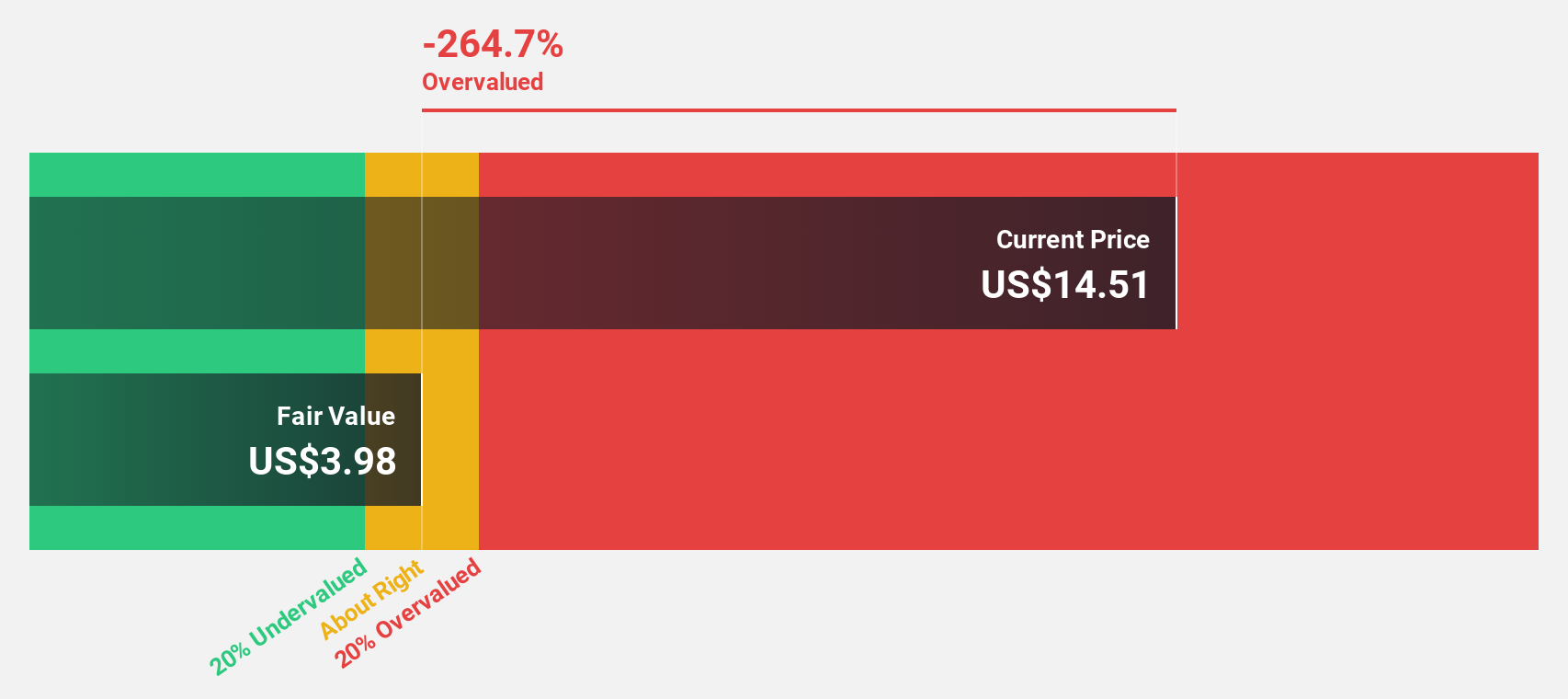

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)