- United States

- /

- Consumer Finance

- /

- NYSE:COF

March 2025's Top Stocks That May Be Priced Below Estimated Value

Reviewed by Simply Wall St

As of March 2025, the major U.S. stock indices have managed to break their recent losing streaks, buoyed by gains in big tech stocks and a steady interest rate from the Federal Reserve. Despite ongoing economic uncertainties, including tariff concerns and mixed corporate earnings reports, investors are on the lookout for opportunities in undervalued stocks that may offer potential value amid market fluctuations. In such an environment, identifying stocks priced below their estimated value can be crucial for investors seeking to capitalize on market inefficiencies while navigating current economic challenges.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Berkshire Hills Bancorp (NYSE:BHLB) | $26.12 | $51.39 | 49.2% |

| ACNB (NasdaqCM:ACNB) | $42.01 | $82.44 | 49% |

| Associated Banc-Corp (NYSE:ASB) | $22.51 | $44.78 | 49.7% |

| German American Bancorp (NasdaqGS:GABC) | $38.20 | $75.38 | 49.3% |

| Datadog (NasdaqGS:DDOG) | $105.03 | $205.72 | 48.9% |

| Coastal Financial (NasdaqGS:CCB) | $84.48 | $167.69 | 49.6% |

| Constellium (NYSE:CSTM) | $11.35 | $22.45 | 49.4% |

| Albemarle (NYSE:ALB) | $77.56 | $152.79 | 49.2% |

| Haemonetics (NYSE:HAE) | $64.00 | $124.62 | 48.6% |

| Mobileye Global (NasdaqGS:MBLY) | $14.56 | $28.75 | 49.4% |

Here's a peek at a few of the choices from the screener.

Roku (NasdaqGS:ROKU)

Overview: Roku, Inc., along with its subsidiaries, operates a TV streaming platform both in the United States and internationally, with a market cap of approximately $11.43 billion.

Operations: Roku generates revenue through its Devices segment, which accounts for $590.12 million, and its Platform segment, contributing $3.52 billion.

Estimated Discount To Fair Value: 46.2%

Roku is trading at US$78.29, significantly below its estimated fair value of US$145.47, indicating potential undervaluation based on discounted cash flows. Despite recent net losses, Roku's revenue growth outpaces the broader U.S. market, with expected annual earnings growth of 54.58%. The recent partnership with Monster Jam enhances content offerings on The Roku Channel, potentially boosting user engagement and ad revenues as the company aims for profitability within three years amidst ongoing strategic expansions.

- Our growth report here indicates Roku may be poised for an improving outlook.

- Dive into the specifics of Roku here with our thorough financial health report.

Sportradar Group (NasdaqGS:SRAD)

Overview: Sportradar Group AG, along with its subsidiaries, offers sports data services for the sports betting and media industries across various regions including the United Kingdom, United States, Malta, Switzerland, and internationally; it has a market cap of approximately $6.68 billion.

Operations: The company's revenue segment includes Data Processing, which generated €1.11 billion.

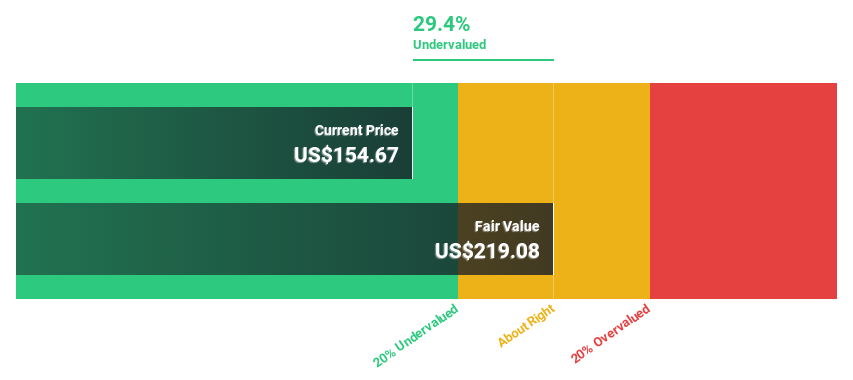

Estimated Discount To Fair Value: 16.2%

Sportradar Group, trading at US$22.32, is undervalued relative to its fair value estimate of US$26.63. Despite a recent net loss due to impairments, its revenue grew to €1.11 billion for 2024 and is expected to rise by at least 15% in 2025. With forecasted earnings growth significantly outpacing the U.S. market and ongoing share buybacks, Sportradar's financial trajectory suggests potential value for investors focusing on cash flow analysis amidst strategic adjustments and board changes.

- In light of our recent growth report, it seems possible that Sportradar Group's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Sportradar Group's balance sheet health report.

Capital One Financial (NYSE:COF)

Overview: Capital One Financial Corporation is a financial services holding company offering a range of financial products and services in the United States, Canada, and the United Kingdom, with a market cap of approximately $66.66 billion.

Operations: Capital One Financial Corporation's revenue is primarily derived from its Credit Card segment at $17.89 billion, followed by Consumer Banking at $7.28 billion and Commercial Banking at $3.59 billion.

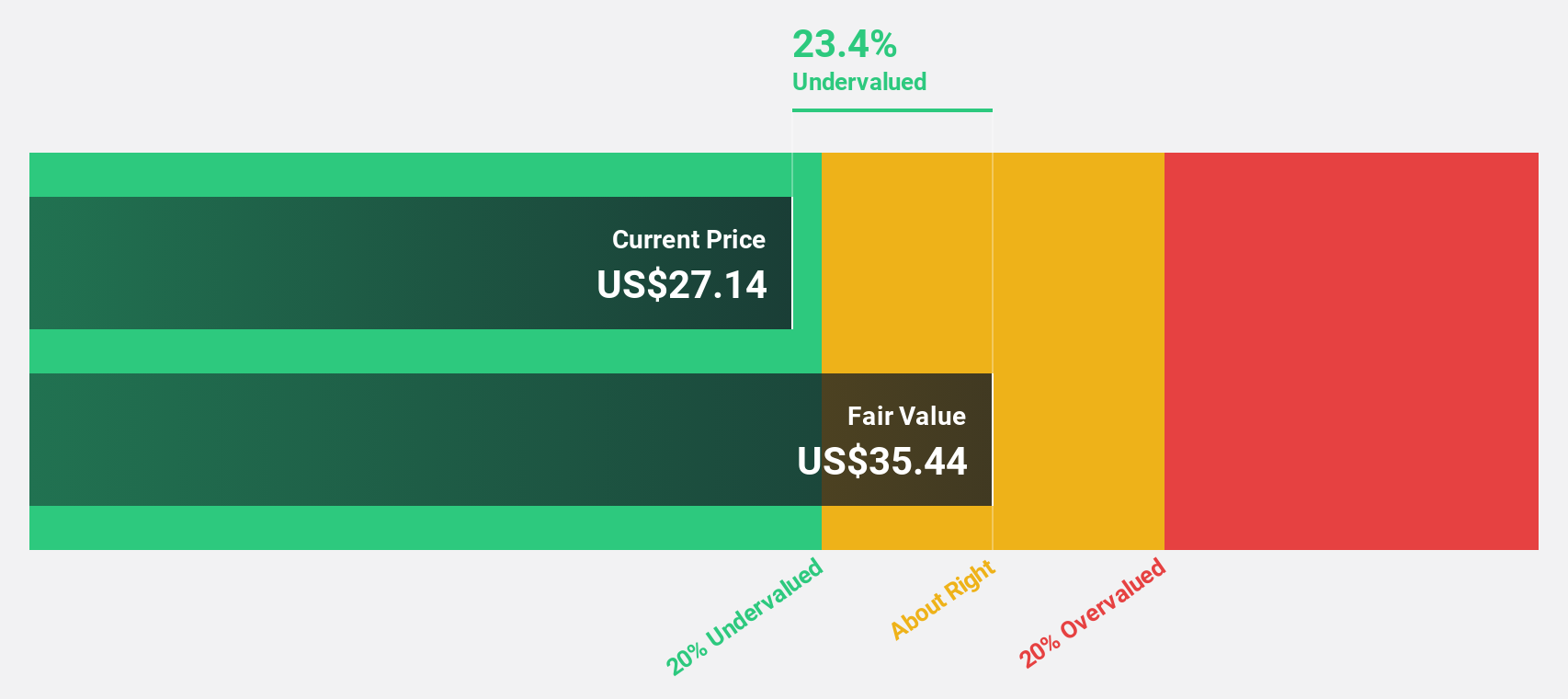

Estimated Discount To Fair Value: 14.7%

Capital One Financial, trading at US$174.82, appears undervalued against its fair value estimate of US$204.96. The company forecasts earnings growth of 22.1% per year, surpassing the U.S. market average, while revenue is expected to grow at 12.4% annually. Recent share buybacks totaling US$963.59 million and consistent dividends underscore strong cash flow management despite a forecasted low return on equity in three years (9.9%).

- The growth report we've compiled suggests that Capital One Financial's future prospects could be on the up.

- Get an in-depth perspective on Capital One Financial's balance sheet by reading our health report here.

Key Takeaways

- Explore the 195 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COF

Capital One Financial

Operates as the financial services holding company for the Capital One, National Association, which engages in the provision of various financial products and services in the United States, Canada, and the United Kingdom.

Flawless balance sheet with reasonable growth potential.