- United States

- /

- Hospitality

- /

- NasdaqGS:PZZA

Papa John's International Leads Three Undervalued Small Caps With Insider Actions

As the broader U.S. stock market exhibits robust performance, with indices like the S&P 500 reaching new heights largely due to mega-cap tech stocks, it creates an intriguing contrast for exploring opportunities in other segments such as undervalued small-cap stocks. In this dynamic market environment, identifying small caps with potential for growth becomes particularly compelling, especially when considering insider actions that might signal unrecognized value.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ramaco Resources | 11.6x | 0.9x | 26.16% | ★★★★★★ |

| Columbus McKinnon | 21.5x | 1.0x | 41.99% | ★★★★★★ |

| Modiv Industrial | NA | 2.8x | 33.26% | ★★★★★☆ |

| Thryv Holdings | NA | 0.7x | 27.54% | ★★★★★☆ |

| Appian | NA | 3.5x | -327.24% | ★★★★☆☆ |

| Chatham Lodging Trust | NA | 1.3x | 17.51% | ★★★★☆☆ |

| Franklin Financial Services | 9.2x | 1.9x | 37.65% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Lindblad Expeditions Holdings | NA | 0.7x | -82.83% | ★★★☆☆☆ |

| Titan Machinery | 3.9x | 0.1x | -9.01% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Papa John's International (NasdaqGS:PZZA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Papa John's International operates as a pizza delivery company, managing domestic company-owned restaurants, North America and international franchises, and North America commissaries with a market capitalization of approximately $2.58 billion.

Operations: The company generates revenue through various segments including international operations, North America franchise, North America commissary, and domestic company-owned restaurants. Gross profit margins have shown a trend of fluctuation over the years with figures like 35.32% in 2013 decreasing to around 30.76% by the end of the period analyzed, reflecting changes in cost of goods sold and operational efficiency.

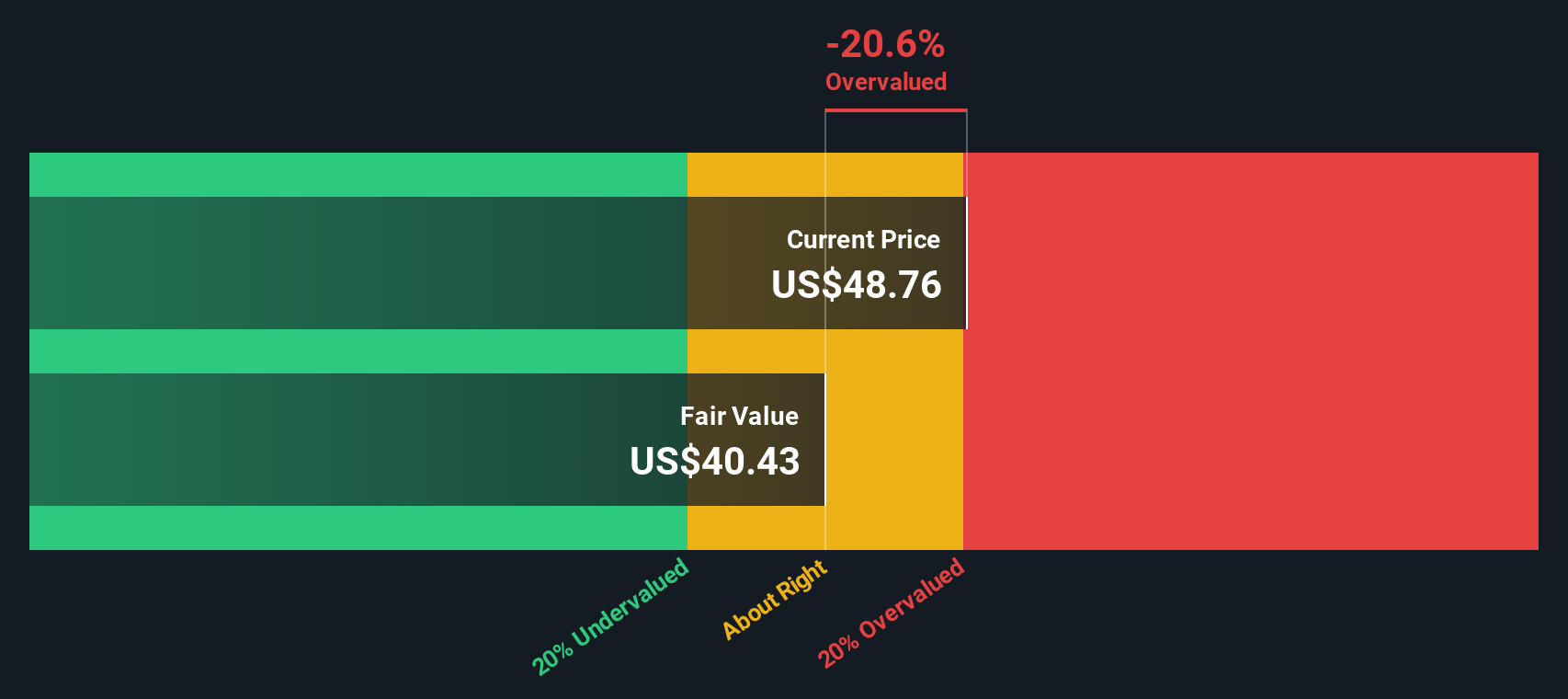

PE: 21.5x

Papa John's International, recently demonstrating a 28% increase in sales to US$40.71 million for Q1 2024, reflects a promising trajectory despite a slight dip in net income and earnings per share from the previous year. Insider confidence is underscored by recent share purchases, signaling strong belief in the company's value proposition amidst expanding operations, including plans for 50 new restaurants by 2028. This growth initiative aligns with their robust marketing strategies and product innovations like the Crispy Cuppy Roni line, enhancing consumer engagement and brand strength.

Ready Capital (NYSE:RC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ready Capital is a real estate finance company that specializes in small business lending and lower middle market commercial real estate, with a market capitalization of approximately $1.07 billion.

Operations: The company's gross profit margin has shown a notable increase from 9.58% in late 2013 to 85.36% by mid-2024, reflecting substantial growth in efficiency or pricing power over the period. This financial trajectory is complemented by revenue expansion from $16.48 million at the end of 2013 to $310.50 million as of mid-2024, underscoring significant business scale-up.

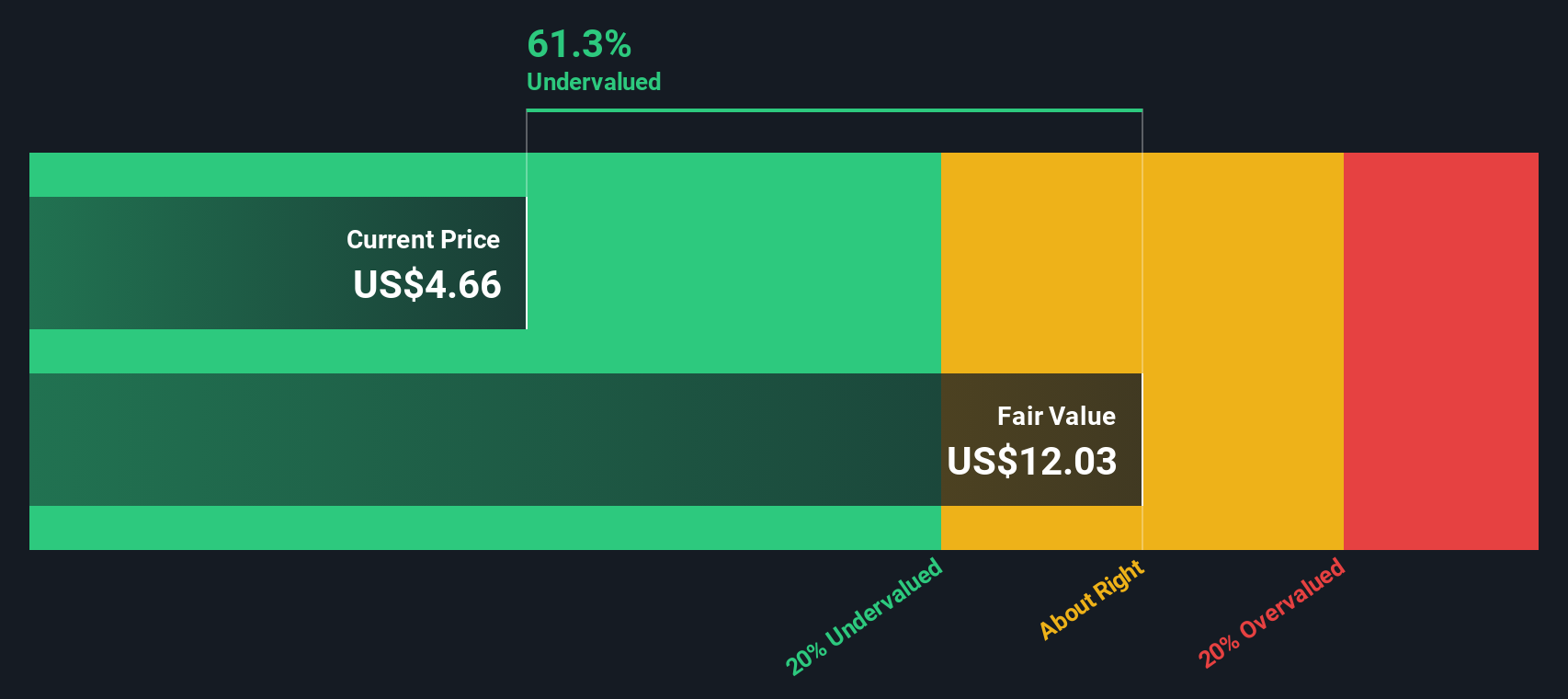

PE: 6.4x

Recently, Ready Capital displayed insider confidence with significant share purchases, acquiring 3.74 million shares for US$32.72 million, signaling strong belief in the company's prospects despite a challenging quarter where it reported a net loss of US$74.28 million. This move complements their consistent dividend payouts, including the latest at $0.30 per common share and varied rates for preferred stocks, underpinning its commitment to shareholder returns amidst financial volatility highlighted by one-off items impacting results. Their active presence at key industry conferences further underscores their strategic positioning within the sector.

- Get an in-depth perspective on Ready Capital's performance by reading our valuation report here.

-

Evaluate Ready Capital's historical performance by accessing our past performance report.

Wabash National (NYSE:WNC)

Simply Wall St Value Rating: ★★★★★★

Overview: Wabash National is a manufacturer of semi-trailers and liquid transportation systems, with a market capitalization of approximately $1 billion.

Operations: Parts & Services and Transportation Solutions generate the primary revenue for the entity, with respective contributions of $222.97 million and $2.23 billion, excluding Corporate and Eliminations which detract $23.10 million from total revenue calculations. The company's gross profit margin has shown a trend of increase over recent periods, reaching 0.19 in the latest quarter reported.

PE: 4.9x

Recently, Wabash National, a notable player in the manufacturing sector, demonstrated insider confidence through substantial share purchases. Despite a challenging quarter with sales dropping to US$515 million from US$621 million year-over-year and net income falling to US$18 million, insiders are evidently bullish about the company's prospects. This insider activity could signal a belief in potential recovery or growth not yet reflected in the stock price. Additionally, Wabash maintains its revenue outlook at around US$2.3 billion for the year, suggesting stability ahead.

- Delve into the full analysis valuation report here for a deeper understanding of Wabash National.

-

Gain insights into Wabash National's past trends and performance with our Past report.

Where To Now?

- Unlock more gems! Our Undervalued Small Caps With Insider Buying screener has unearthed 56 more companies for you to explore.Click here to unveil our expertly curated list of 59 Undervalued Small Caps With Insider Buying.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PZZA

Papa John's International

Operates and franchises pizza delivery and carryout restaurants under the Papa Johns trademark in the United States, Canada, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives