- United States

- /

- Hospitality

- /

- NasdaqGS:ATAT

US Growth Companies With High Insider Ownership For February 2025

Reviewed by Simply Wall St

As of February 2025, the U.S. stock market is experiencing a period of optimism, with major indices like the S&P 500 closing just shy of record highs and posting weekly gains. In this favorable environment, investors often seek growth companies with high insider ownership as these firms may align management interests closely with shareholder value and can potentially offer robust returns in an advancing market.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 27.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.9% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Astera Labs (NasdaqGS:ALAB) | 15.7% | 61.3% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 103.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.3% | 33.8% |

| Capital Bancorp (NasdaqGS:CBNK) | 31% | 30.2% |

Here we highlight a subset of our preferred stocks from the screener.

Atour Lifestyle Holdings (NasdaqGS:ATAT)

Simply Wall St Growth Rating: ★★★★★★

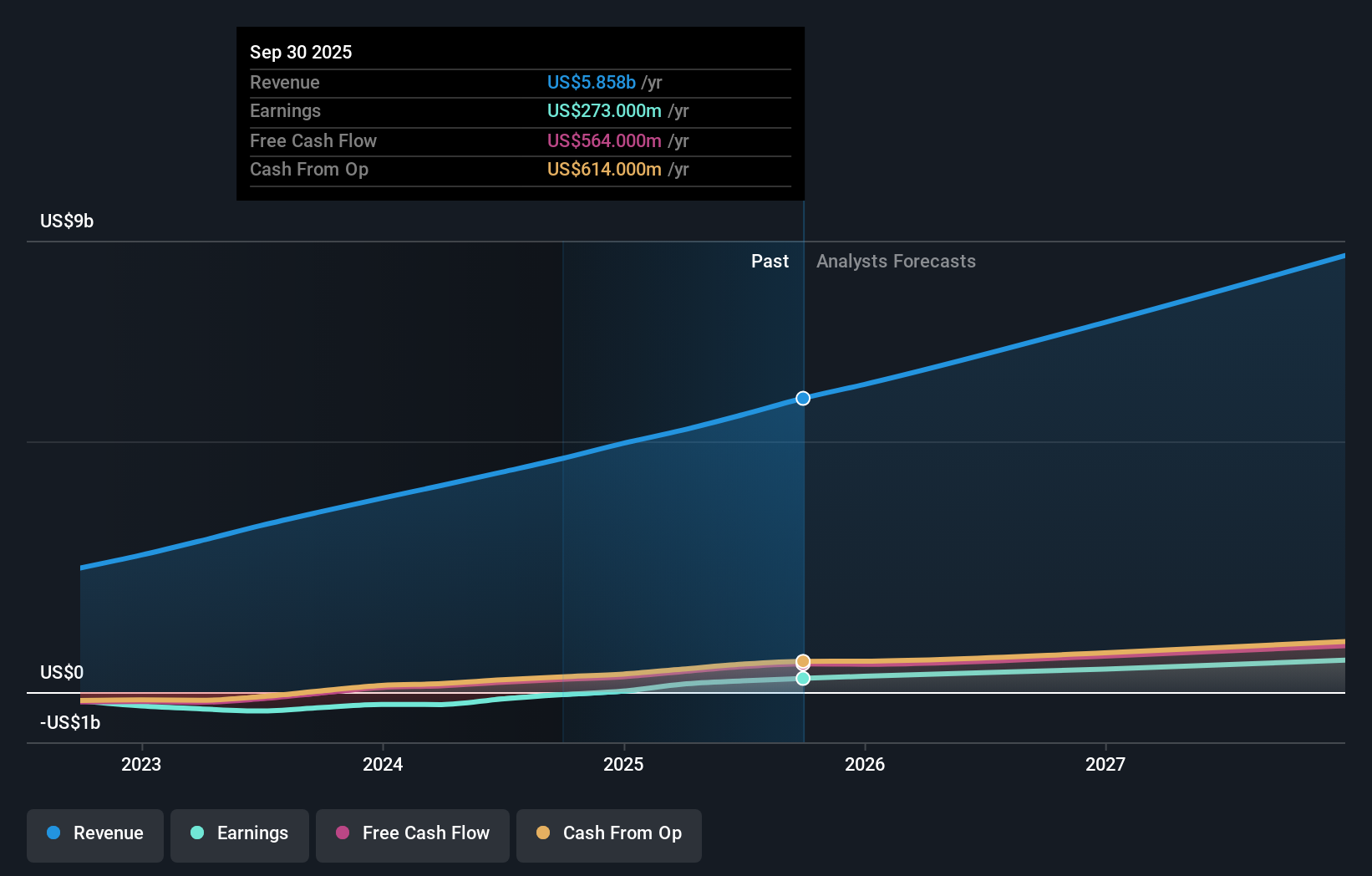

Overview: Atour Lifestyle Holdings Limited, with a market cap of approximately $4.24 billion, operates in the People's Republic of China where it develops lifestyle brands centered around hotel offerings through its subsidiaries.

Operations: The company's revenue is primarily generated from the Atour Group segment, totaling CN¥6.67 billion.

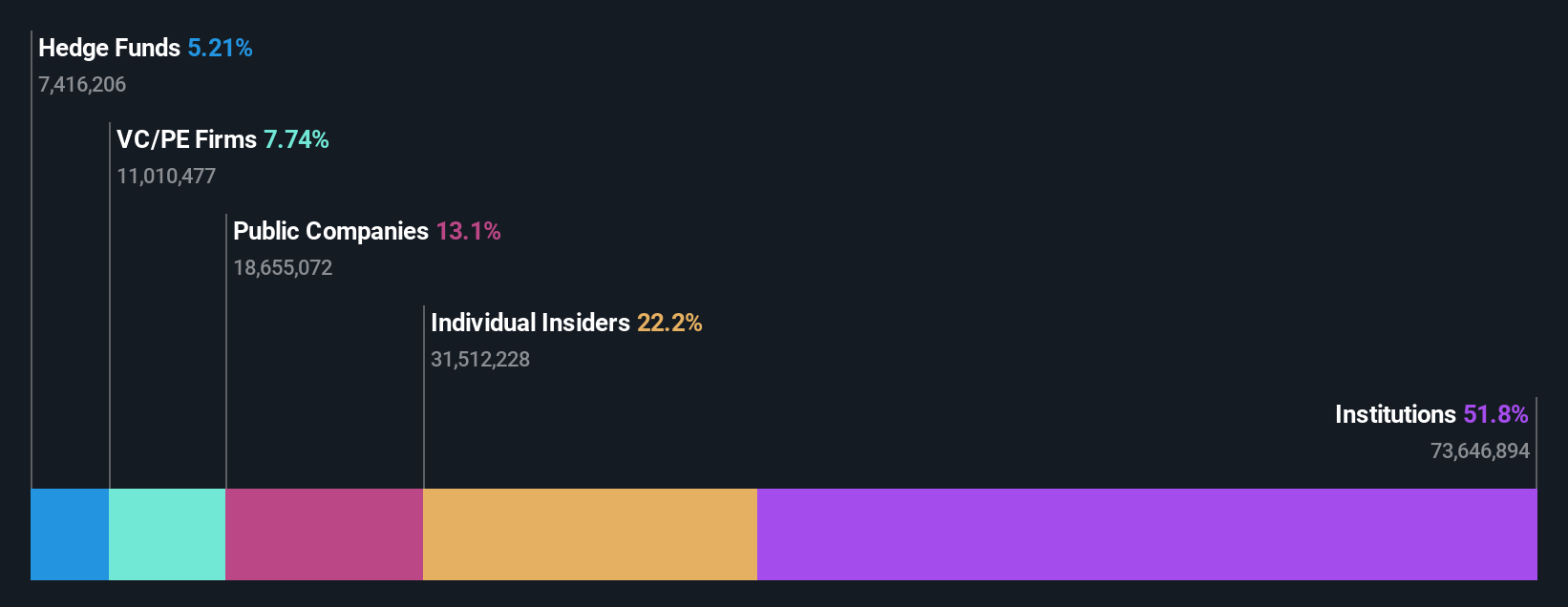

Insider Ownership: 26%

Return On Equity Forecast: 46% (2027 estimate)

Atour Lifestyle Holdings demonstrates significant growth potential, with earnings projected to grow 25.6% annually, surpassing the US market average. Recent results show revenue of CNY 5.16 billion for the first nine months of 2024, a notable increase from CNY 3.16 billion previously, and net income rose to CNY 945.2 million from CNY 517.08 million a year ago. The stock trades at a substantial discount to its estimated fair value and boasts strong insider ownership without recent significant insider trading activity.

- Take a closer look at Atour Lifestyle Holdings' potential here in our earnings growth report.

- The valuation report we've compiled suggests that Atour Lifestyle Holdings' current price could be quite moderate.

LendingTree (NasdaqGS:TREE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LendingTree, Inc. operates an online consumer platform in the United States and has a market cap of $627.61 million.

Operations: The company's revenue segments include Home at $119.98 million, Consumer at $216.33 million, and Insurance at $436.60 million.

Insider Ownership: 18.1%

Return On Equity Forecast: 55% (2027 estimate)

LendingTree is poised for profitability within three years, with earnings projected to grow 52.66% annually. The company's strategic partnership with Coverdash enhances its platform by integrating business insurance, aiding small businesses in risk management and loan approval. Substantial insider buying in recent months underscores confidence in its growth trajectory. Despite revenue growth forecasts of 8.7% annually being slightly below the market average, analysts expect a potential stock price increase of 47.5%.

- Dive into the specifics of LendingTree here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that LendingTree is trading behind its estimated value.

Toast (NYSE:TOST)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Toast, Inc. operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, and India with a market cap of approximately $22.99 billion.

Operations: The company's revenue is primarily generated from its data processing segment, which amounts to $4.66 billion.

Insider Ownership: 20.3%

Return On Equity Forecast: 33% (2027 estimate)

Toast is expected to achieve profitability within three years, with earnings projected to grow 44.99% annually and revenue anticipated to increase by 16.2% per year, outpacing the US market. Recent product expansions into retail sectors like convenience stores and grocers highlight its strategic growth initiatives. Despite significant insider selling recently, Toast's partnership with Uber Direct aims to enhance delivery efficiency for restaurants, potentially boosting operational reach and customer satisfaction across its platform.

- Delve into the full analysis future growth report here for a deeper understanding of Toast.

- According our valuation report, there's an indication that Toast's share price might be on the expensive side.

Summing It All Up

- Discover the full array of 196 Fast Growing US Companies With High Insider Ownership right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATAT

Atour Lifestyle Holdings

Through its subsidiaries, develops lifestyle brands around hotel offerings in the People’s Republic of China.

Exceptional growth potential with outstanding track record.

Market Insights

Community Narratives