- United States

- /

- Commercial Services

- /

- NasdaqGS:LQDT

Undiscovered Gems in the United States for February 2025

Reviewed by Simply Wall St

The United States market has experienced a flat week but has shown impressive growth of 23% over the past year, with earnings projected to increase by 15% annually in the coming years. In this thriving environment, identifying stocks that possess strong fundamentals and potential for long-term growth can be key to uncovering undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

EZCORP (NasdaqGS:EZPW)

Simply Wall St Value Rating: ★★★★★☆

Overview: EZCORP, Inc. operates pawn service businesses in the United States and Latin America with a market capitalization of $736.73 million.

Operations: EZCORP generates revenue primarily through its U.S. Pawn and Latin America Pawn segments, with $850.85 million and $330.90 million respectively.

EZCORP, a player in the consumer finance sector, has demonstrated robust growth with earnings climbing 70.8% last year, surpassing industry averages. Its net debt to equity ratio at 18.6% is satisfactory, indicating sound financial health. The company boasts high-quality earnings and a price-to-earnings ratio of 9x, which is attractive compared to the US market average of 18.5x. Recent strategic expansions in Latin America and U.S acquisitions are expected to bolster revenue further while initiatives like EZ+ Rewards enhance customer engagement and profitability prospects amidst varying economic conditions.

Liquidity Services (NasdaqGS:LQDT)

Simply Wall St Value Rating: ★★★★★★

Overview: Liquidity Services, Inc. operates e-commerce marketplaces and offers auction tools and value-added services both in the United States and internationally, with a market cap of $1.05 billion.

Operations: The company's primary revenue streams include Retail Supply Chain Group ($276.96 million), GovDeals ($81.18 million), Capital Assets Group ($39.69 million), and Machinio ($16.57 million).

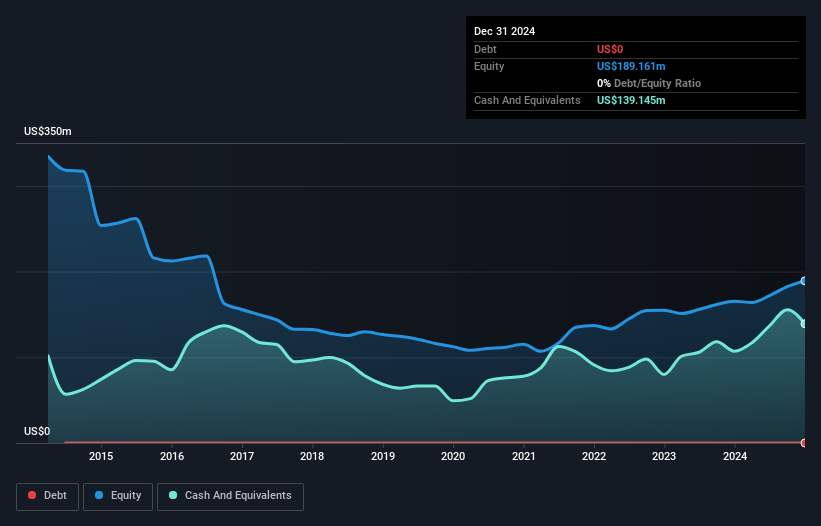

Liquidity Services, a nimble player in the commercial services sector, has been making waves with its robust earnings growth of 26% last year, outpacing the industry average of 14%. The company recently announced a strategic partnership with Biocom California to streamline surplus equipment sales, potentially unlocking significant capital for life science companies. Trading at about half its estimated fair value and boasting no debt over the past five years, Liquidity Services seems well-positioned for continued growth. Its recent quarterly results showed net income climbing to US$5.81 million from US$1.91 million year-over-year, signaling strong performance momentum.

Tennant (NYSE:TNC)

Simply Wall St Value Rating: ★★★★★★

Overview: Tennant Company, along with its subsidiaries, specializes in designing, manufacturing, and marketing floor cleaning equipment across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of approximately $1.66 billion.

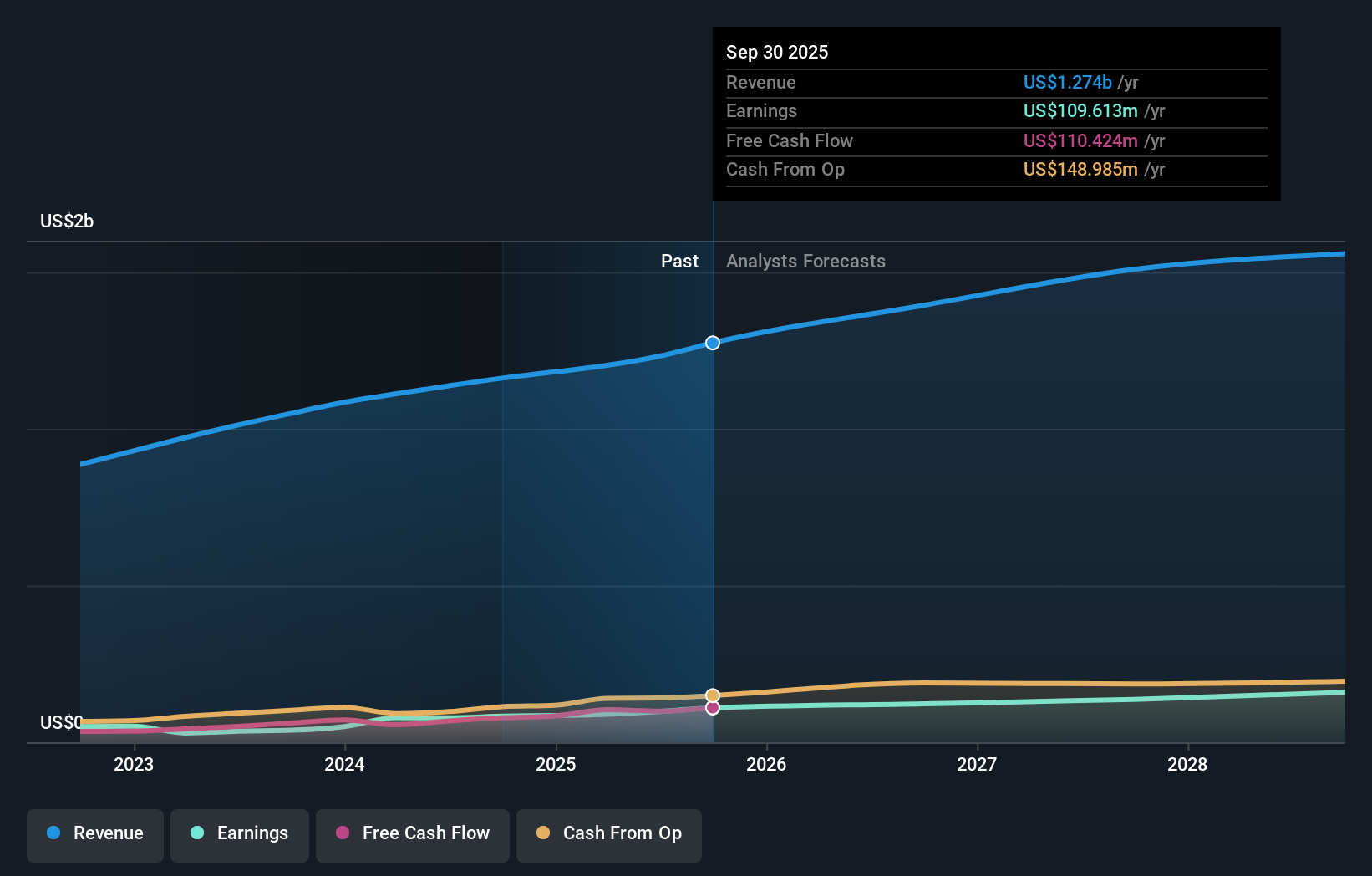

Operations: Tennant generates revenue primarily from the design, manufacture, and sale of products used in the maintenance of nonresidential surfaces, totaling approximately $1.27 billion.

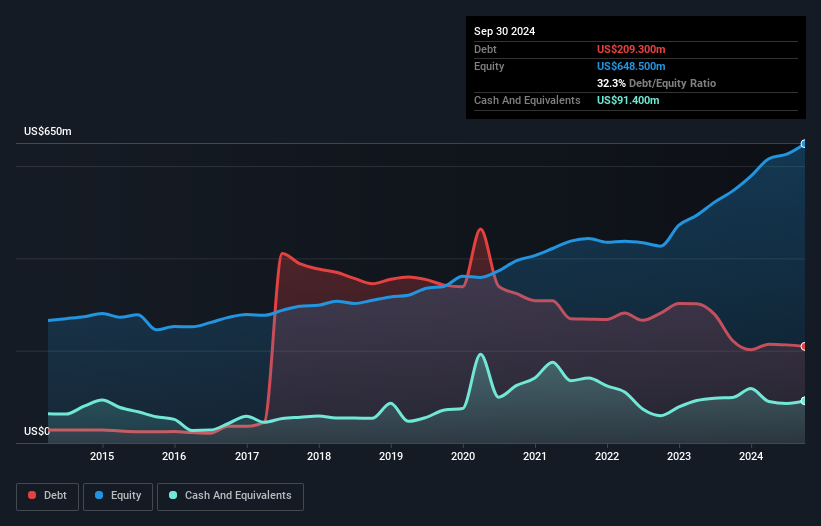

Tennant's strategic moves in product innovation and acquisitions position it as a promising player in the industrial machinery sector. Recent launches like the lithium-ion battery-powered T12 and T16 scrubbers align with sustainability goals, potentially boosting customer productivity. Over five years, Tennant's debt-to-equity ratio improved from 100.7% to 32.3%, indicating solid financial management, while its net debt to equity stands at a satisfactory 18.2%. Although earnings grew by an impressive 23.2% annually over this period, they lagged behind industry growth of 13.3% last year—highlighting both progress and areas for improvement within their market strategy.

Make It Happen

- Explore the 283 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Liquidity Services, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LQDT

Liquidity Services

Provides e-commerce marketplaces, self-directed auction listing tools, and value-added services in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives