Last Update30 Apr 25Fair value Increased 1.41%

AnalystConsensusTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Tennant's strategic focus on AMR technology expansion and geographic reach aims to drive substantial revenue growth and tap into fast-growing market segments.

- Disciplined pricing, cost efficiencies, and strategic M&A activities are poised to strengthen margins and support long-term growth despite potential sales challenges.

- Tennant is facing revenue growth challenges due to regional demand declines, cost pressures, and foreign exchange impacts, potentially affecting margins and earnings.

Catalysts

About Tennant- Designs, manufactures, and markets floor cleaning equipment in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

- Tennant's strategic investments in new AMR (Autonomous Mobile Robot) products like the X4 and X6 ROVR are expected to drive significant revenue growth, as these products target a rapidly growing market addressing labor shortages and rising costs. Tennant aims to capitalize on the booming AMR market with expected annual net sales exceeding $100 million by 2027.

- Expansion of the geographic reach of Small Space products, such as the i-mop family, is expected to boost revenue while leveraging an already established brand in new markets like Brazil, France, Portugal, and Spain. This international expansion targets incremental revenue growth by capturing shares in the fast-growing segment.

- Through its enterprise strategy, Tennant achieved better-than-expected price realization in 2024, with contributions to adjusted EBITDA margin expansion. Continued pricing discipline coupled with cost-out initiatives is anticipated to bolster margins, potentially driving earnings improvements despite projected sales headwinds from backlog dynamics in 2025.

- Strategic M&A activities, including the acquisition of TCS and investments in strategic partners like Brain Corp, are focused on enhancing Tennant’s long-term growth outlook. These investments target $150 million in additional net sales growth over three years, contributing not only to top-line revenue growth but also providing broader operational synergy opportunities.

- The ERP modernization project is expected to unlock significant operational efficiencies and reduce costs by $10 million to $15 million annually. As these efficiencies are achieved, Tennant anticipates improved net margins through enhanced productivity and reduced operating expense ratios.

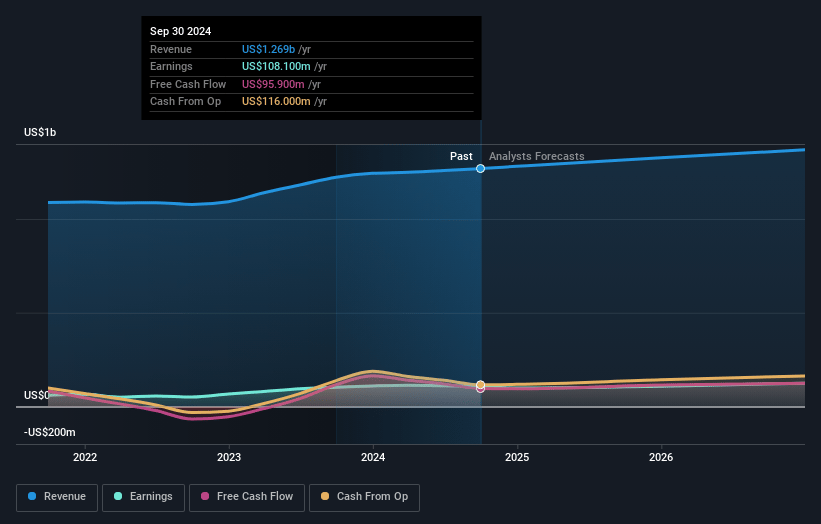

Tennant Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tennant's revenue will decrease by 0.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.5% today to 10.0% in 3 years time.

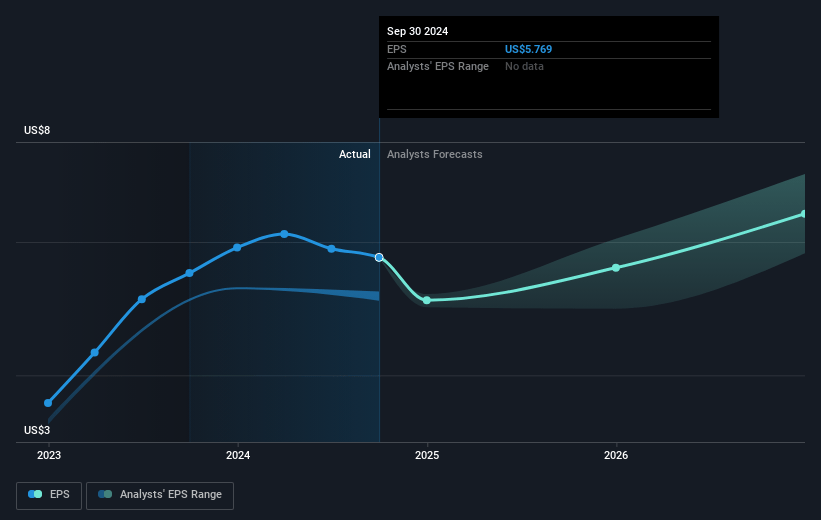

- Analysts expect earnings to reach $130.4 million (and earnings per share of $6.77) by about April 2028, up from $83.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.2x on those 2028 earnings, up from 16.4x today. This future PE is greater than the current PE for the US Machinery industry at 21.3x.

- Analysts expect the number of shares outstanding to decline by 1.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.46%, as per the Simply Wall St company report.

Tennant Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Tennant faces challenges in the APAC region, particularly in China, where stark demand declines and government-induced overproduction are causing price and margin pressure, which could impact revenue growth.

- The company anticipates an organic sales decline of 1% to 4% in 2025 due to a backlog reduction headwind, indicating potential short-term revenue impact and limiting top-line growth prospects.

- There are concerns regarding inflationary pressures on materials and elevated freight costs, which have previously affected gross margins and might continue to compress net margins.

- Higher-than-anticipated R&D and ERP costs, along with restructuring-related charges and legal contingencies, have increased operating expenses and could impact earnings if cost management does not align with revenue growth.

- Potential foreign exchange impacts, notably in Europe, Brazil, and China, are foreseen to present a negative 2% hit to revenue, further complicating Tennant's ability to achieve favorable financial results across its international operations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $129.333 for Tennant based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $143.0, and the most bearish reporting a price target of just $120.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $130.4 million, and it would be trading on a PE ratio of 22.2x, assuming you use a discount rate of 7.5%.

- Given the current share price of $72.89, the analyst price target of $129.33 is 43.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.