Last Update01 May 25Fair value Increased 2.42%

AnalystConsensusTarget has decreased revenue growth from 16.2% to 12.9%.

Read more...Key Takeaways

- Implementation of AI and asset-light models will drive margin expansion, cost reduction, and operational efficiency across the platform.

- International growth, new large clients, and supply chain trends will increase platform demand, deepen customer relationships, and strengthen revenue stability.

- Dependence on government contracts, margin compression, rising logistics costs, competition, and regulatory uncertainty create persistent earnings volatility and challenges for long-term growth.

Catalysts

About Liquidity Services- Provides e-commerce marketplaces, self-directed auction listing tools, and value-added services in the United States and internationally.

- Adoption of AI-assisted asset description, image recognition, and enhanced e-commerce features is expected to increase seller and buyer conversion rates, automate costly manual processes, and reduce listing and labor costs—supporting ongoing expansion of net margins and operating leverage.

- Expansion into new international markets and onboarding large, multinational e-commerce clients through easy integration tools and multilingual capabilities will broaden the company’s addressable market, fueling future GMV and revenue growth.

- Growing interest from government agencies and larger commercial clients, motivated by sustainability initiatives and a need for secure, cost-efficient surplus asset management, supports a multi-year pipeline of recurring, higher-margin business, positively impacting revenue stability and customer retention.

- Moving toward higher adoption of asset-light and consignment models is expected to moderate operating expenses relative to GMV, resulting in improved margin profile and enhanced profitability as revenues grow.

- Shifts in global trade and supply chain underlying the “trade down” effect—where rising costs for new goods or tariffs drive greater demand for recommerce and used equipment—will increase transactional volumes on Liquidity Services’ platforms, sustaining top-line revenue and earnings momentum.

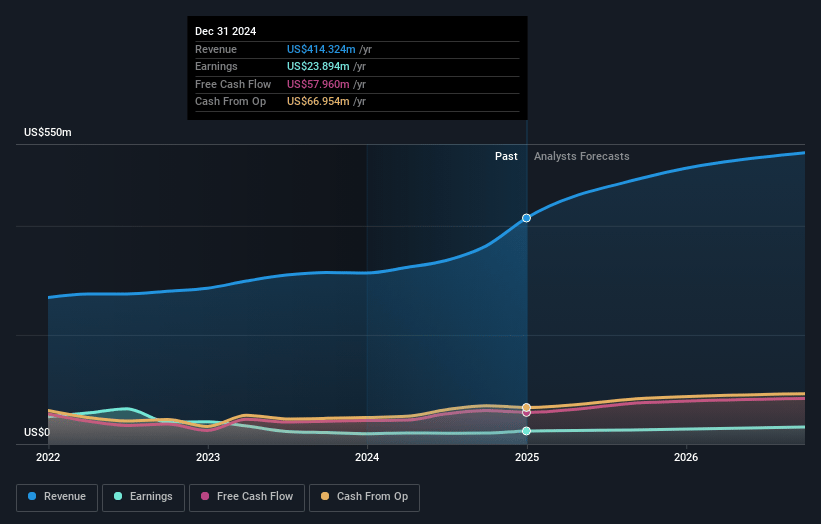

Liquidity Services Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Liquidity Services's revenue will grow by 12.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 5.7% today to 5.6% in 3 years time.

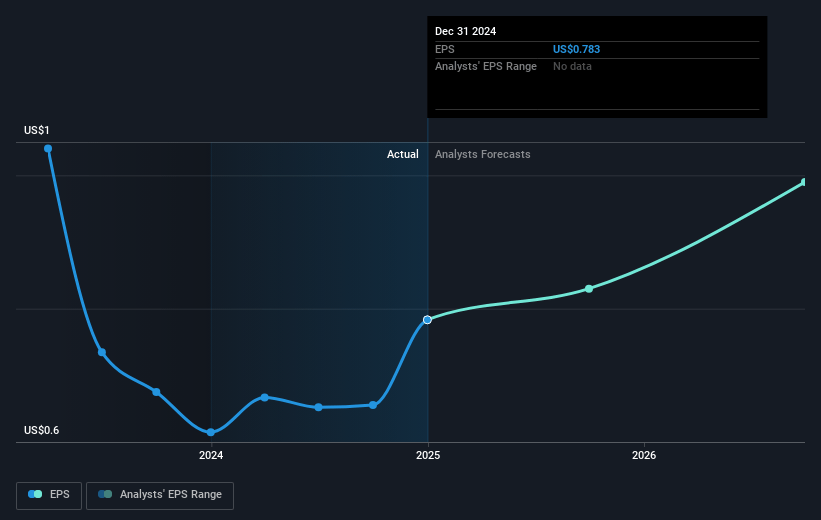

- Analysts expect earnings to reach $35.6 million (and earnings per share of $1.11) by about May 2028, up from $25.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 46.0x on those 2028 earnings, up from 31.3x today. This future PE is greater than the current PE for the US Commercial Services industry at 26.1x.

- Analysts expect the number of shares outstanding to grow by 2.42% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.51%, as per the Simply Wall St company report.

Liquidity Services Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Liquidity Services' heavy reliance on government contracts, particularly in its GovDeals segment, exposes the company to the timing and complexity of slow-moving, unpredictable inter-agency procurement processes, which may lead to revenue volatility and uncertainty in earnings.

- The increased use of third-party referrals and revenue sharing arrangements, especially in the purchase models within the retail and CAG segments, is compressing take rates and reducing margins, while persistent investments in new programs and logistics infrastructure create ongoing net margin pressure.

- Rising logistics costs, inbound transportation expenses, and operational disruptions (such as severe weather or tariff-related supply chain issues) can lead to fluctuating gross profits and delayed asset sales, creating unpredictability in both revenue and earnings.

- Intensifying competition, including from global e-commerce marketplaces and industry consolidation, could challenge Liquidity Services' ability to maintain or expand market share, potentially limiting long-term GMV growth and top-line revenue expansion.

- Increased regulatory and macroeconomic uncertainty—such as new tariffs, higher compliance costs for international transactions, and weakening consumer demand—may affect both the supply of surplus assets and the willingness of buyers to absorb higher costs, impacting the company’s addressable market size and future revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $41.0 for Liquidity Services based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $632.8 million, earnings will come to $35.6 million, and it would be trading on a PE ratio of 46.0x, assuming you use a discount rate of 6.5%.

- Given the current share price of $25.26, the analyst price target of $41.0 is 38.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.