- United States

- /

- Energy Services

- /

- NasdaqGS:ACDC

3 Undervalued Small Caps In US With Insider Action To Consider

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet over the past 12 months, it has seen a notable rise of 24%, with earnings forecasted to grow by 15% annually. In this context, identifying small-cap stocks that appear undervalued and have recent insider activity can offer intriguing opportunities for investors seeking potential growth amid current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Quanex Building Products | 34.8x | 0.9x | 37.45% | ★★★★☆☆ |

| McEwen Mining | 4.1x | 2.1x | 47.35% | ★★★★☆☆ |

| ProPetro Holding | NA | 0.6x | 39.17% | ★★★★☆☆ |

| German American Bancorp | 14.7x | 4.9x | 45.89% | ★★★☆☆☆ |

| Capital Bancorp | 14.6x | 3.0x | 46.18% | ★★★☆☆☆ |

| Limbach Holdings | 36.8x | 1.9x | 43.16% | ★★★☆☆☆ |

| RGC Resources | 17.1x | 2.4x | 22.09% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -63.64% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -79.03% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

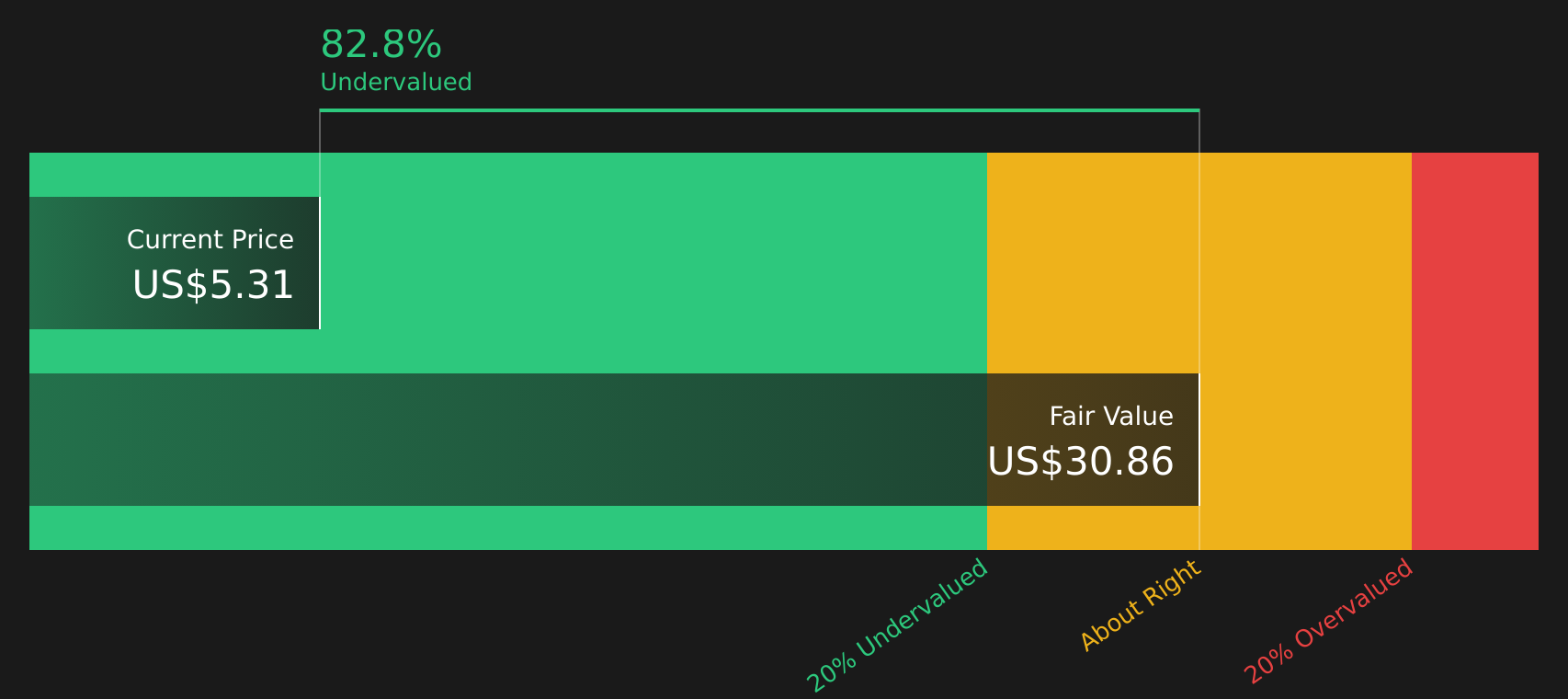

ProFrac Holding (NasdaqGS:ACDC)

Simply Wall St Value Rating: ★★★★★☆

Overview: ProFrac Holding is a company engaged in providing stimulation services, proppant production, and manufacturing within the energy sector, with a market capitalization of $2.12 billion.

Operations: ProFrac Holding generates its revenue primarily from Stimulation Services, which contributes significantly to its total income, alongside Manufacturing and Proppant Production. The company's gross profit margin has shown variability, peaking at 40.69% in December 2022 before declining to 34.51% by September 2024.

PE: -5.5x

ProFrac Holding, a smaller company in the U.S., is capturing attention with its recent strategic alliance, partnering with Prairie Operating Co. to electrify hydraulic fracturing operations in Colorado. Despite reporting a net loss of US$45 million for Q3 2024, insider confidence is evident as Matthew Wilks acquired 79,960 shares valued at approximately US$623,000. The company's earnings are projected to grow significantly by 133% annually. However, it relies entirely on external borrowing for funding.

- Dive into the specifics of ProFrac Holding here with our thorough valuation report.

Assess ProFrac Holding's past performance with our detailed historical performance reports.

Sabre (NasdaqGS:SABR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sabre is a technology company that provides software and services for the travel industry, with operations primarily in Travel Solutions and Hospitality Solutions, and has a market cap of $1.37 billion.

Operations: Sabre's revenue is primarily derived from its Travel Solutions and Hospitality Solutions segments, with Travel Solutions contributing significantly more. The company's gross profit margin showed fluctuations over the years, peaking at 81.41% in mid-2020 before stabilizing around the 59% range in late 2024. Operating expenses have been a substantial part of its cost structure, with research and development being a notable component within these expenses.

PE: -4.7x

Sabre Corporation, a player in travel technology, has shown insider confidence with recent share purchases. Despite a net loss of US$62.82 million in Q3 2024, this small company is gaining traction through strategic partnerships and tech innovations. Recent deals with airlines like Garuda Indonesia and American Airlines highlight its role in modernizing airline operations. Sabre's focus on expanding New Distribution Capability (NDC) offerings positions it for growth as the industry shifts towards personalized travel experiences.

- Unlock comprehensive insights into our analysis of Sabre stock in this valuation report.

Gain insights into Sabre's historical performance by reviewing our past performance report.

Douglas Dynamics (NYSE:PLOW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Douglas Dynamics specializes in manufacturing and selling work truck attachments and solutions, with a market capitalization of approximately $0.87 billion.

Operations: Douglas Dynamics generates revenue primarily from its Work Truck Solutions and Work Truck Attachments segments, with the latter contributing $257.60 million. The company's gross profit margin has shown fluctuations, reaching 24.71% in June 2024 after a low of 23.63% in December 2023, indicating variability in cost management and pricing strategies over time.

PE: 9.9x

Douglas Dynamics, known for its work truck attachments, is navigating a challenging landscape with earnings expected to decline by 3.7% annually over the next three years. Despite this, insider confidence is evident as COO & President of Work Truck Attachments Mark Genderen purchased 5,000 shares valued at US$114,799 in December 2024. The company revised its full-year sales guidance downward to between US$570 million and US$600 million due to market constraints but continues paying dividends at US$0.295 per share for Q4 2024.

- Take a closer look at Douglas Dynamics' potential here in our valuation report.

Understand Douglas Dynamics' track record by examining our Past report.

Next Steps

- Explore the 47 names from our Undervalued US Small Caps With Insider Buying screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACDC

ProFrac Holding

Operates as a technology-focused energy services holding company in the United States.

Undervalued with moderate growth potential.