- United States

- /

- Entertainment

- /

- NasdaqGS:WMG

3 US Stocks That Could Be Trading Below Estimated Value

Reviewed by Simply Wall St

As the United States stock market experiences fluctuations, with major indexes managing to post slight weekly gains despite a recent sell-off led by big-tech declines, investors are keenly observing opportunities that might be trading below their estimated value. In such a climate, identifying undervalued stocks can be crucial for those looking to capitalize on potential discrepancies between market price and intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $27.22 | $53.24 | 48.9% |

| Argan (NYSE:AGX) | $142.95 | $279.45 | 48.8% |

| First National (NasdaqCM:FXNC) | $23.77 | $46.63 | 49% |

| Oddity Tech (NasdaqGM:ODD) | $43.55 | $84.59 | 48.5% |

| Western Alliance Bancorporation (NYSE:WAL) | $83.68 | $164.31 | 49.1% |

| HealthEquity (NasdaqGS:HQY) | $96.30 | $189.22 | 49.1% |

| QuinStreet (NasdaqGS:QNST) | $23.85 | $47.17 | 49.4% |

| Progress Software (NasdaqGS:PRGS) | $65.48 | $129.48 | 49.4% |

| Freshpet (NasdaqGM:FRPT) | $146.36 | $283.12 | 48.3% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.20 | $29.97 | 49.3% |

Let's explore several standout options from the results in the screener.

QuinStreet (NasdaqGS:QNST)

Overview: QuinStreet, Inc. is an online performance marketing company that offers customer acquisition services both in the United States and internationally, with a market cap of approximately $1.34 billion.

Operations: The company generates revenue primarily through its Direct Marketing segment, which accounted for $768.81 million.

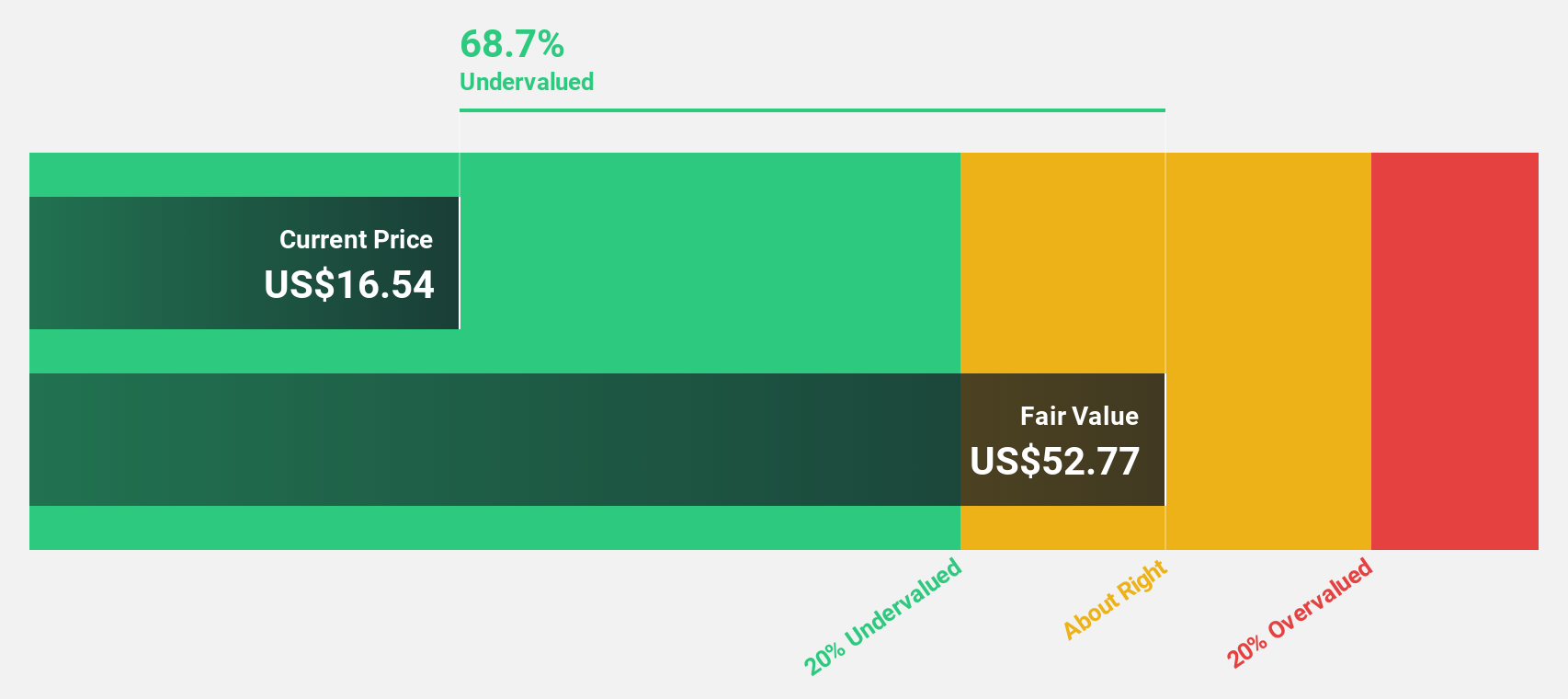

Estimated Discount To Fair Value: 49.4%

QuinStreet is trading at US$23.85, significantly below its estimated fair value of US$47.17, indicating it may be undervalued based on cash flows. Despite recent insider selling and no share repurchases in the latest quarter, the company has shown strong revenue growth from US$123.92 million to US$279.22 million year-over-year and is expected to become profitable within three years with earnings forecasted to grow substantially annually at 105.04%.

- Our comprehensive growth report raises the possibility that QuinStreet is poised for substantial financial growth.

- Click here to discover the nuances of QuinStreet with our detailed financial health report.

Warner Music Group (NasdaqGS:WMG)

Overview: Warner Music Group Corp. is a music entertainment company operating in the United States, the United Kingdom, Germany, and internationally with a market cap of approximately $16.29 billion.

Operations: The company generates revenue from its Recorded Music segment, which accounts for $5.22 billion, and its Music Publishing segment, contributing $1.21 billion.

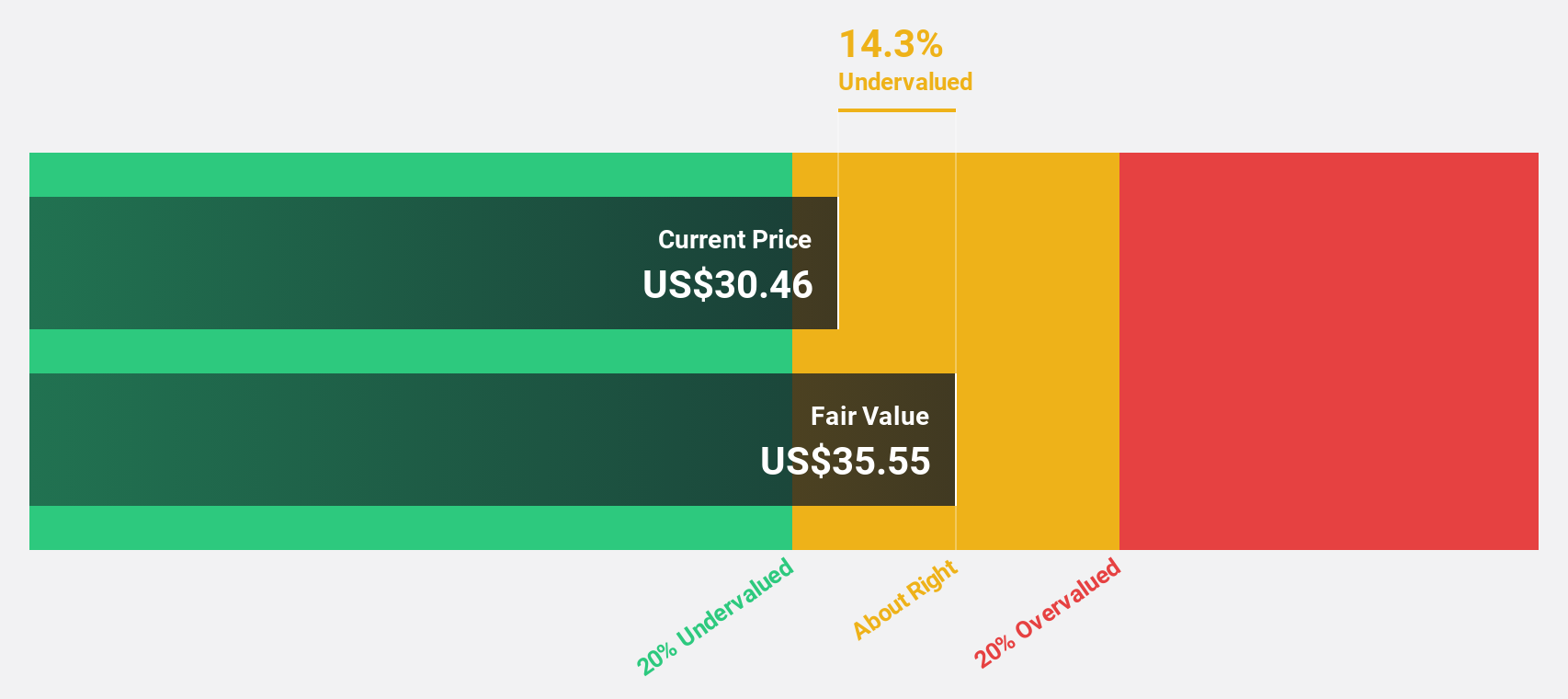

Estimated Discount To Fair Value: 26.5%

Warner Music Group, trading at US$31.45, is undervalued based on cash flows with a fair value estimate of US$42.80. Despite a modest 1.2% earnings growth last year and net income decline in Q4 2024, the company forecasts significant annual profit growth of over 20%. The recent US$100 million share buyback plan highlights confidence in future cash flow generation, while strategic acquisitions in India aim to capitalize on emerging markets for long-term revenue expansion.

- Our growth report here indicates Warner Music Group may be poised for an improving outlook.

- Navigate through the intricacies of Warner Music Group with our comprehensive financial health report here.

RXO (NYSE:RXO)

Overview: RXO, Inc. offers full truckload freight transportation brokering services and has a market cap of approximately $3.92 billion.

Operations: The company generates revenue of $3.86 billion from its trucking transportation services segment.

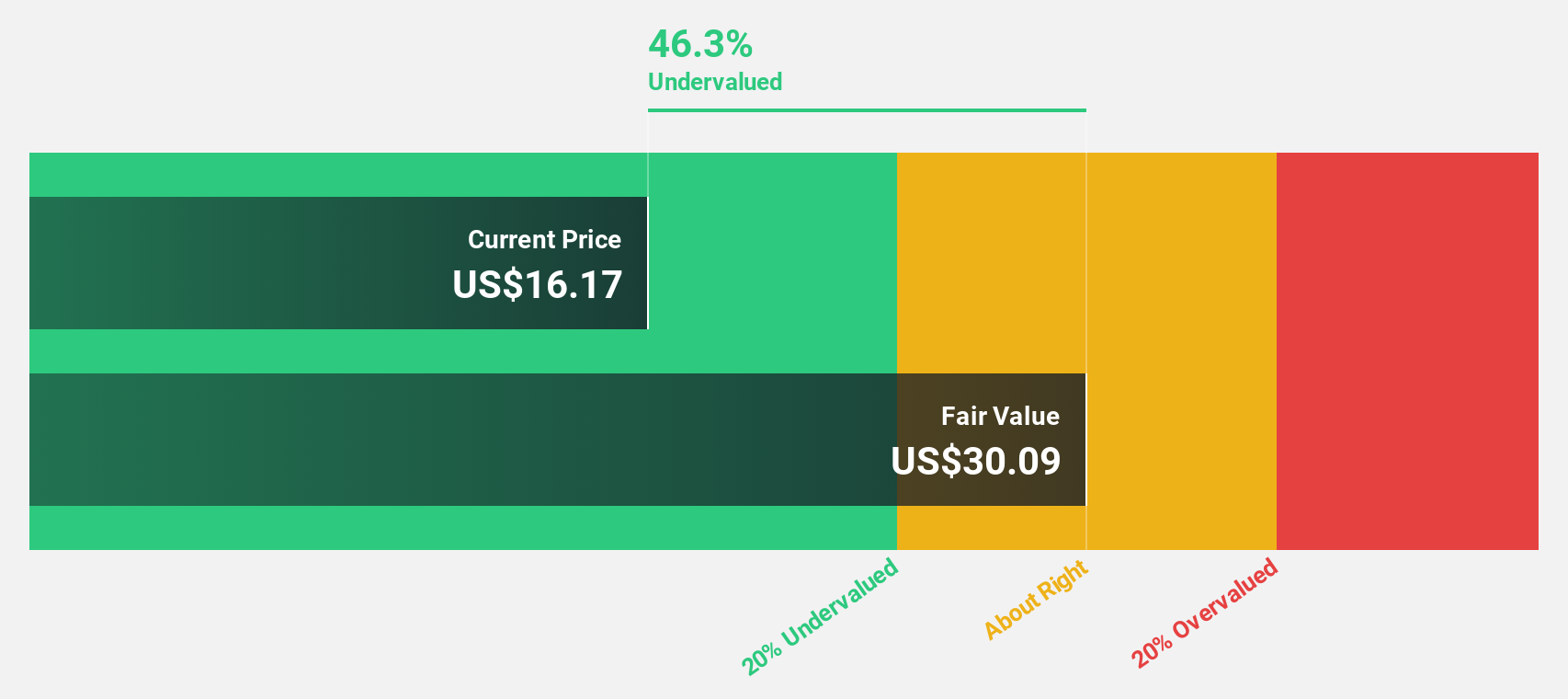

Estimated Discount To Fair Value: 37.6%

RXO, trading at US$24.36, appears undervalued with a fair value estimate of US$39.01 and is trading 37.6% below this estimate. Despite recent net losses of US$243 million in Q3 2024, revenue is forecast to grow by 22.2% annually, surpassing the market average. The company seeks M&A opportunities and has a $125 million share repurchase authorization, indicating strategic capital allocation amid anticipated profitability within three years.

- The growth report we've compiled suggests that RXO's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of RXO.

Seize The Opportunity

- Get an in-depth perspective on all 180 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warner Music Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WMG

Warner Music Group

Operates as a music entertainment company in the United States, the United Kingdom, Germany, and internationally.

Reasonable growth potential and fair value.