- United States

- /

- Electrical

- /

- NasdaqCM:CBAT

Discover US Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, the U.S. stock market has seen mixed movements with major indexes managing to hold onto weekly gains despite recent volatility led by a slump in big-tech stocks. In this context, penny stocks continue to capture the interest of investors looking for affordable entry points into potentially high-growth sectors. While often associated with smaller or newer companies, these stocks can still offer significant opportunities when backed by strong financials and sound business models.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.25 | $1.87B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $104.78M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.86 | $6.25M | ★★★★★★ |

| Pangaea Logistics Solutions (NasdaqCM:PANL) | $4.89 | $229.35M | ★★★★★☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.25 | $9.2M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.07 | $96.23M | ★★★★★☆ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.54 | $44.07M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.45 | $25.72M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.57 | $381.2M | ★★★★☆☆ |

Click here to see the full list of 735 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

CBAK Energy Technology (NasdaqCM:CBAT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CBAK Energy Technology, Inc. manufactures, commercializes, and distributes lithium-ion high power rechargeable batteries across Mainland China, the United States, Europe, and internationally with a market cap of approximately $96.23 million.

Operations: The company's revenue is primarily derived from its CBAT segment, which generated $150.73 million, and the Hitrans segment, contributing $56.70 million.

Market Cap: $96.23M

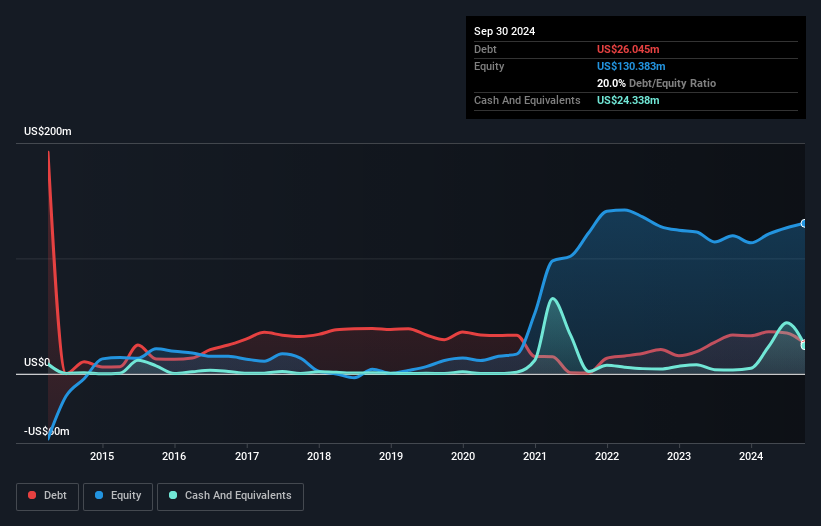

CBAK Energy Technology has shown resilience in its financial performance, with a notable increase in net income to US$16.3 million for the first nine months of 2024, compared to US$2.32 million the previous year. Despite this growth, recent challenges include non-compliance with Nasdaq's minimum bid price requirement, posing potential delisting risks if not addressed by June 2025. The company has improved its debt position significantly over five years and maintains a satisfactory net debt to equity ratio of 1.3%. However, volatility remains high and short-term liabilities exceed short-term assets by US$23.7 million.

- Unlock comprehensive insights into our analysis of CBAK Energy Technology stock in this financial health report.

- Examine CBAK Energy Technology's earnings growth report to understand how analysts expect it to perform.

GoodRx Holdings (NasdaqGS:GDRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoodRx Holdings, Inc. provides tools and information for consumers to compare prices and save on prescription drugs in the United States, with a market cap of approximately $1.78 billion.

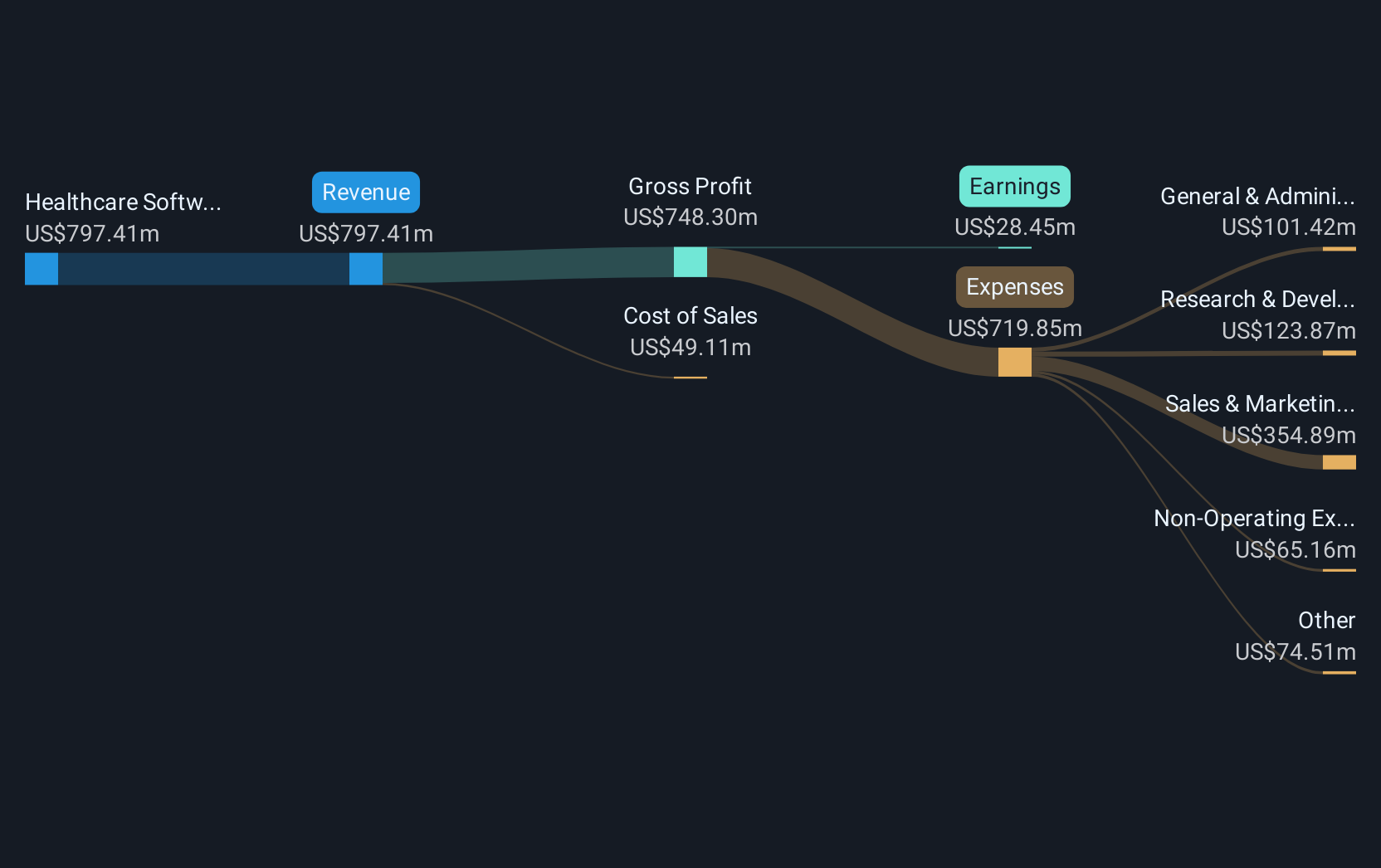

Operations: The company generates revenue primarily from its Healthcare Software segment, amounting to $790.39 million.

Market Cap: $1.78B

GoodRx Holdings, Inc. is navigating the complexities of the healthcare sector with strategic initiatives and leadership changes. The upcoming appointment of Wendy Barnes as CEO brings extensive experience in pharmacy benefit management, which could enhance operational strategies. Recently, GoodRx partnered with Harrow to offer discounts on ophthalmic products, expanding its reach and affordability options for consumers. Despite being unprofitable, GoodRx has a positive cash flow runway exceeding three years and has improved its debt position significantly over time. The company reported third-quarter revenue growth to US$195.25 million and net income of US$3.97 million from a previous loss, indicating financial progress amidst challenges in profitability.

- Navigate through the intricacies of GoodRx Holdings with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into GoodRx Holdings' future.

ATRenew (NYSE:RERE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ATRenew Inc. operates a platform for pre-owned consumer electronics transactions and services in China, with a market cap of approximately $667.23 million.

Operations: The company generates revenue from its Retail - Electronics segment, amounting to CN¥15.35 billion.

Market Cap: $667.23M

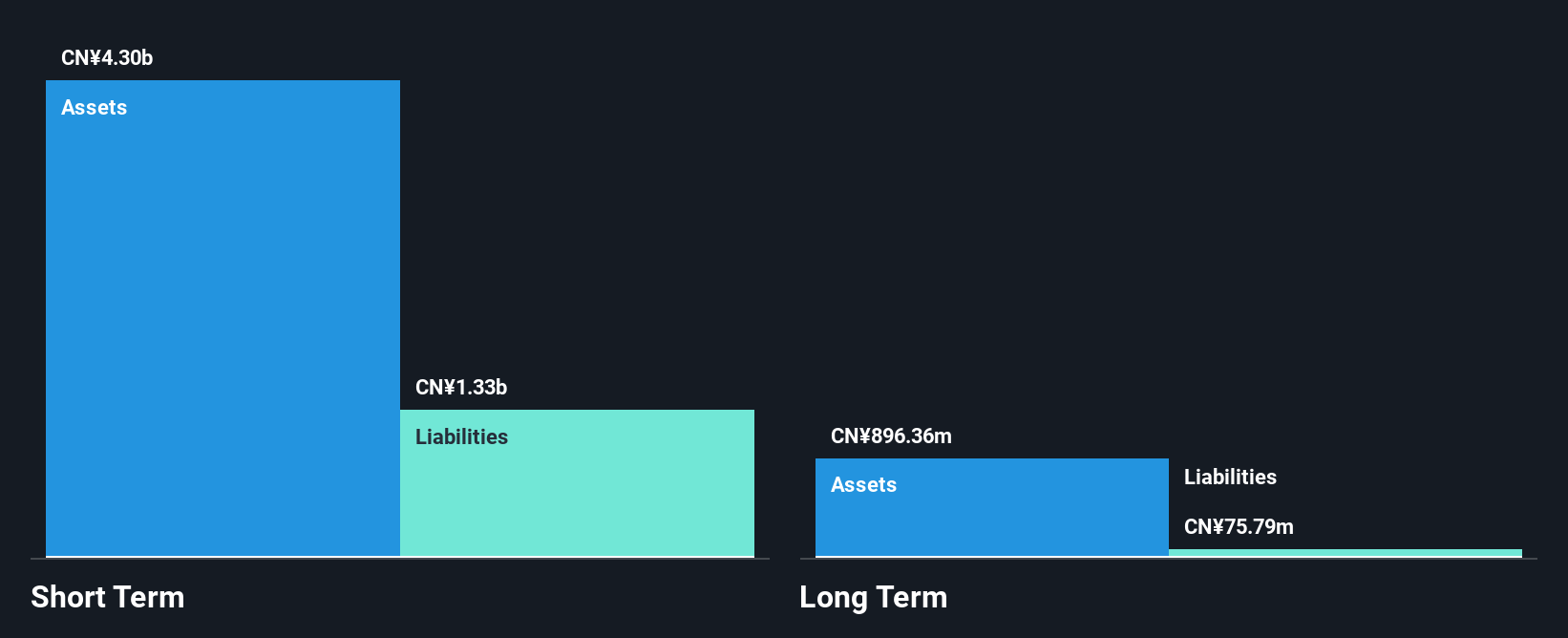

ATRenew Inc. is experiencing significant growth in the pre-owned electronics market, with third-quarter earnings showing a net income of CN¥17.88 million, reversing a previous loss. The company forecasts fourth-quarter revenue between RMB 4.74 billion and RMB 4.84 billion, marking substantial year-over-year growth. Despite its unprofitability, ATRenew has reduced losses by 21.8% annually over five years and maintains strong liquidity with short-term assets exceeding liabilities significantly. The company's experienced management team and strategic share buybacks suggest confidence in its financial health, while high volatility remains a concern for investors seeking stability in penny stocks.

- Dive into the specifics of ATRenew here with our thorough balance sheet health report.

- Learn about ATRenew's future growth trajectory here.

Turning Ideas Into Actions

- Discover the full array of 735 US Penny Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CBAT

CBAK Energy Technology

CBAK Energy Technology, Inc., together with its subsidiaries, manufacture, commercialization, and distribution of lithium ion high power rechargeable batteries in Mainland China, the United States, Europe, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives