- United States

- /

- Metals and Mining

- /

- NYSE:CMP

Undervalued Small Caps With Insider Buying Across Regions

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 2.2%, contributing to an overall increase of 8.2% over the past year, with earnings forecasted to grow by 14% annually. In this context of positive market momentum, identifying small-cap stocks that are currently undervalued and have insider buying activity can offer potential opportunities for investors seeking growth in various regions across the country.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 10.2x | 2.9x | 48.50% | ★★★★★☆ |

| Flowco Holdings | 6.8x | 1.0x | 38.28% | ★★★★★☆ |

| Thryv Holdings | NA | 0.8x | 35.74% | ★★★★☆☆ |

| West Bancorporation | 12.9x | 4.1x | 37.30% | ★★★☆☆☆ |

| Columbus McKinnon | 47.0x | 0.4x | 39.29% | ★★★☆☆☆ |

| MVB Financial | 12.1x | 1.6x | 28.67% | ★★★☆☆☆ |

| Franklin Financial Services | 15.4x | 2.5x | 33.36% | ★★★☆☆☆ |

| Union Bankshares | 17.6x | 3.3x | 25.64% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.4x | -2797.51% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -9.03% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Titan Machinery (NasdaqGS:TITN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Titan Machinery operates as a network of full-service agricultural and construction equipment stores, with a market cap of approximately $0.75 billion.

Operations: The company's revenue primarily stems from its Agriculture and Construction segments, with significant contributions from Europe and Australia. Over the years, the gross profit margin has fluctuated between 14.64% and 20.31%, reflecting variations in cost management and pricing strategies. Operating expenses have consistently been a substantial portion of costs, with general and administrative expenses forming a major component of these outlays.

PE: -11.0x

Titan Machinery, a smaller player in the U.S. market, recently saw insider confidence with David Meyer purchasing 55,000 shares for US$996,600. Despite facing a net loss of US$43.76 million in Q4 2025 and projecting revenue declines for fiscal 2026, this insider activity suggests potential optimism about future prospects. However, the company relies entirely on external borrowing for funding and struggles to cover interest payments with earnings, posing financial risks amid declining revenues.

- Delve into the full analysis valuation report here for a deeper understanding of Titan Machinery.

Assess Titan Machinery's past performance with our detailed historical performance reports.

Compass Minerals International (NYSE:CMP)

Simply Wall St Value Rating: ★★★☆☆☆

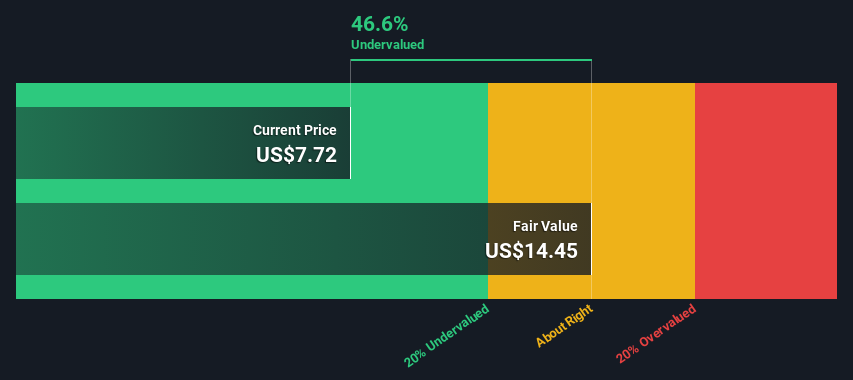

Overview: Compass Minerals International operates in the production and distribution of salt and plant nutrition products, with a market capitalization of $1.51 billion.

Operations: The company generates revenue primarily from its Salt and Plant Nutrition segments, with the Salt segment being the larger contributor. Over recent periods, the gross profit margin has shown a declining trend, reaching 14.61% by the end of 2024. Operating expenses have fluctuated but remain a significant portion of costs, impacting overall profitability.

PE: -3.7x

Compass Minerals International, a smaller company in the U.S. market, presents an intriguing investment opportunity with its anticipated 63.77% annual earnings growth. Despite external borrowing as its sole funding source posing risks, recent strategic moves aim to enhance profitability by cutting costs and refocusing on core businesses like Salt and Plant Nutrition. The company reported a narrowed net loss of US$23.6 million for Q1 2024 compared to US$75.3 million previously, indicating potential operational improvements ahead.

DiamondRock Hospitality (NYSE:DRH)

Simply Wall St Value Rating: ★★★★★☆

Overview: DiamondRock Hospitality is a real estate investment trust that owns a portfolio of hotels, with operations generating $1.13 billion in revenue.

Operations: The primary revenue stream is from hotel ownership, with recent quarterly revenues reaching $1.13 billion. Cost of goods sold (COGS) has been a significant expense, recently reported at $816 million for the same period. The gross profit margin has shown variability over time and was recorded at 27.68% in the latest quarter.

PE: 37.5x

DiamondRock Hospitality, a smaller player in the U.S. market, reported a slight dip in Q1 2025 sales at US$163.12 million but saw net income rise to US$11.86 million from US$8.33 million last year, suggesting operational improvements despite lower profit margins of 3.7%. Insider confidence is evident with recent share purchases, indicating potential optimism for future growth. The company continues to reward shareholders with regular dividends amidst earnings forecasts predicting a 29% annual growth rate, though reliant on external funding sources poses some risk.

- Dive into the specifics of DiamondRock Hospitality here with our thorough valuation report.

Evaluate DiamondRock Hospitality's historical performance by accessing our past performance report.

Summing It All Up

- Click this link to deep-dive into the 92 companies within our Undervalued US Small Caps With Insider Buying screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Compass Minerals International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMP

Compass Minerals International

Provides essential minerals in the United States, Canada, the United Kingdom, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives