- United States

- /

- Banks

- /

- NasdaqGS:CTBI

3 Undiscovered Gems In The US Market

Reviewed by Simply Wall St

The U.S. stock market has recently experienced heightened volatility, with major indices like the Dow Jones and Nasdaq seeing significant declines amid ongoing tariff tensions and broader economic uncertainties. In such a turbulent environment, identifying promising small-cap stocks can be challenging yet rewarding, as these companies often possess unique growth potential that may not be immediately apparent to investors focused on larger market players.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.72% | 4.94% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Cashmere Valley Bank | 15.62% | 5.80% | 3.51% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Community Trust Bancorp (NasdaqGS:CTBI)

Simply Wall St Value Rating: ★★★★★★

Overview: Community Trust Bancorp, Inc. is the bank holding company for Community Trust Bank, Inc., with a market cap of $839.92 million.

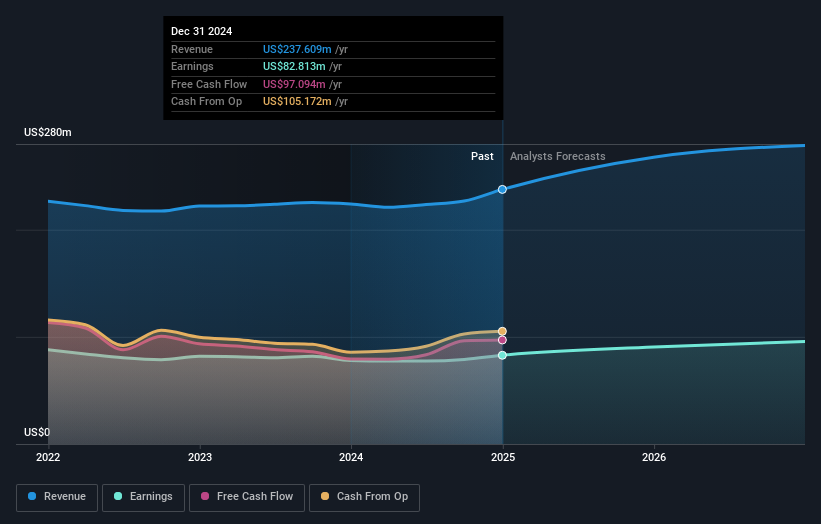

Operations: Community Trust Bancorp generates revenue primarily from its Community Banking Services segment, which contributes $242.74 million, while the Holding Company adds $85.33 million.

Community Trust Bancorp, with total assets of US$6.2 billion and equity of US$757.6 million, is a small bank holding company that seems to offer value trading at 62% below its estimated fair value. With total deposits reaching US$5.1 billion and loans at US$4.4 billion, the bank's net interest margin stands at 3.4%. It has an appropriate allowance for bad loans at 0.6% of total loans, reflecting solid risk management practices supported by primarily low-risk funding sources like customer deposits (93%). The recent dividend declaration and earnings growth over the past year highlight its stable operational footing within the industry context.

- Click here and access our complete health analysis report to understand the dynamics of Community Trust Bancorp.

Evaluate Community Trust Bancorp's historical performance by accessing our past performance report.

Energy Recovery (NasdaqGS:ERII)

Simply Wall St Value Rating: ★★★★★★

Overview: Energy Recovery, Inc. designs, manufactures, and sells energy efficiency technology solutions across various regions globally and has a market capitalization of approximately $786.41 million.

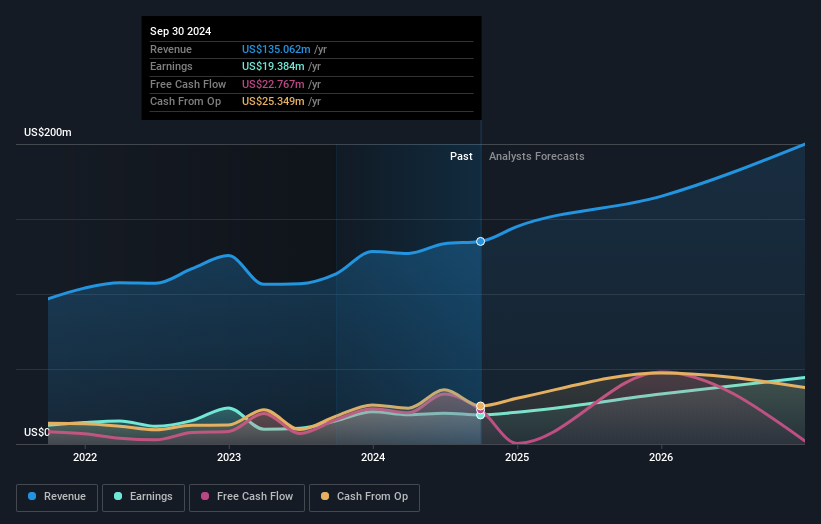

Operations: The company generates revenue primarily from its Water segment, which accounts for $144.31 million, while Emerging Technologies contribute $0.64 million.

Energy Recovery is making strides with its PX technology, expanding into mining and textiles to diversify revenue streams. The company reported annual sales of US$144.95 million, up from US$128.35 million the previous year, alongside a net income increase to US$23.05 million from US$21.5 million. Recently executing a share buyback worth $50 million for 3,248,533 shares (5.61%), Energy Recovery aims to enhance shareholder value further with an additional $30 million repurchase plan over the next year. Despite these positive moves, significant insider selling and reliance on specific regions pose risks to revenue stability and growth projections.

Tompkins Financial (NYSEAM:TMP)

Simply Wall St Value Rating: ★★★★★★

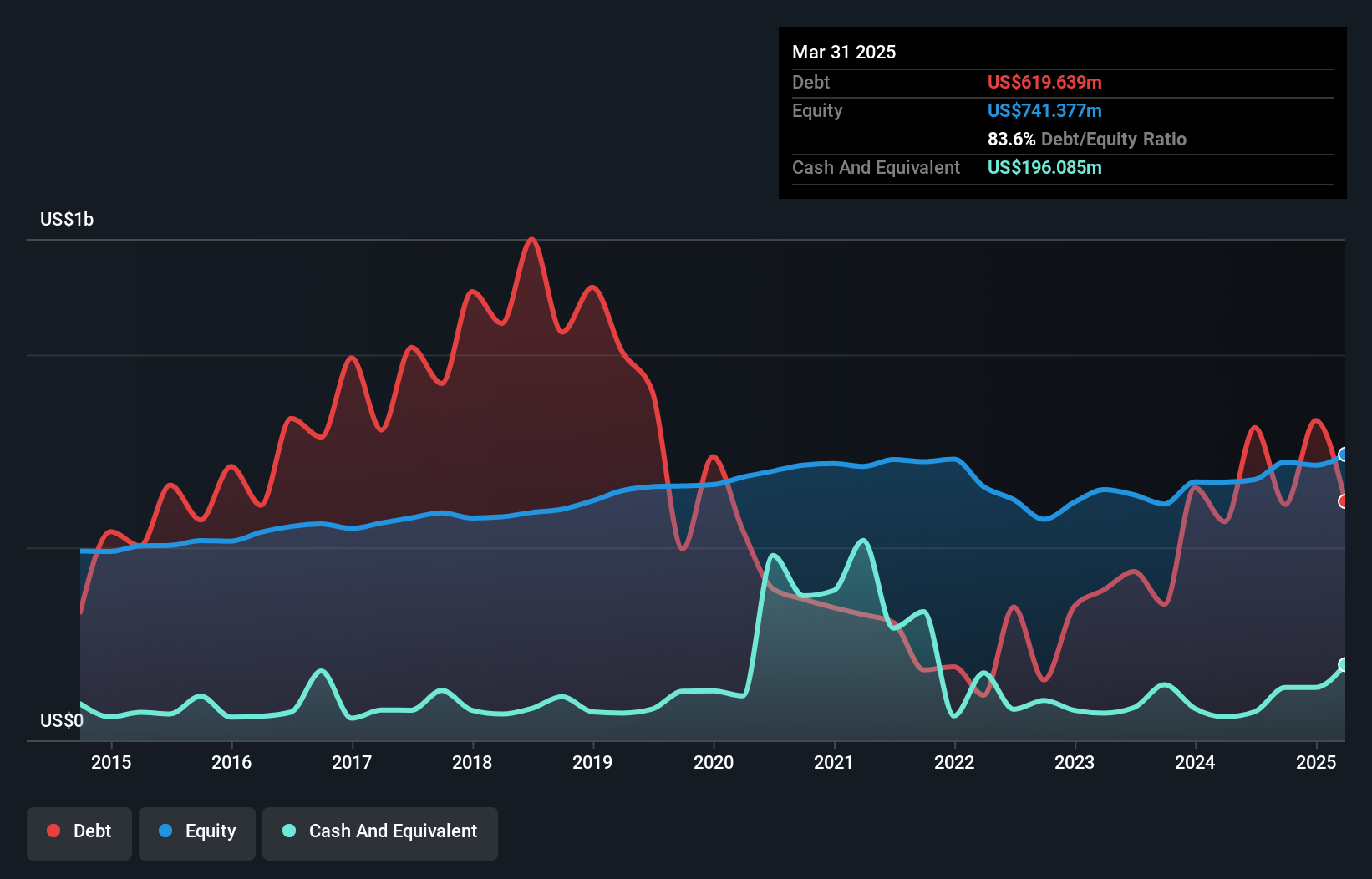

Overview: Tompkins Financial Corporation is a financial holding company that offers a range of services including commercial and consumer banking, leasing, trust and investment management, financial planning and wealth management, and insurance services with a market cap of $816.27 million.

Operations: Tompkins Financial generates revenue primarily from its banking segment, contributing $234.48 million, followed by insurance services at $39.77 million and wealth management at $20.49 million.

With assets totaling US$8.1 billion and equity of US$713.4 million, Tompkins Financial stands out with its strong financial foundation. Total deposits amount to US$6.5 billion, while loans are at US$6 billion, reflecting a well-balanced portfolio. The company boasts a net interest margin of 2.8% and maintains a low bad loan ratio of 0.8%, backed by an allowance for bad loans at 111%. Earnings surged by 648% last year, outpacing the industry significantly, and it trades at a notable discount to its estimated fair value, suggesting potential upside in valuation terms.

- Click here to discover the nuances of Tompkins Financial with our detailed analytical health report.

Assess Tompkins Financial's past performance with our detailed historical performance reports.

Seize The Opportunity

- Gain an insight into the universe of 286 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTBI

Community Trust Bancorp

Operates as the bank holding company for Community Trust Bank, Inc.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives