Lessons From Q1’s Repricing, Rotation And Risks

Reviewed by Bailey Pemberton, Michael Paige

Quote of the Week: “History and societies do not crawl. They make jumps. They go from fracture to fracture, with a few vibrations in between. Yet we (and historians) like to believe in the predictable, small incremental progression.” ― Nassim Nicholas Taleb

The “Trump Trade” was meant to kick 2025 into high gear. Tax cuts, deregulation, tariffs, and infrastructure were back on the menu — and investors had their hopes up.

But it’s been a bumpy start.

This week, we’re breaking down what really happened in Q1. From earnings and economic data to rotations, commodities, and the growing tension between expectations and execution. Plus, what to do moving forward.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or YouTube!

What Happened in Markets This Week?

Here’s a quick summary of what’s been going on:

🧬 23andMe files for bankruptcy ( Reuters )

- 23andMe filed for bankruptcy after years of declining demand and a brutal 2023 data breach.

- Co-founder Anne Wojcicki resigned after failed buyout bids, but plans to try again.

- Investors betting on consumer genetics learned the hard way that DNA kits are a one-and-done business. The $6B SPAC darling is now worth under $15M, with customer trust shredded and regulators circling.

- Is there anything left of this business? Yes, its massive genetic database, which might be more valuable to pharma firms than to retail users.

- Now, just watch for distressed asset buyers eyeing the data trove, not the brand. It turns out that one test was enough, both for customers and investors.

🇺🇸 Trump May Implement Copper Import Tariffs Within Weeks ( Bloomberg )

- Copper prices hit records as the U.S. fast-tracked a decision to impose tariffs, potentially as high as 25%, on copper imports. The price is up around 10% from the start of the year to around $9,611 per tonne.

- Traders are rushing the metal into the U.S. to arbitrage the widening price gap between New York and London.

- IF the tariffs hit soon, U.S. copper could stay expensive and distort global supply chains, particularly squeezing China and other heavy consumers. Metal-intensive sectors, like construction, electronics, and EV’s, could see margin pressure.

- Investors in copper producers might get a near-term boost, but downstream firms that use the metal may feel the pinch.

- The "ship it before tariffs hit" trade has turned into a high-stakes gamble, and traders who miss that window will be left holding expensive metal.

⚛️ Google quantum exec says tech is ‘5 years out from a real breakout’ ( CNBC )

- Google’s quantum hardware lead says practical applications are just five years away—despite needing millions of qubits vs. today’s 105.

- Investor buzz is picking up again post-Google’s December error correction breakthrough, even as Nvidia’s CEO tempers near-term expectations.

- Quantum computing is inching from science fiction to commercial roadmap, with early use cases like simulating complex physics or generating synthetic data. But real utility still hinges on scaling hardware, fixing errors, and finding must-have applications. Public quantum stocks could see speculative interest resurge if investor sentiment swings bullish.

- For now, most investors are treating quantum as a long-term moonshot. Exposure through diversified tech ETFs or chipmakers with quantum R&D (like Google or Microsoft) is considered safer than betting on pure-play startups.

📉 Tesla shares drop on plunging EU sales and tariff concerns ( CNBC )

- Tesla shares dropped nearly 6% after a 40% plunge in EU registrations for February and renewed fears over Trump’s looming auto tariffs.

- While EV demand in Europe is growing, Tesla is losing market share. That’s possibly due to buyers holding out for refreshed models or disliking Musk’s political alignment.

- The tariff talk adds fresh risk to Tesla’s global sales machine, especially as trade tensions between the U.S. and EU escalate. Brand damage, production pauses, and rising Chinese competition are compounding the hit. Meanwhile, hopes for robotaxi revenue remain speculative as rivals like Waymo expand.

- Tesla’s got a demand problem in Europe and a PR problem everywhere else, and tariffs might just seal the deal on an incredibly rough quarter.

📈 OpenAI expects revenue will triple this year ( Bloomberg )

- OpenAI expects revenue to soar to $12.7B in 2024, more than triple last year’s haul—driven by rising demand for its premium AI tools.

- It’s projecting $29.4B in 2025, but doesn’t see positive cash flow until 2029 due to sky-high infrastructure and R&D costs.

- This kind of growth—and burn—is classic hyper-scaler territory. The rumored $40B SoftBank-led raise and potential corporate restructuring suggest OpenAI is gearing up for IPO-level scrutiny. For investors, the more realistic play is through key backers like Microsoft or chip suppliers like Nvidia.

- OpenAI’s numbers are big, but your best exposure is still secondhand, through the ecosystem feeding and funding its AI engine.

📆 Q1 Recap: Trump Trade Hype Meets Market Reality

Heading into 2025, expectations for the ‘Trump Trade’ were high.

Trump’s policies were expected to support higher corporate profits and a strong USD, along with higher inflation and interest rates. Elsewhere, there was some uncertainty about the effect of tariffs, but global growth was expected to remain above 3%. Since valuations outside of the US didn’t seem stretched, the outlook for most markets appeared to be positive.

It turned out to be a case of ‘buy the rumor, sell the fact’ as the USD began to weaken days before the inauguration. US equities hung in until mid-February before they, too began to slide.

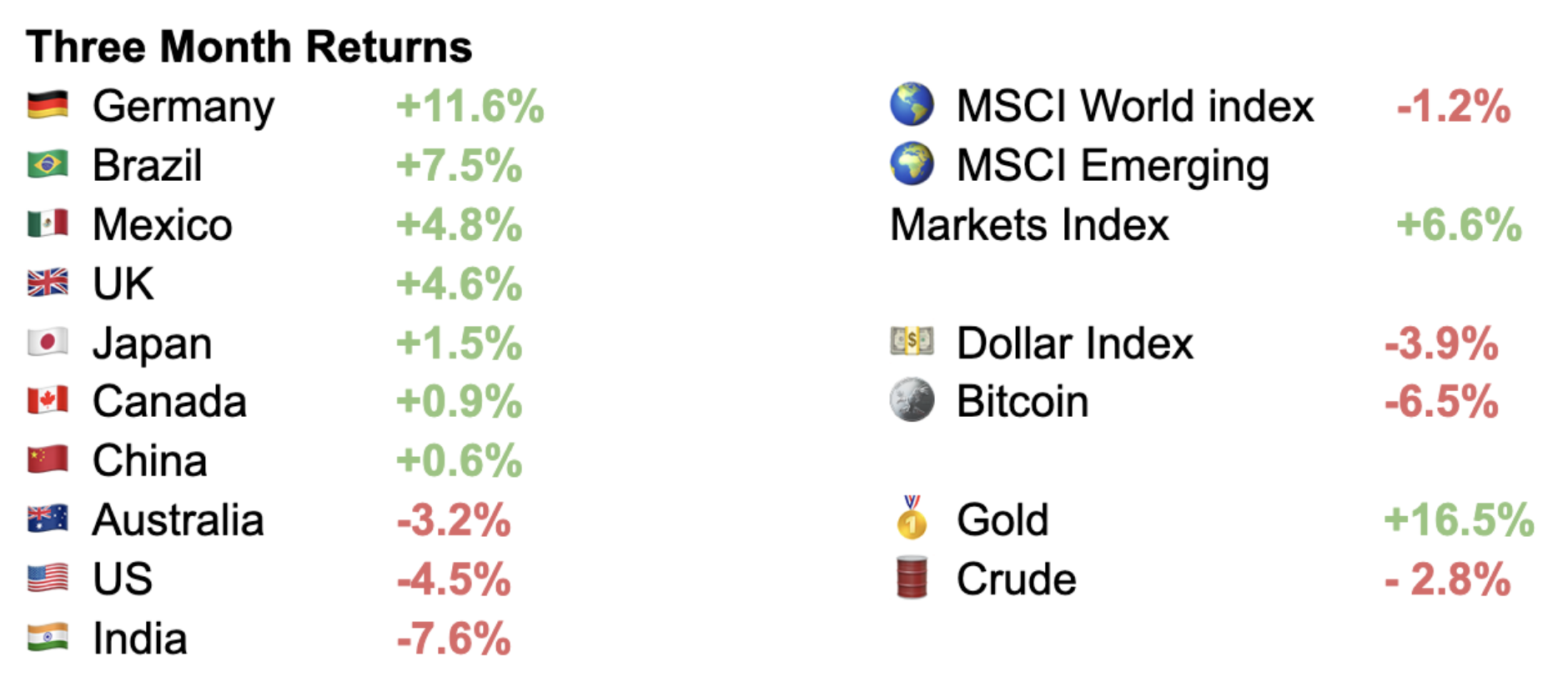

Global equities, as measured by the MSCI World index, ended the quarter about 1.2% lower, but fell nearly 8% between mid-February and mid-March. Within that index, there was a lot of rotation as markets that lagged last year outperformed, while some of last year’s winners fell out of favor.

Donald Trump’s intentions weren’t a surprise, but the execution did catch the market off guard.

From day one his focus was on Canada and Mexico, rather than on China, the more familiar adversary. The economies of the US, Mexico and Canada are tightly integrated, meaning new tariffs would affect all three economies. Reciprocal tariffs would only amplify the impact.

The other priority from day one was the Department of Government Efficiency, aka DOGE, which began to cut government spending and headcount at an unprecedented rate. While cutting government spending was always part of the agenda, economists began to wonder what the knock-on effect on consumer spending would look like.

The potential impact of these actions coincided with softer-than-expected economic data, and slightly higher inflation data in February. Furthermore, guidance from US retailers pointed to slowing consumer spending. All of this resulted in economic projections being revised lower.

🗓️ Earnings Season: A Story of Two Markets

As we mentioned recently, earnings season for S&P 500 companies got off to a decent start, but guidance from retailers and airlines that reported later pointed to weakening consumer demand.

✨ EPS estimates for Q1 have now been cut substantially. That means full year estimates are relying on a rebound in profits later in the year. There’s also a lot riding on the AI trade, with some doubts beginning to emerge.

But what about the rest of the market?

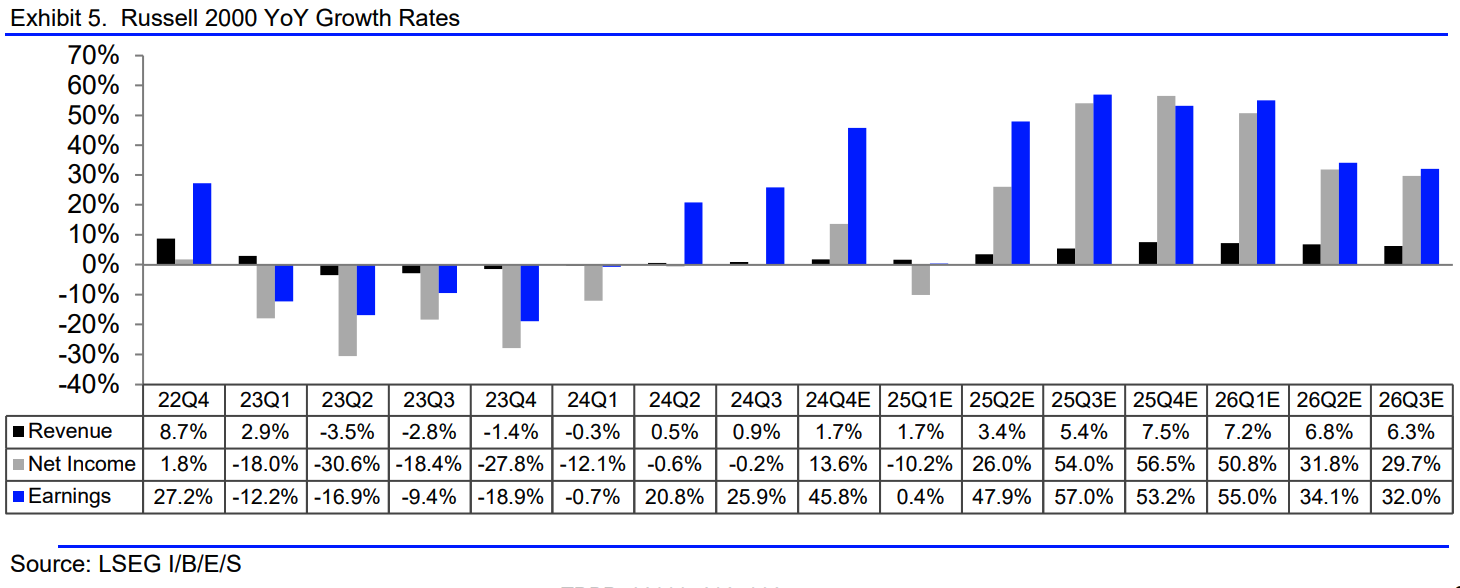

LSEG’s report card for Russell 2000 index companies (i.e. smaller companies) showed EPS up 45% year-on-year. That’s more than double the S&P 500’s 17% increase but was expected as the earnings recovery for smaller companies has lagged large caps.

The bad news is that estimates for Q1 earnings have been cut even more dramatically for this index.

In January, analysts expected Q1 EPS to be up 29% over 12 months, and that’s been cut to just 0.4%. They do, however, expect a rebound during the remaining quarters with Q4 EPS expected to be 45% higher.

So, once again, there’s a lot riding on the second half.

In Europe, the earnings recovery has also lagged, LSEG’s report card for STOXX 600 companies showed EPS up 8% on revenue growth of 1%.

That’s the best quarter since Q1 2023. Yet once again, Q1 estimates have been cut, with a rebound expected later in the year.

🔀 The Great Rotation: From Stars to Sleepers

Rotation has become a theme over the last three months.

In particular, global investors began to sell US equities and buy European equities. When expectations are high in one part of the market, and low elsewhere, even a minor catalyst can trigger substantial outperformance.

Just as investors decided to lighten their exposure to US large caps, Germany announced billions in potential defense investments. So, while US equities fell 4.5% during the quarter, Germany’s market was up over 11%.

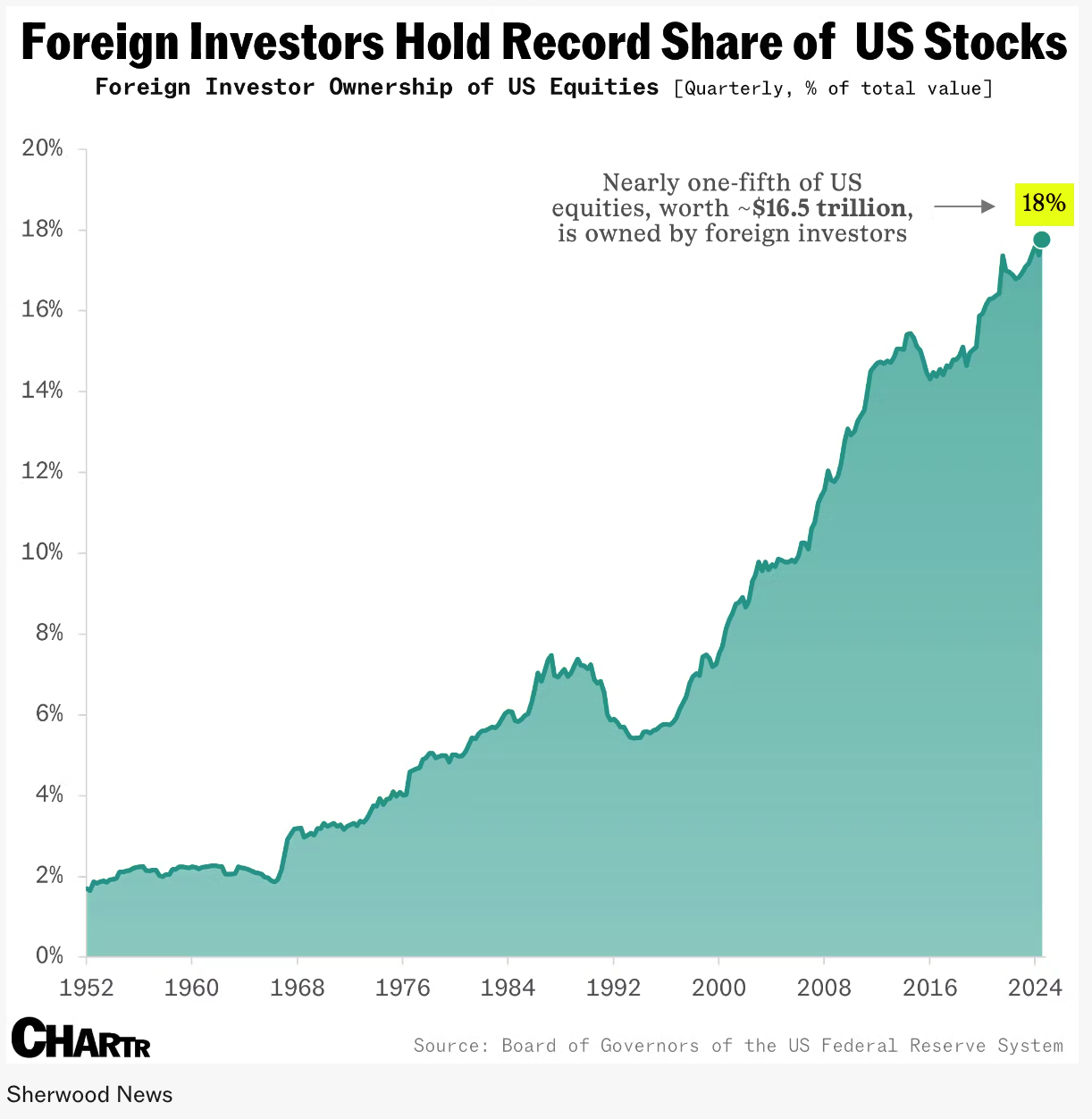

Are we likely to see more of this? Goldman Sachs published a note showing how foreign ownership of US equities has increased over the last 75 years. From under 2% in 1952, foreign ownership has increased to 18% today.

Goldman Sachs actually sees this increasing in 2025. But, if stocks elsewhere really begin to look more attractive, there’s quite a lot to offload.

⌛ Small Caps: Still Waiting For A Comeback

Another potential rotation trade that investors are watching is US large caps to small caps.

Investors have been waiting a long time to see small caps outperforming again. So far, small caps have continued to underperform in 2025, despite the strong recovery in earnings.

Prior to 2010, small cap stocks tended to outperform, particularly in the US.

Even with recent underperformance, the Russell 2000 has actually outperformed the S&P 500 over 25 years. Since 2002 that’s changed, and it’s lagged over most periods.

In a recent video, Jessica Rabe at DataTrek made some interesting observations about small caps and why they may have lost their edge. Basically, smaller companies are more exposed to the US economy, while the S&P 500 is dominated by tech giants, which are exposed to digital disruption.

It’s the same in other countries: smaller companies are exposed to the local economy, while large companies operate across the globe, and are often exposed to major secular trends.

The takeaway is that you shouldn’t expect smaller companies to outperform as a group. Obviously, individual companies can stand out based on their own merits.

🛢️ Commodities: Oil Feels The Heat, Gold Glows

Donald Trump has always been a champion of the oil industry.

But he also promised lower gas prices, which would of course result from his drill baby, drill policies. Lower fuel prices are good for consumers, the economy and inflation. But they aren’t necessarily good for oil and gas producers.

The Dallas Fed recently published comments from O&G companies - which were submitted anonymously. This comment summed up many of the others:

“ There cannot be "U.S. energy dominance" and $50 per barrel oil; those two statements are contradictory. At $50-per-barrel oil, we will see U.S. oil production start to decline immediately, and likely significantly.”

✨ The White House has suggested $50 a barrel is on the cards, while oil producers suggest $70 to $80 is the level required to invest in new capacity. This is a story to keep an eye on.

As we mentioned recently, near-term volatility can create great opportunities to invest in companies that stand to benefit from ongoing demand over the long term.

Meanwhile, the gold price recently crossed the $3,000 mark for the first time. Investors generally hate uncertainty, but gold bulls love it, and gold is living up to its reputation as a safe haven asset.

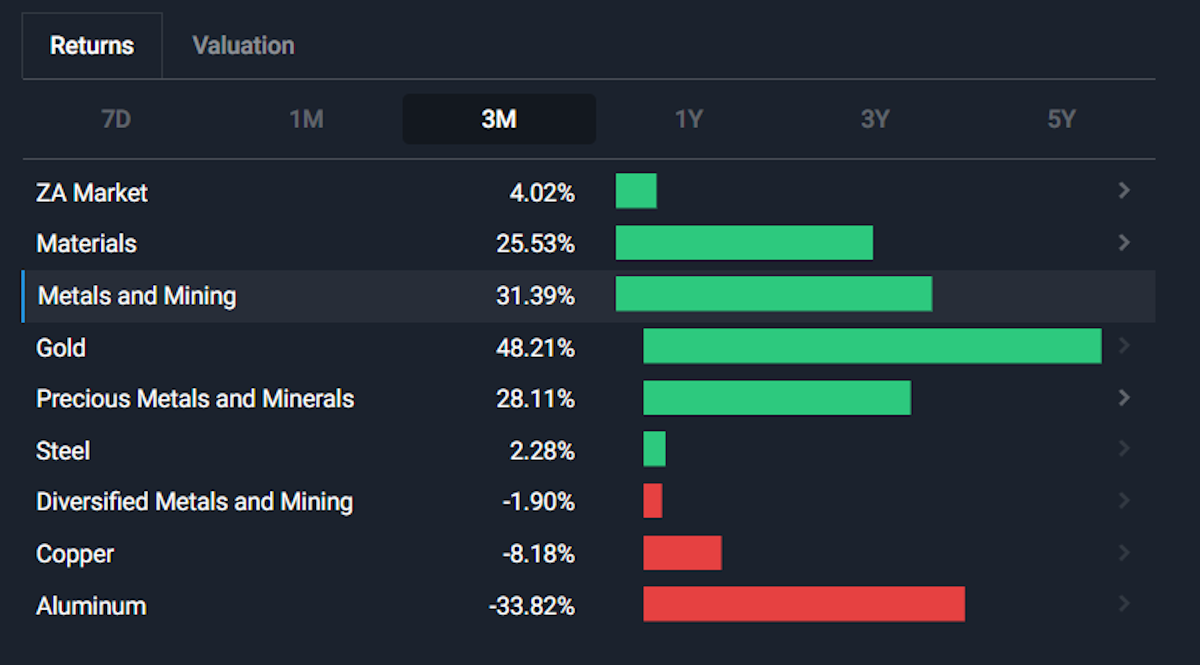

Gold miners are loving these prices. Let’s see if they manage to keep costs under control this time, unlike in previous cycles. Over three months gold stocks were 48% in South Africa (below), 29% in the US, 38% in the UK, and 27% in Australia.

✨ While precious metals rallied, and the oil price remained under pressure, the rest of the commodity space was mixed.

Industrial metals remained depressed due to the uncertain growth outlook - apart from copper, which also rallied to a record high.

As mentioned in our news stories, US companies are reportedly rushing to import copper ahead of expected tariffs. We’ll have to see whether that becomes another “ buy-the-rumor, sell the fact” trade.

💡 The Insight: Tread Carefully With The Rotation Trade

With the current uncertainty, and potential market and sector rotation taking place, it’s easy to get sucked into FOMO trades.

One way to avoid that is to think long-term and focus on what companies will be doing in 5 to 10 years time - not next month.

Another way is to look for different companies operating in their own niche.

The companies that dominate the news tend to be those in trending industries, making notable announcements, or reporting solid (or poor) results. But the companies that everyone’s watching are more likely to be fully valued, and to be highly correlated to the indexes.

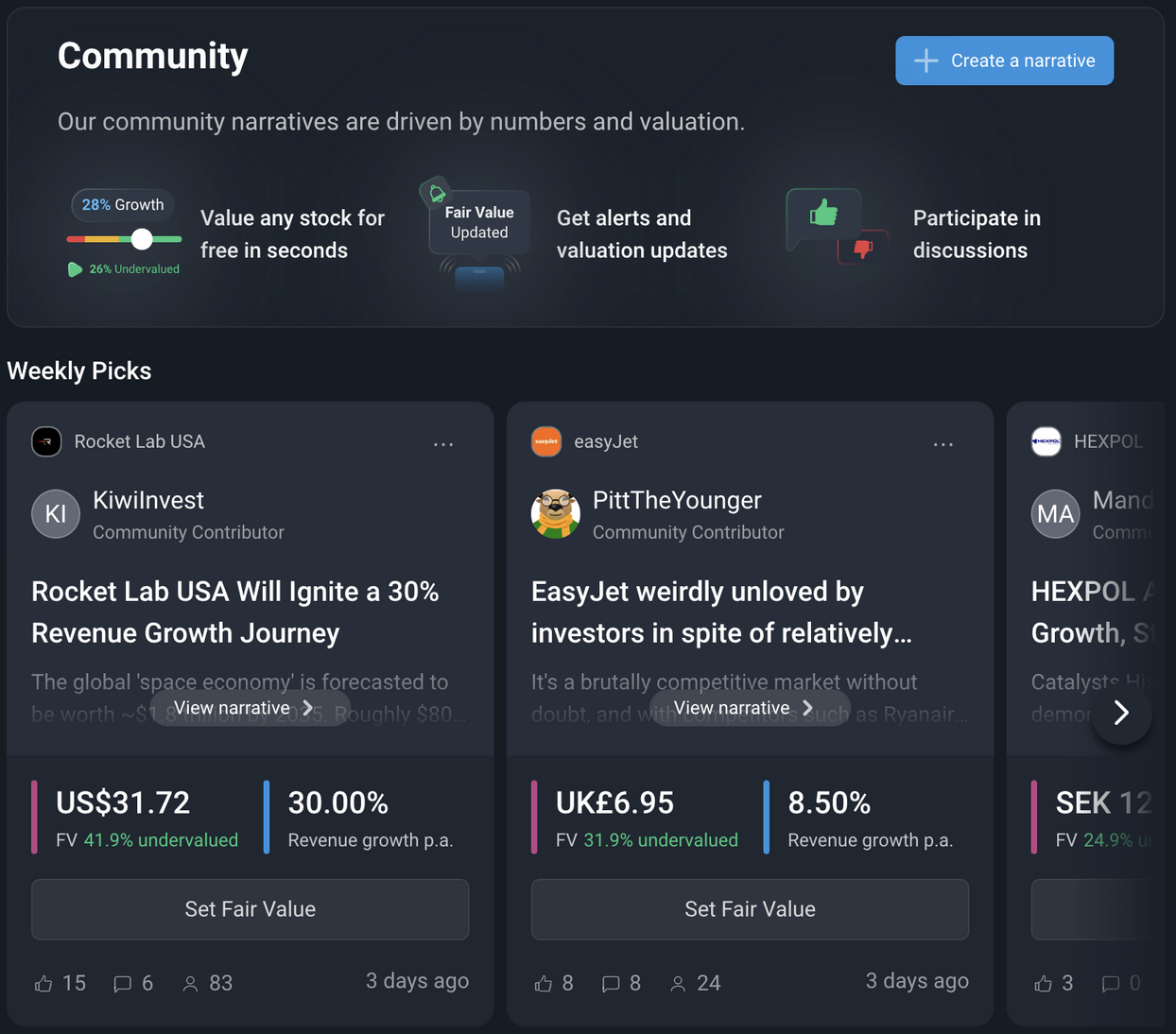

Keep an eye on the Community Page, where you’ll find narratives published by community members.

Often, these are less well-known and interesting companies, and the authors have already done some of the hard work for you. You can use their narrative as a starting point and build on it to create your own investment thesis.

Key Events During the Next Week

Investors will be closely monitoring employment reports this week in light of the potential economic slowdown.

Monday

- 🇩🇪 Germany’s preliminary estimate of inflation is expected to remain at 2.3%.

Tuesday

- 🇦🇺 Australia’s central bank will be meeting to discuss interest rates. The RBA is expected to hold rates at 4.1%.

- 🇪🇺 The Eurozone Flash inflation estimate will be published. Economists expect the annual inflation rate to drop from 2.3% to 2.1%.

- 🇪🇺 Eurozone unemployment is forecast at 6.3%, up slightly from the previous 6.2% level.

- 🇺🇸 The US JOLTs report is expected to show job openings falling from 7.74 million to 7.5 million. That would be the largest decline since September.

Wednesday

- 🇺🇸 The ADP National Employment Report will be published. Economists expect to see just 60k new jobs, down from 77k and the lowest since July.

Friday

- 🇨🇦 Canada’s unemployment rate is forecast to rise marginally, from 6.6% to 6.7%.

- 🇺🇸 US Unemployment is expected to remain at 4.1%, while non-farm payrolls are expected to fall from 150k to 80k.

Q1 earnings season kicks off at the end of next week. Until then, there are just a few companies due to report, including:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.