- United States

- /

- Banks

- /

- NYSEAM:EVBN

Dividend Stocks To Watch For February 2025

Reviewed by Simply Wall St

As the U.S. stock market looks to rebound from a recent four-day slump, investors are keenly watching key earnings reports and economic data that could influence future trends. In this environment, dividend stocks continue to attract attention for their potential to provide steady income and serve as a buffer against market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.41% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.75% | ★★★★★★ |

| FMC (NYSE:FMC) | 6.07% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.77% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.71% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.34% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.10% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.99% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.17% | ★★★★★★ |

Click here to see the full list of 142 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

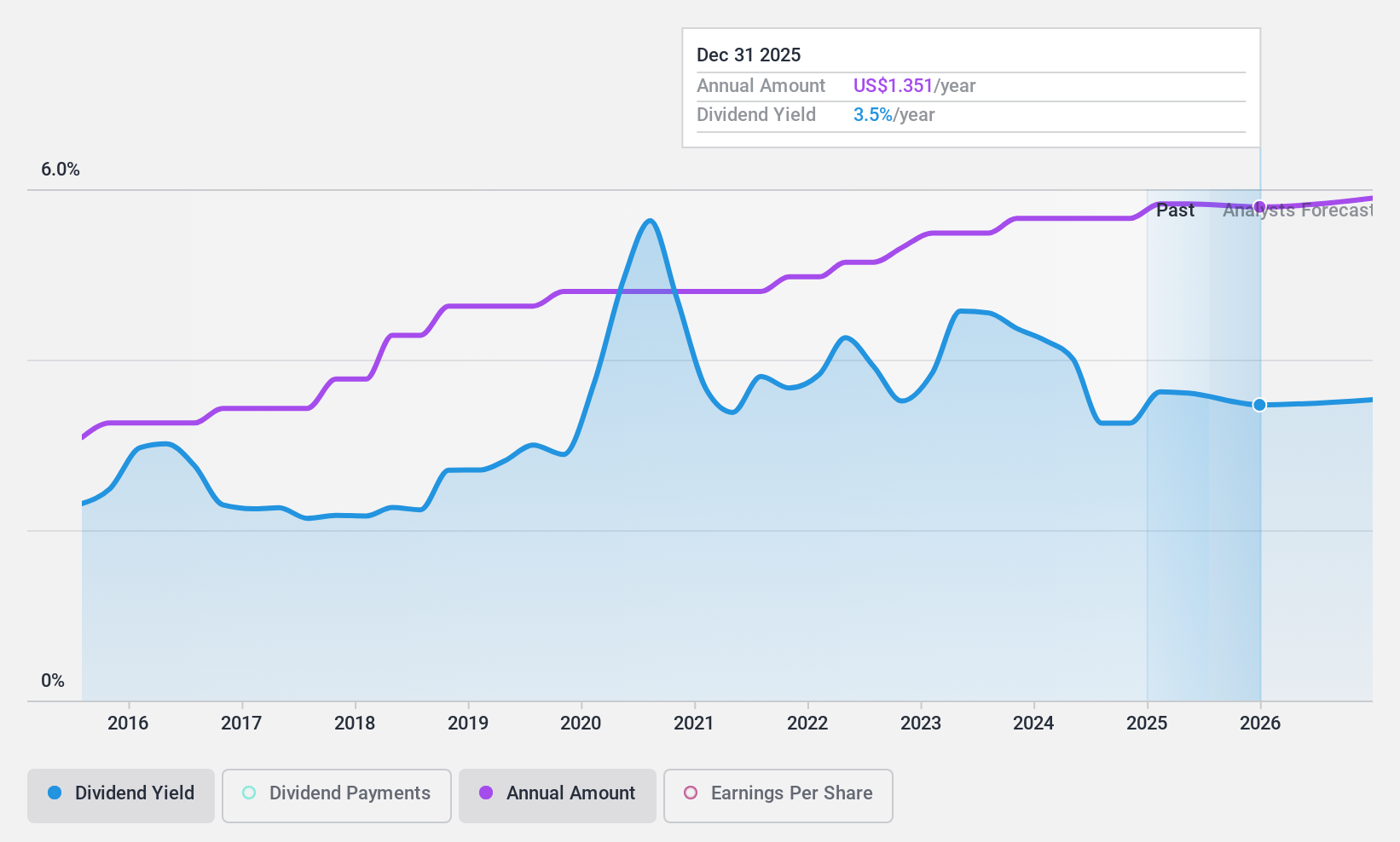

S&T Bancorp (NasdaqGS:STBA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: S&T Bancorp, Inc. is the bank holding company for S&T Bank, offering retail and commercial banking products and services, with a market cap of approximately $1.50 billion.

Operations: S&T Bancorp, Inc. generates revenue through its Community Banking segment, which accounts for $383.76 million.

Dividend Yield: 3.4%

S&T Bancorp's dividend payments are well-covered by earnings with a payout ratio of 39.3%, and its dividends have been stable and growing over the past decade. Although its current yield of 3.42% is below top-tier payers, the recent increase to $0.34 per share reflects continued commitment to shareholders. Recent earnings show a slight decline, with net income for 2024 at US$131.27 million compared to US$144.78 million in 2023, but dividends remain sustainable and reliable.

- Dive into the specifics of S&T Bancorp here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that S&T Bancorp is trading behind its estimated value.

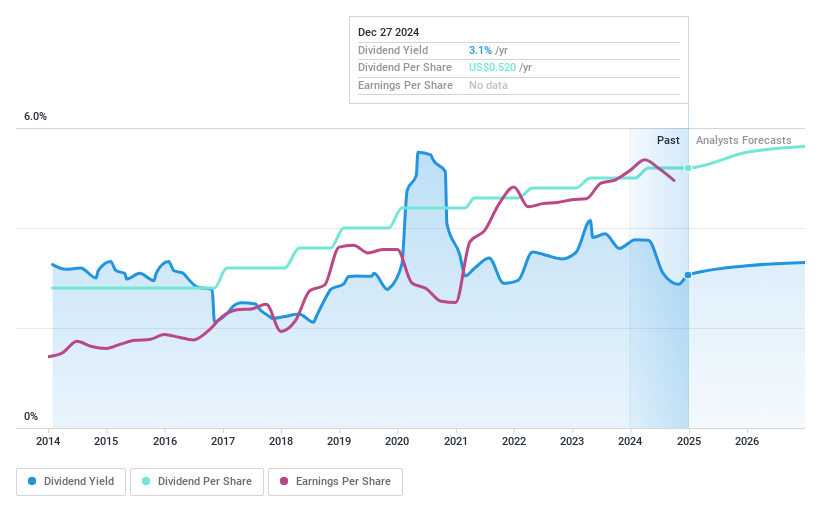

Evans Bancorp (NYSEAM:EVBN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evans Bancorp, Inc. is a financial holding company for Evans Bank, N.A., with a market cap of $233.92 million.

Operations: Unfortunately, the provided text does not contain specific details about Evans Bancorp's revenue segments. Therefore, I cannot summarize them into a sentence. If you have additional information on their revenue breakdown, please share it for further assistance.

Dividend Yield: 3.1%

Evans Bancorp's dividend payments have been stable and growing over the past decade, with a current yield of 3.07%, though this is below the top tier in the US market. The recent declaration of a $0.66 per share dividend underscores its commitment to shareholders. However, net income for 2024 significantly declined to US$11.95 million from US$24.52 million in 2023, impacting profitability despite dividends being covered by earnings with a payout ratio of 61.2%.

- Delve into the full analysis dividend report here for a deeper understanding of Evans Bancorp.

- According our valuation report, there's an indication that Evans Bancorp's share price might be on the expensive side.

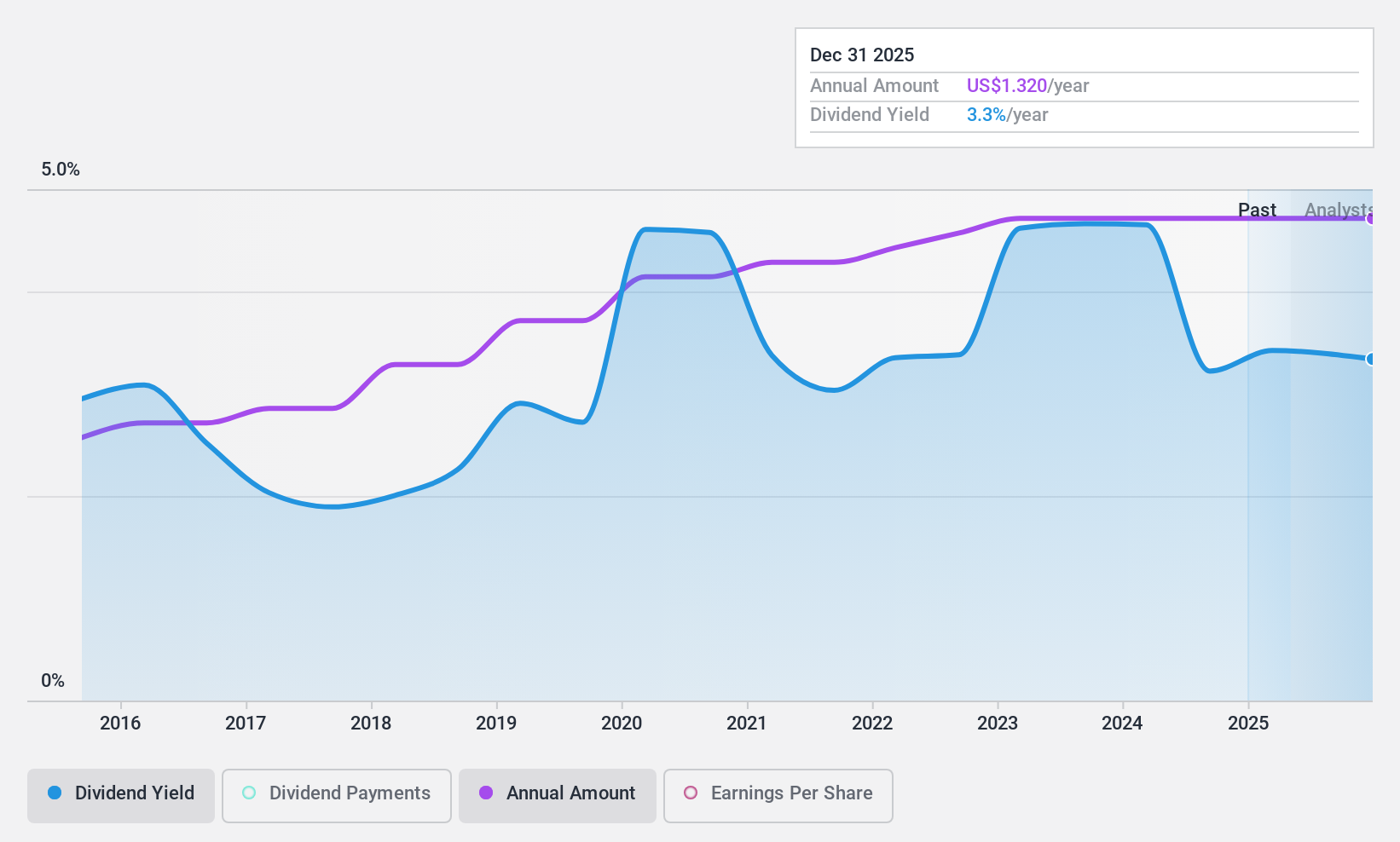

First Commonwealth Financial (NYSE:FCF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: First Commonwealth Financial Corporation is a financial holding company offering consumer and commercial banking services in the United States, with a market cap of approximately $1.63 billion.

Operations: First Commonwealth Financial Corporation generates revenue primarily through its banking segment, which accounts for $448.50 million.

Dividend Yield: 3.2%

First Commonwealth Financial maintains a stable dividend history with a recent 4% increase, yielding 3.18%, though below top-tier US payers. The payout ratio of 37.3% indicates dividends are well-covered by earnings, despite net income declining to US$35.85 million for Q4 2024 from US$44.83 million in the previous year. Recent share buybacks and executive realignment may support future financial stability, while analysts expect stock price growth of 21%.

- Click here and access our complete dividend analysis report to understand the dynamics of First Commonwealth Financial.

- The valuation report we've compiled suggests that First Commonwealth Financial's current price could be quite moderate.

Seize The Opportunity

- Navigate through the entire inventory of 142 Top US Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evans Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:EVBN

Evans Bancorp

Primarily operates as financial holding company for Evans Bank, N.A.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives