- United States

- /

- Banks

- /

- NYSE:NTB

3 Dividend Stocks To Consider With Up To 5.4% Yield

Reviewed by Simply Wall St

As U.S. stock indexes reach new heights, with the S&P 500 and Nasdaq setting all-time records and the Dow Jones hovering near its peak, investors are closely monitoring market dynamics amid recent interest rate cuts by the Federal Reserve. In this environment of optimism tempered by caution, dividend stocks can offer a compelling option for those seeking steady income streams alongside potential capital appreciation.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.38% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.50% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.62% | ★★★★★★ |

| Ennis (EBF) | 5.51% | ★★★★★★ |

| Employers Holdings (EIG) | 3.03% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.65% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.42% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.58% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.32% | ★★★★★☆ |

| Archer-Daniels-Midland (ADM) | 3.31% | ★★★★★☆ |

Click here to see the full list of 125 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

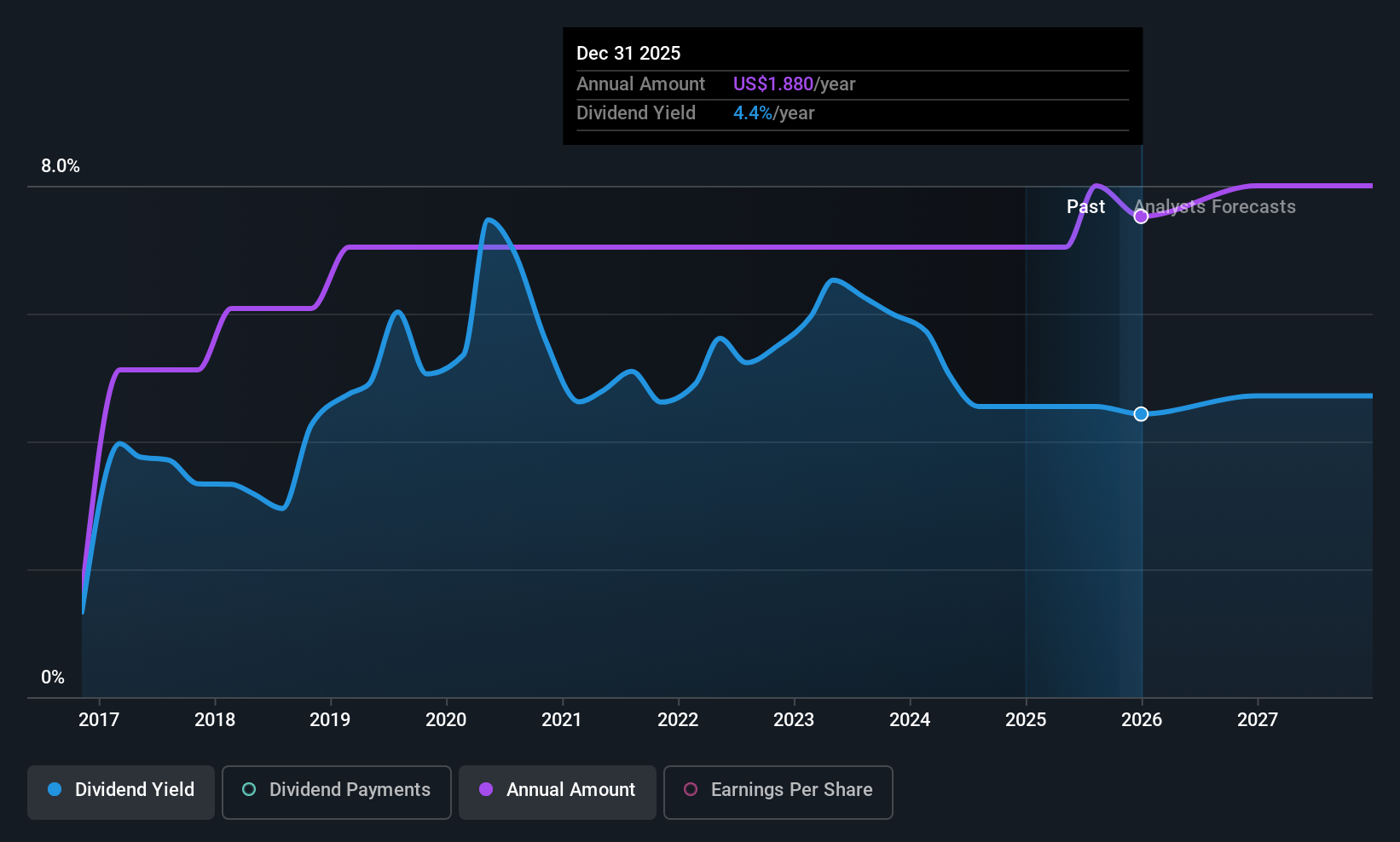

Coca-Cola FEMSA. de (KOF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Coca-Cola FEMSA, S.A.B. de C.V., a franchise bottler, operates by producing, marketing, selling, and distributing Coca-Cola trademark beverages across several Latin American countries including Mexico and Brazil with a market cap of approximately $17.73 billion.

Operations: Coca-Cola FEMSA generates its revenue primarily from the Non-Alcoholic Beverages segment, which amounts to MX$288.81 billion.

Dividend Yield: 4.7%

Coca-Cola FEMSA's dividend, currently at US$0.86 per share, offers a yield of 4.74%, placing it among the top 25% of U.S. dividend payers. However, its high cash payout ratio of 233.5% indicates dividends are not well covered by cash flows, raising sustainability concerns despite a reasonable earnings payout ratio of 65.6%. The company has consistently increased and maintained stable dividends over the past decade, reflecting reliability amidst recent earnings growth challenges and conference presentations in the U.S.

- Unlock comprehensive insights into our analysis of Coca-Cola FEMSA. de stock in this dividend report.

- The analysis detailed in our Coca-Cola FEMSA. de valuation report hints at an deflated share price compared to its estimated value.

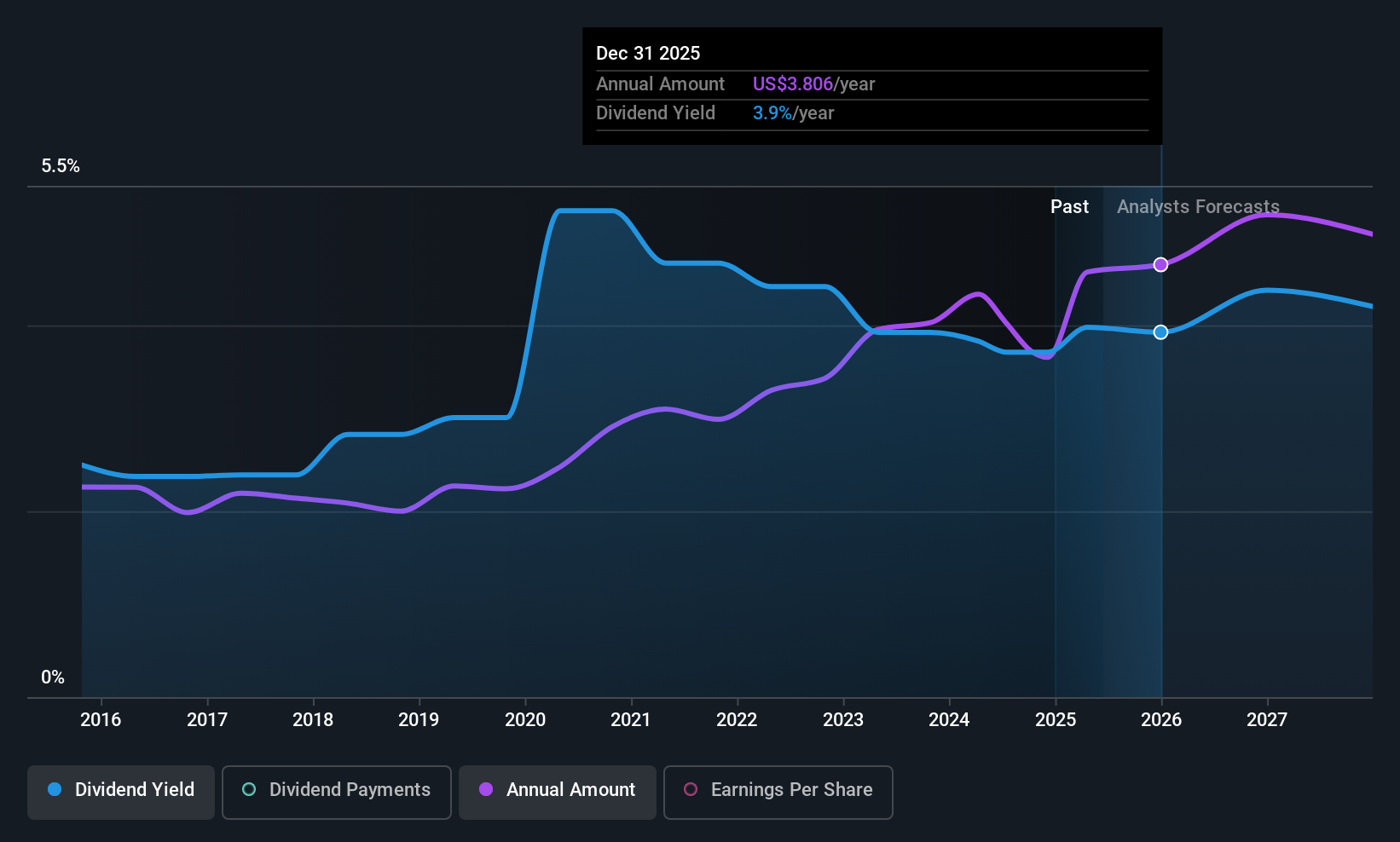

Bank of N.T. Butterfield & Son (NTB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Bank of N.T. Butterfield & Son Limited offers community, commercial, and private banking services to individuals and small to medium-sized businesses, with a market cap of $1.84 billion.

Operations: The Bank of N.T. Butterfield & Son Limited generates revenue primarily from its banking segment, amounting to $588.90 million.

Dividend Yield: 4.5%

The Bank of N.T. Butterfield & Son has increased its quarterly dividend to US$0.50 per share, maintaining a competitive yield in the U.S. market's top 25%. Despite a high bad loans ratio of 2.6%, dividends are well covered by earnings with a payout ratio of 34.6%. Recent executive changes, including the reappointment of Michael Schrum as CFO, underscore the bank's focus on risk management and strategic growth amidst stable dividend payments over nine years.

- Get an in-depth perspective on Bank of N.T. Butterfield & Son's performance by reading our dividend report here.

- Our valuation report here indicates Bank of N.T. Butterfield & Son may be undervalued.

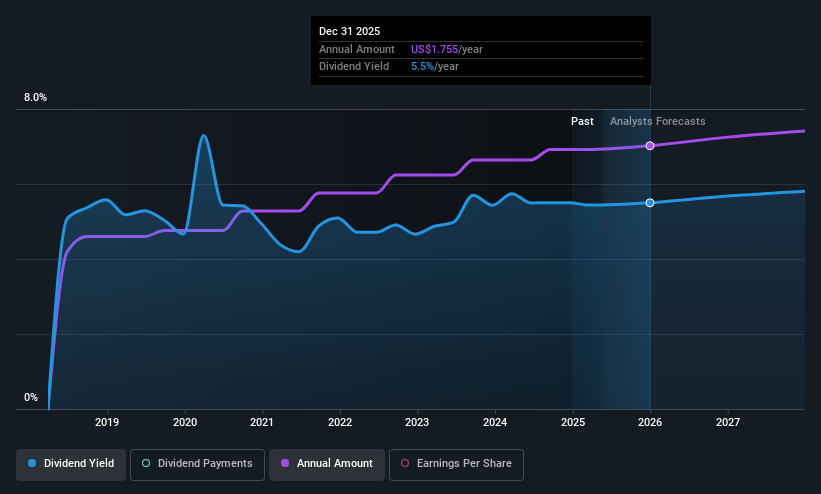

VICI Properties (VICI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: VICI Properties Inc. is an S&P 500 experiential real estate investment trust that owns a significant portfolio of gaming, hospitality, wellness, entertainment and leisure destinations such as Caesars Palace Las Vegas and MGM Grand, with a market cap of approximately $33.95 billion.

Operations: VICI Properties Inc. generates revenue primarily through its Real Property and Real Estate Lending Activities, amounting to $3.93 billion.

Dividend Yield: 5.4%

VICI Properties recently raised its quarterly dividend to $0.45 per share, marking a 4% increase, and offers a yield in the top quartile of U.S. dividend payers. While dividends have been stable over seven years, they are well-covered by earnings with a payout ratio of 65.4%. The company's financials show growth with Q2 revenue at $1 billion and net income at $865 million, though debt coverage by operating cash flow remains an area for improvement.

- Click to explore a detailed breakdown of our findings in VICI Properties' dividend report.

- The valuation report we've compiled suggests that VICI Properties' current price could be quite moderate.

Seize The Opportunity

- Click here to access our complete index of 125 Top US Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bank of N.T. Butterfield & Son might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NTB

Bank of N.T. Butterfield & Son

Provides a range of community, commercial, and private banking services to individuals and small to medium-sized businesses.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)