- United States

- /

- Banks

- /

- NasdaqGS:STBA

Undervalued Small Caps With Insider Activity In US February 2025

Reviewed by Simply Wall St

Over the past year, the United States market has experienced a robust growth of 22%, with a recent uptick of 1.5% in the last week and an optimistic forecast of 15% annual earnings growth. In this thriving environment, identifying small-cap stocks with potential insider activity can be an intriguing approach for investors seeking opportunities that align with current market dynamics.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 11.6x | 3.0x | 48.21% | ★★★★★☆ |

| McEwen Mining | 3.8x | 2.0x | 47.18% | ★★★★★☆ |

| OptimizeRx | NA | 1.4x | 27.85% | ★★★★★☆ |

| First United | 12.7x | 3.4x | 32.34% | ★★★★☆☆ |

| Quanex Building Products | 33.0x | 0.9x | 35.86% | ★★★★☆☆ |

| Innovex International | 9.0x | 2.1x | 46.44% | ★★★★☆☆ |

| West Bancorporation | 15.5x | 4.7x | 40.04% | ★★★☆☆☆ |

| Limbach Holdings | 39.1x | 2.0x | 43.19% | ★★★☆☆☆ |

| ChromaDex | 302.6x | 4.9x | 26.48% | ★★★☆☆☆ |

| Franklin Financial Services | 15.1x | 2.4x | 21.59% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

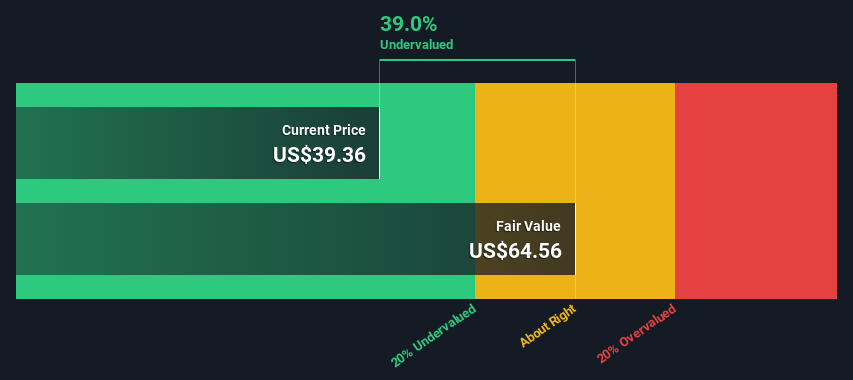

German American Bancorp (NasdaqGS:GABC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: German American Bancorp is a financial holding company that provides a range of banking and financial services, with a market capitalization of approximately $0.92 billion.

Operations: The company generates revenue entirely from its operations, with consistent gross profit margins of 100%. Operating expenses primarily consist of general and administrative costs, which have shown a gradual increase over time. Net income margins have fluctuated, reaching up to 36.47% at their peak.

PE: 14.3x

German American Bancorp, a smaller company in the financial sector, has shown growth potential with its recent earnings report indicating net interest income of US$51.03 million for Q4 2024, up from US$45.61 million the previous year. Insider confidence is evident with share purchases made recently, reflecting optimism in its prospects. The company also increased its dividend by 7.4%, signaling financial health and commitment to returning value to shareholders amidst board changes and strategic appointments following a merger agreement.

- Click to explore a detailed breakdown of our findings in German American Bancorp's valuation report.

Evaluate German American Bancorp's historical performance by accessing our past performance report.

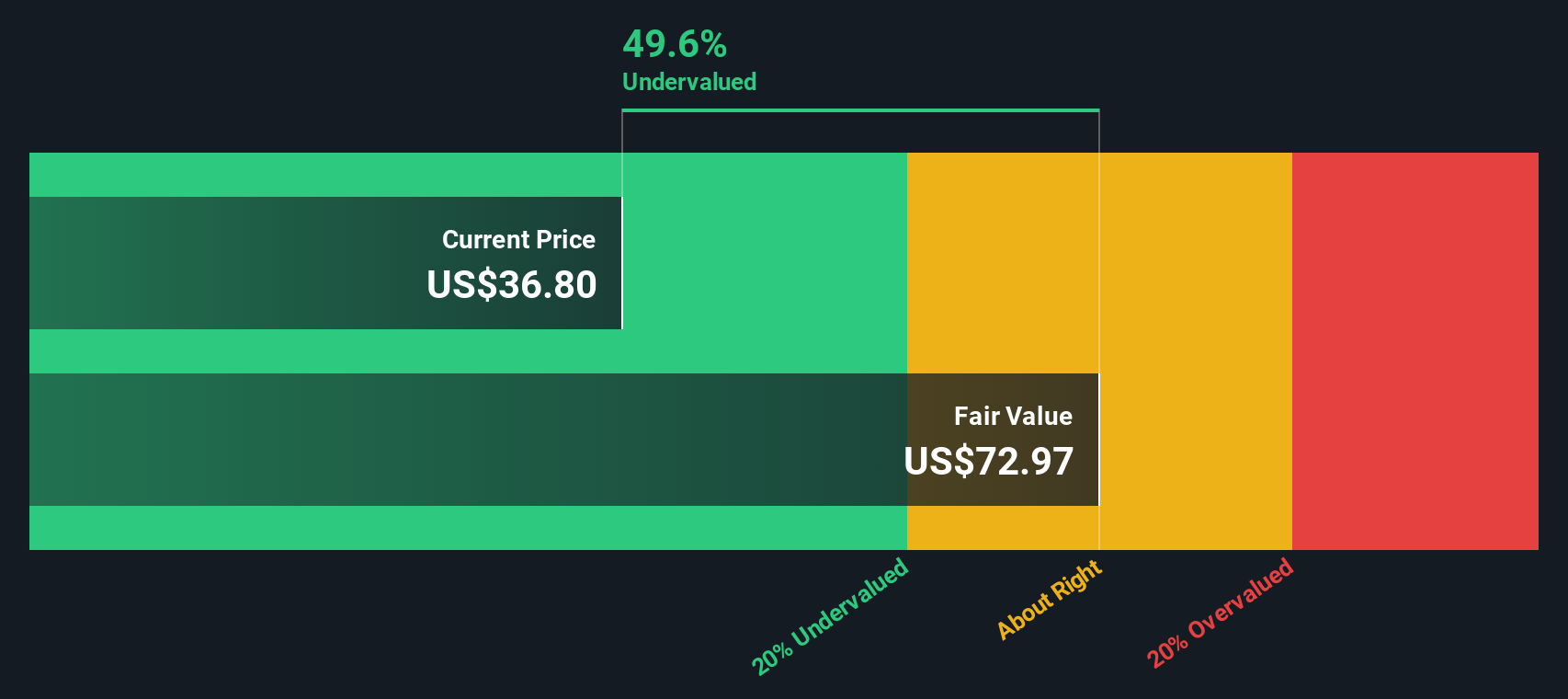

S&T Bancorp (NasdaqGS:STBA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: S&T Bancorp is a financial holding company that primarily provides community banking services, with a market cap of $0.98 billion.

Operations: The company generates revenue primarily from community banking, with recent figures showing $383.76 million in revenue. Operating expenses have been a significant cost factor, reaching $214.74 million in the latest period. The net income margin has shown variability, most recently recorded at 34.21%.

PE: 11.7x

S&T Bancorp, a smaller U.S. financial entity, recently reported a dip in its fourth-quarter and full-year earnings for 2024, with net income at US$33.07 million compared to US$37.05 million the previous year. Despite this, insider confidence is evident as insiders have been purchasing shares over recent months. The company also increased its quarterly dividend to US$0.34 per share, reflecting steady shareholder returns amid challenging times for revenue growth projections over the next few years.

- Click here to discover the nuances of S&T Bancorp with our detailed analytical valuation report.

Assess S&T Bancorp's past performance with our detailed historical performance reports.

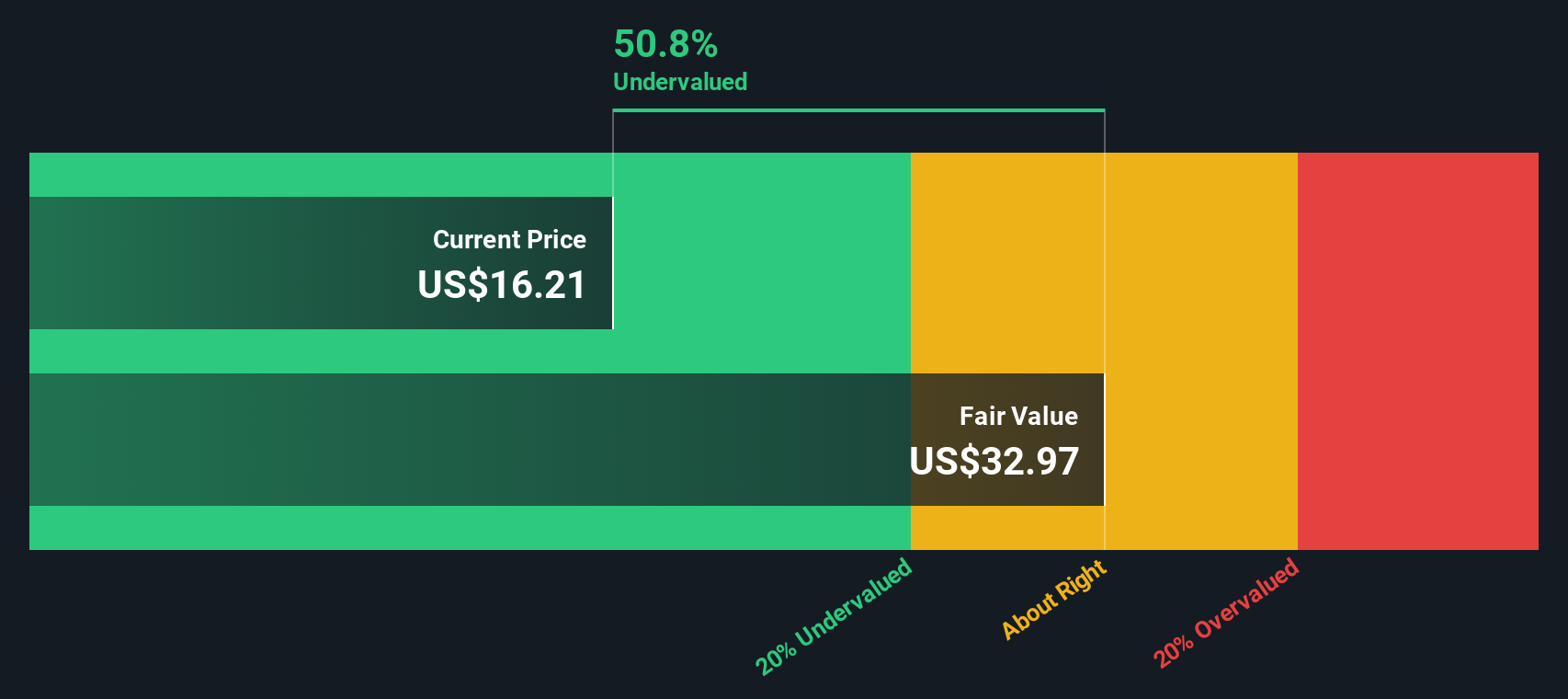

First Commonwealth Financial (NYSE:FCF)

Simply Wall St Value Rating: ★★★★★☆

Overview: First Commonwealth Financial is a financial services company primarily engaged in providing banking services, with a market capitalization of approximately $1.48 billion.

Operations: The company generates revenue primarily from its banking operations, with the latest reported revenue at $448.50 million. Operating expenses, including general and administrative costs of $207.64 million and sales & marketing expenses of $5.54 million, significantly impact net income. The net income margin has shown variability over time, with a recent figure of 31.79%.

PE: 11.7x

First Commonwealth Financial, a smaller financial institution, is drawing attention with its strategic moves and insider confidence. They recently repurchased 476,979 shares from October to December 2024 for US$7.92 million, completing a buyback program initiated in 2021. While net income dropped to US$35.85 million from US$44.83 million year-over-year in Q4 2024, the company maintains a steady dividend increase of 4% over the previous year’s fourth quarter. Earnings are projected to grow at an annual rate of 8.81%, suggesting potential value for investors seeking growth within this sector.

Summing It All Up

- Dive into all 53 of the Undervalued US Small Caps With Insider Buying we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STBA

S&T Bancorp

Operates as the bank holding company for S&T Bank that engages in the provision of retail and commercial banking products and services.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives