- United States

- /

- Banks

- /

- NYSE:FBK

Undervalued US Stocks For December 2024 Estimated To Be Trading Below Market Value

Reviewed by Simply Wall St

As the U.S. market navigates a period of uncertainty with stock futures slipping and investors closely monitoring the Federal Reserve's decisions on interest rates, opportunities for identifying undervalued stocks become particularly relevant. In this environment, a good stock is often characterized by strong fundamentals that suggest it may be trading below its intrinsic value, offering potential for growth once market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | $123.38 | $244.22 | 49.5% |

| Business First Bancshares (NasdaqGS:BFST) | $27.78 | $54.95 | 49.4% |

| Sensus Healthcare (NasdaqCM:SRTS) | $7.97 | $15.58 | 48.9% |

| West Bancorporation (NasdaqGS:WTBA) | $23.63 | $46.43 | 49.1% |

| Equity Bancshares (NYSE:EQBK) | $46.66 | $92.69 | 49.7% |

| U.S. Physical Therapy (NYSE:USPH) | $95.56 | $187.03 | 48.9% |

| Constellium (NYSE:CSTM) | $11.01 | $21.77 | 49.4% |

| Privia Health Group (NasdaqGS:PRVA) | $21.87 | $43.17 | 49.3% |

| Equifax (NYSE:EFX) | $273.50 | $534.38 | 48.8% |

| Vertex Pharmaceuticals (NasdaqGS:VRTX) | $468.09 | $913.78 | 48.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Independent Bank (NasdaqGS:INDB)

Overview: Independent Bank Corp. is the bank holding company for Rockland Trust Company, offering commercial banking products and services to individuals and small-to-medium sized businesses in the United States, with a market cap of $3.01 billion.

Operations: The company generates revenue of $655.49 million from its Community Banking segment, providing financial services to individuals and small-to-medium sized enterprises across the United States.

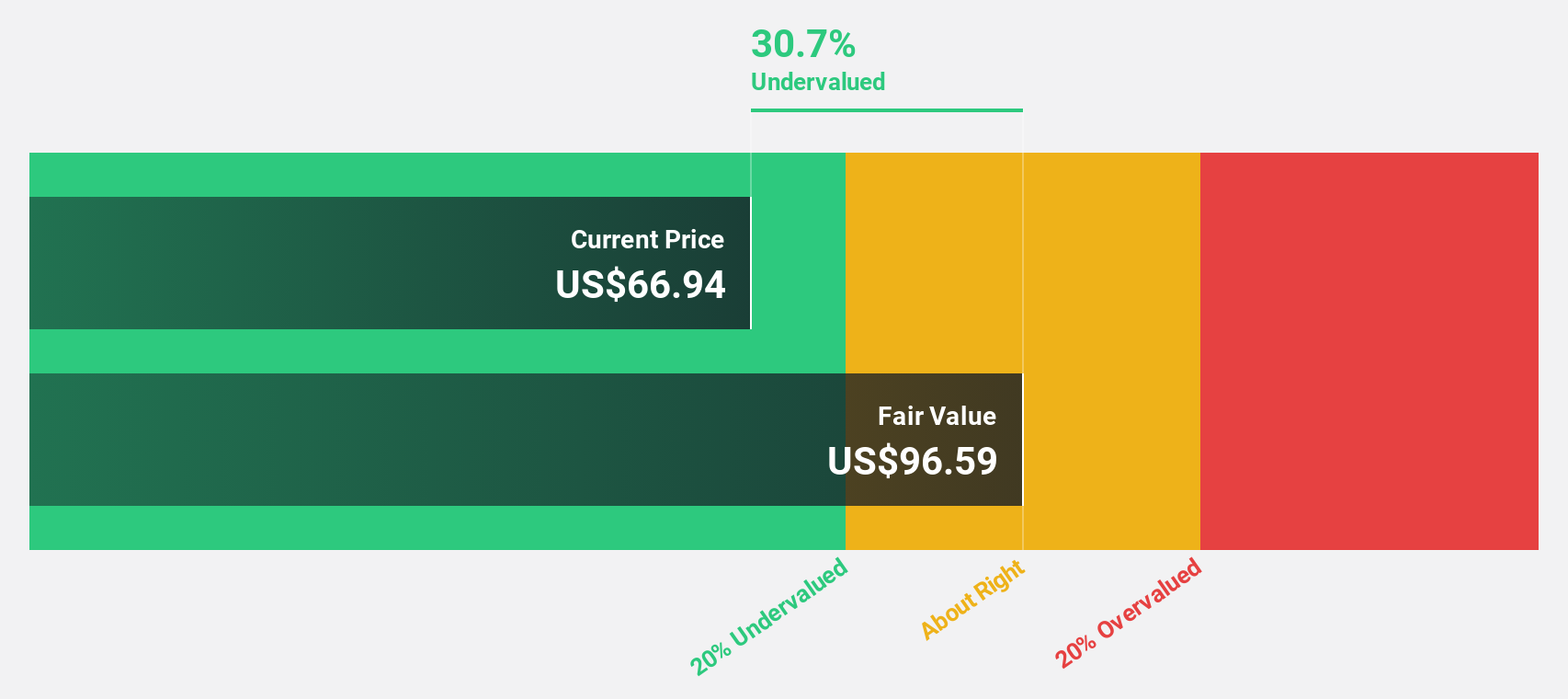

Estimated Discount To Fair Value: 32.2%

Independent Bank Corp. appears undervalued, trading at US$71.68, which is 32.2% below its estimated fair value of US$105.68. Despite recent earnings declines, with net income dropping to US$42.95 million in Q3 2024 from US$60.81 million a year ago, the company forecasts significant annual earnings growth of 26%, surpassing market expectations of 15.3%. The recent merger agreement valued at approximately $562 million could enhance future cash flows and strategic positioning.

- The growth report we've compiled suggests that Independent Bank's future prospects could be on the up.

- Navigate through the intricacies of Independent Bank with our comprehensive financial health report here.

FB Financial (NYSE:FBK)

Overview: FB Financial Corporation, with a market cap of $2.57 billion, operates as a bank holding company for FirstBank, offering a range of commercial and consumer banking services to businesses, professionals, and individuals.

Operations: The company's revenue is derived from its Banking segment, which generated $391.62 million, and its Mortgage segment, which contributed $44.78 million.

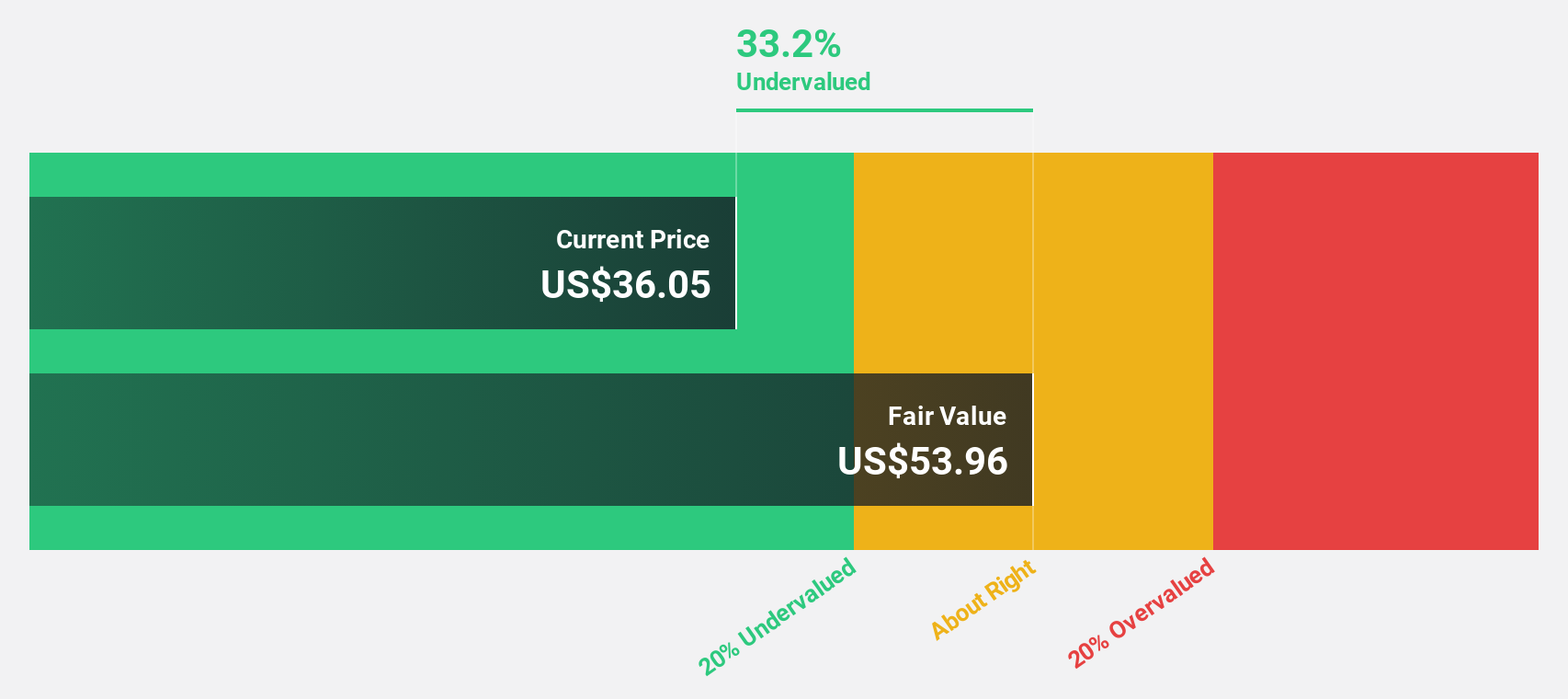

Estimated Discount To Fair Value: 12.8%

FB Financial, trading at US$56.01, is undervalued by 12.8% relative to its fair value estimate of US$64.23. Despite a decline in Q3 net income to US$10.22 million from US$19.18 million the previous year, earnings are forecasted to grow significantly at 24.4% annually over the next three years, outpacing the broader market's growth rate of 15.3%. However, revenue growth is expected to be moderate compared to profit expansion forecasts.

- The analysis detailed in our FB Financial growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of FB Financial.

Renasant (NYSE:RNST)

Overview: Renasant Corporation, with a market cap of $2.32 billion, operates as a bank holding company for Renasant Bank offering financial, wealth management, fiduciary, and insurance services to both retail and commercial customers.

Operations: The company's revenue segments include Community Banks generating $676.63 million, Wealth Management contributing $26.75 million, and Insurance services adding $10.98 million.

Estimated Discount To Fair Value: 41.8%

Renasant, priced at US$37.4, is significantly undervalued by 41.8% compared to its fair value of US$64.31. Recent earnings reports show net income rose to US$72.46 million from US$41.83 million year-over-year, with expected annual profit growth of 25%, surpassing the market's rate of 15.3%. Despite shareholder dilution and low future return on equity forecasts, Renasant maintains a stable dividend and anticipates robust revenue growth at 23.7% annually.

- Our earnings growth report unveils the potential for significant increases in Renasant's future results.

- Click to explore a detailed breakdown of our findings in Renasant's balance sheet health report.

Make It Happen

- Explore the 188 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade FB Financial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FBK

FB Financial

Operates as a bank holding company for FirstBank that provides a suite of commercial and consumer banking services.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives