- United States

- /

- Banks

- /

- NYSE:CFG

3 Reliable Dividend Stocks Yielding Up To 4.4%

Reviewed by Simply Wall St

As the U.S. stock market navigates a turbulent February marked by inflation concerns and geopolitical tensions, investors are increasingly turning their attention to reliable dividend stocks as a source of steady income. In such uncertain times, choosing stocks with strong dividend yields can provide stability and potential for income growth, making them an appealing option for those seeking to balance risk in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.39% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.82% | ★★★★★★ |

| FMC (NYSE:FMC) | 6.29% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.25% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.00% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.01% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.49% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.12% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.79% | ★★★★★★ |

Click here to see the full list of 142 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

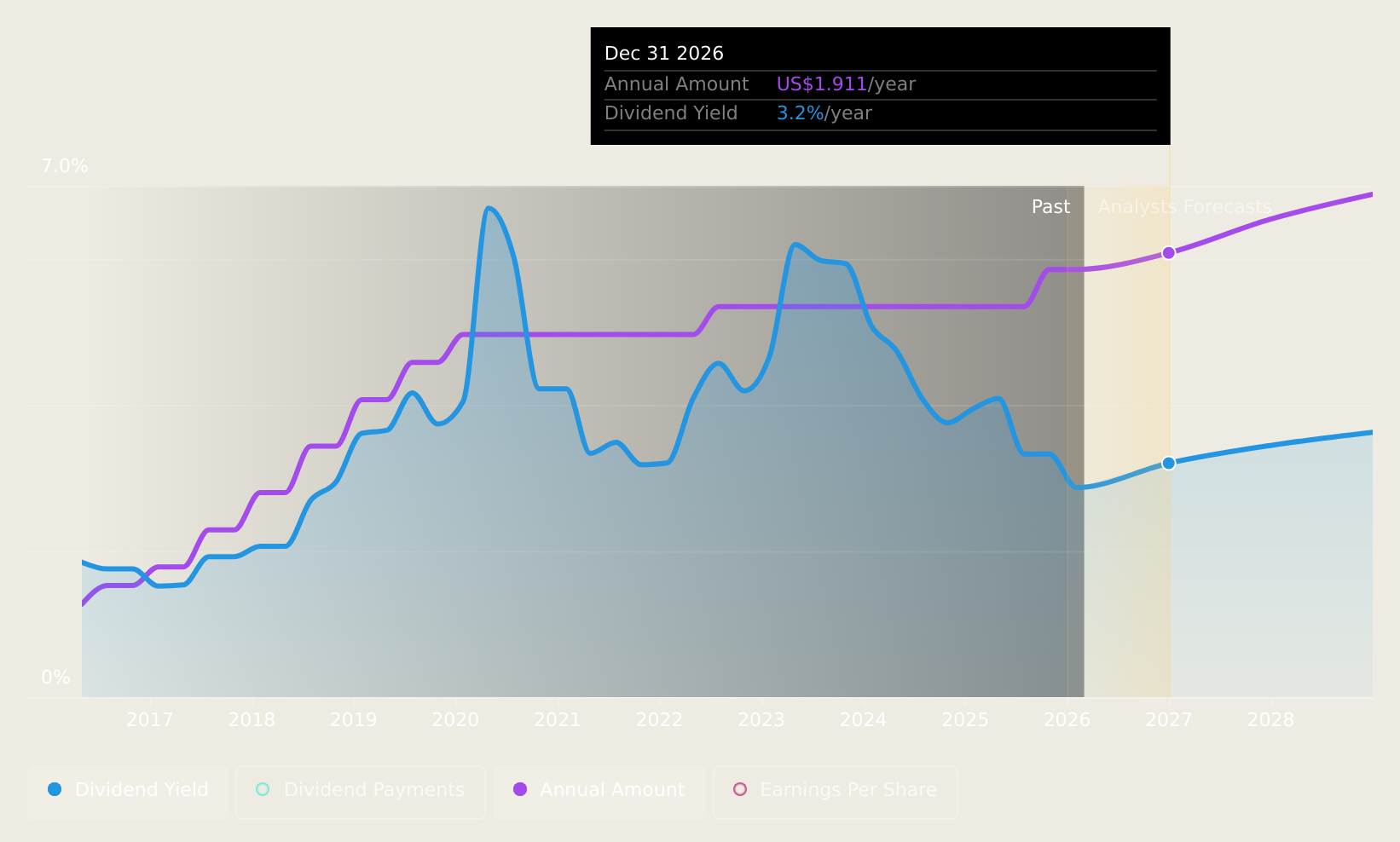

Northrim BanCorp (NasdaqGS:NRIM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Northrim BanCorp, Inc. is a bank holding company for Northrim Bank, offering commercial banking products and services to businesses and professional individuals, with a market cap of $454.15 million.

Operations: Northrim BanCorp, Inc. generates revenue through two primary segments: Community Banking, contributing $110.79 million, and Home Mortgage Lending, which accounts for $34.34 million.

Dividend Yield: 3.1%

Northrim BanCorp's dividends have been stable and growing over the past decade, with recent increases to $0.64 per share. The company maintains a low payout ratio of 37.1%, indicating dividends are well covered by earnings, which grew significantly last year. Despite trading below its estimated fair value, its dividend yield of 3.11% is lower than top-tier US dividend payers but remains reliable and sustainable with future coverage projected at a 29.9% payout ratio in three years.

- Get an in-depth perspective on Northrim BanCorp's performance by reading our dividend report here.

- Our valuation report unveils the possibility Northrim BanCorp's shares may be trading at a discount.

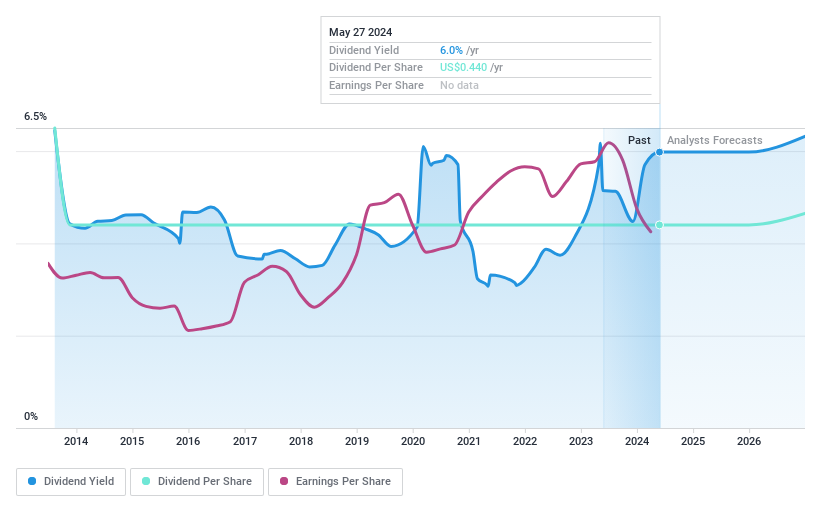

Valley National Bancorp (NasdaqGS:VLY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Valley National Bancorp, with a market cap of approximately $5.50 billion, operates as the holding company for Valley National Bank, offering a range of commercial, private banking, retail, insurance, and wealth management financial services.

Operations: Valley National Bancorp generates revenue through its diverse offerings in commercial banking, private banking, retail financial services, insurance products, and wealth management solutions.

Dividend Yield: 4.5%

Valley National Bancorp offers a dividend yield of 4.47%, slightly below the top tier in the US market. Its dividends are currently covered by earnings with a payout ratio of 63.2% and are forecast to be well-covered in three years at 39.4%. Despite stable dividends over the past decade, there has been no growth in payments. Recent announcements affirmed regular cash and preferred dividends, reflecting ongoing commitment to shareholder returns amidst recent executive changes and financial challenges including increased net charge-offs.

- Click here to discover the nuances of Valley National Bancorp with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Valley National Bancorp's current price could be quite moderate.

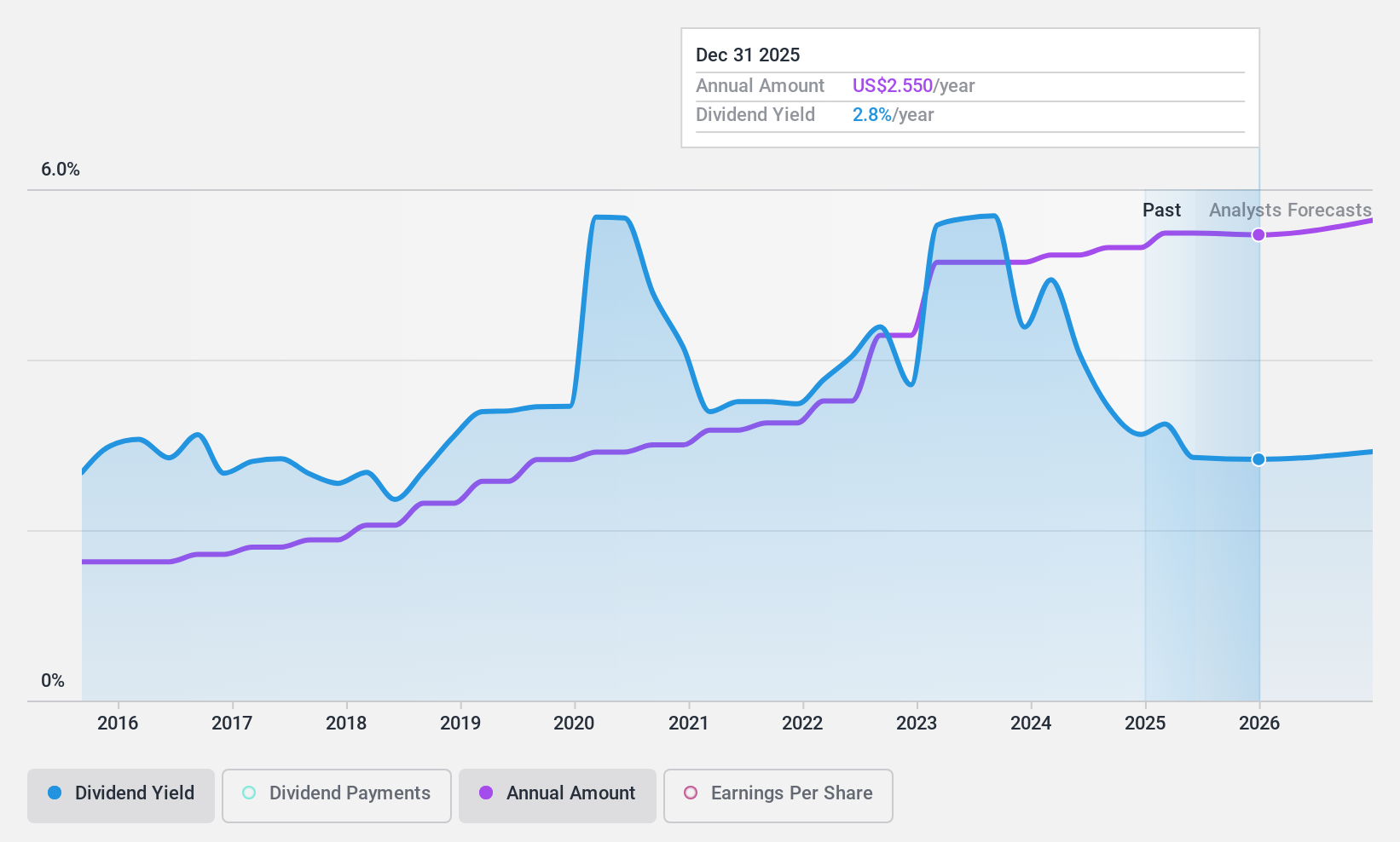

Citizens Financial Group (NYSE:CFG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Citizens Financial Group, Inc. is a bank holding company offering a range of retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions in the United States with a market cap of approximately $20.01 billion.

Operations: Citizens Financial Group generates revenue through its Consumer Banking segment, which contributed $5.37 billion, and its Commercial Banking segment, which added $2.51 billion.

Dividend Yield: 3.7%

Citizens Financial Group offers a dividend yield of 3.67%, which is below the top tier in the US market. The company's dividends have grown and remained stable over the past decade, supported by a sustainable payout ratio of 55.2%. Recent financial results show improved net income despite lower net interest income, while recent fixed-income offerings and preferred dividend declarations highlight its strategic focus on maintaining liquidity and shareholder returns amidst executive changes.

- Delve into the full analysis dividend report here for a deeper understanding of Citizens Financial Group.

- In light of our recent valuation report, it seems possible that Citizens Financial Group is trading behind its estimated value.

Make It Happen

- Delve into our full catalog of 142 Top US Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CFG

Citizens Financial Group

Operates as the bank holding company that provides retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives