- United States

- /

- Banks

- /

- NasdaqGS:WSBC

Discover December 2025's Top Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market experiences a retreat following delayed jobs data and higher-than-expected unemployment rates, investors are closely monitoring economic indicators and Federal Reserve decisions for future guidance. In such an environment, identifying stocks trading below their intrinsic value can present opportunities for those looking to invest wisely amid market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (UMBF) | $119.11 | $232.81 | 48.8% |

| Schrödinger (SDGR) | $18.21 | $35.43 | 48.6% |

| Perfect (PERF) | $1.76 | $3.43 | 48.7% |

| Krystal Biotech (KRYS) | $242.98 | $469.98 | 48.3% |

| Freshworks (FRSH) | $12.47 | $23.77 | 47.5% |

| FirstSun Capital Bancorp (FSUN) | $38.47 | $73.32 | 47.5% |

| First Solar (FSLR) | $255.89 | $483.10 | 47% |

| DexCom (DXCM) | $65.73 | $127.53 | 48.5% |

| Columbia Banking System (COLB) | $29.16 | $57.69 | 49.5% |

| Chagee Holdings (CHA) | $14.18 | $28.32 | 49.9% |

Let's dive into some prime choices out of the screener.

Valley National Bancorp (VLY)

Overview: Valley National Bancorp is the holding company for Valley National Bank, offering a range of commercial, private banking, retail, insurance, and wealth management financial services products with a market cap of approximately $6.64 billion.

Operations: Valley National Bank generates its revenue from various segments including Consumer Banking ($367.09 million), Commercial Banking ($1.24 billion), and Treasury and Corporate Other ($130.09 million).

Estimated Discount To Fair Value: 40.5%

Valley National Bancorp is trading at US$11.91, significantly below its estimated fair value of US$20.01, suggesting it may be undervalued based on cash flows. The bank's earnings have grown by 54.2% over the past year and are forecast to grow at 20.83% annually, outpacing the broader U.S. market's growth rate of 16.1%. Despite a low forecasted return on equity of 9.5%, Valley offers a reliable dividend yield of 3.69%.

- The growth report we've compiled suggests that Valley National Bancorp's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Valley National Bancorp.

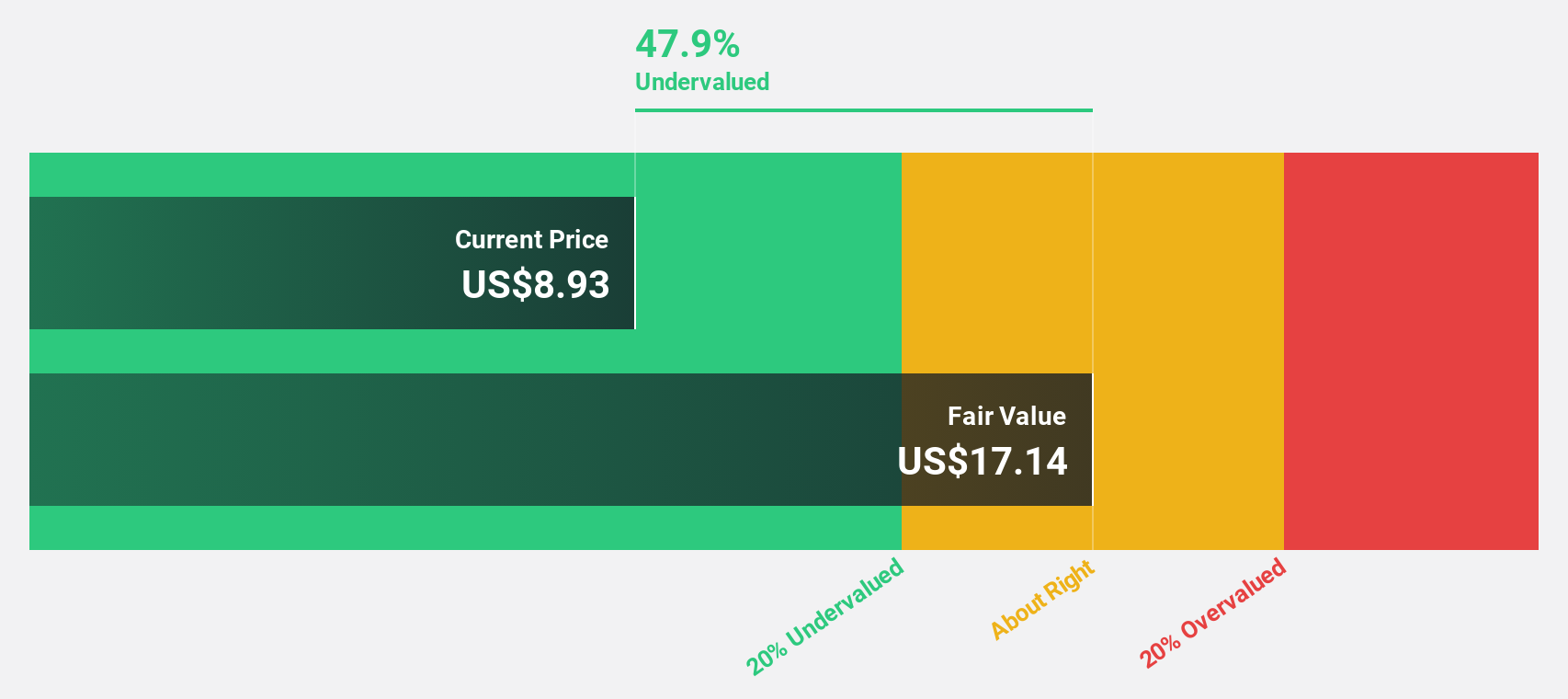

WesBanco (WSBC)

Overview: WesBanco, Inc. is a bank holding company for WesBanco Bank, Inc., with a market cap of approximately $3.38 billion.

Operations: WesBanco generates its revenue primarily from Community Banking, which accounts for $792.29 million, and Trust and Investment Services, contributing $30.71 million.

Estimated Discount To Fair Value: 38.1%

WesBanco, Inc. is trading at US$35.15, well below its estimated fair value of US$56.77, highlighting potential undervaluation based on cash flows. The company's earnings surged 35.3% last year and are projected to grow 38.52% annually over the next three years, surpassing the U.S. market's growth rate of 16.1%. Despite a modest forecasted return on equity of 9.5%, WesBanco maintains an attractive dividend yield of 4.21%.

- Our comprehensive growth report raises the possibility that WesBanco is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in WesBanco's balance sheet health report.

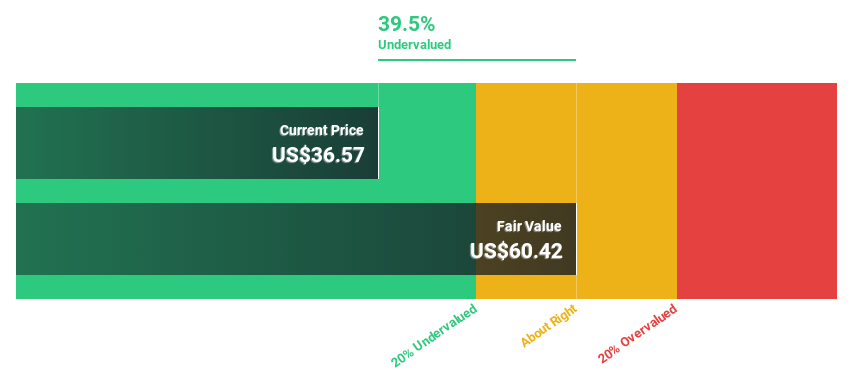

Glacier Bancorp (GBCI)

Overview: Glacier Bancorp, Inc. is a bank holding company for Glacier Bank, offering commercial banking services to individuals, small to medium-sized businesses, community organizations, and public entities in the United States, with a market cap of approximately $5.72 billion.

Operations: The company generates revenue primarily from its banking services, amounting to $900.15 million.

Estimated Discount To Fair Value: 27.5%

Glacier Bancorp is trading at US$44.48, significantly below its estimated fair value of US$61.31, suggesting it may be undervalued based on cash flows. The company's earnings grew 29.7% last year and are projected to increase by 34.1% annually over the next three years, outpacing the U.S. market's growth rate of 16.1%. Despite a low forecasted return on equity of 12%, Glacier Bancorp has declared consistent dividends for many quarters.

- In light of our recent growth report, it seems possible that Glacier Bancorp's financial performance will exceed current levels.

- Get an in-depth perspective on Glacier Bancorp's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Gain an insight into the universe of 209 Undervalued US Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WesBanco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WSBC

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)