- United States

- /

- Mortgage REITs

- /

- NYSE:NLY

US Stocks That May Be Undervalued For January 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of volatility with recent declines in major indices like the Dow Jones and Nasdaq Composite, investors are closely examining earnings reports and economic indicators that could influence Federal Reserve interest rate decisions. Amidst this environment, identifying potentially undervalued stocks becomes crucial, as these opportunities may offer value in a market where mega-cap tech stocks have recently slipped.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Burke & Herbert Financial Services (NasdaqCM:BHRB) | $61.21 | $117.59 | 47.9% |

| German American Bancorp (NasdaqGS:GABC) | $39.47 | $78.06 | 49.4% |

| Berkshire Hills Bancorp (NYSE:BHLB) | $28.50 | $55.69 | 48.8% |

| Old National Bancorp (NasdaqGS:ONB) | $22.70 | $43.90 | 48.3% |

| Equity Bancshares (NYSE:EQBK) | $43.00 | $85.17 | 49.5% |

| Kanzhun (NasdaqGS:BZ) | $13.86 | $27.19 | 49% |

| Cadre Holdings (NYSE:CDRE) | $36.03 | $70.00 | 48.5% |

| Constellium (NYSE:CSTM) | $10.93 | $21.09 | 48.2% |

| Bilibili (NasdaqGS:BILI) | $16.98 | $32.73 | 48.1% |

| Mobileye Global (NasdaqGS:MBLY) | $16.51 | $32.92 | 49.9% |

Here we highlight a subset of our preferred stocks from the screener.

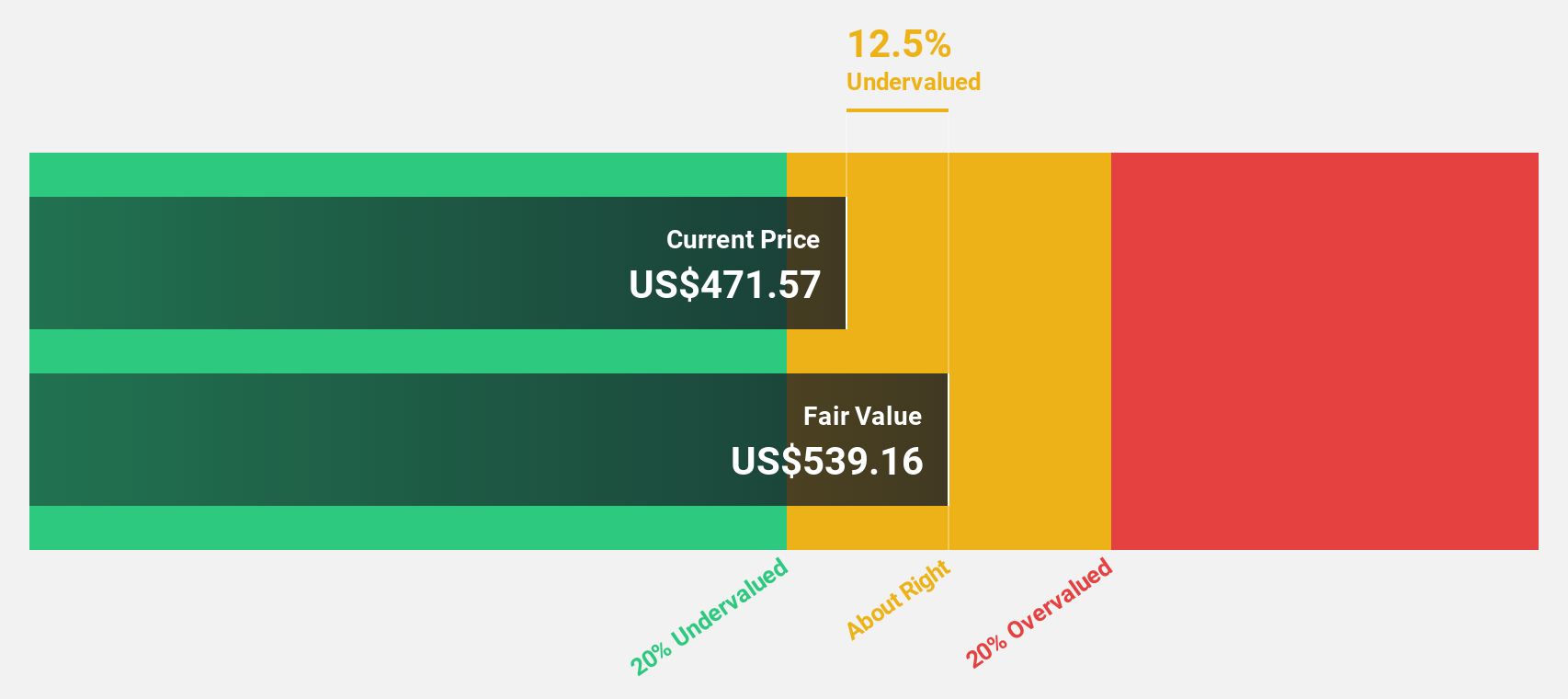

Duolingo (NasdaqGS:DUOL)

Overview: Duolingo, Inc. is a mobile learning platform that operates in the United States, the United Kingdom, and internationally with a market cap of approximately $14.07 billion.

Operations: The company's revenue primarily comes from its educational software segment, which generated $689.46 million.

Estimated Discount To Fair Value: 37.3%

Duolingo is trading at US$341.8, significantly below its estimated fair value of US$544.84, indicating potential undervaluation based on cash flows. The company recently became profitable and forecasts suggest robust earnings growth of 34.7% annually over the next three years, outpacing the broader US market. Despite significant insider selling in recent months, Duolingo's innovative product expansions and strategic board appointments could enhance its long-term growth prospects.

- The growth report we've compiled suggests that Duolingo's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Duolingo.

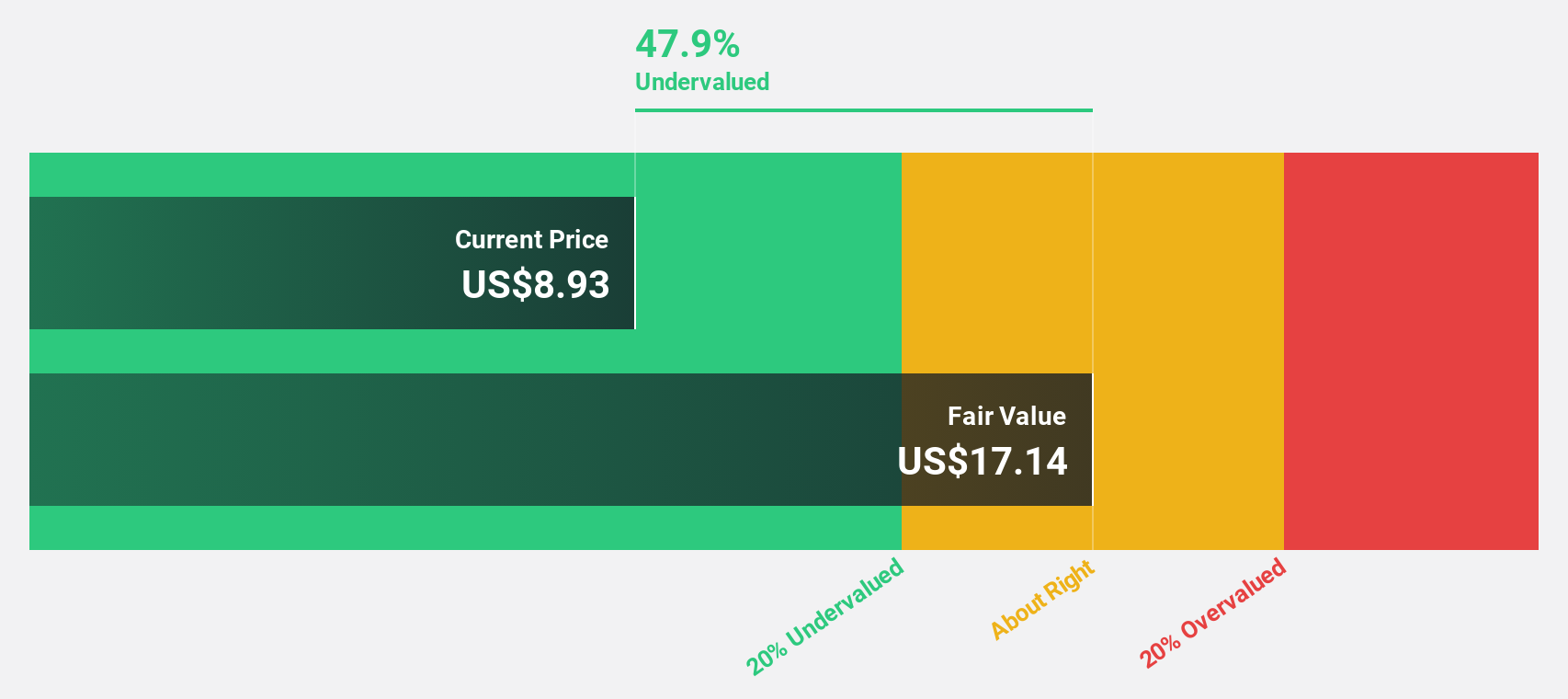

Valley National Bancorp (NasdaqGS:VLY)

Overview: Valley National Bancorp is the holding company for Valley National Bank, offering a range of commercial, private banking, retail, insurance, and wealth management services with a market cap of approximately $5.26 billion.

Operations: The company generates revenue through its segments, with Consumer Banking contributing $234.79 million, Commercial Banking accounting for $1.30 billion, and Treasury and Corporate Other adding $72.02 million.

Estimated Discount To Fair Value: 32.9%

Valley National Bancorp is trading at US$9.41, well below its estimated fair value of US$14.03, highlighting potential undervaluation based on cash flows. Despite a recent decline in profit margins and net income, the company forecasts significant earnings growth of 30.7% annually over the next three years, surpassing the broader US market's expectations. Recent leadership changes and strategic expansions could support Valley's growth trajectory while maintaining a high dividend yield of 4.68%.

- The analysis detailed in our Valley National Bancorp growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Valley National Bancorp's balance sheet health report.

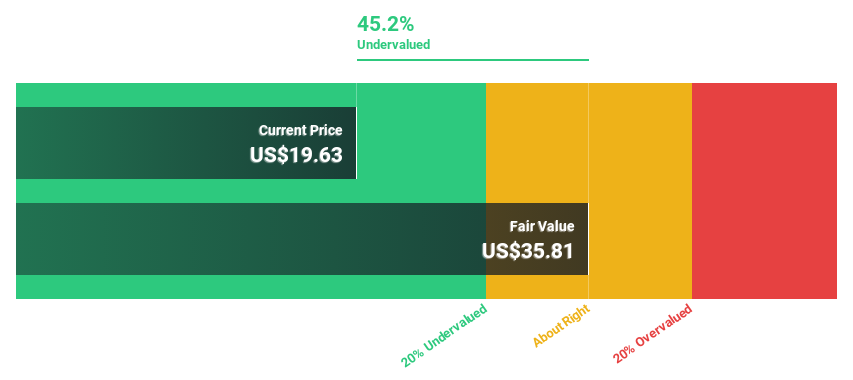

Annaly Capital Management (NYSE:NLY)

Overview: Annaly Capital Management, Inc. is a diversified capital manager specializing in mortgage finance, with a market capitalization of approximately $10.50 billion.

Operations: The company generates revenue primarily from mortgage-backed securities, totaling $369.37 million.

Estimated Discount To Fair Value: 44.2%

Annaly Capital Management is trading at US$19.16, significantly below its fair value estimate of US$34.35, suggesting potential undervaluation based on cash flows. The company has announced a substantial share repurchase program worth up to $1.5 billion, which may enhance shareholder value. Despite challenges with debt coverage by operating cash flow and unsustainable dividends, Annaly's revenue is forecast to grow rapidly at 87.8% annually over the next three years, outpacing the broader market growth expectations.

- Upon reviewing our latest growth report, Annaly Capital Management's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Annaly Capital Management's balance sheet by reading our health report here.

Make It Happen

- Discover the full array of 165 Undervalued US Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NLY

Annaly Capital Management

A diversified capital manager, engages in the mortgage finance business.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives