- United States

- /

- Food and Staples Retail

- /

- NYSE:NGVC

Undiscovered Gems in the US Market for September 2025

Reviewed by Simply Wall St

As the U.S. market navigates a period of mixed performance with the Nasdaq and S&P 500 slipping slightly while the Dow reaches new heights, investors are keenly observing how Federal Reserve policies and economic indicators will impact small-cap stocks. In this environment, identifying promising opportunities requires a focus on companies that demonstrate resilience and adaptability amid shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| First Northern Community Bancorp | NA | 8.05% | 12.27% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| FRMO | 0.10% | 42.87% | 47.51% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

First Financial (THFF)

Simply Wall St Value Rating: ★★★★★★

Overview: First Financial Corporation operates through its subsidiaries to offer a range of financial products and services across regions in Indiana, Illinois, Kentucky, Tennessee, and Georgia with a market capitalization of $692.79 million.

Operations: First Financial generates revenue primarily from its banking segment, which accounts for $230.45 million. The company's net profit margin is a key financial metric to consider when analyzing its profitability.

First Financial, a nimble player in the banking sector, boasts total assets of US$5.6 billion and equity of US$587.7 million, with deposits at US$4.7 billion and loans totaling US$3.8 billion. Its allowance for bad loans is robust at 0.3% of total loans, reflecting prudent risk management practices. The bank's earnings growth outpaced the industry average by reaching 21.5% over the past year, signaling strong operational performance and high-quality earnings potential as highlighted by its recent addition to several Russell Growth Indexes in June 2025, enhancing its visibility among investors seeking promising opportunities.

Univest Financial (UVSP)

Simply Wall St Value Rating: ★★★★★★

Overview: Univest Financial Corporation operates as the bank holding company for Univest Bank and Trust Co., with a market capitalization of approximately $899.01 million.

Operations: Univest Financial Corporation generates revenue primarily from its Banking segment, which contributes $253.93 million, followed by Wealth Management and Insurance segments at $31.37 million and $22.17 million, respectively.

Univest Financial, with assets totaling $7.9 billion and equity at $916.7 million, stands out for its robust financial health. It holds deposits of $6.6 billion against loans of $6.7 billion and maintains a sufficient allowance for bad loans at 310%. Despite significant insider selling recently, Univest has managed to grow earnings by 4.5% annually over five years, although it trails the banking industry's growth rate of 13%. The company repurchased shares worth $4.97 million in Q2 2025 and trades at a discount to its estimated fair value by about 30%, indicating potential investment appeal despite competitive pressures in the sector.

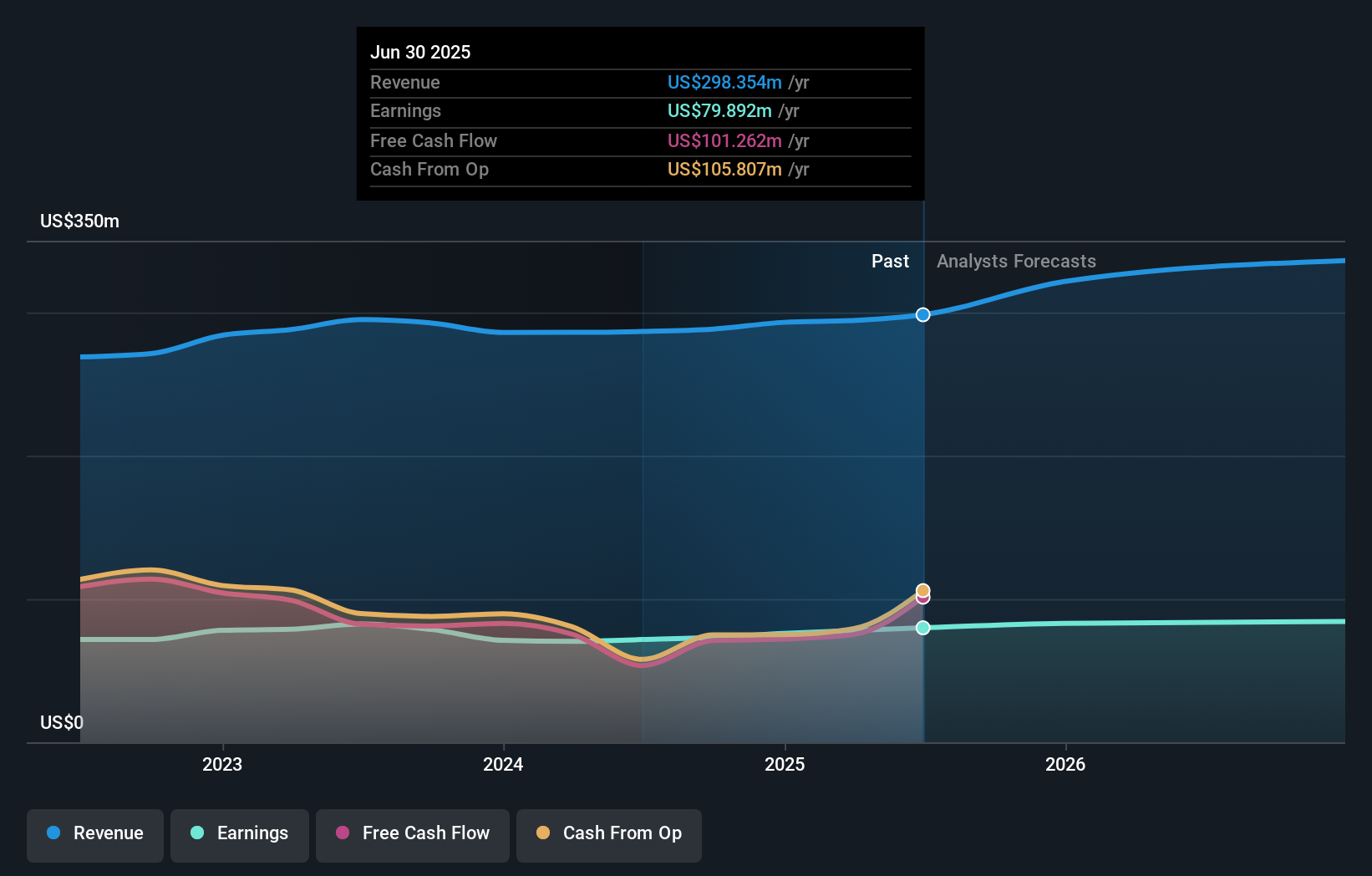

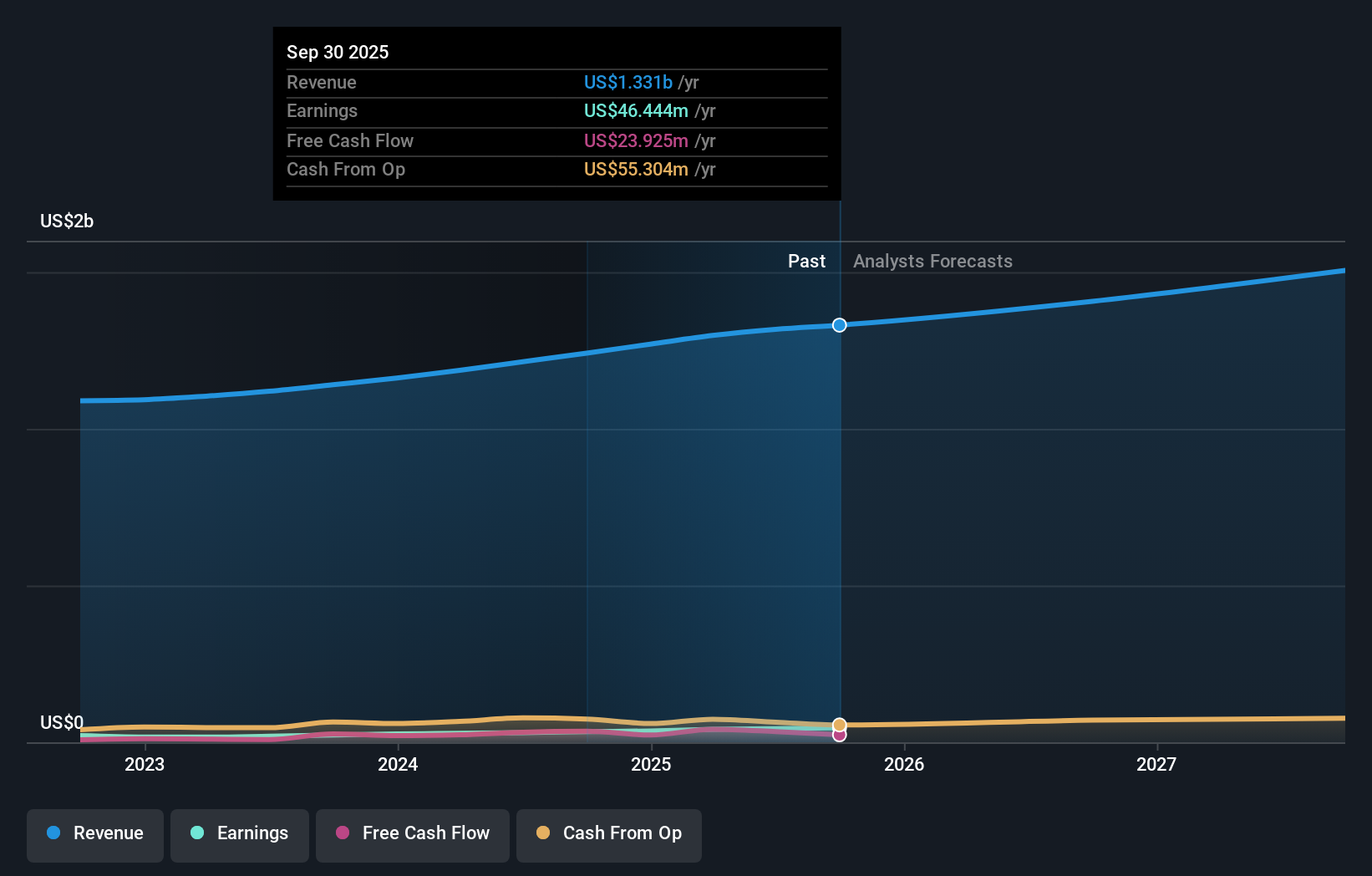

Natural Grocers by Vitamin Cottage (NGVC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Natural Grocers by Vitamin Cottage, Inc. operates retail stores in the United States focusing on natural and organic groceries and dietary supplements, with a market cap of $824.74 million.

Operations: The company generates revenue of $1.32 billion from its natural and organic retail stores.

Natural Grocers, a nimble player in the retail sector, showcases impressive earnings growth of 41.7% over the past year, outpacing its industry peers at 10.8%. The company boasts high-quality earnings and operates debt-free, eliminating concerns about interest payments. Its price-to-earnings ratio stands at 19.1x, slightly undercutting the broader US market's 19.2x, indicating potential value for investors. Recent product launches in their private-label brand include organic egg pasta and tortilla chips, emphasizing quality and affordability while expanding their diverse lineup of over 900 products exclusive to Natural Grocers stores across the nation.

Key Takeaways

- Click through to start exploring the rest of the 283 US Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Natural Grocers by Vitamin Cottage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NGVC

Natural Grocers by Vitamin Cottage

Natural Grocers by Vitamin Cottage, Inc., together with its subsidiaries, retails natural and organic groceries, and dietary supplements in the United States.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)