- United States

- /

- Logistics

- /

- NYSE:UPS

3 Top US Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market experiences a notable upswing, with major indexes like the Dow Jones and S&P 500 on track for significant weekly gains, investors are increasingly eyeing opportunities to bolster their portfolios. In this dynamic environment, dividend stocks stand out as attractive options due to their potential for providing steady income streams amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.67% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.73% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.12% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 5.13% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.77% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.78% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.96% | ★★★★★★ |

Click here to see the full list of 147 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

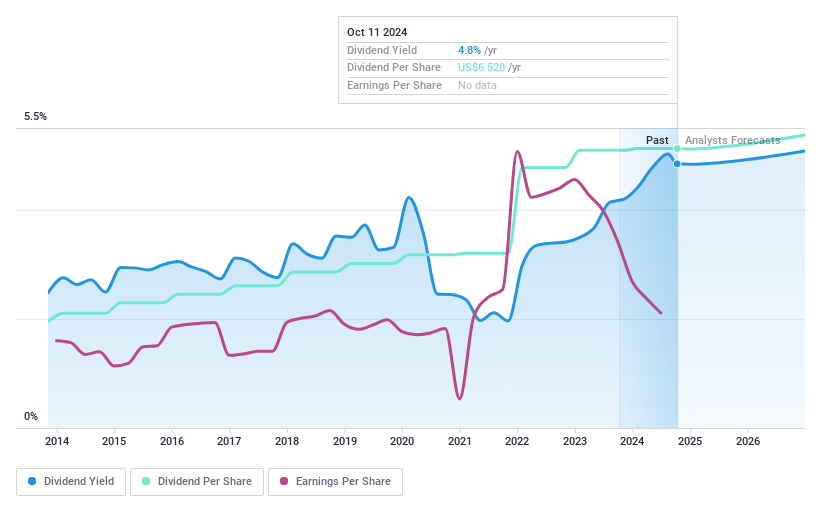

Penns Woods Bancorp (NasdaqGS:PWOD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Penns Woods Bancorp, Inc. is the bank holding company for Jersey Shore State Bank, offering commercial and retail banking services to individuals, partnerships, non-profit organizations, and corporations with a market cap of $229.60 million.

Operations: Penns Woods Bancorp, Inc. generates revenue primarily through its Community Banking segment, which accounts for $67.72 million.

Dividend Yield: 4.2%

Penns Woods Bancorp offers a stable dividend yield of 4.17%, supported by a low payout ratio of 48.8%. Over the past decade, dividends have been reliable and growing, though they fall short compared to top-tier US dividend payers. Recent earnings growth of 25.6% enhances its financial position, but future dividend coverage remains uncertain due to insufficient data. An acquisition by Northwest Bancshares for approximately US$260 million is expected in Q3 2025, potentially impacting future dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Penns Woods Bancorp.

- The valuation report we've compiled suggests that Penns Woods Bancorp's current price could be quite moderate.

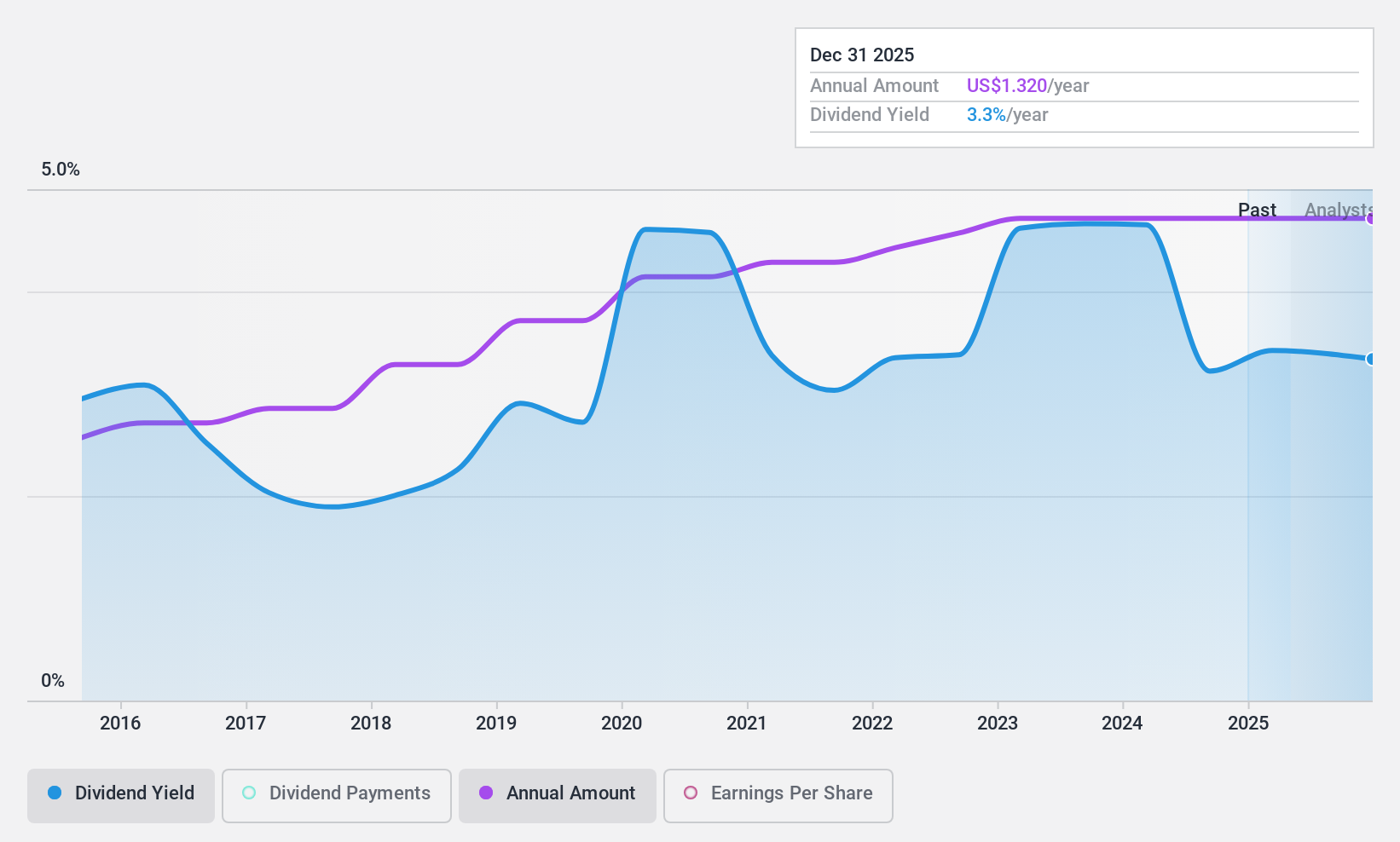

Evans Bancorp (NYSEAM:EVBN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evans Bancorp, Inc. operates as a financial holding company for Evans Bank, N.A., with a market cap of $235.73 million.

Operations: Evans Bancorp, Inc.'s revenue is primarily derived from its Banking Activities segment, totaling $60.39 million.

Dividend Yield: 3.1%

Evans Bancorp's dividend payments have been stable and growing over the past decade, supported by a low payout ratio of 39.4%, indicating they are well covered by earnings. However, its current yield of 3.08% is below the top tier in the US market. The company reported net income of US$2.94 million for Q3 2024, down from US$3.62 million a year ago, with earnings forecasted to decline over the next three years.

- Click to explore a detailed breakdown of our findings in Evans Bancorp's dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Evans Bancorp shares in the market.

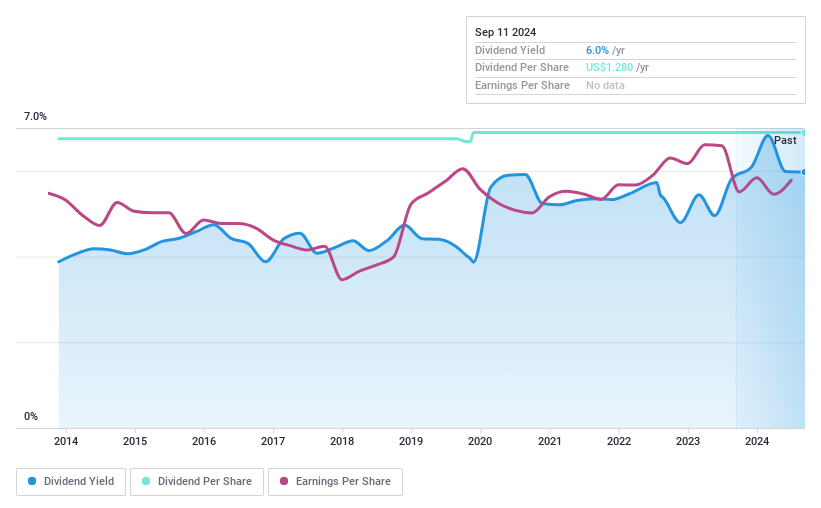

United Parcel Service (NYSE:UPS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Parcel Service, Inc. is a package delivery company offering transportation, delivery, distribution, contract logistics, ocean freight, airfreight, customs brokerage, and insurance services with a market cap of approximately $108.78 billion.

Operations: United Parcel Service's revenue is primarily derived from its U.S. Domestic Package segment at $59.72 billion, followed by the International Package segment at $17.64 billion, and Supply Chain Solutions at $13.33 billion.

Dividend Yield: 5%

United Parcel Service's dividends have been stable and growing over the past decade, offering a yield of 5.02%, placing it in the top 25% of US dividend payers. However, its high payout ratio of 98.4% and cash payout ratio of 127.7% suggest dividends are not well covered by earnings or free cash flows. Despite significant insider selling recently and a lower net profit margin, UPS continues regular dividend payments with recent affirmations at $1.63 per share.

- Delve into the full analysis dividend report here for a deeper understanding of United Parcel Service.

- Upon reviewing our latest valuation report, United Parcel Service's share price might be too pessimistic.

Taking Advantage

- Get an in-depth perspective on all 147 Top US Dividend Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UPS

United Parcel Service

A package delivery and logistics provider, offers transportation and delivery services.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives