- United States

- /

- Banks

- /

- NasdaqGS:FFIC

3 US Dividend Stocks Yielding Up To 5.9%

Reviewed by Simply Wall St

In the wake of the Federal Reserve's recent rate cut decision, major U.S. stock indexes have experienced fluctuations as investors reassess their strategies. With economic projections indicating further rate reductions, dividend stocks offering substantial yields can provide a reliable income stream amidst market uncertainty. When selecting dividend stocks, it's crucial to consider companies with strong financial health and consistent payout histories, especially in a volatile market environment.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.68% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.71% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.85% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.11% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.81% | ★★★★★★ |

| OTC Markets Group (OTCPK:OTCM) | 4.72% | ★★★★★★ |

| OceanFirst Financial (NasdaqGS:OCFC) | 4.41% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.53% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 4.40% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.37% | ★★★★★★ |

Click here to see the full list of 173 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

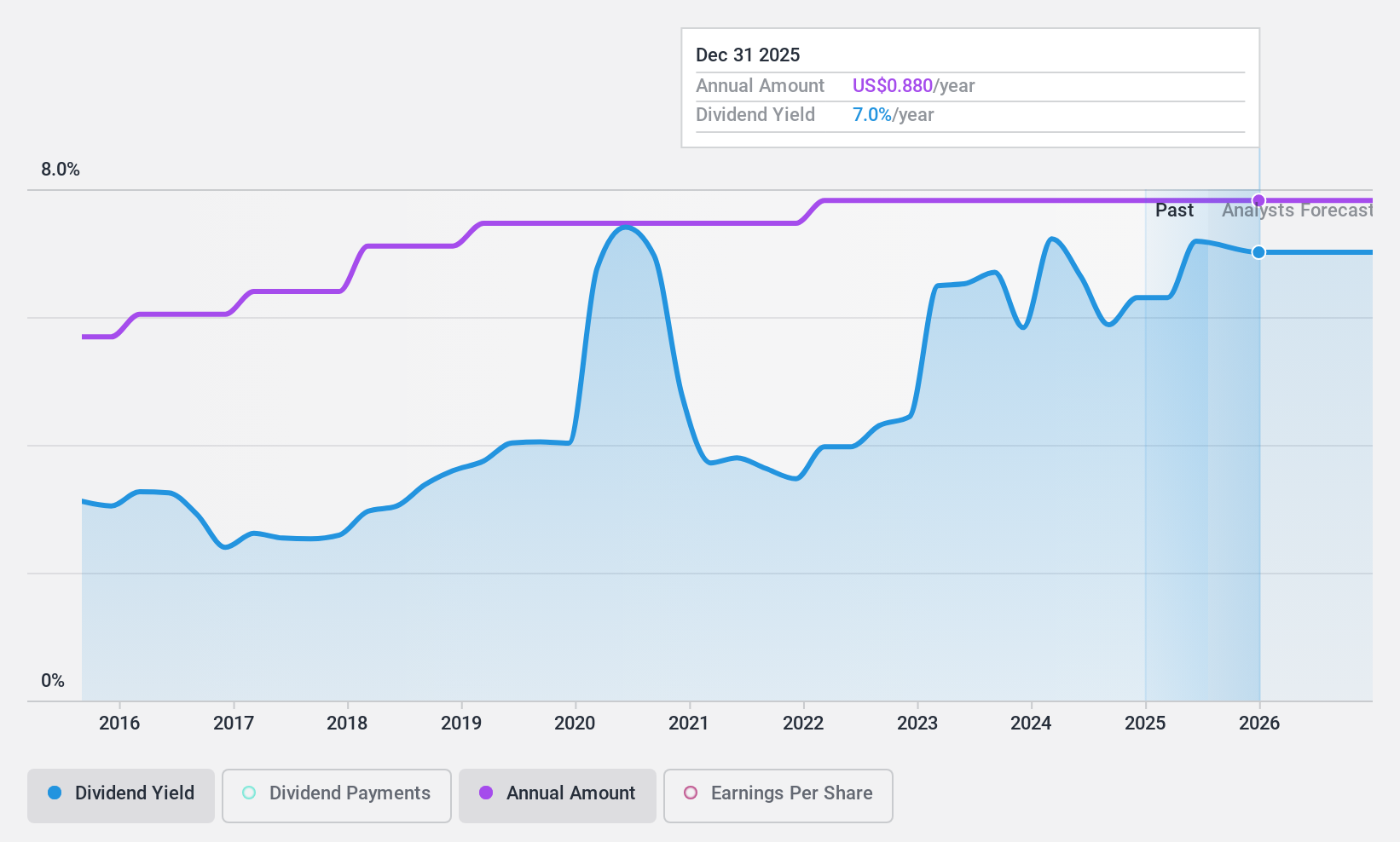

Flushing Financial (NasdaqGS:FFIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Flushing Financial Corporation, with a market cap of $422.95 million, operates as the bank holding company for Flushing Bank, offering banking products and services to consumers, businesses, and governmental units.

Operations: Flushing Financial Corporation generates $190.70 million in revenue from its Community Bank segment, which provides banking products and services primarily to consumers, businesses, and governmental units.

Dividend Yield: 6%

Flushing Financial's dividend payments have been stable and growing over the past 10 years, positioning it among the top 25% of US dividend payers with a yield of 5.97%. However, its high payout ratio (104.9%) raises concerns about sustainability. Recent events include a $0.22 quarterly dividend declaration and significant insider selling over the past three months. Despite a forecasted earnings growth of 19.18%, profitability issues persist, highlighted by activist investor Larry Seidman's call for a sale due to poor performance.

- Click here and access our complete dividend analysis report to understand the dynamics of Flushing Financial.

- The analysis detailed in our Flushing Financial valuation report hints at an inflated share price compared to its estimated value.

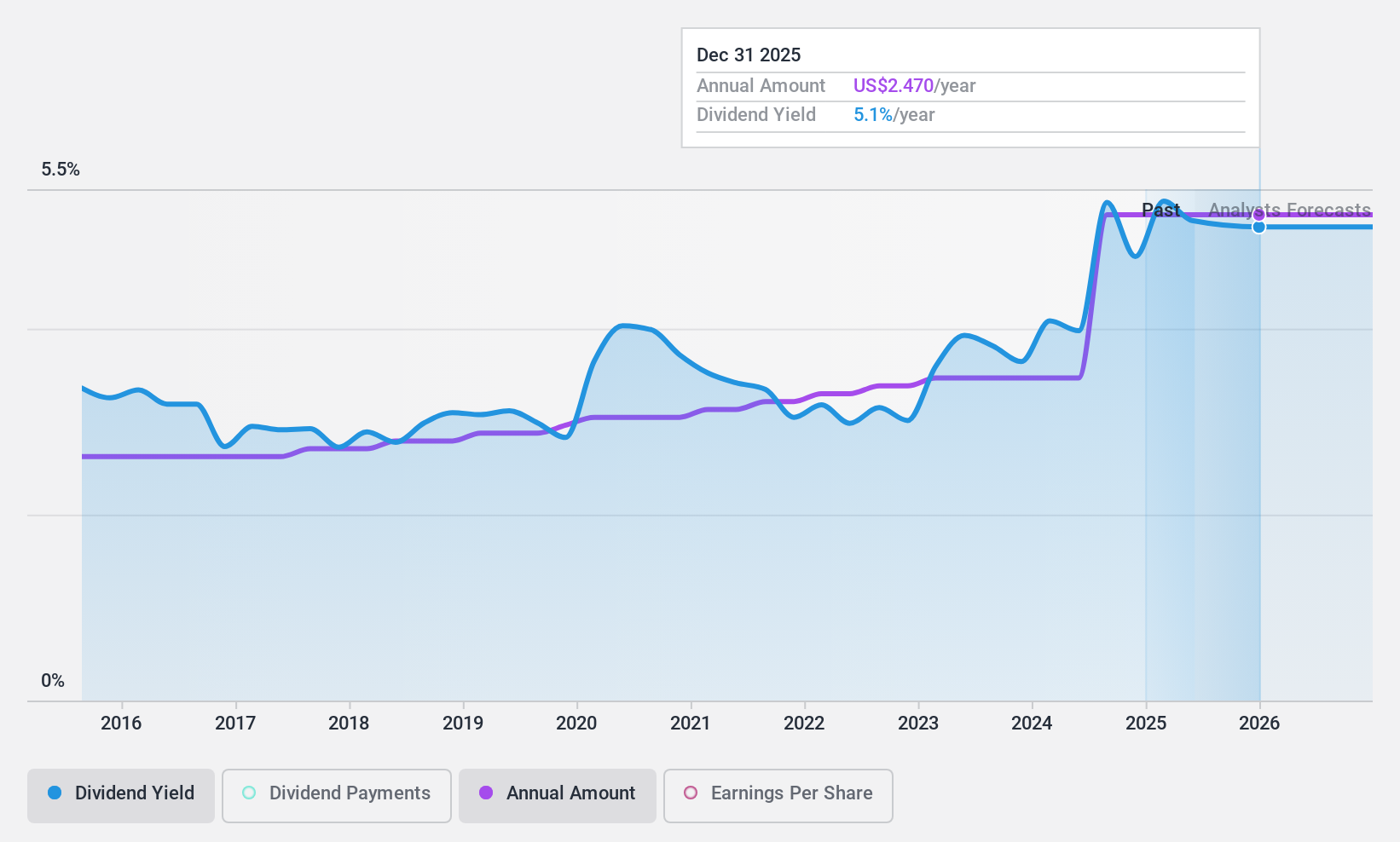

Peoples Financial Services (NasdaqGS:PFIS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Peoples Financial Services Corp., with a market cap of $471.36 million, operates as the bank holding company for Peoples Security Bank and Trust Company, offering a range of commercial and retail banking services.

Operations: Peoples Financial Services Corp. generates $90.82 million from its banking services segment.

Dividend Yield: 5.1%

Peoples Financial Services recently declared a third-quarter cash dividend of $0.6175 per share, marking a 50.6% increase from the previous quarter and year. Despite lower net interest income and net income compared to last year, the company's dividends have been stable and growing over the past decade, with a current yield of 5.13%, placing it in the top 25% of US dividend payers. However, recent charge-offs indicate some financial challenges ahead.

- Take a closer look at Peoples Financial Services' potential here in our dividend report.

- According our valuation report, there's an indication that Peoples Financial Services' share price might be on the cheaper side.

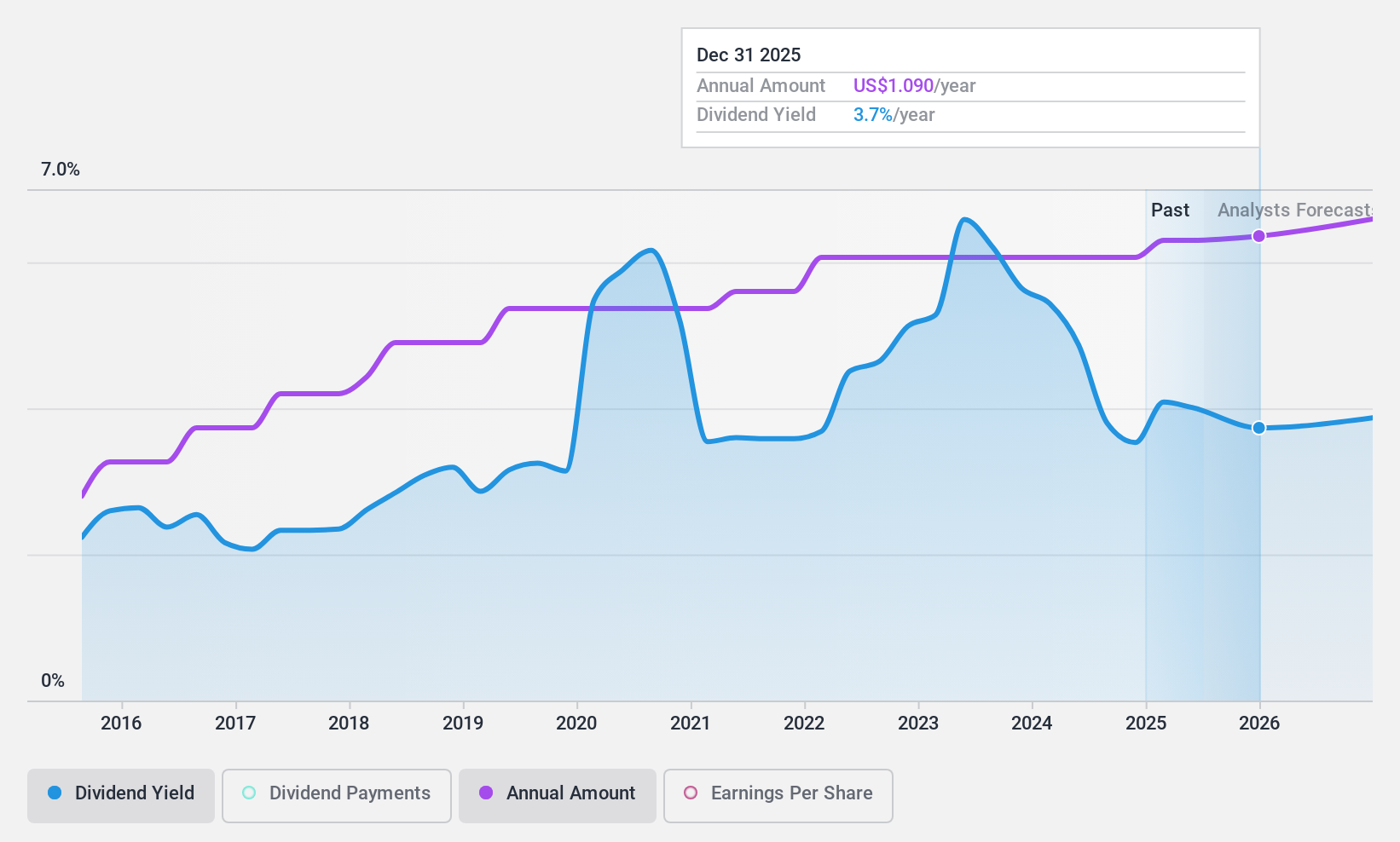

Central Pacific Financial (NYSE:CPF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Central Pacific Financial Corp., with a market cap of $768.61 million, operates as the bank holding company for Central Pacific Bank, offering a variety of commercial banking products and services to businesses, professionals, and individuals in the United States.

Operations: Central Pacific Financial Corp. generates revenue primarily through its banking segment, amounting to $238.03 million.

Dividend Yield: 3.7%

Central Pacific Financial offers a stable dividend yield of 3.65%, although it falls short of the top 25% in the US market. The company has maintained reliable and growing dividend payments over the past decade, supported by a low payout ratio of 49.5%. Recent earnings reports show slight declines in net interest income but an increase in net income to US$15.82 million for Q2 2024, with basic earnings per share rising to US$0.58 from US$0.54 last year.

- Delve into the full analysis dividend report here for a deeper understanding of Central Pacific Financial.

- The valuation report we've compiled suggests that Central Pacific Financial's current price could be quite moderate.

Where To Now?

- Explore the 173 names from our Top US Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FFIC

Flushing Financial

Operates as the bank holding company for Flushing Bank that provides banking products and services primarily to consumers, businesses, and governmental units.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives