- United States

- /

- Banks

- /

- NasdaqGM:FDBC

Exploring Three Undervalued Small Caps With Insider Buying In Your Region

Reviewed by Simply Wall St

As the major U.S. stock indexes recently reached new highs, only to close lower, attention has turned towards small-cap stocks, which often offer unique opportunities in fluctuating market conditions. In this environment of shifting indices and economic indicators, identifying promising small-cap companies can be a strategic move for investors seeking potential growth and value.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Limbach Holdings | 29.7x | 1.9x | 42.20% | ★★★★★★ |

| PCB Bancorp | 9.5x | 2.8x | 35.92% | ★★★★★☆ |

| Peoples Bancorp | 10.2x | 1.9x | 43.47% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.8x | 25.41% | ★★★★★☆ |

| Citizens & Northern | 11.4x | 2.8x | 41.07% | ★★★★☆☆ |

| First Northern Community Bancorp | 9.8x | 2.8x | 47.34% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 36.53% | ★★★★☆☆ |

| Shore Bancshares | 10.1x | 2.6x | -81.07% | ★★★☆☆☆ |

| Farmland Partners | 6.9x | 8.3x | -42.16% | ★★★☆☆☆ |

| Tilray Brands | NA | 2.3x | -43.71% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

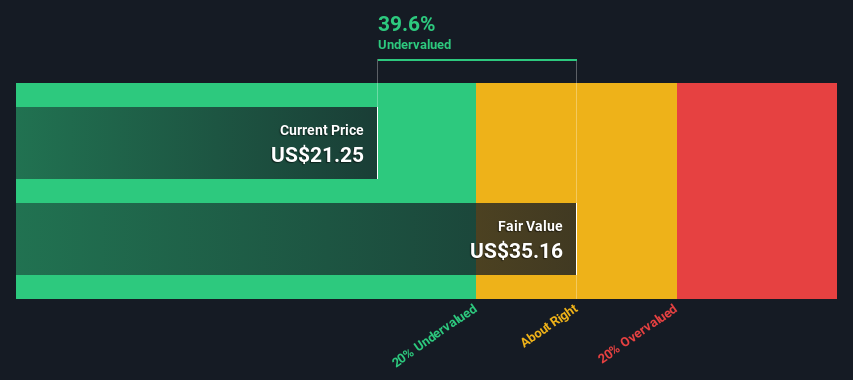

Citizens & Northern (CZNC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Citizens & Northern is a community banking institution with operations focused on providing financial services, holding a market cap of approximately $0.38 billion.

Operations: Community Banking generates $108.31 million in revenue, with operating expenses totaling $74.97 million and a net income of $26.72 million, resulting in a net income margin of 24.67%. The gross profit margin stands at 100%.

PE: 11.4x

Citizens & Northern, a smaller U.S. financial entity, exhibits potential for growth with earnings projected to rise 24.69% annually. Despite net charge-offs increasing to $548,000 in Q2 2025, the company maintains a low allowance for bad loans at 86%. Insider confidence is evident from recent share purchases. Net interest income rose to $21.14 million in Q2 2025 from $19.45 million a year prior, while maintaining steady dividends of $0.28 per share suggests stability amidst leadership changes and market challenges.

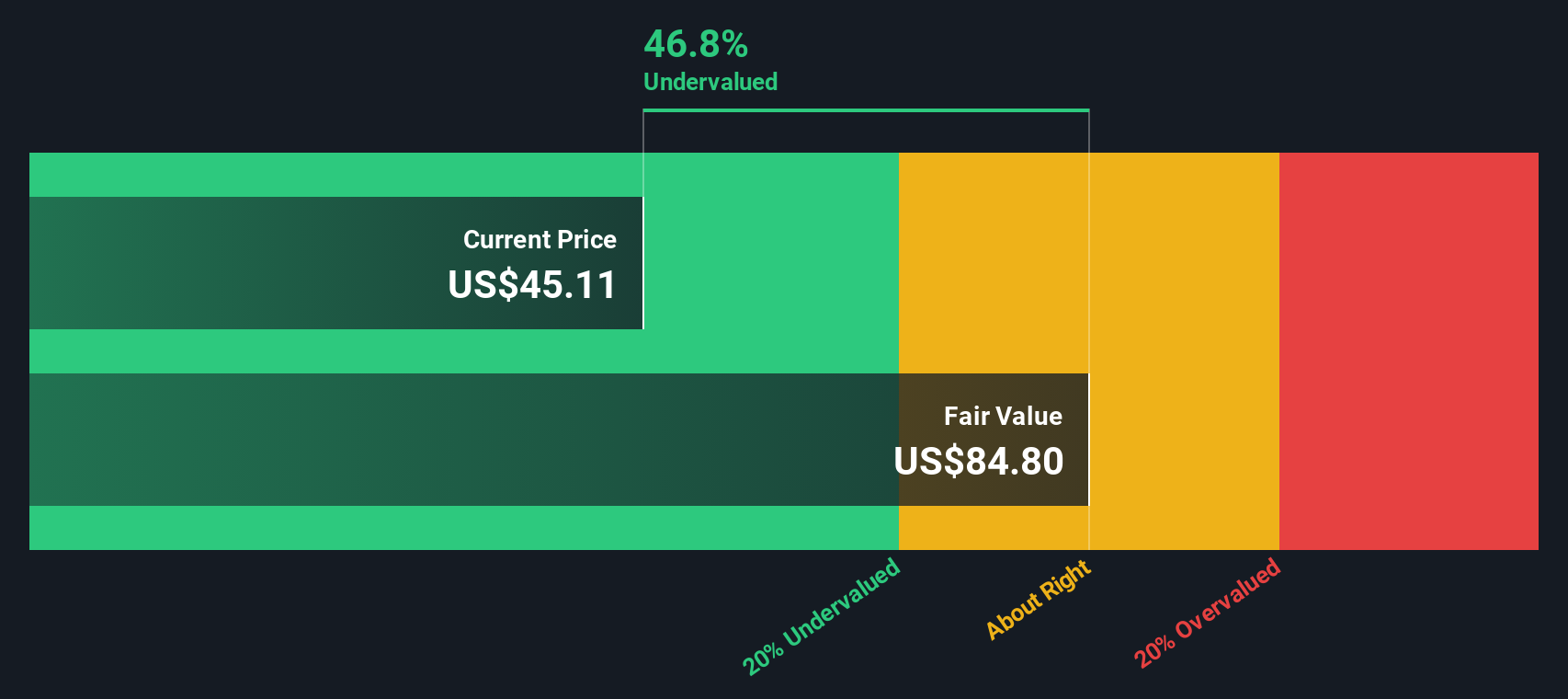

Fidelity D & D Bancorp (FDBC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fidelity D & D Bancorp operates primarily in the banking, trust, and financial services sectors with a market capitalization of $0.32 billion.

Operations: Fidelity D & D Bancorp generates its revenue primarily from Banking, Trust, and Financial Services. The company consistently achieves a gross profit margin of 100%, indicating no cost of goods sold is reported. Operating expenses are dominated by general and administrative costs, which reached $47.16 million in the latest period. Net income margin has shown variability, with a recent figure of 27.91%.

PE: 10.6x

Fidelity D & D Bancorp, a smaller player in the financial sector, has shown promising financial performance with net interest income rising to US$17.93 million for Q2 2025 from US$15.12 million a year prior. Insider confidence is evident as key figures have been increasing their shareholdings recently, signaling potential trust in the company's trajectory. Despite recent executive retirements, such as Eugene J. Walsh's departure on July 25, 2025, Fidelity continues to pay dividends consistently at US$0.40 per share for Q3 2025.

- Click here to discover the nuances of Fidelity D & D Bancorp with our detailed analytical valuation report.

Gain insights into Fidelity D & D Bancorp's past trends and performance with our Past report.

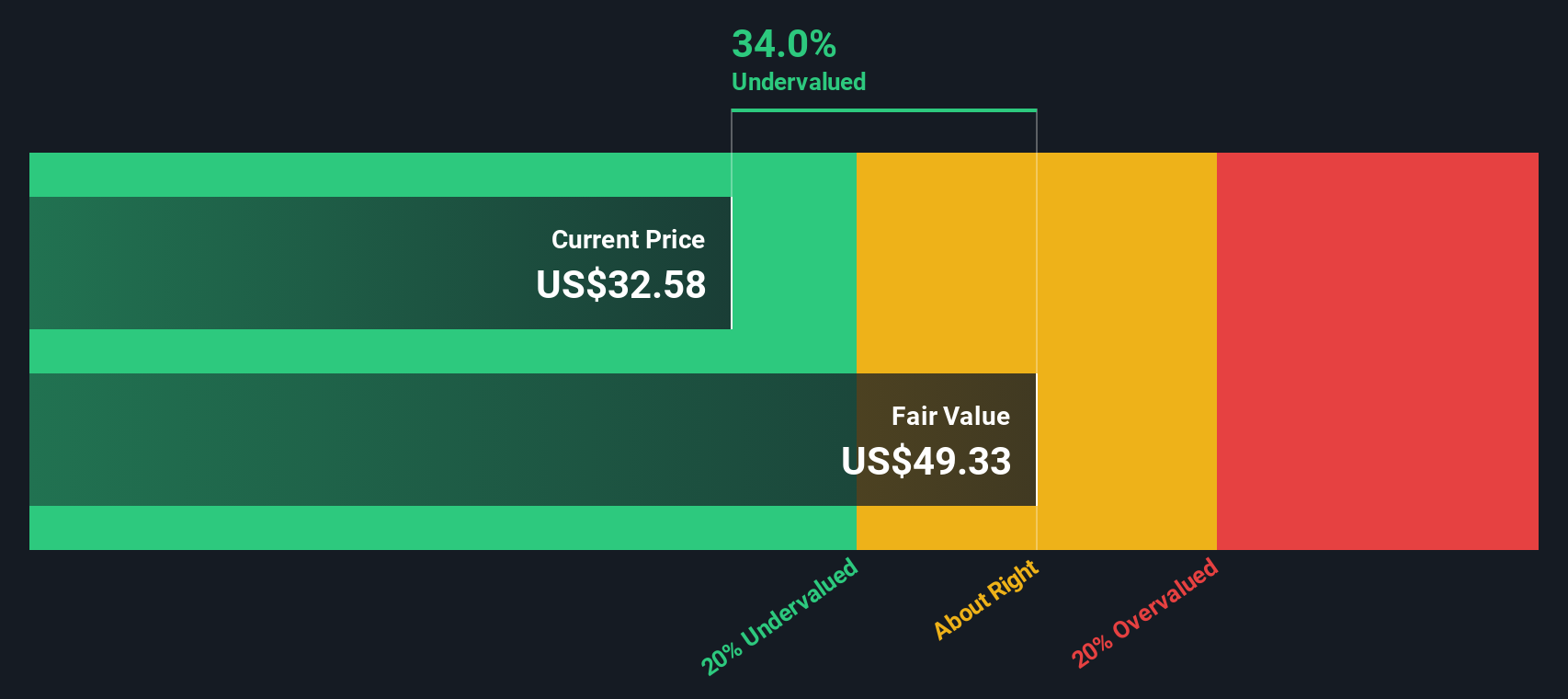

First Community Bankshares (FCBC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: First Community Bankshares operates as a financial services company primarily engaged in community banking, with a market capitalization of approximately $0.43 billion.

Operations: The company generates revenue primarily from community banking, with recent figures showing $162.76 million. Operating expenses are significant, totaling $95.11 million, including general and administrative expenses of $77.05 million and sales and marketing expenses of $4.34 million. The net income margin has been observed at 30.80%.

PE: 12.3x

First Community Bankshares, a small-cap financial entity, recently declared a quarterly dividend of US$0.31 per share, reinforcing its commitment to shareholder returns. Despite reporting slightly lower net income of US$12.25 million for Q2 2025 compared to the previous year, insider confidence is evident with notable insider purchases over the past months. The company completed a share repurchase program amounting to 2.73% of outstanding shares for US$16.8 million by June 2025, indicating management's belief in intrinsic value amidst forecasted earnings decline over the next three years.

Turning Ideas Into Actions

- Investigate our full lineup of 70 Undervalued US Small Caps With Insider Buying right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FDBC

Fidelity D & D Bancorp

Operates as the bank holding company for The Fidelity Deposit and Discount Bank that provides a range of banking, trust, and financial services to individuals, small businesses, and corporate customers.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives