- United States

- /

- Banks

- /

- NasdaqGS:ESSA

ChoiceOne Financial Services And 2 Other Reliable Dividend Stocks To Consider

Reviewed by Simply Wall St

Amid a surge in U.S. stock markets driven by optimism over easing China tariffs and renewed confidence in Federal Reserve policies, investors are keenly eyeing opportunities that promise stability and income. In such an environment, dividend stocks like ChoiceOne Financial Services stand out as reliable options for those seeking consistent returns amidst market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.32% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 5.52% | ★★★★★★ |

| Douglas Dynamics (NYSE:PLOW) | 5.00% | ★★★★★★ |

| Brookline Bancorp (NasdaqGS:BRKL) | 5.36% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.01% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 8.09% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.75% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 5.10% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.98% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.48% | ★★★★★★ |

Click here to see the full list of 163 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

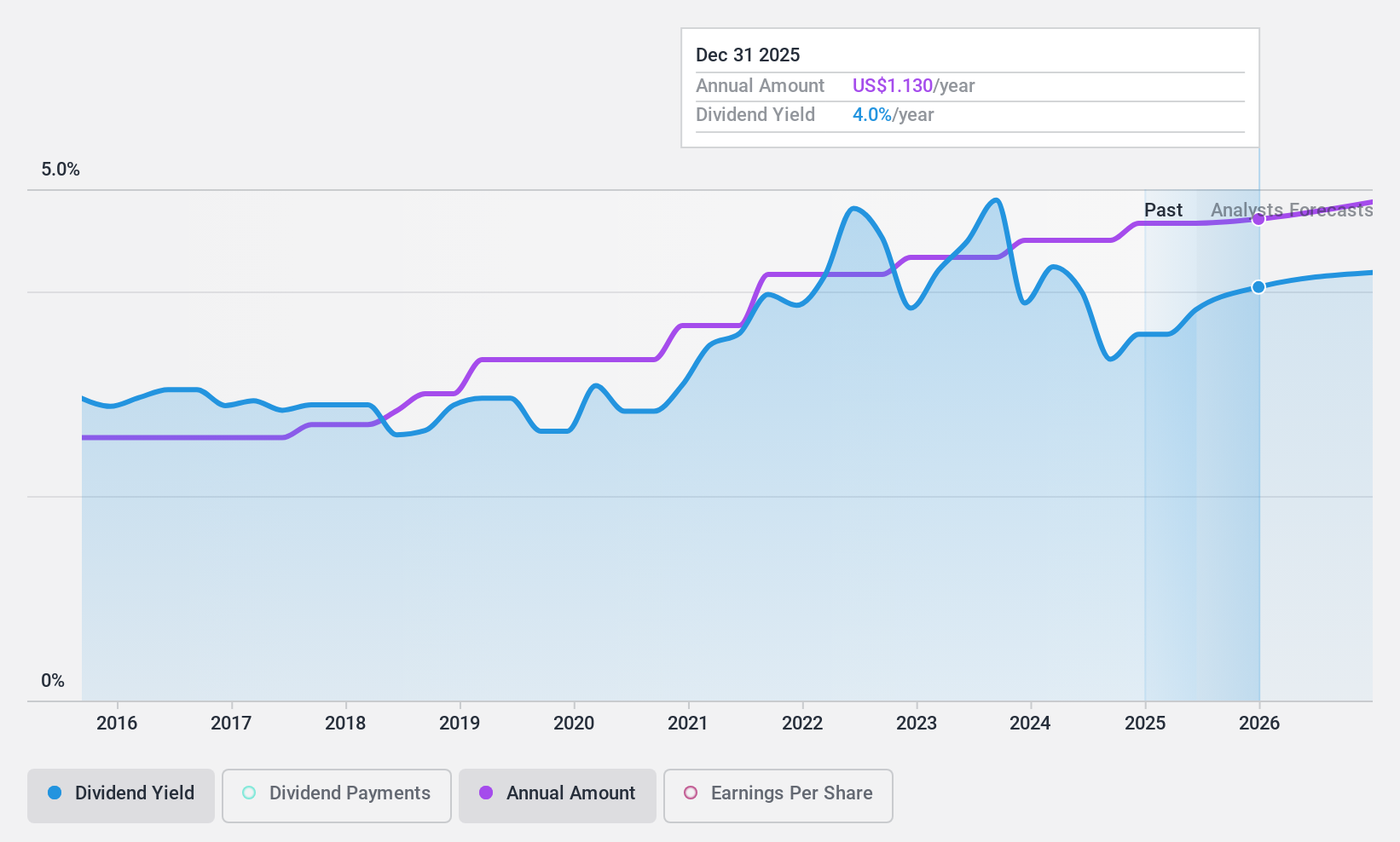

ChoiceOne Financial Services (NasdaqCM:COFS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ChoiceOne Financial Services, Inc. is a bank holding company for ChoiceOne Bank, offering banking services in Michigan with a market cap of $235.43 million.

Operations: ChoiceOne Financial Services, Inc. generates its revenue primarily from its banking segment, which accounts for $91.11 million.

Dividend Yield: 4.1%

ChoiceOne Financial Services offers a stable and reliable dividend, recently affirming a cash dividend of $0.28 per share, slightly higher than the previous year. Despite a lower yield of 4.14% compared to top-tier US dividend payers, its dividends are well covered by earnings with a low payout ratio of 33.3%. The company’s consistent dividend growth over the past decade adds appeal for income-focused investors, although recent board changes following a merger may impact future governance dynamics.

- Get an in-depth perspective on ChoiceOne Financial Services' performance by reading our dividend report here.

- The analysis detailed in our ChoiceOne Financial Services valuation report hints at an deflated share price compared to its estimated value.

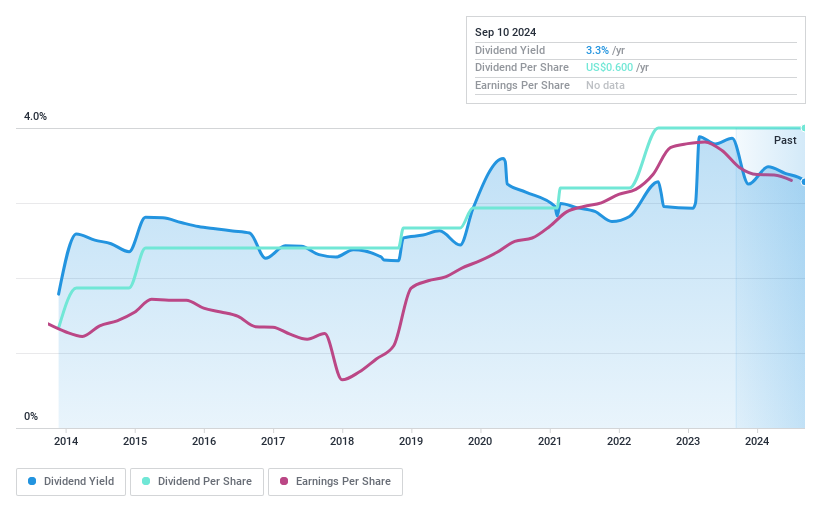

ESSA Bancorp (NasdaqGS:ESSA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ESSA Bancorp, Inc. is a bank holding company for ESSA Bank & Trust, offering various financial services to individuals, families, and businesses in Pennsylvania with a market cap of $176.84 million.

Operations: ESSA Bancorp, Inc. generates revenue primarily from its Thrift/Savings and Loan Institutions segment, which accounts for $67.43 million.

Dividend Yield: 3.3%

ESSA Bancorp's dividend, yielding 3.3%, is reliably covered by a low payout ratio of 34.4%, though it trails top-tier US dividend payers. Dividends have grown steadily over the past decade with minimal volatility, reflecting stability and reliability for income investors. Recent earnings showed a slight decline in net income to US$3.96 million, while an upcoming merger with CNB may influence future strategic directions and governance, potentially affecting dividend sustainability and growth prospects.

- Dive into the specifics of ESSA Bancorp here with our thorough dividend report.

- The valuation report we've compiled suggests that ESSA Bancorp's current price could be quite moderate.

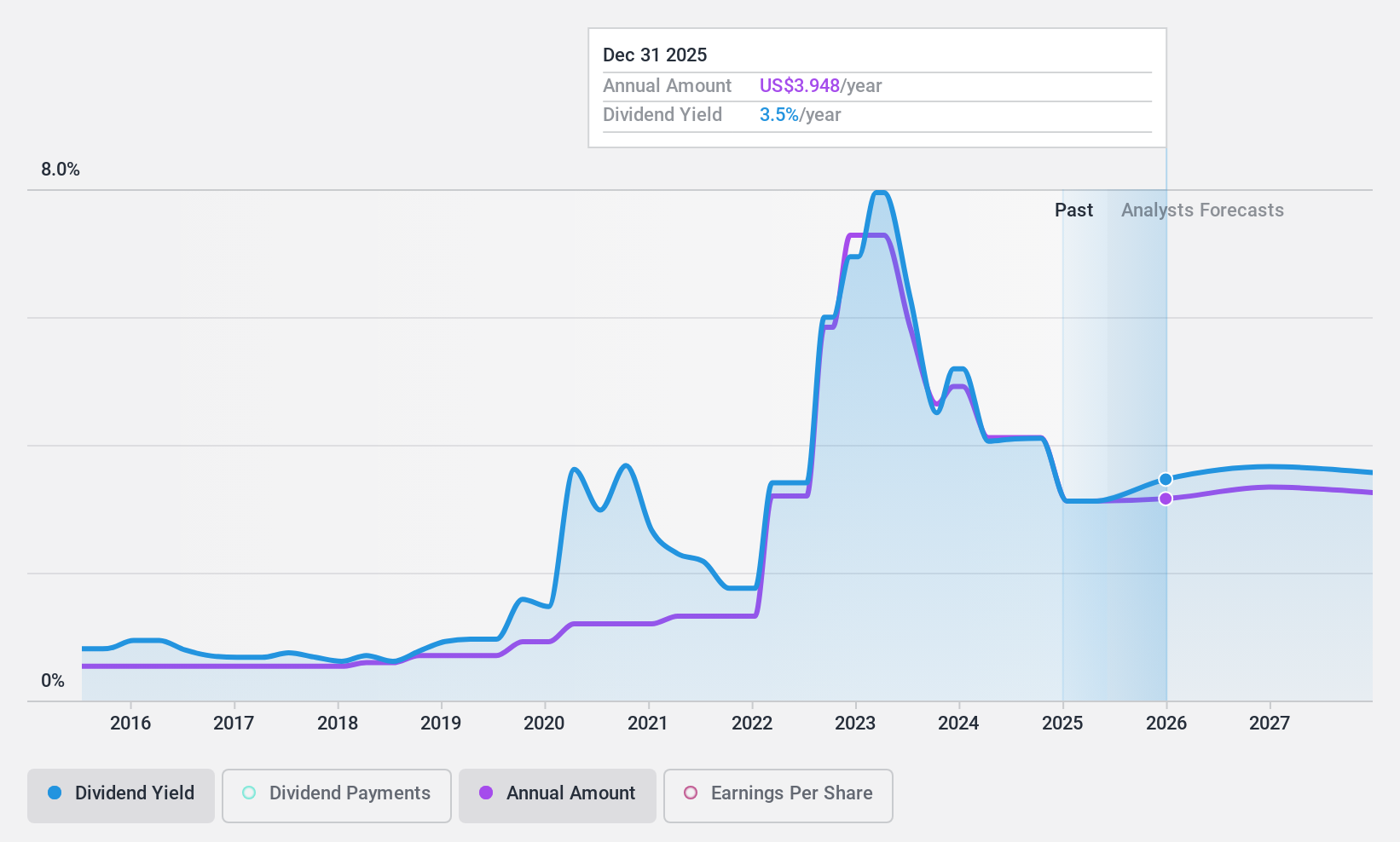

EOG Resources (NYSE:EOG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EOG Resources, Inc. is engaged in the exploration, development, production, and marketing of crude oil, natural gas liquids, and natural gas across various producing basins in the United States and internationally, with a market cap of approximately $60.18 billion.

Operations: EOG Resources generates revenue primarily from its Crude Oil and Natural Gas Exploration and Production segment, which amounted to $23.48 billion.

Dividend Yield: 3.5%

EOG Resources offers a modest dividend yield of 3.5%, below the top US dividend payers, but maintains strong coverage with a payout ratio of 32.8%. Despite past volatility, dividends have grown over the last decade. Recent earnings showed a decrease in net income to US$6.4 billion for 2024. EOG's strategic alliance with TETRA Technologies on water treatment could enhance operational efficiency and potentially support future dividend stability amidst forecasted earnings declines.

- Click here to discover the nuances of EOG Resources with our detailed analytical dividend report.

- Our valuation report here indicates EOG Resources may be undervalued.

Where To Now?

- Explore the 163 names from our Top US Dividend Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade ESSA Bancorp, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ESSA Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ESSA

ESSA Bancorp

Operates as a bank holding company for ESSA Bank & Trust that provides a range of financial services to individuals, families, and businesses in Pennsylvania.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives