- United States

- /

- Banks

- /

- NasdaqGS:WABC

3 Dividend Stocks On US Exchanges Yielding Up To 5.6%

Reviewed by Simply Wall St

As the U.S. stock market experiences a resurgence with major indices like the S&P 500 and Dow Jones posting significant gains, investors are turning their attention to dividend stocks as a potential source of steady income amid fluctuating market conditions. In this environment, selecting dividend stocks that offer strong yields can provide both stability and growth potential, making them an attractive option for those looking to balance risk and return in their investment portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.63% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.74% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.04% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 5.11% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.57% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.78% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

Click here to see the full list of 144 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

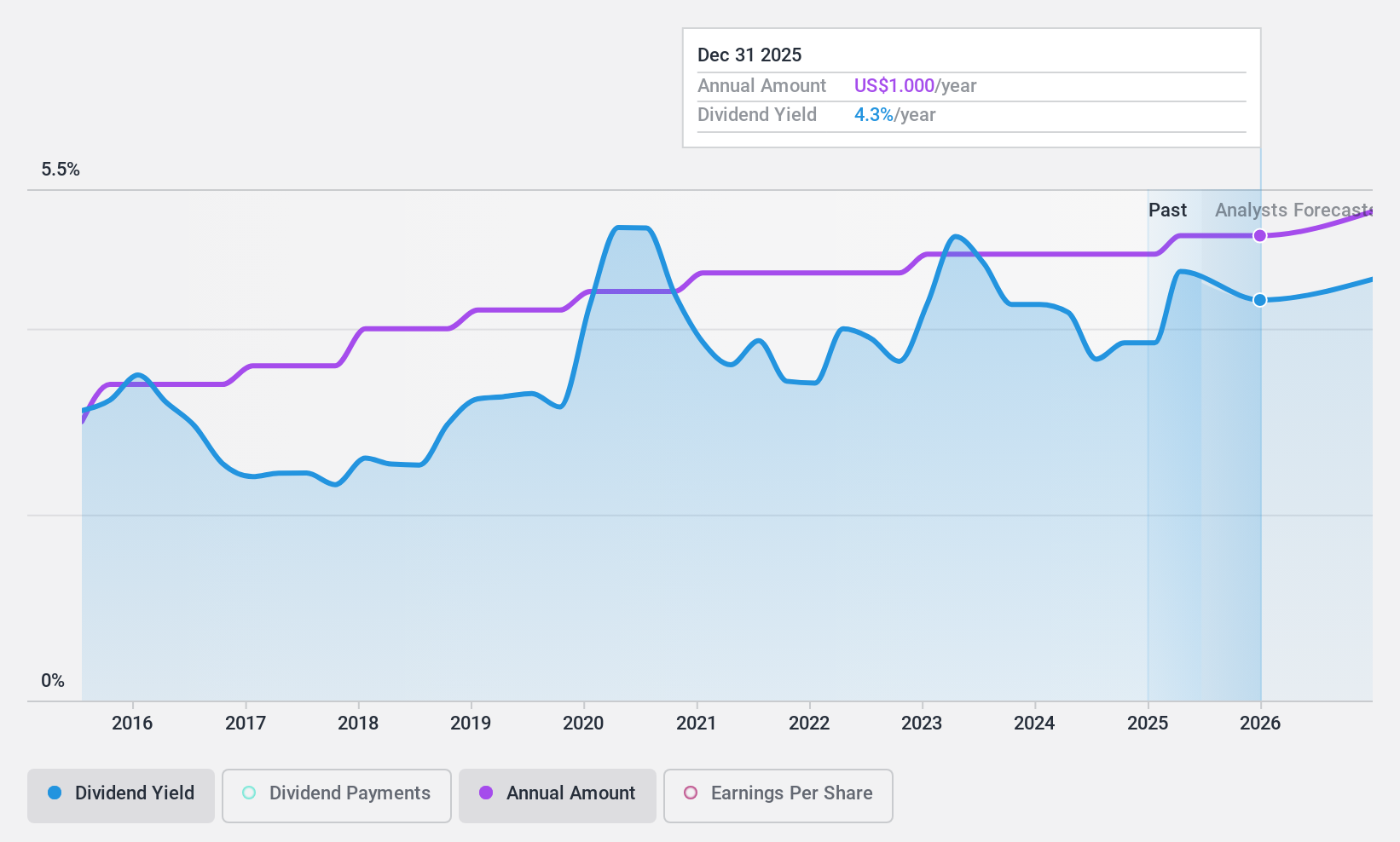

First Busey (NasdaqGS:BUSE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: First Busey Corporation is a bank holding company for Busey Bank, offering retail and commercial banking services to various customer segments in the United States, with a market cap of approximately $1.32 billion.

Operations: First Busey Corporation's revenue is primarily derived from its Banking segment at $385.10 million, supplemented by Wealth Management at $61.82 million and Firs Tech contributing $23.54 million.

Dividend Yield: 4.2%

First Busey recently increased its dividend by 4.2% to US$0.25 per share, reflecting a decade of stable and growing dividends. The company's payout ratio is currently 48.5%, indicating that dividends are well-covered by earnings, with future coverage expected to improve further. Despite trading at a significant discount to estimated fair value and offering a yield lower than the top quartile of U.S. dividend payers, First Busey provides reliable income for investors seeking stability in their portfolio.

- Dive into the specifics of First Busey here with our thorough dividend report.

- Our valuation report here indicates First Busey may be undervalued.

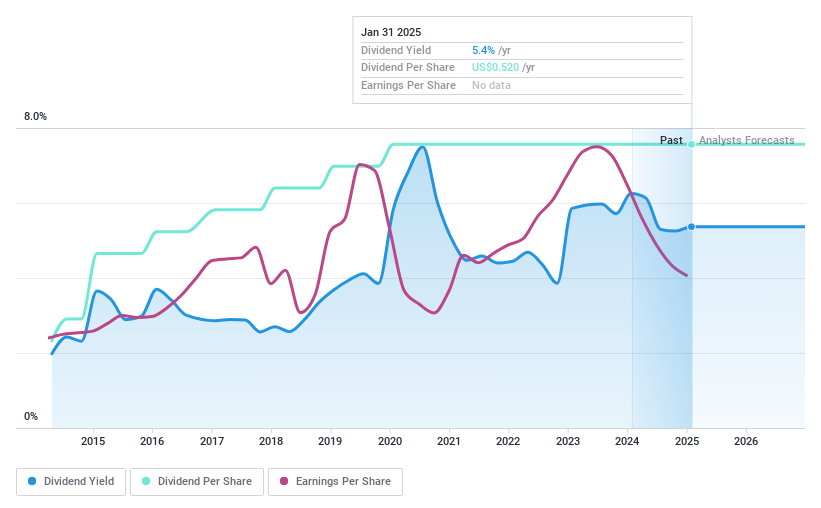

Heritage Commerce (NasdaqGS:HTBK)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Heritage Commerce Corp, with a market cap of $565.22 million, operates as the bank holding company for Heritage Bank of Commerce, offering a range of commercial and personal banking services to residents and businesses in California.

Operations: Heritage Commerce Corp generates revenue primarily through its Banking segment, contributing $159.94 million, and its Factoring segment, which adds $9.23 million.

Dividend Yield: 5.6%

Heritage Commerce offers a stable dividend with a payout ratio of 73.6%, ensuring coverage by earnings, and is forecasted to improve to 65.8% in three years. The dividend yield of 5.64% places it among the top U.S. payers, supported by consistent growth over the past decade. Despite recent declines in net income and interest income, dividends remain reliable with regular quarterly payments affirmed at US$0.13 per share amidst executive transitions within the company’s financial leadership team.

- Delve into the full analysis dividend report here for a deeper understanding of Heritage Commerce.

- Our expertly prepared valuation report Heritage Commerce implies its share price may be lower than expected.

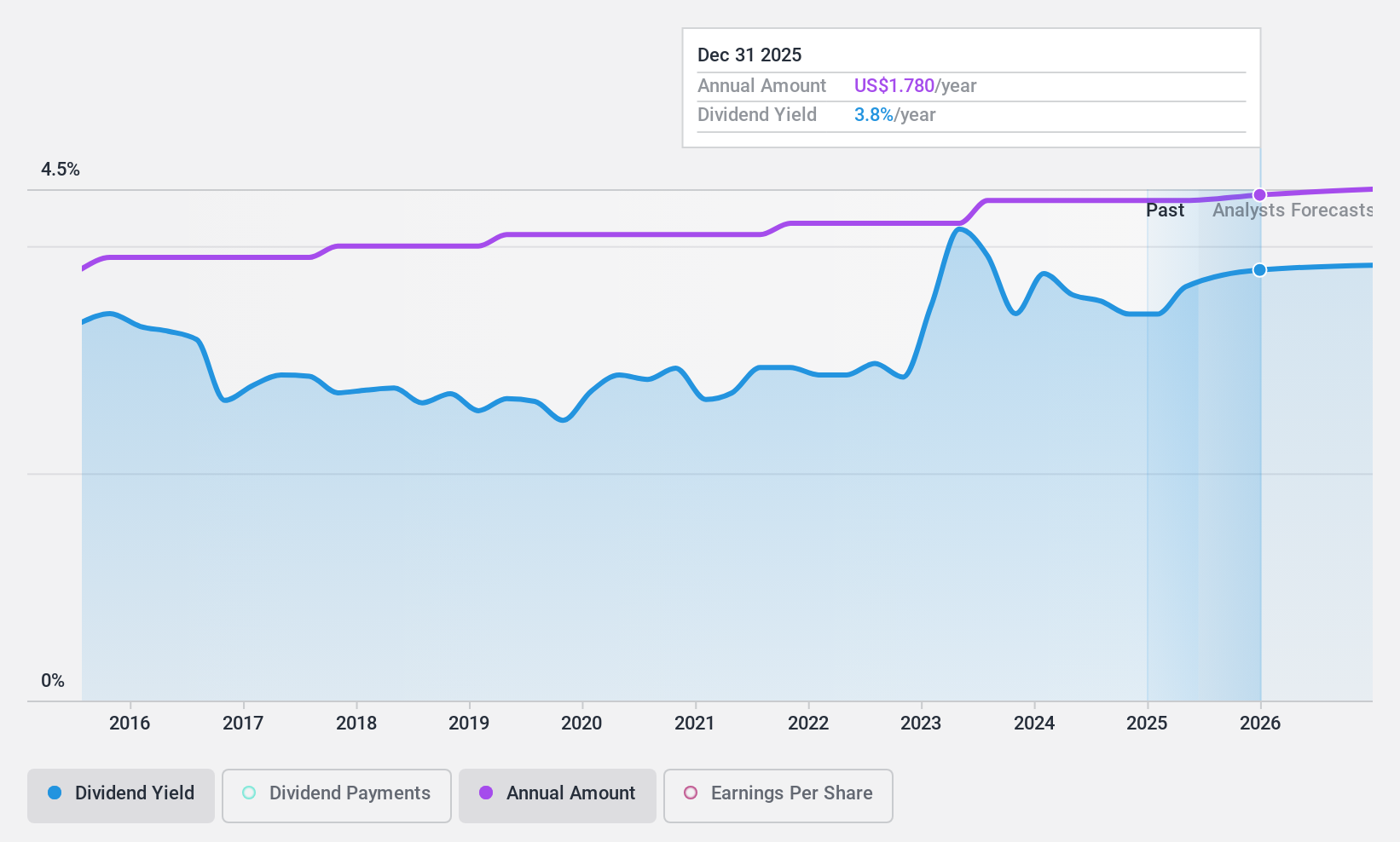

Westamerica Bancorporation (NasdaqGS:WABC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Westamerica Bancorporation is a bank holding company for Westamerica Bank, offering a range of banking products and services to individual and commercial customers, with a market cap of approximately $1.40 billion.

Operations: Westamerica Bancorporation generates its revenue primarily through its banking segment, which accounted for $293.25 million.

Dividend Yield: 3.4%

Westamerica Bancorporation maintains a stable dividend, supported by a low payout ratio of 33.9%, ensuring coverage by earnings and forecasted to remain sustainable at 44.4% in three years. Despite recent declines in net interest income and net income, the company continues its reliable quarterly dividend payments, recently affirming US$0.44 per share. However, its dividend yield of 3.36% is below the top quartile of U.S. market payers, indicating room for improvement in attractiveness relative to peers.

- Navigate through the intricacies of Westamerica Bancorporation with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Westamerica Bancorporation shares in the market.

Where To Now?

- Investigate our full lineup of 144 Top US Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westamerica Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WABC

Westamerica Bancorporation

Operates as a bank holding company for the Westamerica Bank that provides various banking products and services to individual and commercial customers.

Flawless balance sheet established dividend payer.