- United States

- /

- Pharma

- /

- NasdaqCM:LQDA

3 US Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As the United States stock market experiences a surge, with major indices like the S&P 500 and Dow Jones Industrial Average posting significant gains, investor interest in growth companies remains high. In this environment, stocks with strong insider ownership can be particularly appealing as they often indicate confidence from those closest to the company's operations and strategy.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 48% |

| Travelzoo (NasdaqGS:TZOO) | 38% | 34.7% |

| CarGurus (NasdaqGS:CARG) | 16.9% | 42.4% |

| Spotify Technology (NYSE:SPOT) | 17.6% | 29.8% |

| MP Materials (NYSE:MP) | 10.9% | 83% |

Let's explore several standout options from the results in the screener.

Liquidia (NasdaqCM:LQDA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Liquidia Corporation is a biopharmaceutical company that develops, manufactures, and commercializes products for unmet patient needs in the United States, with a market cap of approximately $1.09 billion.

Operations: The company generates revenue from its Pharmaceuticals segment, totaling $15.61 million.

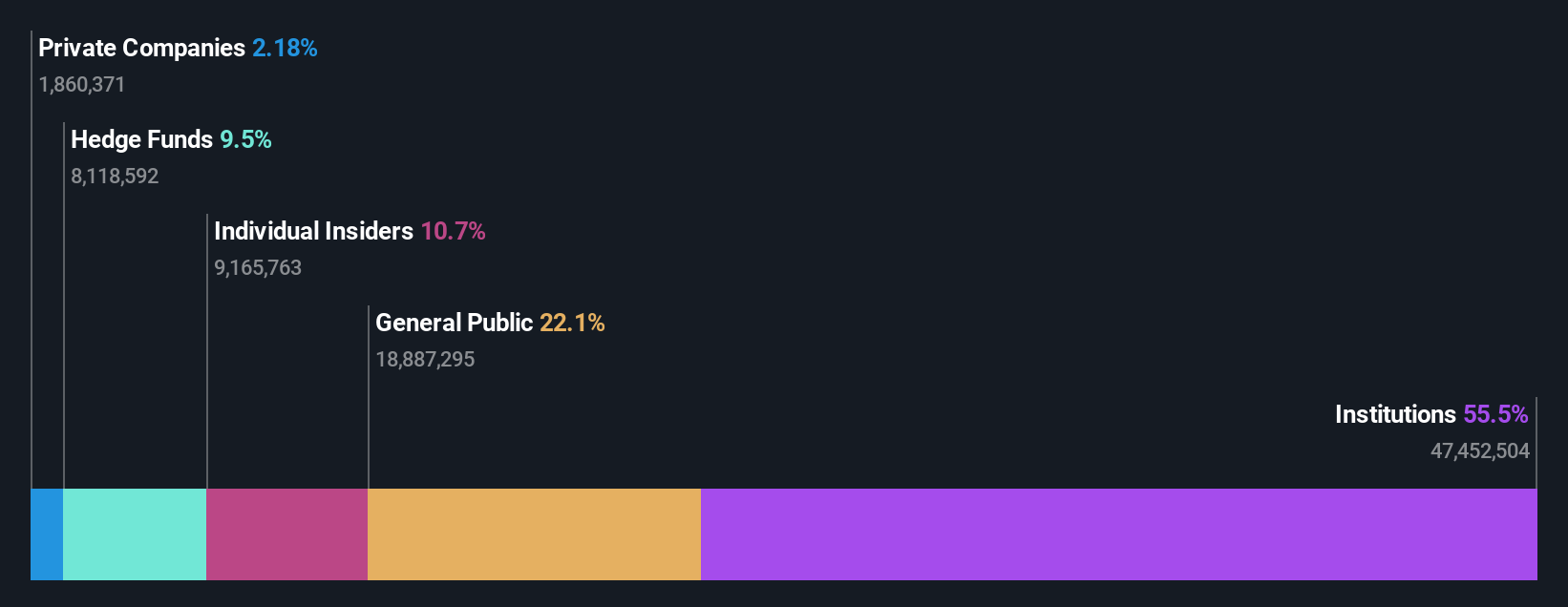

Insider Ownership: 10.7%

Liquidia demonstrates potential as a growth company with high insider ownership, reflected in its forecasted revenue growth of 48.4% per year, outpacing the US market. Despite reporting a net loss of US$23.16 million for Q3 2024, the company's earnings are projected to grow by 56.9% annually and it is expected to become profitable within three years. Currently trading at 85.3% below estimated fair value, Liquidia remains an intriguing option for investors seeking high-growth opportunities.

- Navigate through the intricacies of Liquidia with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Liquidia's shares may be trading at a premium.

P10 (NYSE:PX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: P10, Inc. operates as a multi-asset class private market solutions provider in the U.S. alternative asset management industry with a market cap of approximately $1.49 billion.

Operations: The company's revenue is primarily derived from its asset management segment, totaling $274.50 million.

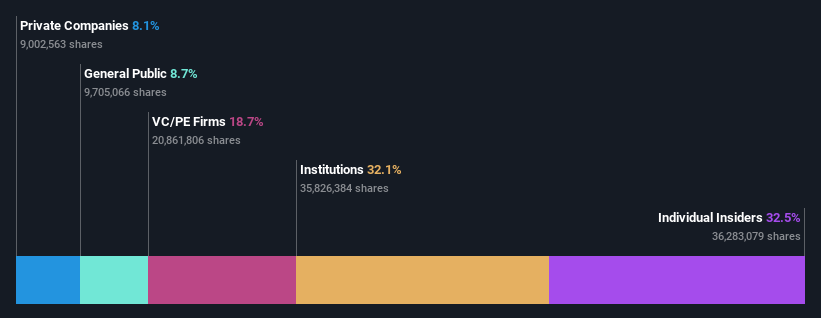

Insider Ownership: 31.7%

P10 is experiencing significant earnings growth, forecasted at 50% annually, surpassing the US market's average. Despite slower revenue growth of 7.3%, recent profitability marks a positive shift. Insider activity shows substantial buying over the past three months, indicating confidence in future prospects. Recent executive changes and a completed share buyback program enhance strategic positioning. The company reported Q3 net income of US$1.41 million compared to a loss last year, reflecting improved financial health.

- Click here and access our complete growth analysis report to understand the dynamics of P10.

- Upon reviewing our latest valuation report, P10's share price might be too optimistic.

Tutor Perini (NYSE:TPC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tutor Perini Corporation is a construction company offering general contracting, construction management, and design-build services to both private and public sectors in the United States and internationally, with a market cap of approximately $1.33 billion.

Operations: The company's revenue segments consist of $615.19 million from Specialty Contractors, $2.14 billion from Civil (including Management Services), and $1.70 billion from Building (including Management Services).

Insider Ownership: 16.2%

Tutor Perini's revenue is forecast to grow at 13% annually, outpacing the US market average. While currently unprofitable, it is expected to achieve profitability within three years, with earnings projected to grow significantly. Recent leadership changes saw Gary Smalley becoming CEO, succeeding Ronald Tutor. Despite no substantial insider buying recently and some significant selling, the company has reduced debt by US$150 million and secured major contracts worth billions of dollars for future projects.

- Click here to discover the nuances of Tutor Perini with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Tutor Perini's share price might be too pessimistic.

Seize The Opportunity

- Access the full spectrum of 207 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LQDA

Liquidia

A biopharmaceutical company, develops, manufactures, and commercializes various products for unmet patient needs in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives