- United States

- /

- Banks

- /

- NasdaqGS:SRCE

Three Undiscovered Gems in the US Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a slight decline of 1.2%, yet it has shown robust growth over the past year with a rise of 23%, and earnings are projected to increase by 15% annually. In this dynamic environment, identifying stocks that combine solid fundamentals with potential for growth can uncover hidden opportunities in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Bank7 (NasdaqGS:BSVN)

Simply Wall St Value Rating: ★★★★★★

Overview: Bank7 Corp. is a bank holding company for Bank7, offering banking and financial services to individual and corporate customers, with a market cap of $417.45 million.

Operations: Bank7 generates revenue primarily from its banking services, totaling $85.88 million. The company's financial performance is reflected in its net profit margin, which stands at 35%.

Bank7, with total assets of US$1.7 billion and equity of US$204.2 million, stands out in the financial sector due to its robust asset base and strategic positioning. The bank's earnings grew by 0.2% last year, outperforming the industry average of -11.8%, showcasing its resilience in a challenging market environment. It boasts a sufficient allowance for bad loans at 231%, ensuring stability against potential defaults, while maintaining low-risk funding with 99% liabilities sourced from customer deposits. Trading significantly below estimated fair value enhances its appeal as an investment opportunity amidst economic uncertainties and competitive pressures.

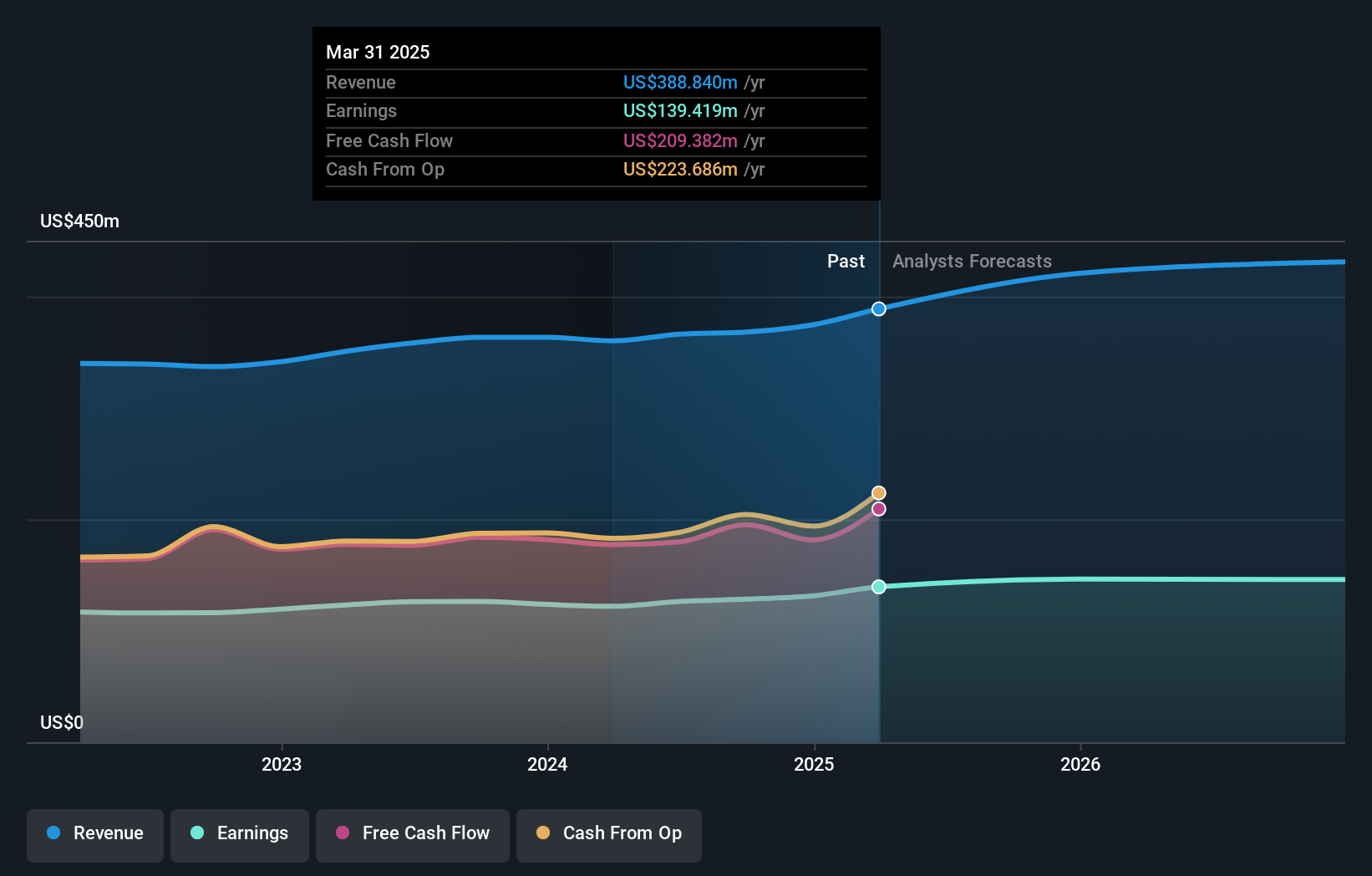

Capital City Bank Group (NasdaqGS:CCBG)

Simply Wall St Value Rating: ★★★★★★

Overview: Capital City Bank Group, Inc. is a financial holding company for Capital City Bank, offering various banking-related services to individual and corporate clients with a market capitalization of $597.63 million.

Operations: Capital City Bank Group generates revenue primarily through its commercial banking segment, which reported $226.02 million in revenue. The company recorded a net profit margin of 22%, reflecting its profitability from these operations.

Capital City Bank Group, with assets totaling US$4.2 billion and equity of US$476.5 million, showcases a robust financial standing. Deposits stand at US$3.6 billion while loans amount to US$2.7 billion, indicating solid banking operations supported by a net interest margin of 4.1%. The bank's allowance for bad loans is comfortably set at 0.2%, demonstrating prudent risk management practices alongside low-risk funding sources comprising 95% customer deposits. Earnings growth over the past year reached 2.8%, outpacing the broader banking industry's performance, which saw an -11.8% figure, highlighting its competitive edge in challenging market conditions.

- Click here to discover the nuances of Capital City Bank Group with our detailed analytical health report.

Gain insights into Capital City Bank Group's past trends and performance with our Past report.

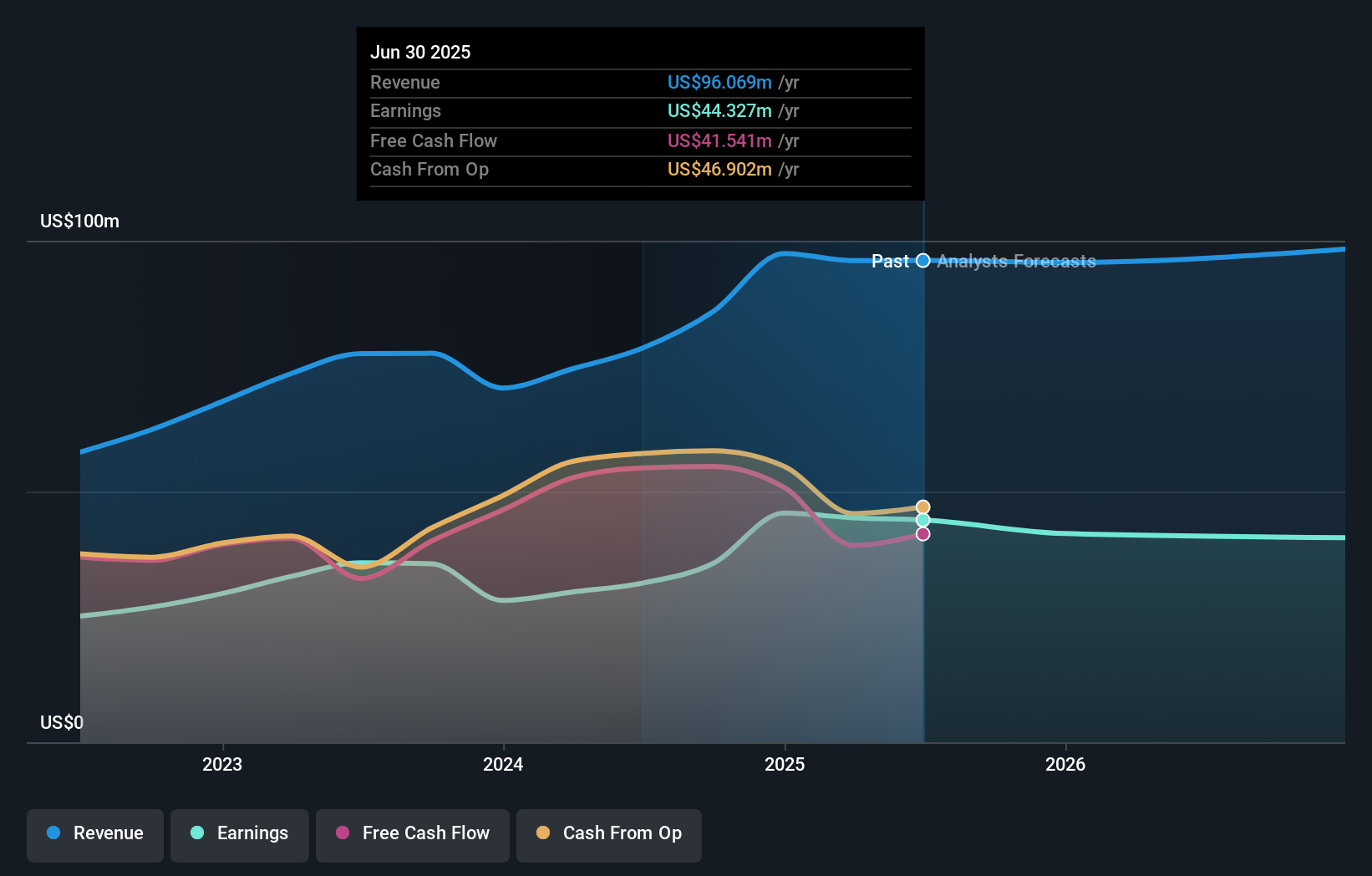

1st Source (NasdaqGS:SRCE)

Simply Wall St Value Rating: ★★★★★★

Overview: 1st Source Corporation, with a market cap of $1.41 billion, operates as the bank holding company for 1st Source Bank, offering commercial and consumer banking services, trust and wealth advisory services, and insurance products to individual and business clients.

Operations: 1st Source generates revenue primarily from its commercial banking segment, which accounts for $369.01 million. The company's financial performance is reflected in its market cap of $1.41 billion.

1st Source, with total assets of US$8.8 billion and equity of US$1.2 billion, seems to be a solid player in the banking sector. Total deposits stand at US$7.1 billion against loans of US$6.5 billion, highlighting its robust deposit base primarily sourced from low-risk customer deposits (94%). The bank's bad loan allowance is sufficient at 495%, covering non-performing loans that are just 0.5% of total loans—a commendable figure indicating prudent risk management. Trading at 64% below fair value estimates suggests potential undervaluation, while earnings growth of 1.6% outpaces the industry average by a significant margin.

- Take a closer look at 1st Source's potential here in our health report.

Review our historical performance report to gain insights into 1st Source's's past performance.

Turning Ideas Into Actions

- Reveal the 248 hidden gems among our US Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRCE

1st Source

Operates as the bank holding company for 1st Source Bank that provides commercial and consumer banking services, trust and wealth advisory services, and insurance products to individual and business clients.

Flawless balance sheet, undervalued and pays a dividend.