- United States

- /

- Banks

- /

- NasdaqGS:PNFP

3 US Stocks That Investors Might Be Undervaluing By Up To 41.9%

Reviewed by Simply Wall St

As the U.S. stock market reacts positively to benign inflation data and strong bank earnings, investors are keenly observing potential opportunities amid fluctuating indices. In this environment, identifying undervalued stocks can be crucial for those looking to capitalize on market inefficiencies and potentially enhance their investment portfolios.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Dime Community Bancshares (NasdaqGS:DCOM) | $31.25 | $61.63 | 49.3% |

| Burke & Herbert Financial Services (NasdaqCM:BHRB) | $60.55 | $117.78 | 48.6% |

| German American Bancorp (NasdaqGS:GABC) | $39.26 | $78.06 | 49.7% |

| Afya (NasdaqGS:AFYA) | $15.21 | $29.63 | 48.7% |

| Ally Financial (NYSE:ALLY) | $35.32 | $68.95 | 48.8% |

| Mr. Cooper Group (NasdaqCM:COOP) | $96.54 | $188.33 | 48.7% |

| Bilibili (NasdaqGS:BILI) | $16.65 | $32.75 | 49.2% |

| Ubiquiti (NYSE:UI) | $393.63 | $771.91 | 49% |

| Coeur Mining (NYSE:CDE) | $6.35 | $12.63 | 49.7% |

| Zillow Group (NasdaqGS:ZG) | $68.92 | $136.88 | 49.7% |

We'll examine a selection from our screener results.

Pinnacle Financial Partners (NasdaqGS:PNFP)

Overview: Pinnacle Financial Partners, Inc. is a bank holding company for Pinnacle Bank, offering a range of banking products and services to individuals, businesses, and professional entities in the United States with a market cap of approximately $9.03 billion.

Operations: The company generates revenue primarily from its banking segment, which accounts for $1.55 billion.

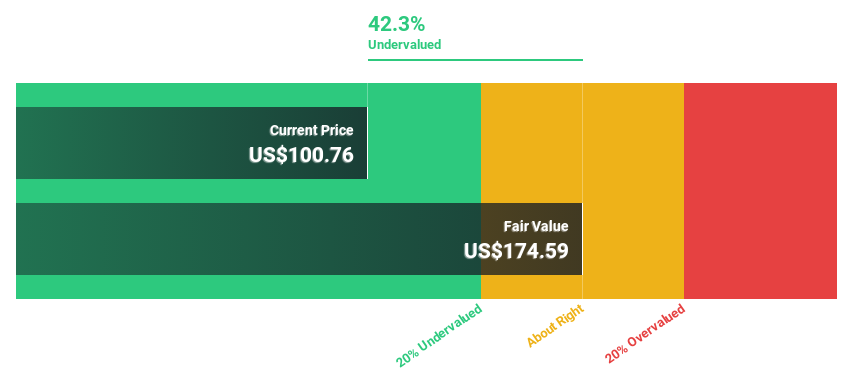

Estimated Discount To Fair Value: 39.1%

Pinnacle Financial Partners is trading at US$117.97, significantly below its estimated fair value of US$193.85, indicating undervaluation based on discounted cash flow analysis. Despite a forecasted low return on equity in three years, earnings are expected to grow significantly at 24% annually, outpacing the broader US market's growth rate. Recent financial results show increased net interest income and stable net loan charge-offs, though net income has declined year-over-year for the nine months ending September 2024.

- Upon reviewing our latest growth report, Pinnacle Financial Partners' projected financial performance appears quite optimistic.

- Dive into the specifics of Pinnacle Financial Partners here with our thorough financial health report.

Glacier Bancorp (NYSE:GBCI)

Overview: Glacier Bancorp, Inc. is a bank holding company for Glacier Bank, offering commercial banking services to individuals, small to medium-sized businesses, community organizations, and public entities in the United States, with a market cap of approximately $5.76 billion.

Operations: The company generates revenue of $780.33 million from its banking services segment, which includes offerings to individuals, small to medium-sized businesses, community organizations, and public entities in the United States.

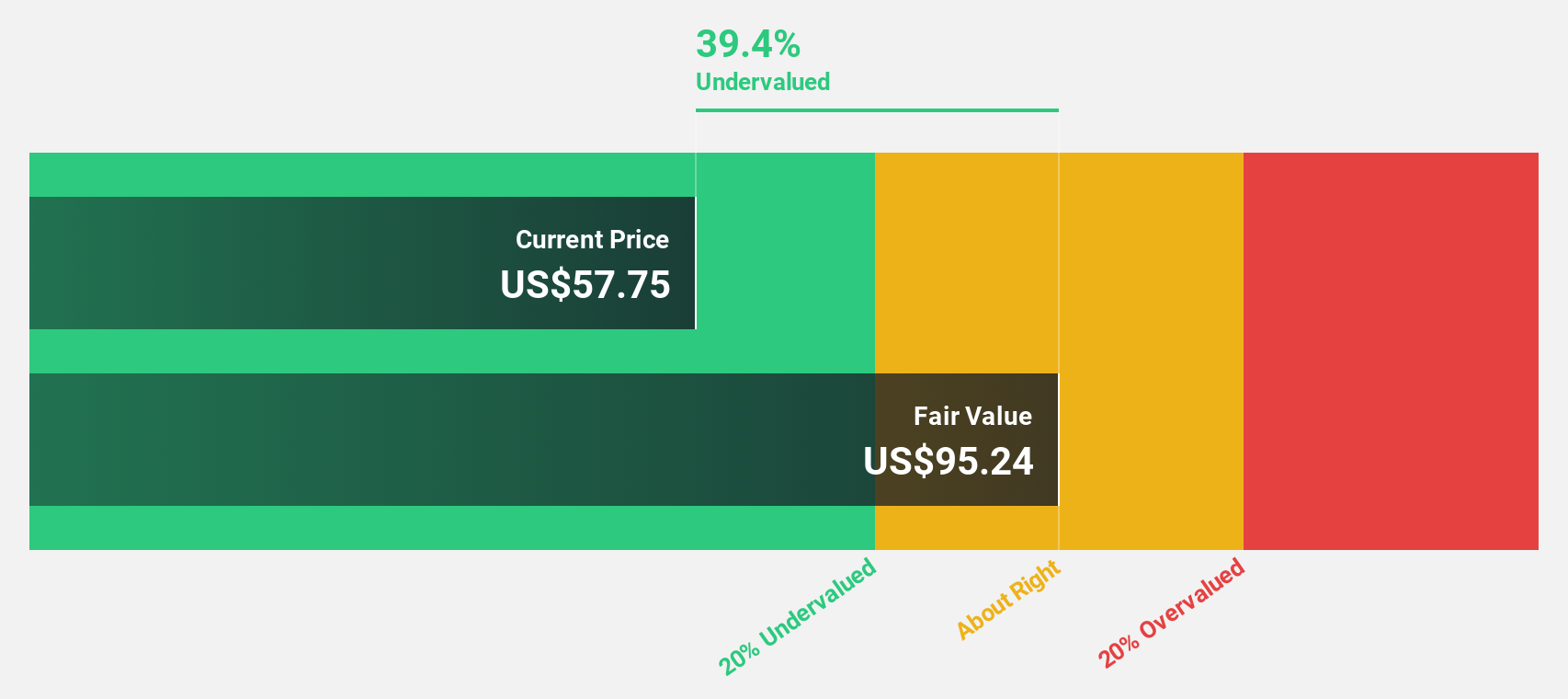

Estimated Discount To Fair Value: 10.6%

Glacier Bancorp is trading at US$50.76, slightly below its estimated fair value of US$56.8, suggesting potential undervaluation based on cash flow analysis. Despite a low forecasted return on equity of 9.4% in three years and recent shareholder dilution, earnings are expected to grow significantly at 30.3% annually, surpassing the broader US market's growth rate. Recent discussions about acquiring Bank of Idaho Holding Company could impact future cash flows positively or negatively depending on integration success.

- According our earnings growth report, there's an indication that Glacier Bancorp might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Glacier Bancorp.

Viking Holdings (NYSE:VIK)

Overview: Viking Holdings Ltd operates in passenger shipping and other forms of passenger transport across North America, the United Kingdom, and internationally, with a market cap of $18.74 billion.

Operations: The company's revenue segments include Viking Ocean, generating $2.12 billion, and Viking River, contributing $2.51 billion.

Estimated Discount To Fair Value: 41.9%

Viking Holdings is trading at US$43.41, significantly below its estimated fair value of US$74.72, highlighting potential undervaluation based on cash flows. The company has shown strong revenue growth, with recent third-quarter sales reaching US$1.68 billion compared to US$1.51 billion the previous year and a shift from a net loss to a net income of US$375 million. New product offerings in Europe could further enhance revenue streams in upcoming years.

- The growth report we've compiled suggests that Viking Holdings' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Viking Holdings.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 167 Undervalued US Stocks Based On Cash Flows now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Pinnacle Financial Partners, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PNFP

Pinnacle Financial Partners

Operates as the bank holding company for Pinnacle Bank that provides various banking products and services to individuals, businesses, and professional entities in the United States.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives