- United States

- /

- Specialty Stores

- /

- NasdaqGM:ONEW

3 Undervalued Small Caps With Insider Action Across Various Regions

Reviewed by Simply Wall St

The United States market has shown positive momentum recently, rising 1.4% in the last week and climbing 17% over the past year, with all sectors experiencing gains. In this environment of anticipated annual earnings growth of 15%, identifying promising small-cap stocks that exhibit potential for value appreciation and insider activity can be a strategic approach for investors seeking opportunities across various regions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 1.0x | 29.17% | ★★★★★★ |

| Columbus McKinnon | NA | 0.5x | 39.81% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.8x | 33.78% | ★★★★★☆ |

| Citizens & Northern | 11.2x | 2.8x | 48.17% | ★★★★☆☆ |

| Southside Bancshares | 10.6x | 3.6x | 44.04% | ★★★★☆☆ |

| Gentherm | 33.2x | 0.7x | 42.50% | ★★★★☆☆ |

| Farmland Partners | 7.0x | 8.4x | 0.10% | ★★★★☆☆ |

| Montrose Environmental Group | NA | 1.1x | 32.10% | ★★★★☆☆ |

| Shore Bancshares | 9.8x | 2.5x | -14.06% | ★★★☆☆☆ |

| MVB Financial | 16.0x | 2.1x | 25.02% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

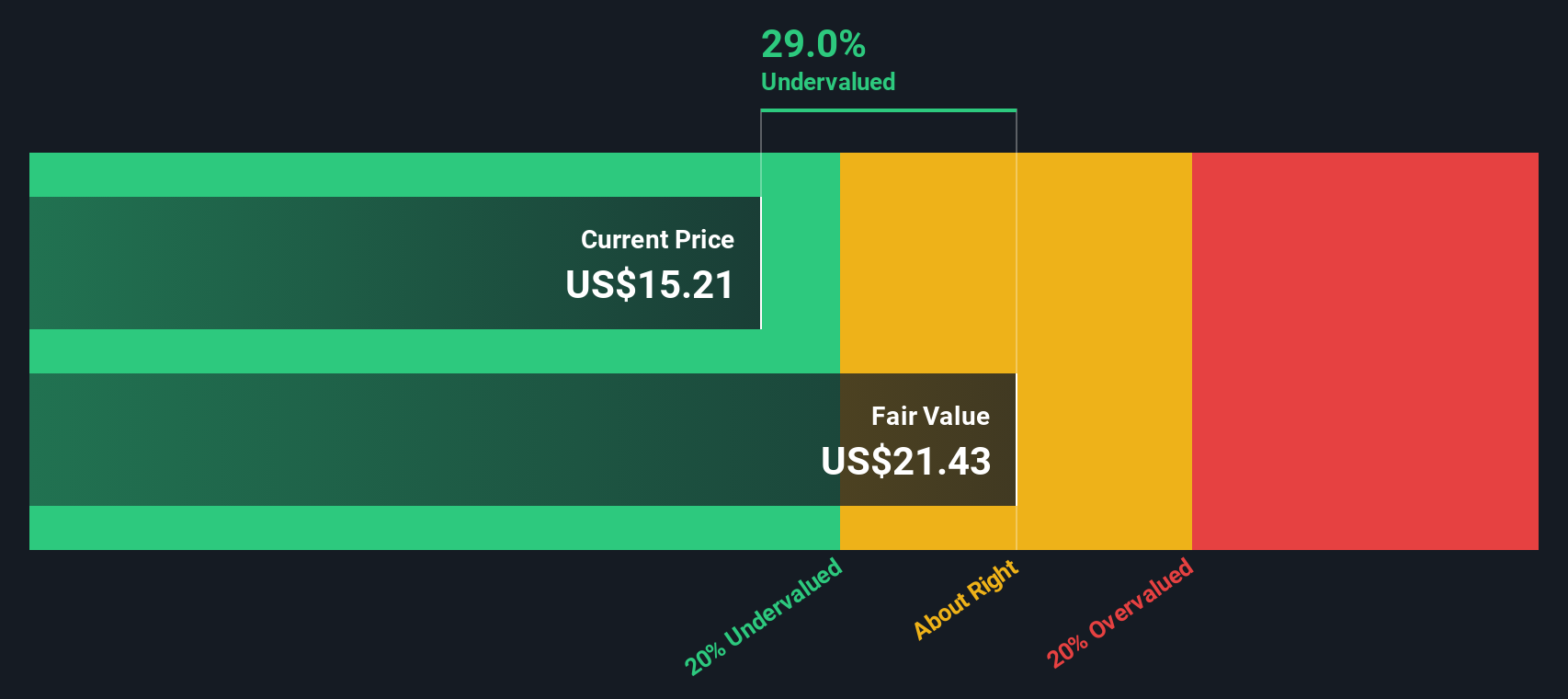

OneWater Marine (ONEW)

Simply Wall St Value Rating: ★★★★★☆

Overview: OneWater Marine operates as a recreational boat retailer with a market cap of $0.48 billion, focusing on dealership and distribution services.

Operations: The company's revenue primarily comes from its dealerships segment, contributing $1.63 billion, followed by distribution at $150.83 million. Over recent periods, the gross profit margin has shown a decreasing trend, moving from 31.75% to 23.70%. Operating expenses have been significant, with general and administrative expenses being a major component.

PE: -36.3x

OneWater Marine, a small-cap player in the U.S. market, reported second-quarter revenue of US$483.52 million, slightly down from last year but showing a reduced net loss of US$0.368 million compared to US$3.97 million previously. Despite earnings not covering interest payments well and reliance on external borrowing, insider confidence is evident with share repurchases totaling 73,487 shares for US$1.93 million since March 2022. The company projects annual revenue between US$1.7 billion and US$1.8 billion for fiscal 2025 amidst flat dealership sales expectations.

- Dive into the specifics of OneWater Marine here with our thorough valuation report.

Examine OneWater Marine's past performance report to understand how it has performed in the past.

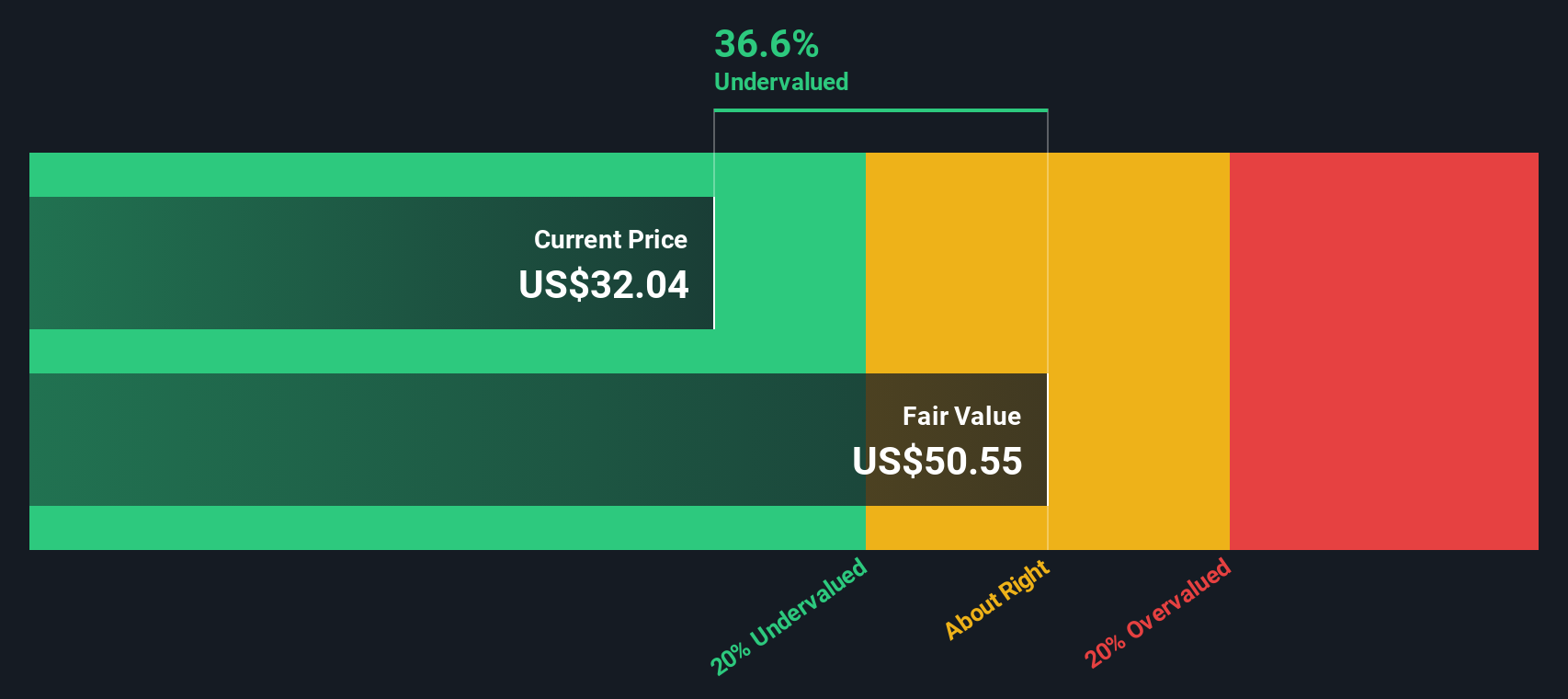

Gentherm (THRM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gentherm is a company specializing in thermal management technologies, primarily serving the automotive and medical sectors, with a market cap of approximately $1.77 billion.

Operations: The company generates revenue primarily from its Automotive segment, with a smaller contribution from the Medical segment. Over recent periods, the gross profit margin has shown fluctuations, reaching 25.62% in late 2024 before slightly decreasing to 24.58% by early 2025. Operating expenses have been consistent around $243 million to $251 million in recent quarters, with R&D expenses being a notable component within this category.

PE: 33.2x

Gentherm, a player in thermal management solutions, has seen its profit margins shrink to 2.2% from 4.6% last year. Despite this, earnings are projected to grow by over 59% annually. The company recently revised its revenue guidance upwards for 2025, indicating potential growth momentum. From April to June 2025, they repurchased over a million shares worth US$39.89 million, reflecting insider confidence in the company's future prospects amidst shifting index placements towards value benchmarks and strategic partnerships in Europe expanding their market reach.

- Delve into the full analysis valuation report here for a deeper understanding of Gentherm.

Gain insights into Gentherm's historical performance by reviewing our past performance report.

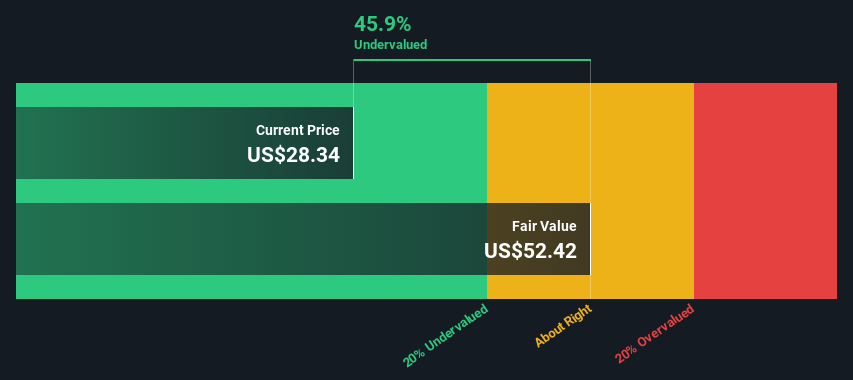

Live Oak Bancshares (LOB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Live Oak Bancshares operates a banking platform primarily focused on serving small businesses, with a market capitalization of approximately $1.59 billion.

Operations: The company generates revenue primarily through its banking platform for small businesses, with recent figures showing $406.00 million in revenue. Operating expenses are a significant component of the cost structure, reaching $318.52 million, with general and administrative expenses accounting for $272.15 million of this total. The net income margin has varied over time, most recently recorded at 13.81%.

PE: 27.6x

Live Oak Bancshares, a smaller player in the financial sector, has shown mixed performance recently. Their Q2 2025 earnings revealed net interest income of US$109.22 million, up from US$91.32 million the previous year, though net income dipped to US$23.43 million from US$26.96 million. Insider confidence is evident with recent stock purchases by executives earlier this year, signaling potential optimism about future growth despite challenges like a high bad loans ratio of 4.2%.

- Navigate through the intricacies of Live Oak Bancshares with our comprehensive valuation report here.

Understand Live Oak Bancshares' track record by examining our Past report.

Summing It All Up

- Click this link to deep-dive into the 74 companies within our Undervalued US Small Caps With Insider Buying screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ONEW

OneWater Marine

Operates as a recreational marine retailer in the United States.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion