Three Stocks Possibly Trading Below Intrinsic Value In January 2025

Reviewed by Simply Wall St

As global markets continue to react to recent political developments and economic indicators, U.S. stocks have been marching toward record highs, buoyed by optimism surrounding potential trade deals and AI investments. Amidst this backdrop of growth stocks outperforming value shares, investors are increasingly on the lookout for opportunities where certain equities may be trading below their intrinsic value. Identifying undervalued stocks requires a keen understanding of market conditions and the ability to recognize companies whose current prices do not reflect their true worth based on financial fundamentals or future prospects.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$526.72 | 49.8% |

| Berkshire Hills Bancorp (NYSE:BHLB) | US$28.32 | US$56.60 | 50% |

| Shenzhen Yinghe Technology (SZSE:300457) | CN¥18.80 | CN¥37.54 | 49.9% |

| World Fitness Services (TWSE:2762) | NT$92.70 | NT$184.63 | 49.8% |

| Vertiseit (OM:VERT B) | SEK50.20 | SEK99.93 | 49.8% |

| Fudo Tetra (TSE:1813) | ¥2153.00 | ¥4301.30 | 49.9% |

| Greenworks (Jiangsu) (SZSE:301260) | CN¥13.95 | CN¥27.81 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5854.00 | ¥11678.68 | 49.9% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥9.10 | CN¥18.19 | 50% |

| Tenable Holdings (NasdaqGS:TENB) | US$43.39 | US$86.65 | 49.9% |

Underneath we present a selection of stocks filtered out by our screen.

Lindab International (OM:LIAB)

Overview: Lindab International AB (publ) manufactures and sells products and solutions for ventilation systems in Europe, with a market cap of SEK15.21 billion.

Operations: The company generates revenue from its segments, with Ventilation Systems contributing SEK10.10 billion and Profile Systems adding SEK3.23 billion.

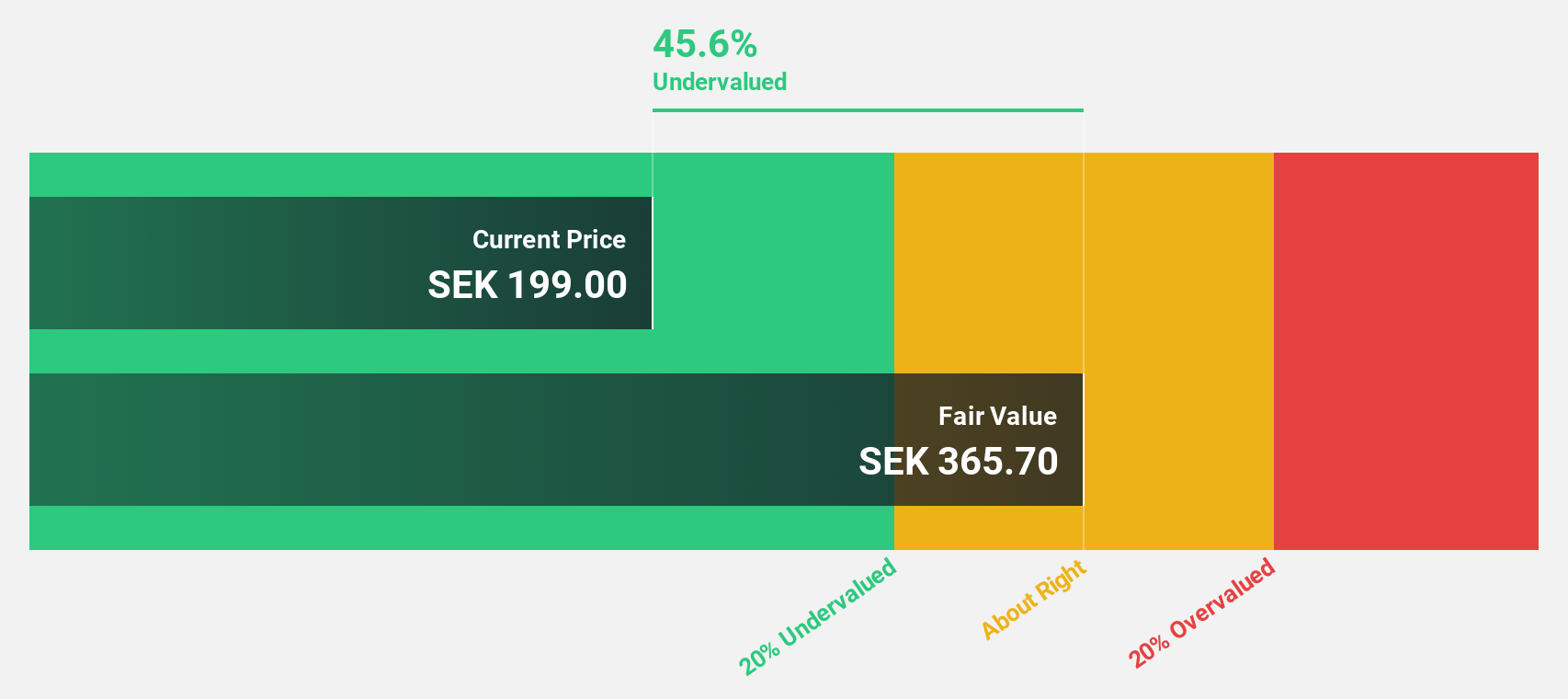

Estimated Discount To Fair Value: 46%

Lindab International is trading at SEK197.5, significantly below its estimated fair value of SEK365.84, highlighting its undervaluation based on cash flows. Despite a low forecasted return on equity of 12.5%, the company anticipates significant earnings growth of 27% annually over three years, outpacing the Swedish market's average. Recent restructuring and acquisition plans aim to enhance profitability and operational efficiency, potentially supporting future financial performance improvements amidst reliable dividend payments.

- Our expertly prepared growth report on Lindab International implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Lindab International stock in this financial health report.

Docebo (TSX:DCBO)

Overview: Docebo Inc. is a learning management software company offering an AI-powered learning platform across North America and internationally, with a market cap of CA$1.87 billion.

Operations: The company generates revenue of $209.17 million from its educational software segment.

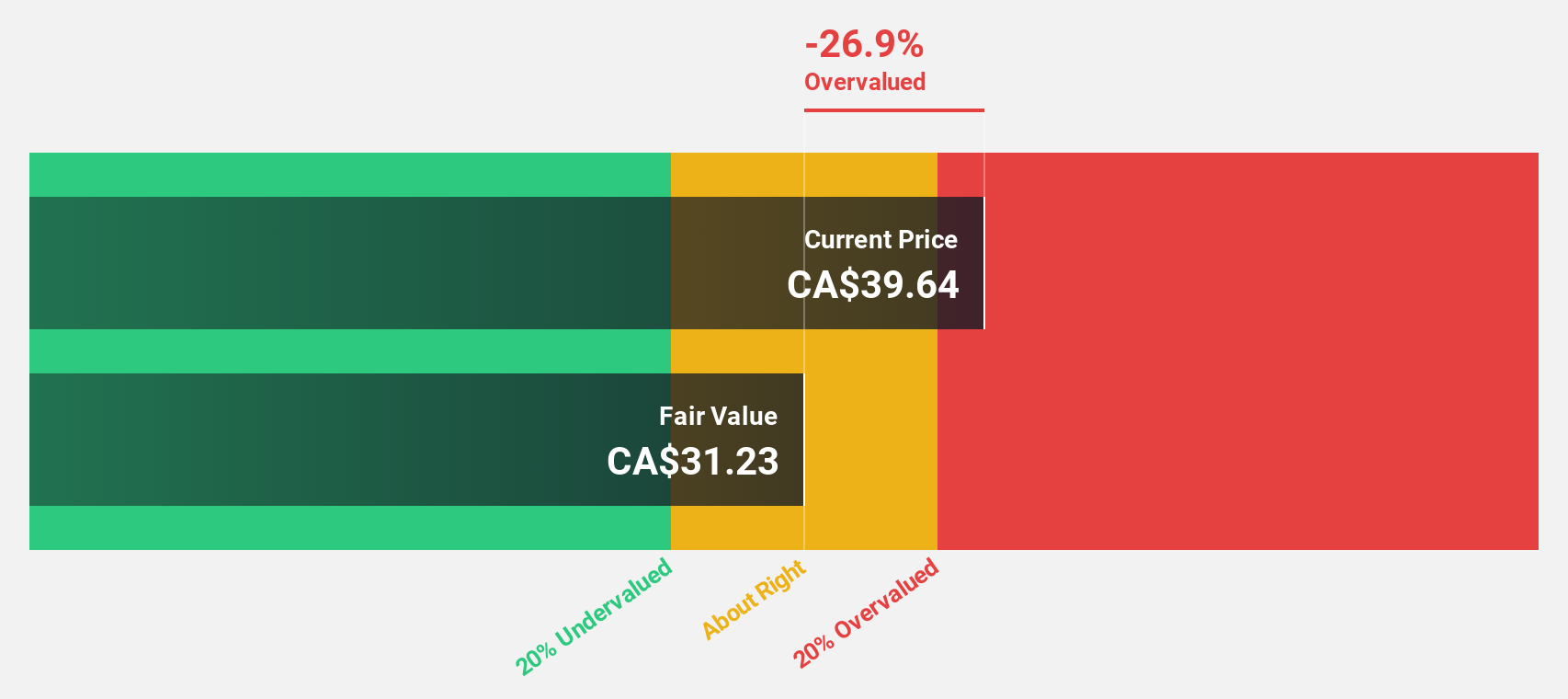

Estimated Discount To Fair Value: 16.5%

Docebo is trading at CA$62, below its estimated fair value of CA$74.28, suggesting undervaluation based on cash flows. The company's earnings have grown substantially over the past year and are forecast to continue growing significantly faster than the Canadian market. Recent strategic alliances with Class Technologies and Deloitte aim to enhance Docebo's offerings and operational efficiency, potentially supporting future growth despite recent executive changes.

- Our comprehensive growth report raises the possibility that Docebo is poised for substantial financial growth.

- Dive into the specifics of Docebo here with our thorough financial health report.

Spin Master (TSX:TOY)

Overview: Spin Master Corp. is a children's entertainment company involved in creating, designing, manufacturing, licensing, and marketing toys, entertainment products, and digital games globally with a market cap of CA$3.27 billion.

Operations: The company's revenue segments consist of $1.79 billion from toys, $159 million from digital games, and $172.50 million from entertainment.

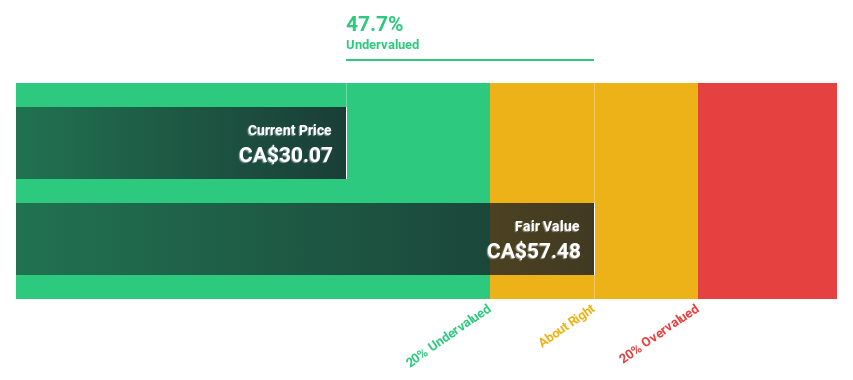

Estimated Discount To Fair Value: 45.2%

Spin Master is trading at CA$31.89, significantly below its estimated fair value of CA$58.16, indicating it is undervalued based on cash flows. Despite a decline in net income to US$60.8 million for the first nine months of 2024, earnings are expected to grow significantly over the next three years, outpacing the Canadian market average. The company has also completed a share buyback program and maintained its dividend payout strategy amidst fluctuating revenues and profit margins.

- Our growth report here indicates Spin Master may be poised for an improving outlook.

- Get an in-depth perspective on Spin Master's balance sheet by reading our health report here.

Make It Happen

- Unlock our comprehensive list of 887 Undervalued Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LIAB

Lindab International

Manufactures and sells products and solutions for ventilation systems in Europe.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives