- Finland

- /

- Metals and Mining

- /

- HLSE:OUT1V

3 Stocks Estimated To Be Up To 43% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating interest rates and geopolitical tensions, investors are keenly observing the impact on major indices. While U.S. stocks faced volatility due to AI competition fears, European markets were buoyed by strong earnings and rate cuts from the ECB. In this environment, identifying undervalued stocks becomes crucial, as these can offer potential opportunities when market sentiment shifts or economic conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wistron (TWSE:3231) | NT$99.00 | NT$197.62 | 49.9% |

| Alltop Technology (TPEX:3526) | NT$265.00 | NT$528.78 | 49.9% |

| Decisive Dividend (TSXV:DE) | CA$5.90 | CA$11.79 | 50% |

| Northwest Bancshares (NasdaqGS:NWBI) | US$13.17 | US$26.31 | 49.9% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.72 | €5.43 | 49.9% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.22 | SEK165.90 | 49.8% |

| Spin Master (TSX:TOY) | CA$30.23 | CA$60.17 | 49.8% |

| Coastal Financial (NasdaqGS:CCB) | US$86.74 | US$172.68 | 49.8% |

| Equifax (NYSE:EFX) | US$266.77 | US$531.78 | 49.8% |

| Facephi Biometria (BME:FACE) | €2.23 | €4.45 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

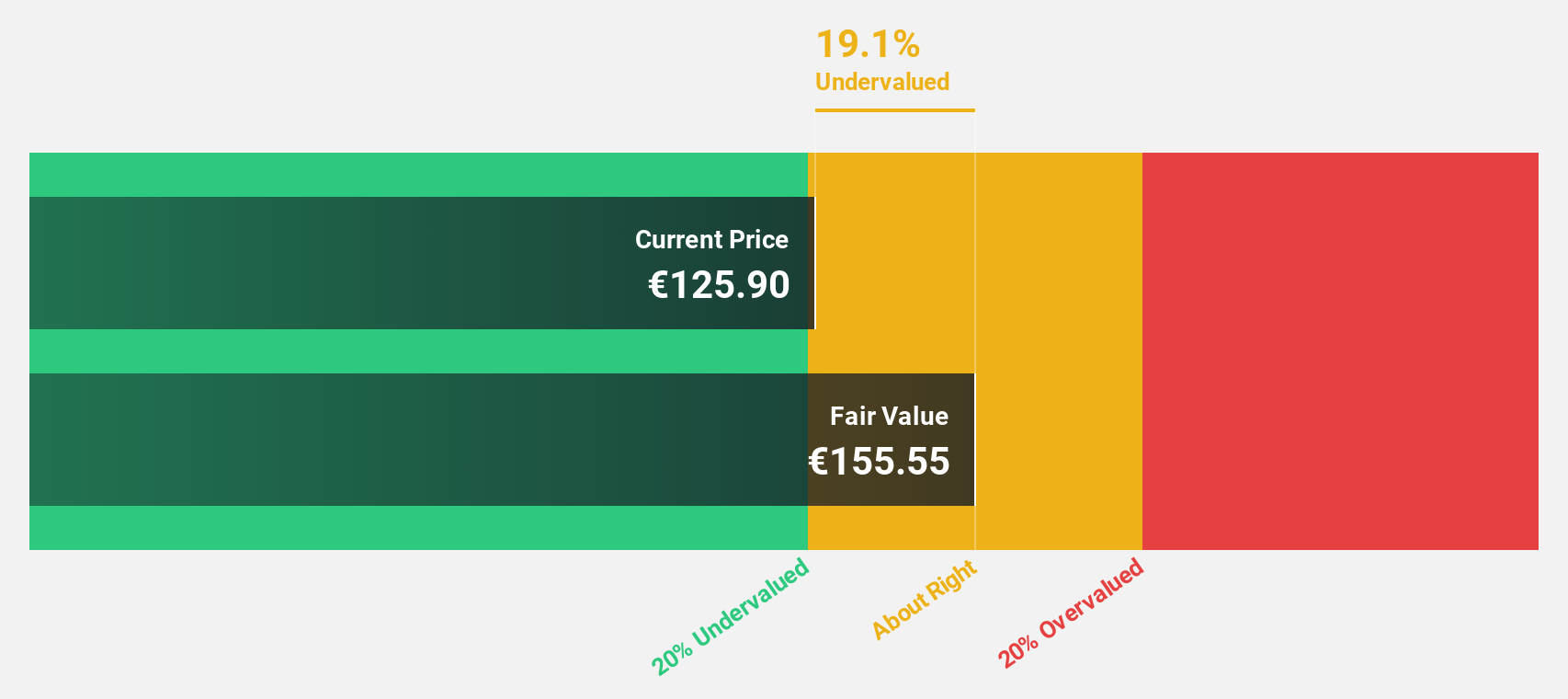

BE Semiconductor Industries (ENXTAM:BESI)

Overview: BE Semiconductor Industries N.V. develops, manufactures, markets, sells, and services semiconductor assembly equipment globally with a market cap of €9.71 billion.

Operations: The company's revenue is primarily generated from its Semiconductor Equipment and Services segment, which amounted to €613.70 million.

Estimated Discount To Fair Value: 17.9%

BE Semiconductor Industries is trading at €120.5, below its estimated fair value of €146.79, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 25.3% annually over the next three years, outpacing the Dutch market's growth rate of 14.5%. Despite recent share price volatility, BE Semiconductor's revenue growth is expected to remain robust at 20.3% per year, surpassing market averages and supporting its long-term prospects.

- Upon reviewing our latest growth report, BE Semiconductor Industries' projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in BE Semiconductor Industries' balance sheet health report.

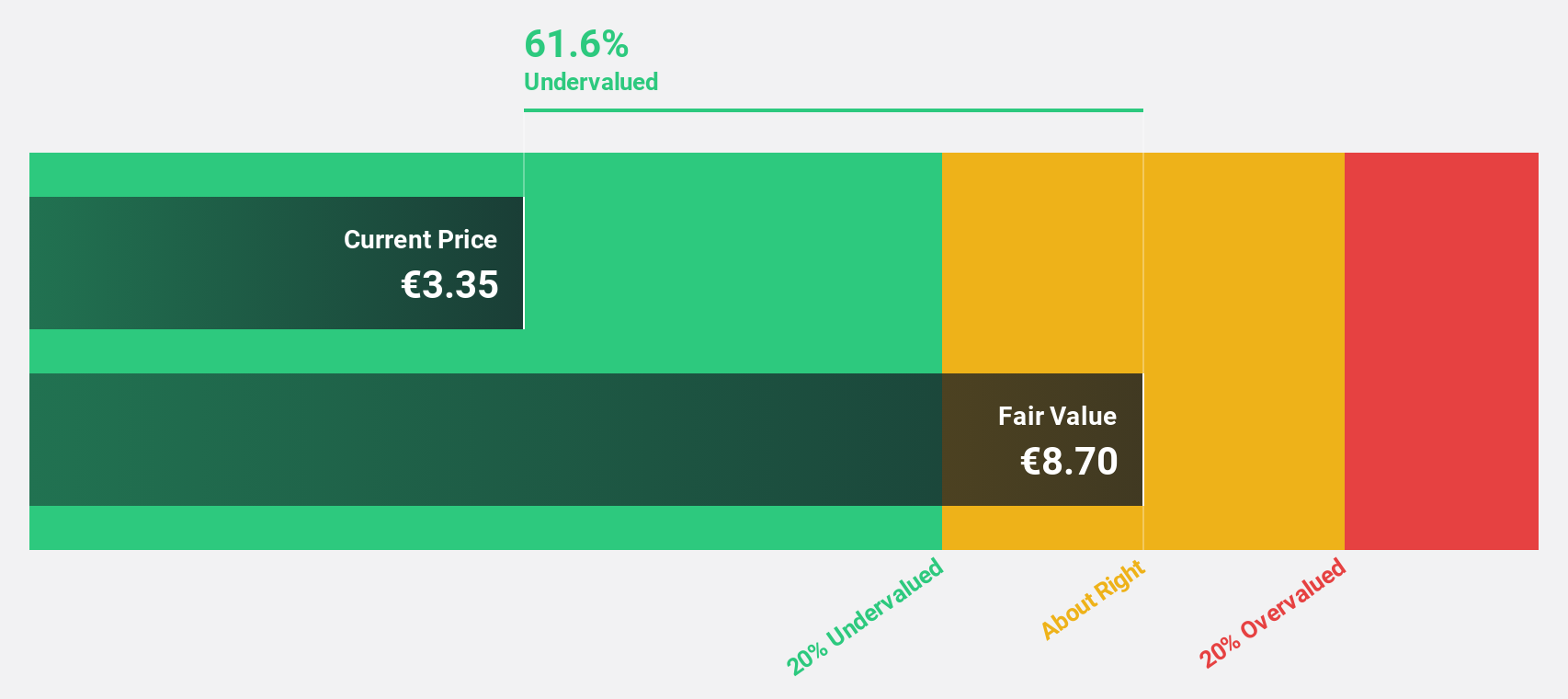

Outokumpu Oyj (HLSE:OUT1V)

Overview: Outokumpu Oyj is a company that produces and sells various stainless steel products across Finland, other European countries, North America, the Asia-Pacific, and internationally with a market cap of approximately €1.30 billion.

Operations: The company's revenue segments consist of €1.72 billion from the Americas, €491 million from Ferrochrome, and €4.21 billion from Europe (excluding Ferrochrome).

Estimated Discount To Fair Value: 43%

Outokumpu Oyj is trading at €3.09, significantly below its estimated fair value of €5.42, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow by 65.78% annually over the next three years, with revenue growth expected to exceed the Finnish market rate at 3.2% per year. However, its dividend yield of 8.43% is not well covered by earnings or free cash flows, and return on equity remains low at a forecasted 4%.

- The analysis detailed in our Outokumpu Oyj growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Outokumpu Oyj stock in this financial health report.

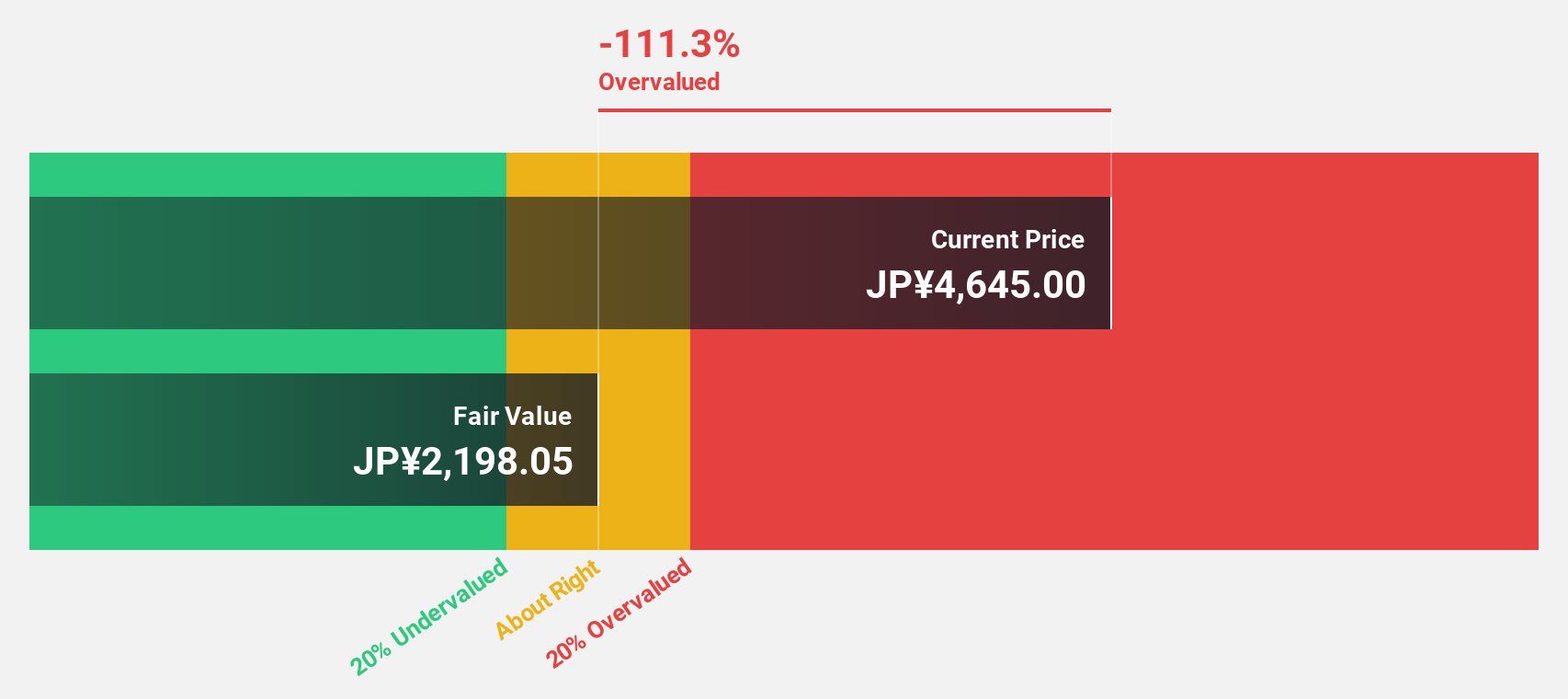

Money Forward (TSE:3994)

Overview: Money Forward, Inc. offers financial solutions for individuals, financial institutions, and corporations mainly in Japan with a market cap of ¥245 billion.

Operations: The company's revenue segment, Platform Services Business, generated ¥40.36 billion.

Estimated Discount To Fair Value: 29.2%

Money Forward is trading at ¥4,455, significantly below its estimated fair value of ¥6,289.83, suggesting potential undervaluation based on cash flows. The company anticipates becoming profitable within three years with earnings growth forecasted at 59.17% annually. Revenue is expected to grow at 18.9% per year, outpacing the Japanese market's 4.2%. Despite high volatility in share price recently, its return on equity is projected to reach a robust 20.4%.

- In light of our recent growth report, it seems possible that Money Forward's financial performance will exceed current levels.

- Take a closer look at Money Forward's balance sheet health here in our report.

Seize The Opportunity

- Gain an insight into the universe of 930 Undervalued Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:OUT1V

Outokumpu Oyj

Produces and sells various stainless steel products in Finland, Germany, Italy, the United Kingdom, other European countries, North America, the Asia-Pacific, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)