Amidst a backdrop of tentative optimism surrounding a potential EU-U.S. trade deal and the European Central Bank's steady interest rate stance, European markets have shown resilience, with indices like the STOXX Europe 600 posting gains. In this environment, dividend stocks offer an attractive proposition for investors seeking stability and income, particularly as they can provide regular returns even when market conditions are uncertain.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.49% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.22% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.63% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.67% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.78% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.86% | ★★★★★★ |

| ERG (BIT:ERG) | 5.24% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.04% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.63% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.47% | ★★★★★★ |

Click here to see the full list of 224 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

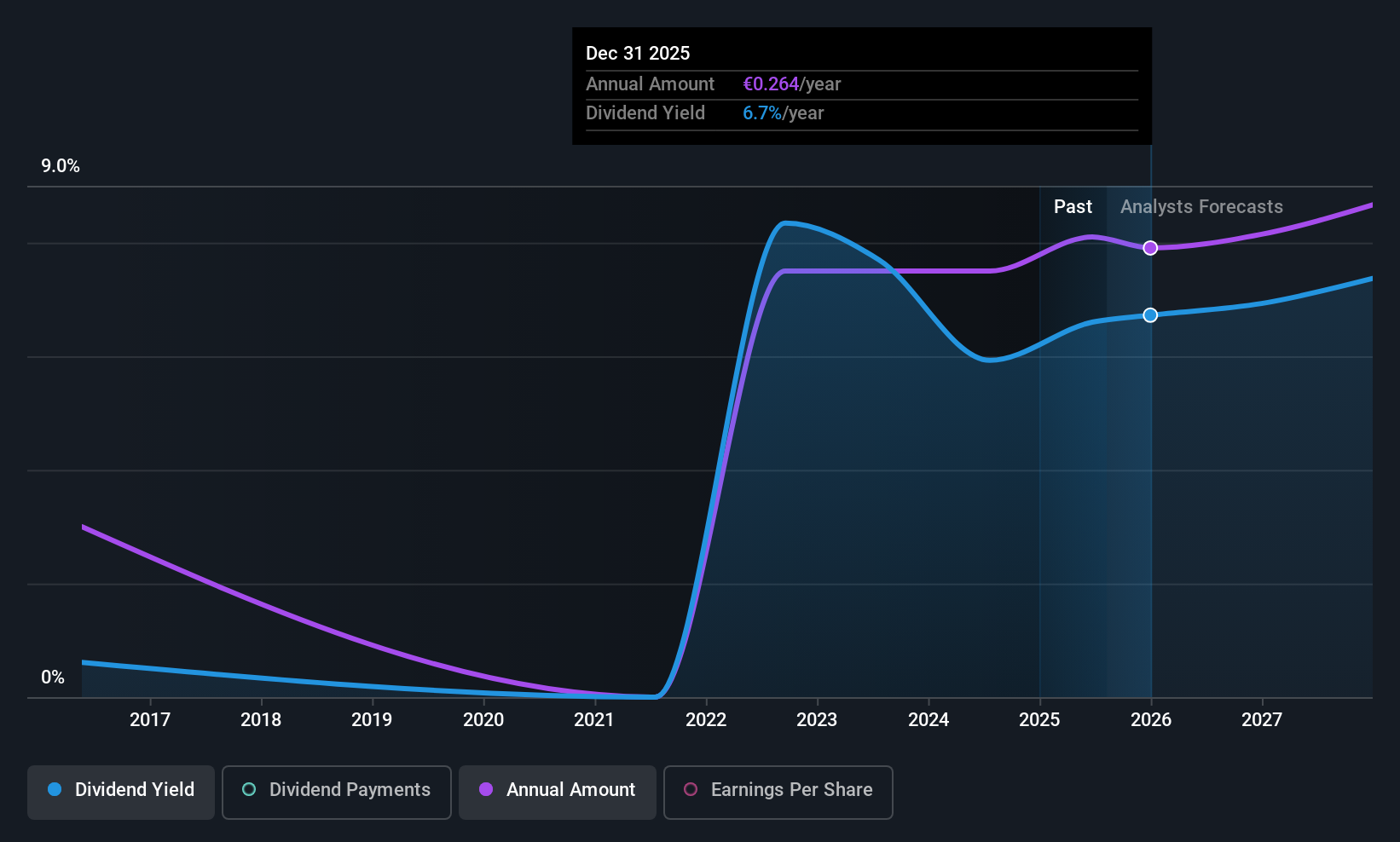

MFE-Mediaforeurope (BIT:MFEB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MFE-Mediaforeurope N.V. operates in the television industry in Italy and Spain, with a market cap of €1.87 billion.

Operations: MFE-Mediaforeurope N.V. generates its revenue from operations in the television sector across Italy and Spain.

Dividend Yield: 6.6%

MFE-Mediaforeurope's dividend yield of 6.64% places it in the top 25% of Italian dividend payers, but its sustainability is questionable due to a high payout ratio of 109.9%. Despite recent earnings growth, dividends remain volatile and not fully covered by earnings or cash flows. The company announced a €0.27 per share cash dividend with an ex-date on June 23, 2025, highlighting ongoing shareholder returns amidst fluctuating sales figures and strategic meetings addressing governance and policy issues.

- Navigate through the intricacies of MFE-Mediaforeurope with our comprehensive dividend report here.

- The analysis detailed in our MFE-Mediaforeurope valuation report hints at an deflated share price compared to its estimated value.

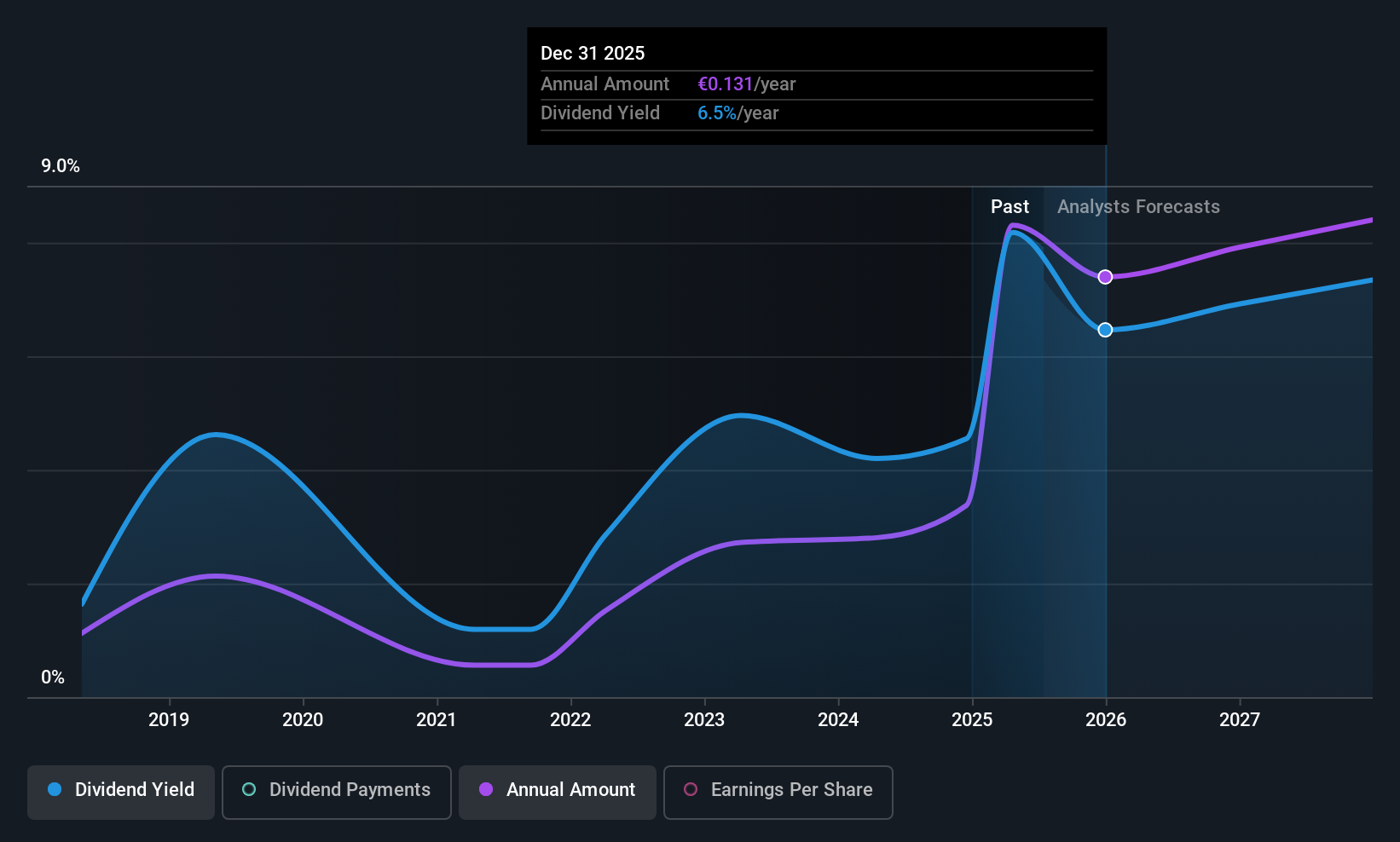

Unicaja Banco (BME:UNI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Unicaja Banco, S.A. operates in the retail banking sector in Spain and has a market capitalization of €5.88 billion.

Operations: Unicaja Banco, S.A. focuses on retail banking activities within Spain.

Dividend Yield: 6.5%

Unicaja Banco's dividend yield of 6.45% ranks it among the top 25% of Spanish dividend payers, supported by a reasonable payout ratio of 61.7%. However, its dividends have been unreliable and volatile over the past seven years. Recent earnings growth is notable, with net income for the first half of 2025 rising to €338 million from €294 million last year. The bank's high level of bad loans at 2.5% remains a concern despite ongoing efforts in fixed-income offerings and strategic discussions surrounding potential M&A activities.

- Click here and access our complete dividend analysis report to understand the dynamics of Unicaja Banco.

- Insights from our recent valuation report point to the potential overvaluation of Unicaja Banco shares in the market.

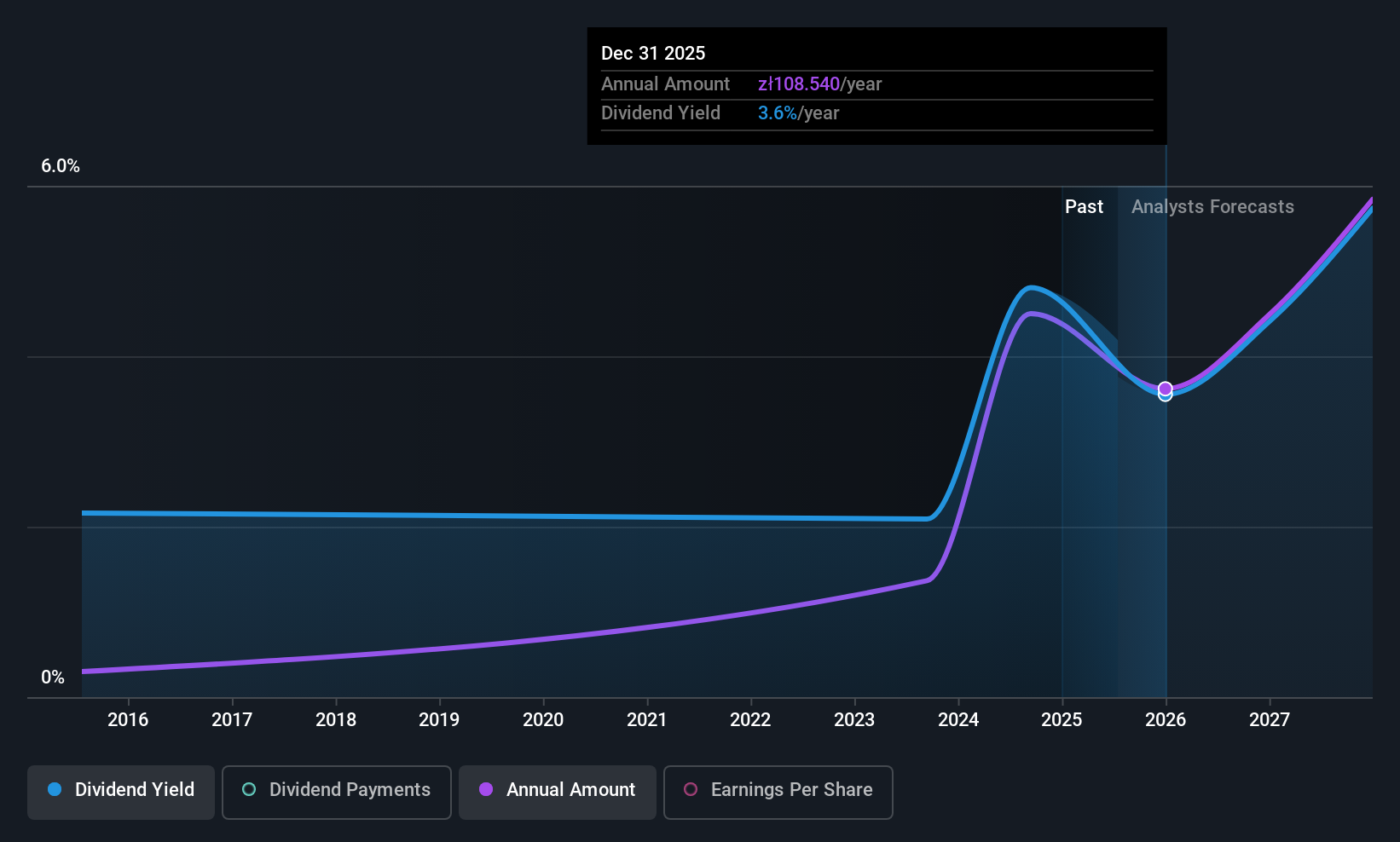

Benefit Systems (WSE:BFT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Benefit Systems S.A. offers non-pay employee benefits solutions across several countries including Poland, Czech Republic, Slovakia, Bulgaria, Croatia, and Turkey with a market cap of PLN10.13 billion.

Operations: Benefit Systems S.A.'s revenue segments include PLN2.57 billion from Poland (including Cafeteria).

Dividend Yield: 4%

Benefit Systems' dividend yield of 3.99% is below the top 25% in Poland, reflecting a volatile and unreliable track record over the past decade. Despite recent earnings growth forecasts, its payout ratios—83.4% from earnings and 81.4% from cash flows—indicate dividends are currently sustainable but leave limited room for flexibility. The company recently completed a PLN 1.36 billion equity offering, potentially impacting future dividend stability amidst fluctuating net income figures reported this year.

- Click to explore a detailed breakdown of our findings in Benefit Systems' dividend report.

- According our valuation report, there's an indication that Benefit Systems' share price might be on the cheaper side.

Where To Now?

- Get an in-depth perspective on all 224 Top European Dividend Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:UNI

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives