Amid escalating trade tensions and market volatility, European stocks have experienced a challenging period, with major indices like the STOXX Europe 600 Index posting declines. However, the temporary delay in U.S. tariffs has provided some relief, highlighting the importance of stable dividend-paying stocks that can offer investors a measure of income stability during uncertain times.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 5.39% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.89% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.67% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.76% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.99% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 5.17% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.56% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.35% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.54% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.59% | ★★★★★★ |

Click here to see the full list of 237 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

UniCredit (BIT:UCG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UniCredit S.p.A. is a financial institution offering commercial banking services across Italy, Germany, Central Europe, and Eastern Europe with a market cap of approximately €75 billion.

Operations: UniCredit S.p.A. generates its revenue primarily from commercial banking services, with €10.85 billion from Italy, €5.19 billion from Germany, €4.29 billion from Central Europe, €2.89 billion from Eastern Europe, and €1.44 billion from Russia.

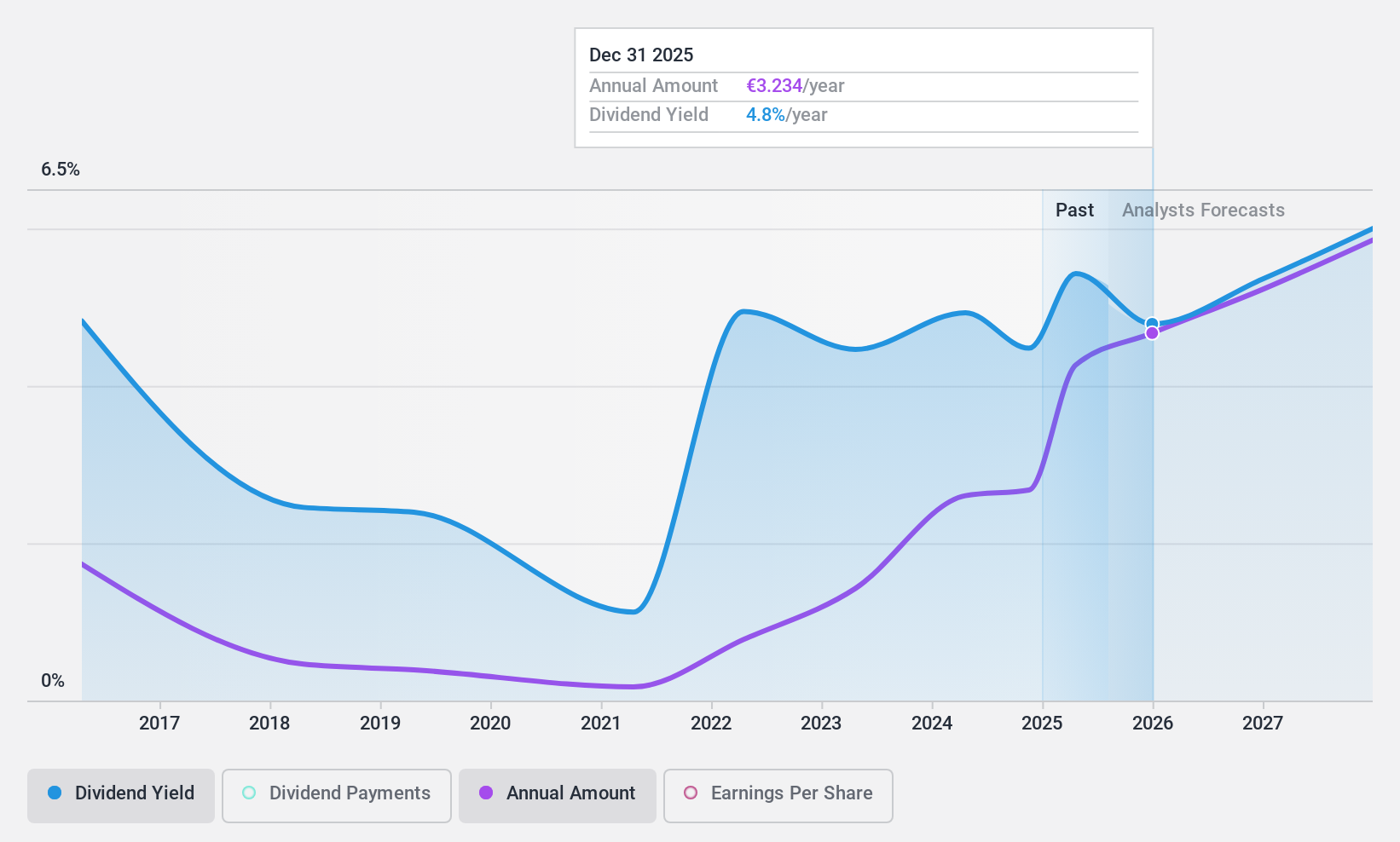

Dividend Yield: 6.1%

UniCredit's dividend profile is characterized by a high yield of 6.13%, placing it in the top 25% of Italian dividend payers, though its history shows volatility and unreliability over the past decade. The dividends are well covered by earnings, with a current payout ratio of 41.1%, expected to rise to 53.8% in three years. Despite trading at good value relative to peers, challenges include a high level of bad loans (2.3%) and low allowance for these loans (83%). Recent strategic moves include plans to acquire a significant stake in Germany's Commerzbank AG, indicating potential future growth avenues but also regulatory scrutiny and geopolitical considerations that could impact financial stability and dividend sustainability.

- Take a closer look at UniCredit's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of UniCredit shares in the market.

Unipol Assicurazioni (BIT:UNI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Unipol Assicurazioni S.p.A., along with its subsidiaries, offers insurance products and services mainly in Italy, with a market cap of €10.12 billion.

Operations: Unipol Assicurazioni S.p.A. generates its revenue primarily from the Insurance - Non-Life Business at €9.64 billion, followed by the Insurance - Life Business at €820 million and Banking at €393 million.

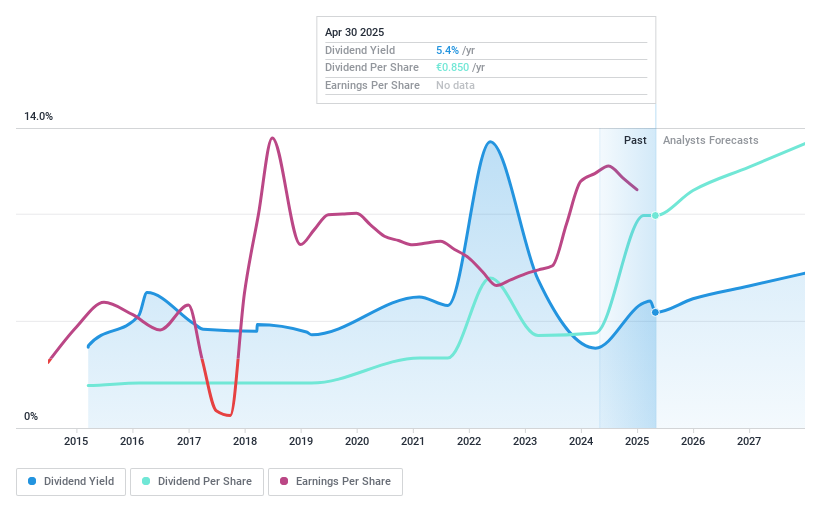

Dividend Yield: 6%

Unipol Assicurazioni's dividend profile reveals a history of volatility, with payments not consistently growing over the past decade. Despite this, dividends are well covered by earnings (58% payout ratio) and cash flows (38.2% cash payout ratio). The current yield of 6.02% is slightly below the top quartile in Italy, yet it trades at a favorable value with a P/E ratio of 9.6x compared to the market's 14x. Recent earnings showed net income at €1.07 billion for 2024, slightly down from €1.10 billion in 2023, ahead of its strategic plan presentation in March 2025.

- Delve into the full analysis dividend report here for a deeper understanding of Unipol Assicurazioni.

- The valuation report we've compiled suggests that Unipol Assicurazioni's current price could be quite moderate.

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors both in the Netherlands and internationally, with a market cap of €1.09 billion.

Operations: Koninklijke Heijmans N.V. generates revenue from its Living segment (€994.30 million), Connect segment (€996.60 million), and to Work segment (€634.60 million).

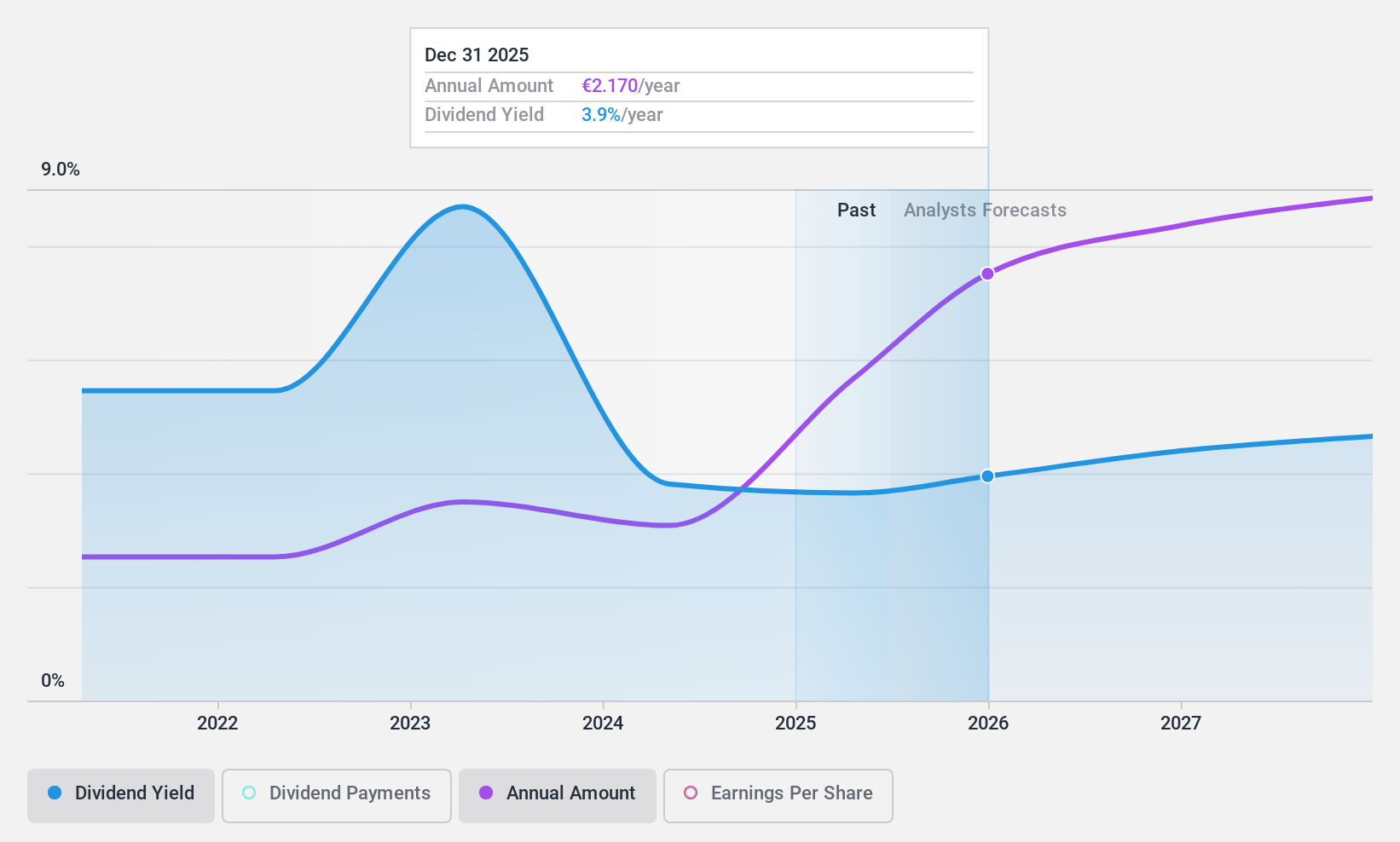

Dividend Yield: 4.1%

Koninklijke Heijmans offers a mixed dividend profile with a payout ratio of 49.6%, indicating dividends are well covered by earnings, and a low cash payout ratio of 20.6%, ensuring strong cash flow support. Despite recent dividend growth, the track record remains volatile over the past decade. The dividend yield is relatively low at 4.15% compared to top-tier Dutch payers but trades at good value, though recent removal from the ASCX index may impact investor sentiment.

- Click here to discover the nuances of Koninklijke Heijmans with our detailed analytical dividend report.

- Our valuation report here indicates Koninklijke Heijmans may be undervalued.

Summing It All Up

- Gain an insight into the universe of 237 Top European Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:UNI

Unipol Assicurazioni

Provides insurance products and services primarily in Italy.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives