- United Kingdom

- /

- Capital Markets

- /

- AIM:FEN

Spotlight On 3 UK Penny Stocks With Market Caps Over £60M

Reviewed by Simply Wall St

The UK market has faced challenges recently, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting global economic uncertainties. In such a climate, investors often seek opportunities in smaller or newer companies that might offer growth potential despite broader market volatility. Penny stocks, though an older term, continue to intrigue as they can provide affordability and potential financial strength.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.855 | £543.55M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.08 | £168.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.18 | £155.95M | ✅ 4 ⚠️ 3 View Analysis > |

| Ingenta (AIM:ING) | £0.77 | £11.63M | ✅ 2 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.5325 | $309.56M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.94 | £347.59M | ✅ 5 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.425 | £123.16M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.19 | £189.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.73 | £10.05M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £1.808 | £682.92M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 292 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

everplay group (AIM:EVPL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Everplay Group PLC, with a market cap of £557.60 million, develops and publishes independent video games for both digital and physical markets in the United Kingdom.

Operations: The group's revenue is primarily derived from its operations in developing and publishing games and apps, amounting to £158.33 million.

Market Cap: £557.6M

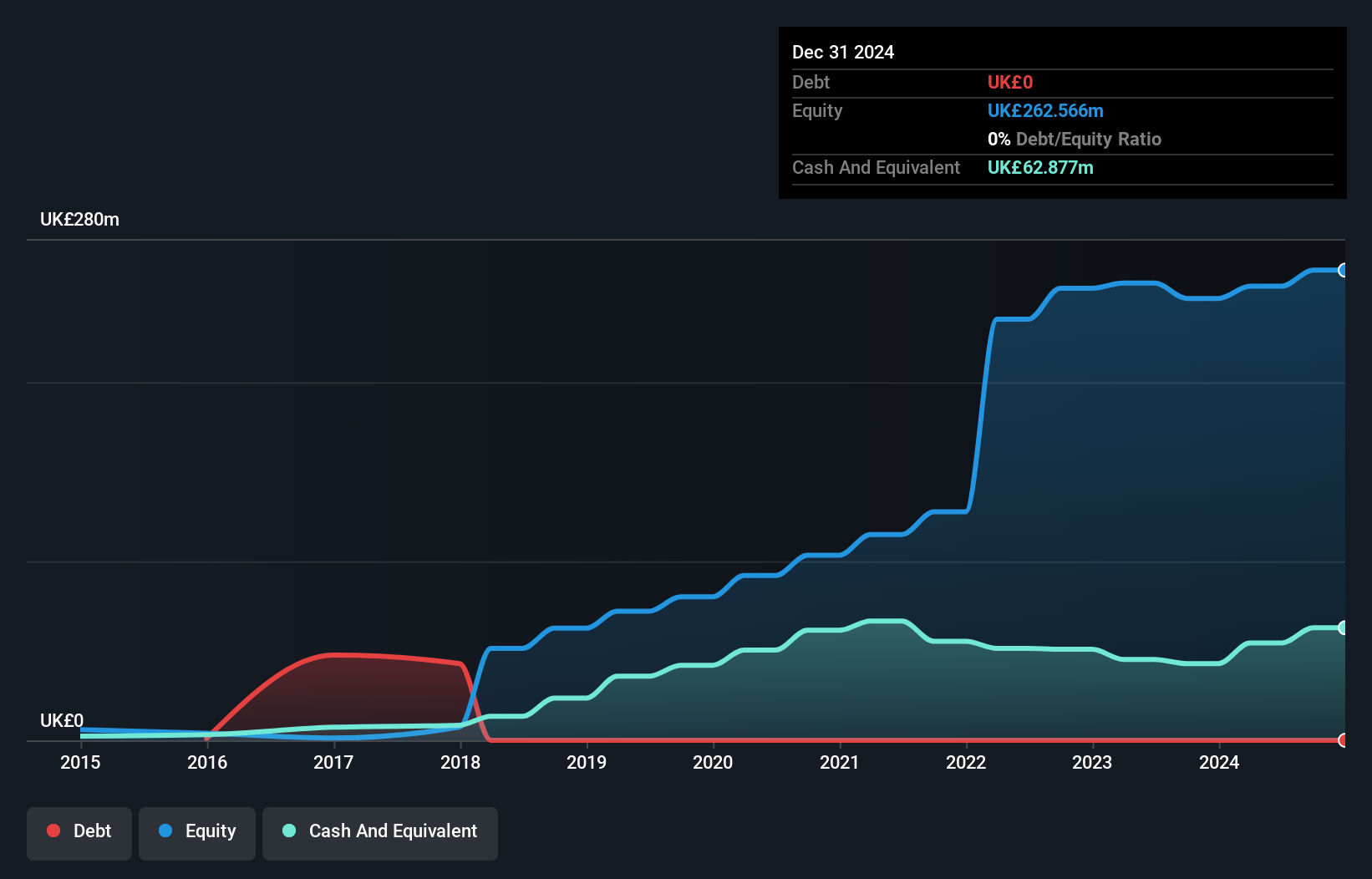

Everplay Group PLC, with a market cap of £557.60 million, has shown resilience in the competitive gaming industry by becoming profitable this year despite facing a large one-off loss of £7.9 million over the past 12 months. The company's recent earnings report highlighted sales of £72.36 million for H1 2025 and net income growth to £10.63 million from £9.01 million last year, reflecting its strategic focus on expanding first-party IPs like Hell Let Loose: Vietnam and acquiring franchises such as Hammerwatch to bolster long-term growth potential while maintaining financial stability with no debt obligations.

- Dive into the specifics of everplay group here with our thorough balance sheet health report.

- Learn about everplay group's future growth trajectory here.

Frenkel Topping Group (AIM:FEN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frenkel Topping Group Plc, along with its subsidiaries, offers professional and financial services specializing in personal injury and clinical negligence in the United Kingdom, with a market cap of £60.96 million.

Operations: Frenkel Topping Group does not report any specific revenue segments.

Market Cap: £60.96M

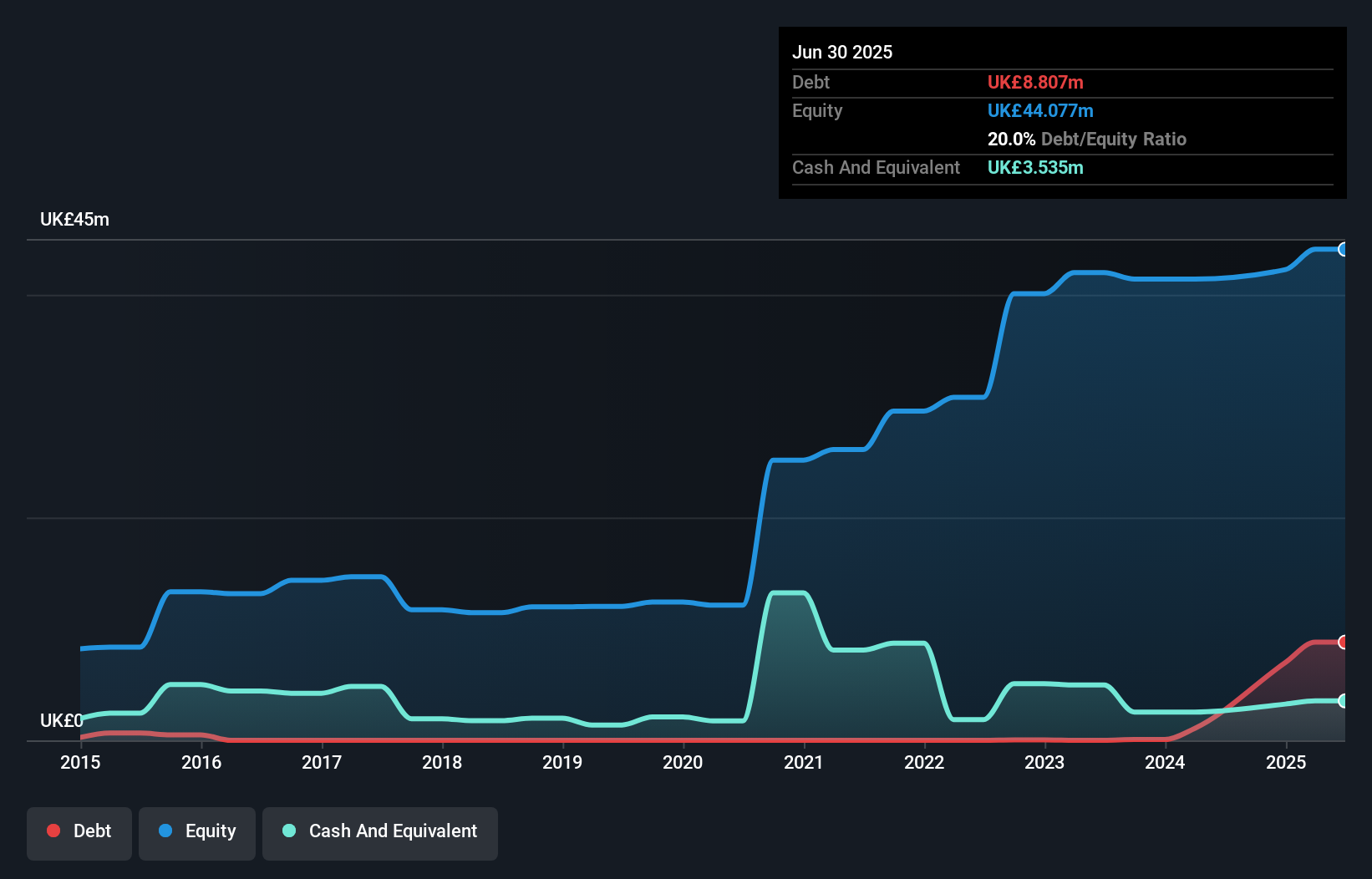

Frenkel Topping Group, with a market cap of £60.96 million, is currently navigating significant corporate changes as it approaches delisting from AIM following an acquisition offer by Irwell Bidco. Despite these transitions, the company has demonstrated robust financial performance with half-year sales rising to £20.93 million and net income increasing to £2.33 million compared to last year. Its strong balance sheet is underscored by zero debt and sufficient asset coverage for liabilities, while profit margins have improved alongside high-quality earnings growth of 81.9% over the past year, outpacing industry averages significantly.

- Get an in-depth perspective on Frenkel Topping Group's performance by reading our balance sheet health report here.

- Explore Frenkel Topping Group's analyst forecasts in our growth report.

On the Beach Group (LSE:OTB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: On the Beach Group plc operates as an online retailer specializing in short haul beach holidays in the United Kingdom, with a market cap of £344.24 million.

Operations: The company's revenue is generated from its Classic Collection segment, contributing £10.2 million, and the OTB segment, which includes Onthebeach.Co.Uk and Sunshine.Co.Uk, bringing in £122.3 million.

Market Cap: £344.24M

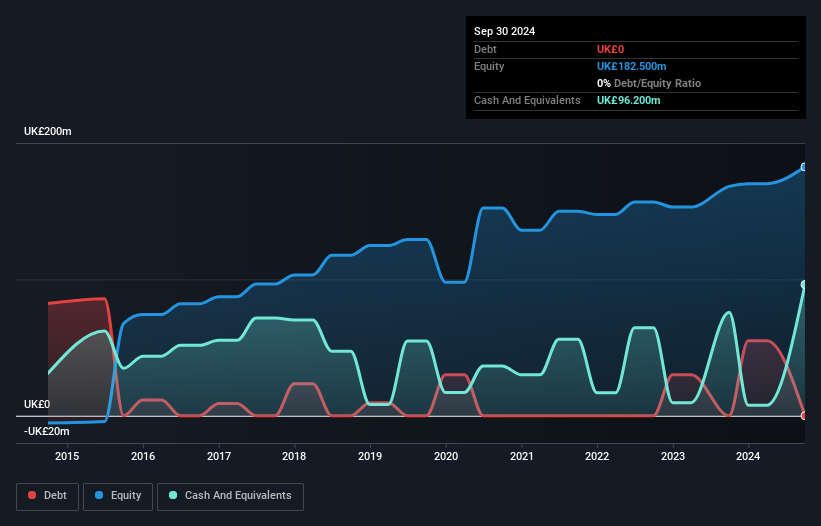

On the Beach Group, with a market cap of £344.24 million, demonstrates financial resilience through its robust asset coverage for both short and long-term liabilities. The company has initiated a share buyback program, authorized to repurchase up to 10% of its issued shares. Despite experiencing slower earnings growth recently at 4.1%, it maintains high-quality past earnings and forecasts suggest a promising annual growth rate of 23.28%. Debt levels are satisfactory with reduced debt-to-equity ratios over five years, while interest payments are well covered by profits, reflecting sound financial management amidst industry challenges.

- Unlock comprehensive insights into our analysis of On the Beach Group stock in this financial health report.

- Understand On the Beach Group's earnings outlook by examining our growth report.

Where To Now?

- Get an in-depth perspective on all 292 UK Penny Stocks by using our screener here.

- Looking For Alternative Opportunities? These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FEN

Frenkel Topping Group

Provides professional and financial services in the personal injury and clinical negligence field in the United Kingdom.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>