- Canada

- /

- Metals and Mining

- /

- TSX:LUG

February 2025's Stock Selections Possibly Priced Below Estimated Worth

Reviewed by Simply Wall St

In February 2025, global markets are experiencing a mix of optimism and caution, with U.S. stock indexes nearing record highs amid an environment of accelerating inflation and uncertain trade policies. As investors navigate these complex conditions, identifying undervalued stocks becomes crucial; such stocks may offer potential opportunities when their intrinsic value is not fully reflected in their current market price.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥26.41 | CN¥51.88 | 49.1% |

| Vimi Fasteners (BIT:VIM) | €0.97 | €1.91 | 49.2% |

| Hibino (TSE:2469) | ¥2770.00 | ¥5502.58 | 49.7% |

| Shanghai Haohai Biological Technology (SEHK:6826) | HK$26.30 | HK$52.47 | 49.9% |

| Power Wind Health Industry (TWSE:8462) | NT$110.50 | NT$220.43 | 49.9% |

| América Móvil. de (BMV:AMX B) | MX$15.07 | MX$29.71 | 49.3% |

| Accent Group (ASX:AX1) | A$2.11 | A$4.19 | 49.6% |

| Saigon Thuong Tin Commercial Bank (HOSE:STB) | ₫38750.00 | ₫76325.14 | 49.2% |

| Com2uS (KOSDAQ:A078340) | ₩48250.00 | ₩96043.58 | 49.8% |

| Shenzhen Anche Technologies (SZSE:300572) | CN¥18.75 | CN¥36.88 | 49.2% |

Let's explore several standout options from the results in the screener.

BlueNord (OB:BNOR)

Overview: BlueNord ASA is an oil and gas company engaged in the exploration, development, and production of hydrocarbon resources across Norway, Denmark, the Netherlands, and the United Kingdom with a market cap of NOK18.26 billion.

Operations: The company's revenue is primarily derived from its oil and gas exploration and production segment, totaling $702.30 million.

Estimated Discount To Fair Value: 32.9%

BlueNord ASA is currently trading at a significant discount, approximately 32.9% below its estimated fair value of NOK1026.61, indicating potential undervaluation based on discounted cash flows. Despite recent challenges leading to a net loss of US$70.8 million in 2024, the company forecasts robust annual revenue growth of 12.8%, outpacing the Norwegian market average and signaling future profitability within three years, although interest payments are not well covered by earnings presently.

- Our comprehensive growth report raises the possibility that BlueNord is poised for substantial financial growth.

- Get an in-depth perspective on BlueNord's balance sheet by reading our health report here.

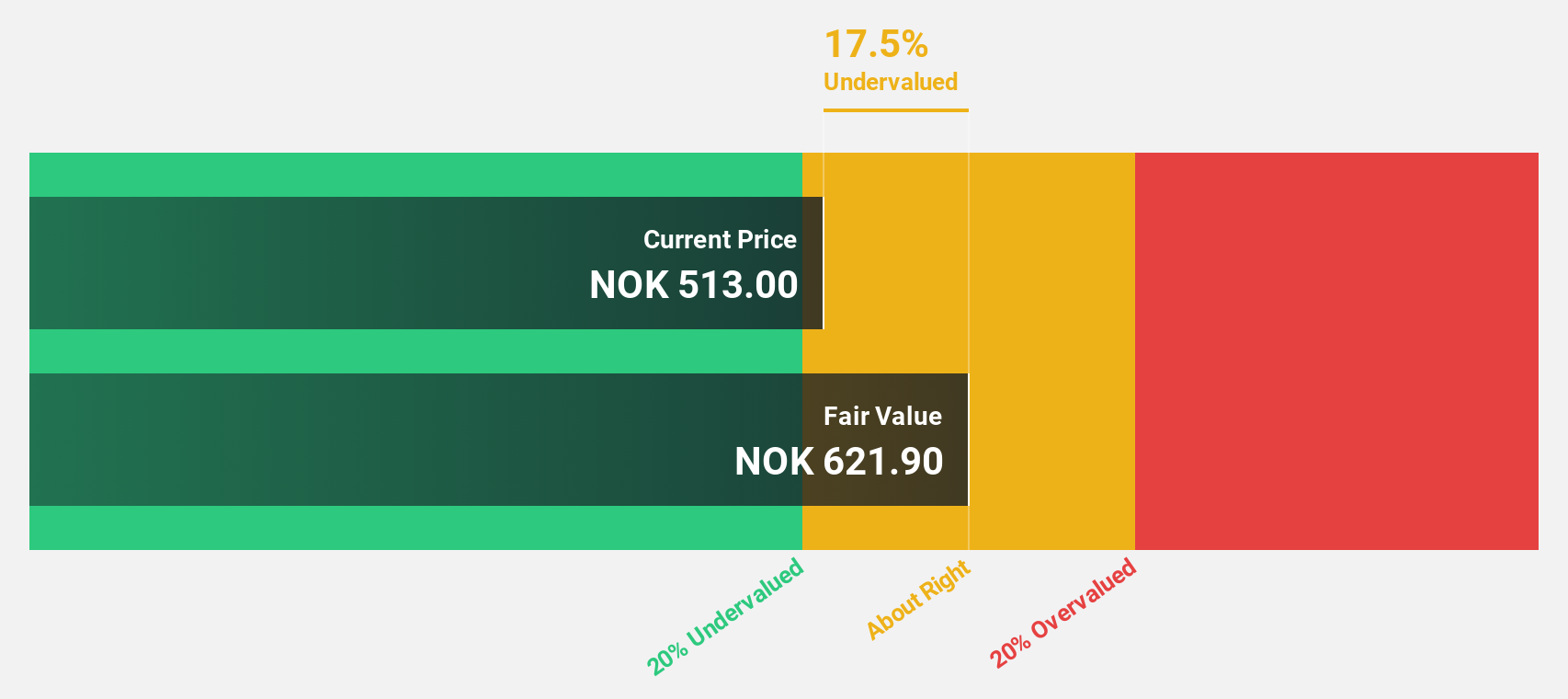

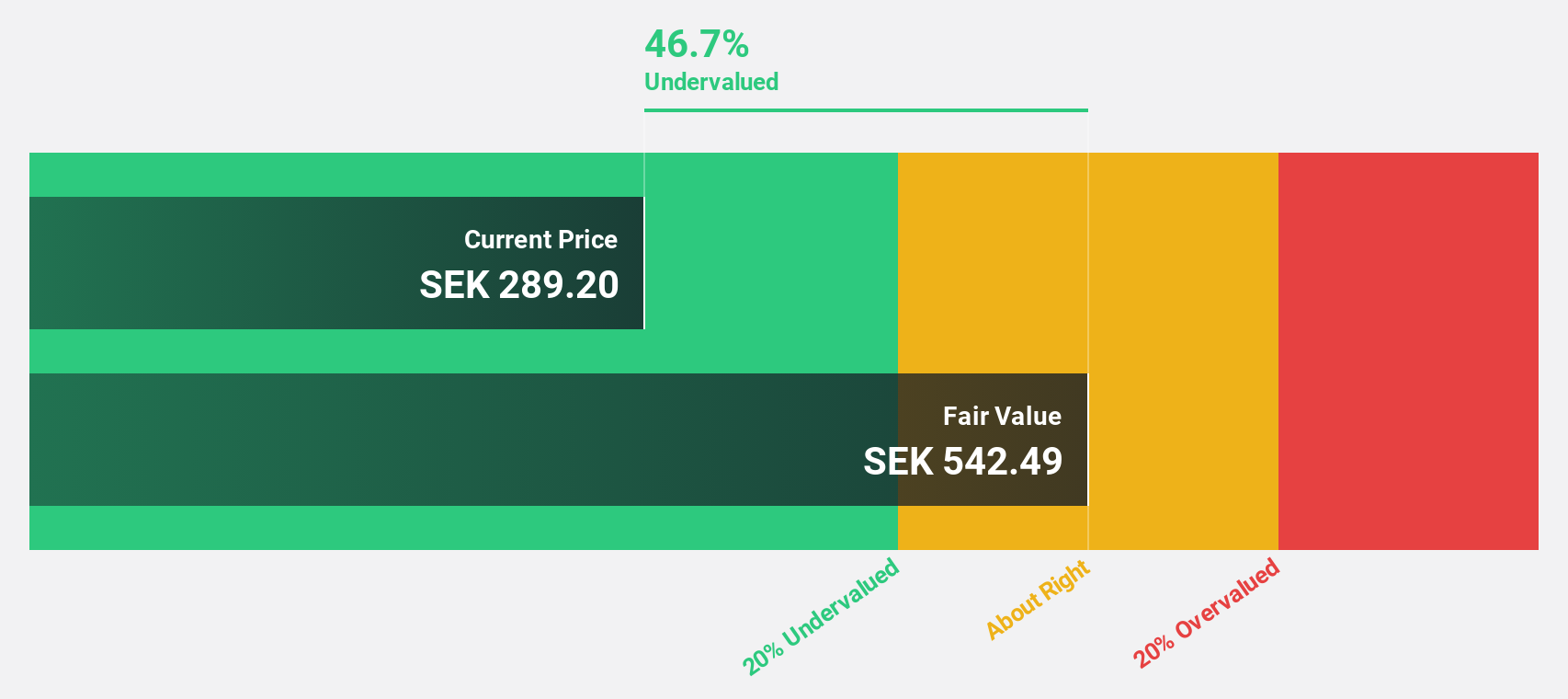

Bonesupport Holding (OM:BONEX)

Overview: Bonesupport Holding AB (publ) is an orthobiologics company that develops and commercializes injectable bio-ceramic bone graft substitutes across Europe, North America, and internationally, with a market cap of SEK22.70 billion.

Operations: The company generates revenue primarily from its Pharmaceuticals segment, amounting to SEK814.46 million.

Estimated Discount To Fair Value: 17.4%

Bonesupport Holding is trading at SEK345, below its estimated fair value of SEK417.72, suggesting undervaluation based on cash flows. The company anticipates revenue growth of 33.8% annually and earnings growth of 73.1%, both surpassing the Swedish market averages. Recent positive clinical study results for CERAMENT products could enhance future revenue streams, although current profit margins have decreased from last year’s 41% to 11.1%.

- The growth report we've compiled suggests that Bonesupport Holding's future prospects could be on the up.

- Dive into the specifics of Bonesupport Holding here with our thorough financial health report.

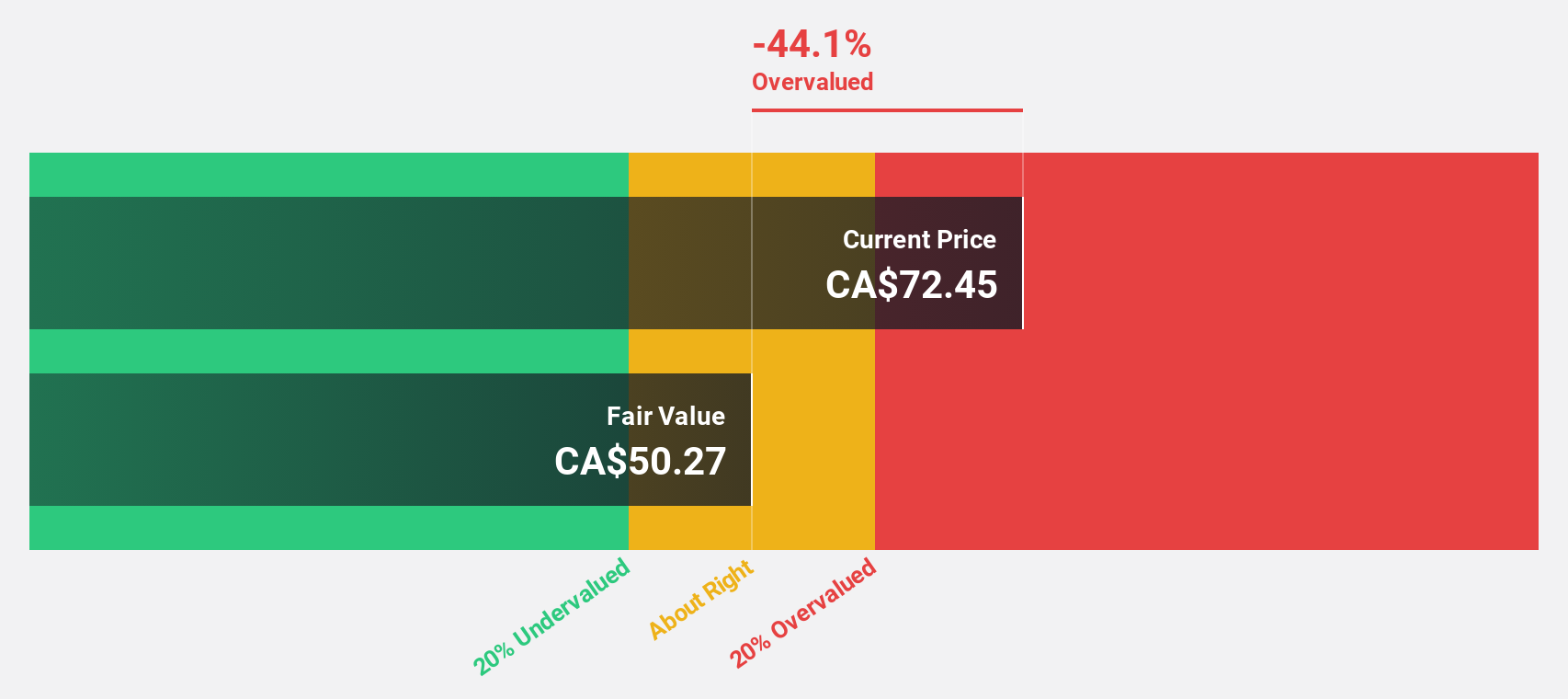

Lundin Gold (TSX:LUG)

Overview: Lundin Gold Inc. is a Canadian mining company with a market cap of CA$9.05 billion, focusing on gold production and exploration activities.

Operations: The company generates revenue primarily from its Fruta Del Norte mining operations, amounting to $1.04 billion.

Estimated Discount To Fair Value: 34.3%

Lundin Gold is trading at CA$38.37, significantly below its estimated fair value of CA$58.42, indicating potential undervaluation based on cash flows. The company reported 2024 sales of US$1.19 billion with net income rising to US$426.05 million from the previous year, supported by increased gold production and successful resource conversion at Fruta del Norte. Earnings are forecasted to grow substantially above market averages, while revenue growth is expected to outpace the Canadian market rate.

- Our growth report here indicates Lundin Gold may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Lundin Gold.

Summing It All Up

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 903 more companies for you to explore.Click here to unveil our expertly curated list of 906 Undervalued Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LUG

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)