- United Arab Emirates

- /

- Chemicals

- /

- ADX:FERTIGLB

Global Value Stocks: 3 Companies That May Be Priced Below Their Intrinsic Estimates

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a rally, buoyed by the U.S.-China agreement to pause tariffs and cooling inflation rates in the U.S., which have lifted investor sentiment across major indices. Amidst this positive market environment, identifying stocks that are potentially undervalued can be an attractive strategy for investors seeking opportunities that may not yet reflect their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shibaura Mechatronics (TSE:6590) | ¥7060.00 | ¥13927.88 | 49.3% |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥22.73 | CN¥44.81 | 49.3% |

| GEM (SZSE:002340) | CN¥6.23 | CN¥12.45 | 50% |

| Lectra (ENXTPA:LSS) | €24.10 | €47.47 | 49.2% |

| H.U. Group Holdings (TSE:4544) | ¥3074.00 | ¥6135.07 | 49.9% |

| Dive (TSE:151A) | ¥921.00 | ¥1813.68 | 49.2% |

| BalnibarbiLtd (TSE:3418) | ¥1165.00 | ¥2314.28 | 49.7% |

| Fuji Oil (TSE:2607) | ¥3034.00 | ¥6054.67 | 49.9% |

| illimity Bank (BIT:ILTY) | €3.684 | €7.28 | 49.4% |

| True Corporation (SET:TRUE) | THB12.40 | THB24.64 | 49.7% |

Here's a peek at a few of the choices from the screener.

Americana Restaurants International (ADX:AMR)

Overview: Americana Restaurants International PLC operates a chain of restaurants across several countries in the Middle East and North Africa, with a market cap of AED18.14 billion.

Operations: The company's revenue segments include the Major Gulf Cooperation Council (GCC) region at $1.69 billion, the Lower Gulf at $213.27 million, and North Africa at $179.10 million.

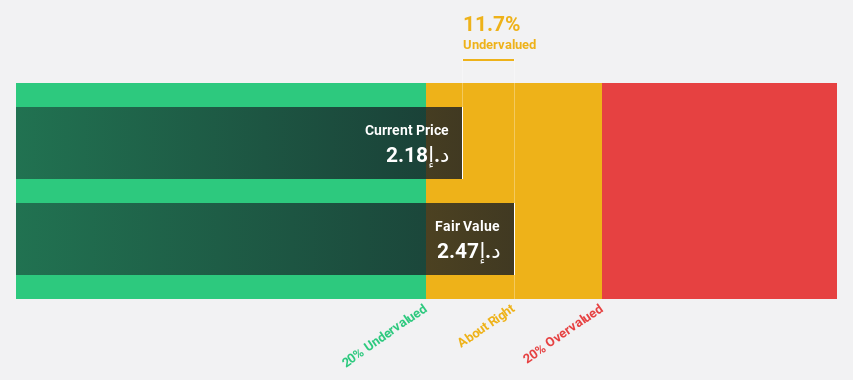

Estimated Discount To Fair Value: 12.4%

Americana Restaurants International presents an intriguing case for potential undervaluation based on cash flows. The stock is trading at AED2.16, below its estimated fair value of AED2.47, although not significantly undervalued. Recent earnings showed a rise in net income to US$32.65 million from US$28.02 million year-over-year, with revenue growth outpacing the market forecast at 8.9% annually compared to 6.7%. Despite high share price volatility, profit growth forecasts remain robust at 17% annually.

- The analysis detailed in our Americana Restaurants International growth report hints at robust future financial performance.

- Take a closer look at Americana Restaurants International's balance sheet health here in our report.

Fertiglobe (ADX:FERTIGLB)

Overview: Fertiglobe plc, along with its subsidiaries, is engaged in the production and sale of nitrogen-based products across various regions including Europe, the Americas, Africa, the Middle East, Asia, and Oceania; it has a market cap of AED20.75 billion.

Operations: The company's revenue is primarily derived from the production and marketing of owned produced volumes, amounting to $1.99 billion, with an additional $156.30 million generated through third-party trading.

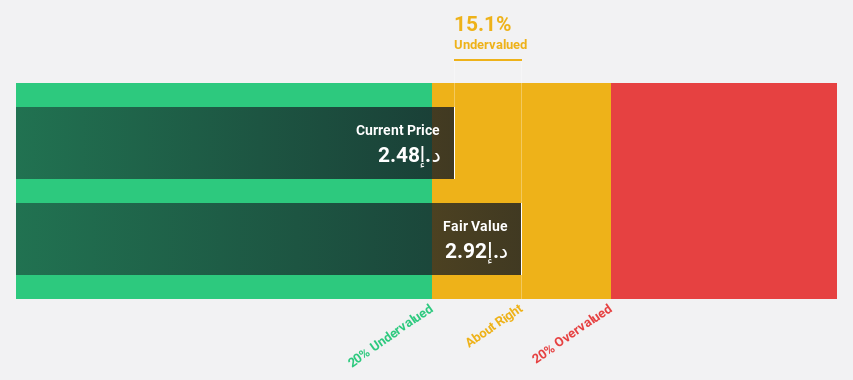

Estimated Discount To Fair Value: 14.5%

Fertiglobe's current valuation appears slightly below its estimated fair value, trading at AED2.5 compared to an estimated AED2.92. Despite a decline in net income from US$116.3 million to US$72.6 million year-over-year, earnings are projected to grow significantly at 22.7% annually over the next three years, outpacing the market average of 5.2%. However, profit margins have decreased and high debt levels remain a concern for financial stability.

- Our growth report here indicates Fertiglobe may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Fertiglobe's balance sheet health report.

Akeso (SEHK:9926)

Overview: Akeso, Inc. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of antibody drugs with a market cap of HK$74.95 billion.

Operations: The company generates revenue of CN¥2.12 billion from its activities in the research, development, production, and sale of biopharmaceutical products.

Estimated Discount To Fair Value: 39.6%

Akeso's stock is trading at HK$83.5, significantly below its estimated fair value of HK$138.34, suggesting it may be undervalued based on cash flows. The company anticipates a robust revenue growth rate of 29.6% annually, surpassing the Hong Kong market average. Recent approvals for ivonescimab and penpulimab highlight Akeso's innovative drug development capabilities, though the share price has been volatile recently and recent earnings showed a net loss of CNY 514.52 million for 2024.

- Upon reviewing our latest growth report, Akeso's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Akeso's balance sheet by reading our health report here.

Seize The Opportunity

- Access the full spectrum of 491 Undervalued Global Stocks Based On Cash Flows by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Fertiglobe, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:FERTIGLB

Fertiglobe

Produces and sells nitrogen-based products in Europe, North and South America, Africa, the Middle East, Asia, and Oceania.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives